For a global economy still struggling in the aftermath of the COVID-19 pandemic, the Russian invasion of Ukraine, steep interest rates, and record-high debt levels, the latest conflict in the Middle East poses a grave danger.

There are reasons to be hopeful: The global economy is now much better equipped to handle oil-price shocks than it was in the 1970s. Yet it would be reckless to ignore the risk emanating from a region that accounts for nearly 30% of global oil production. A major escalation of the conflict would push commodity markets into uncharted territory—the first time the world has endured shocks in two major energy-producing regions within a short period.

So far, the conflict has been contained, with only modest effects on commodity prices. Brent oil prices have declined nearly 4% a barrel since the start of the conflict after increasing 7% in the first two weeks after the attack. Prices of agricultural commodities and most metals have also seen minor declines. That may reflect the global economy’s improved ability to absorb oil price shocks. Since the energy crisis of the 1970s, countries have bolstered their defenses against such shocks by cutting their dependence on oil, diversifying oil suppliers, and expanding energy sources—including renewables. Several governments have established strategic petroleum reserves, improved international coordination and inventory management, and developed futures markets to mitigate the impact of oil shortages on prices.

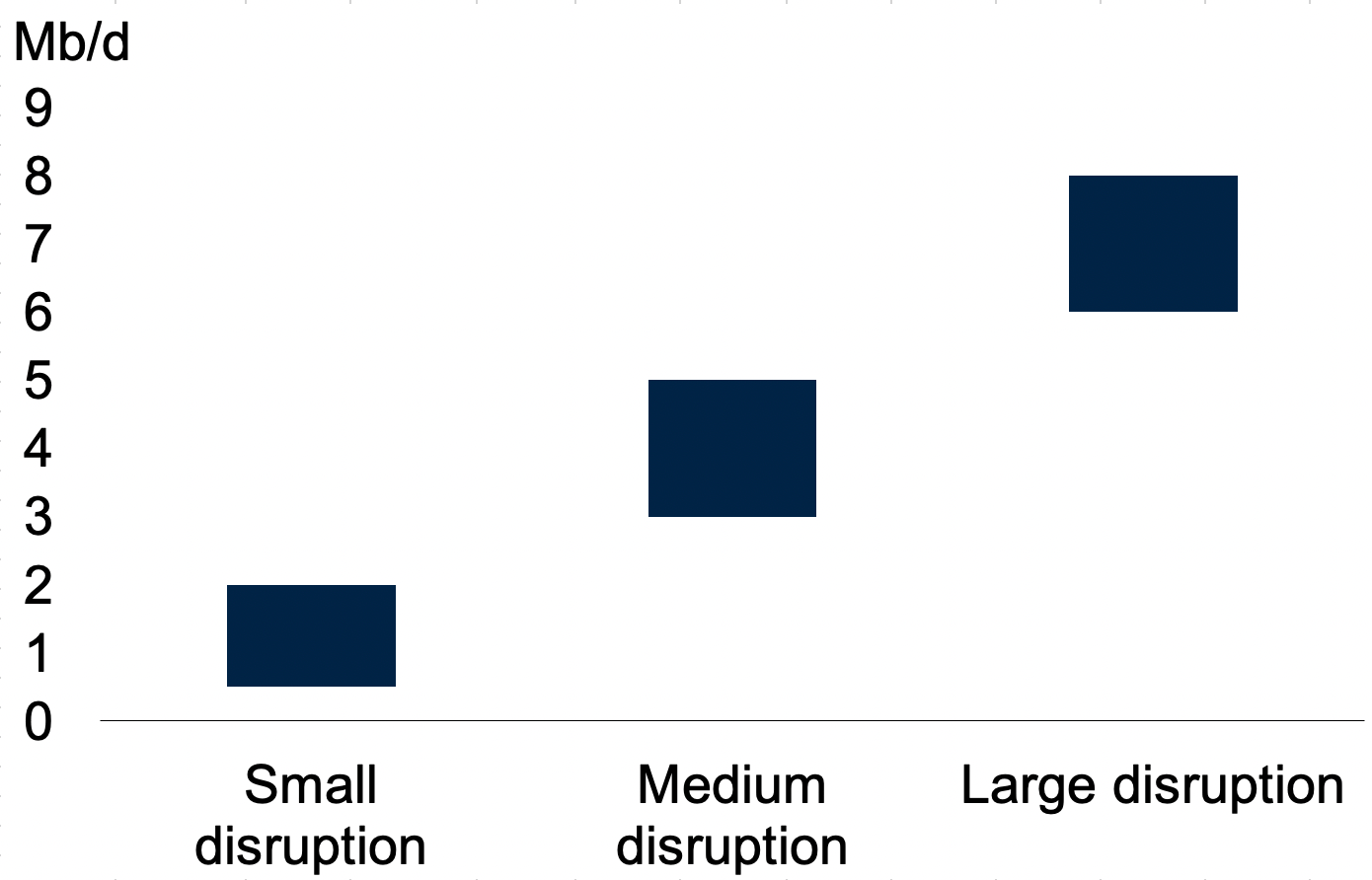

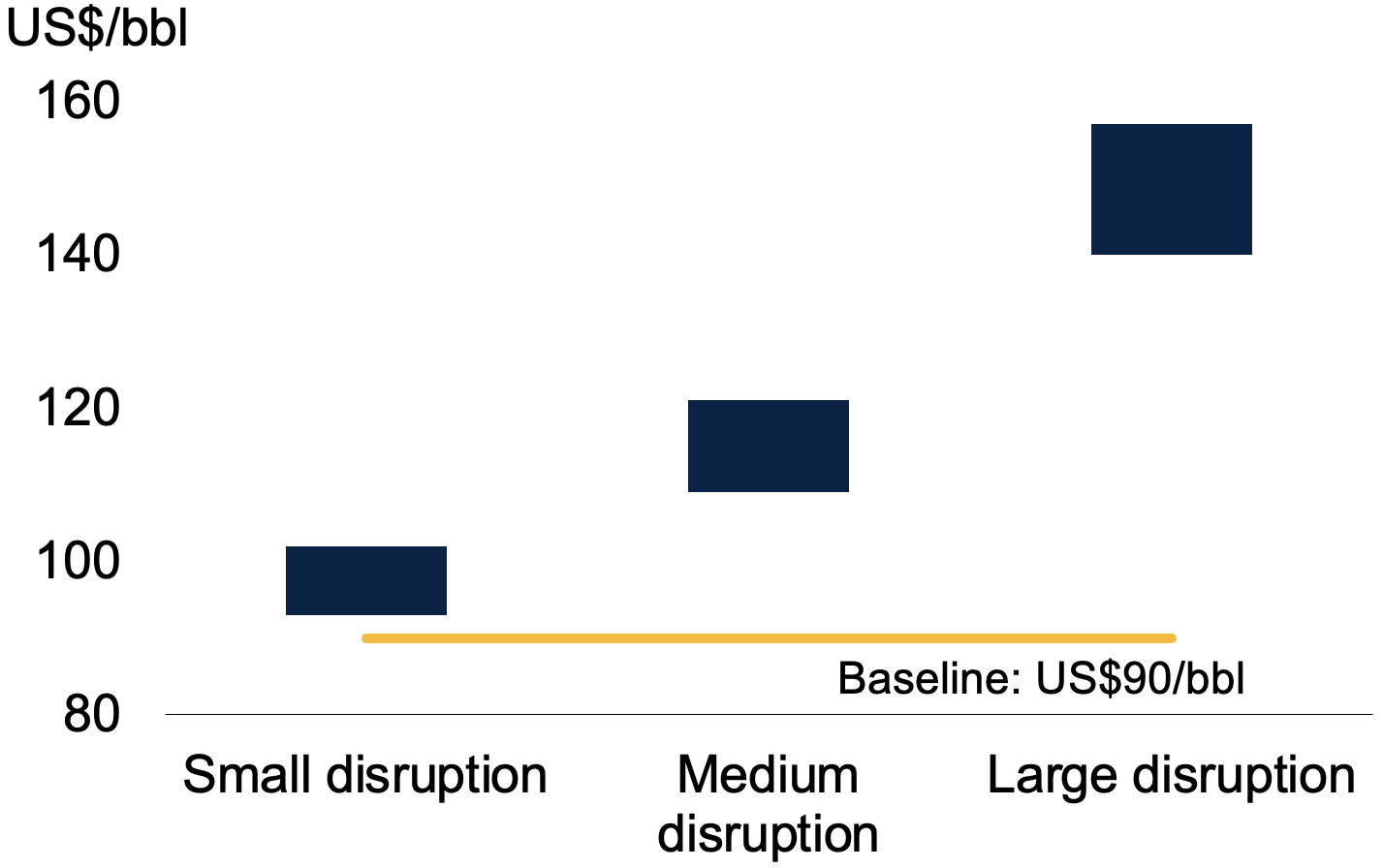

But that resilience would vanish if the conflict spiraled out of control. The World Bank’s latest Commodity Markets Outlook outlines three risk scenarios based on historical experience since the 1970s. It suggests that the size of the effects would depend on the degree of disruption to oil supplies:

- In a “small disruption” scenario, global oil supplies would be reduced by 500,000 to 2 million barrels per day—roughly equivalent to the reduction seen during the Libyan Civil War in 2011. Under this scenario, oil prices would range between $93 and $102 a barrel.

- In a “medium disruption” scenario—roughly equivalent to the Iraq War in 2003—global oil supplies would be reduced by 3 to 5 million barrels per day, driving oil prices up to between $109 and $121 a barrel.

- In a “large disruption” scenario—comparable to the Arab oil embargo of 1973—global oil supplies would shrink by 6 to 8 million barrels per day, driving up prices to between $140 and $157 a barrel.

Figure 1. Initial declines in oil supply under different scenarios

Sources: Bloomberg; World Bank.

Note: Range of initial supply disruptions under three scenarios.

Figure 2. Initial changes in oil prices under different scenarios

Sources: Bloomberg; World Bank.

Note: Range of initial prices of Brent crude oil in response to supply disruptions under three scenarios.

Oil-supply disruptions tend to have a knock-on effect on the prices of other energy commodities. The impact is most pronounced in the markets for natural gas, particularly in Europe and Asia, where a significant portion is traded in the form of liquefied natural gas (LNG).

Higher oil prices also mean higher food prices—not just in the Middle East but across the world. That would intensify food insecurity, already high in many developing countries. Trade restrictions and weather-related disruptions could worsen the situation. At the end of 2022, more than 700 million people—nearly a tenth of the global population—were undernourished. If food prices start climbing, those numbers could increase.

Already, some commodities—gold in particular—are flashing warnings about the outlook. Gold prices have a unique relationship to geopolitical concerns: They rise in periods of conflict and uncertainty, often signaling an erosion of investor confidence. Gold prices have surged about 7% since the onset of the conflict.

None of this is good news. It is true that the global economy has proved remarkably resilient over the past four years. But it is also clear markets are now jittery because of rising geopolitical concerns. If the conflict escalates, policymakers will need to swiftly adjust fiscal and monetary policies to get ahead of its likely impact on inflation and fiscal balances. That will not be easy in an environment where core inflation remains sticky and fiscal space is limited.

Policymakers must be on high alert where food prices are concerned. Given the risk of greater food insecurity, governments should avoid export bans on food and fertilizer, which nearly always do more harm than good. Restrictive trade policies introduced during the 2010-2011 food crisis accounted for 40% of the increase in the global price of wheat and 25% of the rise in the price of maize.

Governments should also resist the temptation of price controls and subsidies in response to higher food and oil prices. These benefit the rich at the expense of the poor. A far better option is to improve social safety nets, diversify food sources, and increase efficiency in food production and trade. Over the longer-term, all countries should pursue the logical next step: accelerating the transition to renewable energy, which would mitigate the effects of oil-price shocks, bolster energy security, and reduce carbon emissions.

Commentary

The Middle East conflict is threatening to cripple a fragile global economy

November 16, 2023