12:30 am IST - 2:00 am IST

Past Event

Content from the Brookings Institution India Center is now archived. After seven years of an impactful partnership, as of September 11, 2020, Brookings India is now the Centre for Social and Economic Progress, an independent public policy institution based in India.

The presentation can be found here.

Our Development Seminar @ Brookings India was on Monday, 12th of December at 3pm, at the Lecture Theatre, Brookings India. 6 Rizal Marg Chanakyapuri, New Delhi.

Title: Corporate Social Responsibility in India: Law, Implementation and Evidence

Abstract: India is unique in mandating that firms satisfying certain profitability, net worth and size thresholds are required to spend at least 2% of their net income on corporate social responsibility (CSR). The speaker will explore the effect of this law (Indian Companies Act 2013) on Environmental, Social and Governance (ESG) investing in India. Scrutinising data from the last three years, the speaker will provide evidence on the status of implementation of the CSR law. The speaker analyses key concerns of enforcement and monitoring of this law that are fundamental to maximise benefits to corporations and society at large.

Speaker: Professor Shivaram Rajgopal, Roy Bernard Kester and T.W. Byrnes Professor of Accounting and Auditing, Columbia Business School

Discussant: Somasekhar Sundaresan, Advocate, and a leading corporate lawyer in India

Discussant: Mukesh Kumar, Chief Programme Executive CSR, National Foundation for Corporate Social Responsibility (NFCSR), Ministry of Corporate Affairs, Government of India

Event Report

Professor Shivaram Rajgopal presented on “Corporate Social Responsibility’ in India: Law, Implementation and Evidence” on December 12, 2016.

India is perhaps one of the only countries that has mandated Corporate Social Responsibility (CSR). Companies that satisfy a profitability in size and net worth threshold are required to spend 2% of their average net profits. While CSR is not well defined in the Company’s Act, there is a list of activities that are acceptable. These include eradicating poverty, promoting education, and combating HIV/AIDS. Nevertheless, there needs to be a lot more clarity in the definition of CSR.

Notably, voluntary CSR, which happens in the U.S., is often compatible with company strategy. For example, companies replace expensive emission emitting activities with less emission emitting activities. On the other hand, in the Indian scenario, CSR poses as an expense rather than an investment. There is little insight into what happens when there is non-compliance with the law.

According to the data, 60% of Indian companies have been affected by the CSR law. There have been mixed reactions to the law. The Left reacted by suggesting that the Government has given its responsibility of building infrastructure to the private sector through this law. Others viewed the 2% CSR expense as a tax, an addition to the generally high taxes in India. The law was also seen as a move to mitigate the ‘corporate friendly’ nature of the 2013 Companies Act. Stocks negatively reacted to the introduction of the law, in contrast to general positive reactions to CSR in the West.

Further questions were raised: How do analysts valuate companies based on their disclosures of CSR expenditures? How credible are these disclosures?

There are several competing sustainability reporting frameworks, concerning the reporting of sustainability for comparisons. The most prevalent reporting standard that is being used is the GRI, the ‘Global Reporting Initiative’. Taking Mahindra and Mahindra as an example, there is a lot of data that shows year-by-year reductions in wastage, thereby showing an improvement. However, questions arise regarding the trade-offs involved in such reduction of wastage.

Taking Infosys and Tata Consultancy Services as examples for CSR disclosures, it is realised that a lot of the CSR spending is done through foundations. There are questions regarding whether the accounts are public and audited, and therefore what happens to the money.

There is uncertainty regarding how to handle the data being disclosed by companies, even if the same unit of analysis is used. Comparability across companies is difficult, an issue of concern. Accounting standards have taken decades to evolve. Maybe the CSR relevant standards will also take time to evolve, and this is just the beginning. How do auditors actually audit the data? It is not clear whether the data disclosed by companies tells us about the sustainability of the firms or the future of the environment. One solution is to conduct time series analysis for one firm.

A lot of data about the workforce and the Board, is available in India in contrast to the U.S.. This helps in learning about the composition of the workforce, such as the number of Boards that high-profile women are on. Will CSR spending yield social benefits?

In India, CSR is a compliance issue. Enforcement is difficult in India. There are many family-owned businesses in India that are not pressurised by external donors’ requirements for complying with the CSR expectations. Public sector funds do not rely on stock markets for capital and hence are unlikely to be affected. If there is a profit motive, then CSR efforts may be sustainable in India.

Professor Rajgopal left the audience with the following issues:

– Can we ensure that CSR spending is audited?

– Can we make the finances of foundations a bit more transparent?

– Is there any institution that collects and tracks both input and output metrics?

– Can we show a link between CSR spending and social outcomes?

– Can we align firm’s incentives with CSR spending?

– As reporting framework emerged for the corporate sector, maybe it is time to extend this to the Government sector. The Government has a far bigger footprint on the economy than the private sector. For example, the Government can tell how many emissions it is cutting.

Like other products of the Brookings Institution India Center, this report is intended to contribute to discussion and stimulate debate on important issues. The views are of the author(s). Brookings India does not have any institutional views.

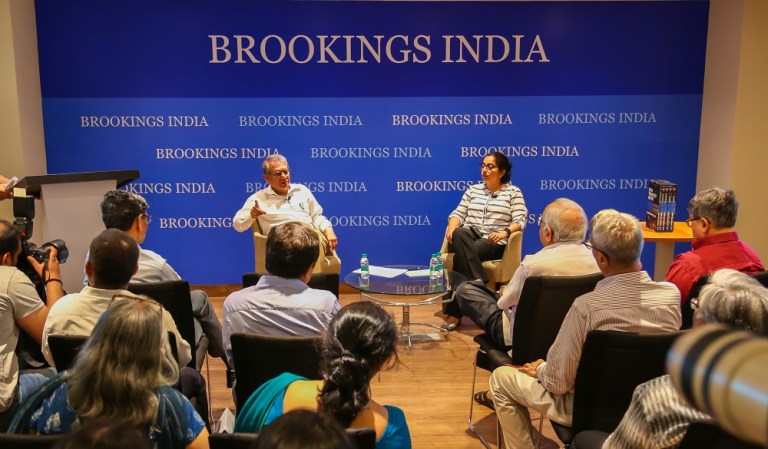

Development Seminar Series Photographs

About Development Seminars Series @ Brookings India

The Development Seminars Series @ Brookings India is a platform for global scholars to present their work to a curated audience of senior government officials, politicians, journalists, academics and policy enthusiasts. The format of the seminars includes a senior researcher as a lead presenter and a government/industry expert to discuss the results and relevance within the Indian context. The fundamental focus of the seminar series is to draw research-based insights to shape and influence policy dialogues in India, through purposeful and pointed discussions.

Other Development Seminars

Rahul Tongia, Anurag Sehgal, Puneet Kamboj

2020

Online Only

Tuesday, 3:00 am - 4:40 am IST

Saneet Chakradeo

August 18, 2020