In September, the Census Bureau announced good news for the American middle class, courtesy of its Current Population Survey (CPS). Real median household income—that is, the income earned by a household squarely in the middle of the U.S. income distribution, adjusted for inflation—rose by 3.2 percent, the second consecutive year in which the measure increased. The trend likely reflected the effects of a tightening U.S. labor market that has drawn in more workers and put upward pressure on wages.

As many observed, however, that impressive income growth merely pushed median household income just past its level from 1999. Over the past 17 years, incomes fell during the recession of the early 2000s, rebounded slowly, dipped dramatically during the Great Recession, and then stalled before finally growing again in 2015 and 2016.

So while the American middle class might have newfound momentum, many of its members may feel like their living standards have not improved in a couple of decades.

But that national middle-class income trend does not hold uniformly around the country. Data from another Census Bureau survey released in September reveal that there are a handful of urban areas around the country doing better than the national average. Conversely, there are many more where middle-class households still fall short of their historical income peak, often by a considerable degree.

This short analysis—a precursor to the much more comprehensive Metro Monitor Brookings will release later this year—uses data from Census 2000 and the 2016 American Community Survey (ACS) to look at changes in median household income across time for metropolitan and micropolitan areas (one or more counties surrounding a dense urban area), that had populations of at least 65,000 in 2016.1 To do so, it uses 2000 county-level data (reflecting 1999 incomes) to mirror 2016 metropolitan and micropolitan definitions.2

Comparing inflation-adjusted median household incomes in 1999 and 2016 for nearly 300 of these urban areas points to five geographically and economically distinctive urban Americas:3

Booming. Census 2000 and 2016 ACS data reflect a roughly 5 percent drop in real U.S. median household income between 1999 and 2016 (as compared to a 0.6 percent increase reported in the CPS).4 Against that backdrop, 25 urban areas managed to post increases of at least 5 percent in regional median household income (Figure 1). They are primarily of two varieties. One group consists of mostly small communities that have benefited from the energy boom over the past decade, primarily around the Marcellus Shale in the Appalachian Basin; the Permian Basin in Texas; and the Williston Basin in the Dakotas and Montana. Another (smaller) group consists of mostly larger communities that have experienced technology-led economic growth in the wake of the Great Recession, including Baltimore, San Francisco, Seattle, and Washington, D.C.

Stabilized. Another 37 urban areas by 2016 managed to post income levels close (within 5 percent) to those they registered in 1999 (Figure 2). Some technology-rich regions—Boston, Pittsburgh, San Diego, San Jose—achieved small gains, fueled by strong income growth in the 2010s. Others such as Austin, Denver, Portland, and Raleigh fell just short of their 1999 levels, but rebounded significantly this decade from steep slides after the housing market crash. After dropping only modestly in the 2000s, however, median incomes in several stabilized urban areas have plateaued since 2009, including in Allentown, Hartford, Los Angeles, Sacramento, Scranton, and Tulsa.

Recovering. A large and diverse group of urban areas—73 in all—had median household incomes in 2016 that were 5 to 10 percent below their 1999 levels (Figure 3). The group includes a number of urban areas in the Northeast that continue to transition from an industrial past (five in Pennsylvania alone), and many others in the West still rebounding from the housing crash of the late 2000s. The group also features a number of urban areas in the Midwest and Southeast that, while they still have some ways to go, managed to avoid the worst effects of the manufacturing downturn during the 2000s. Several of these areas seem to be emerging somewhat more strongly in the current decade, including Charlotte, Columbus, Kansas City, Louisville, Minneapolis-St. Paul, Richmond, and St. Louis.

Struggling. The single largest group of urban areas, numbering 86 overall, suffered median income declines between 10 and 15 percent from 1999 to 2016 (Figure 4). While the group contains a handful of large Sunbelt metro areas still laboring to rebound from the late 2000s housing crash (e.g., Miami, Orlando, Phoenix, Tucson) and a few major industrial centers in the Midwest (e.g., Chicago, Indianapolis, Milwaukee), small- to mid-sized urban areas predominate in this category. Most are manufacturing centers that lost significant numbers of middle-income jobs in the 2000s that have not been replaced, including 10 urban areas in Wisconsin, six each in Michigan and Ohio, and five each in Georgia and Indiana. A few have shown some green shoots in the 2010s after a rough decade, including Ann Arbor and Kalamazoo in Michigan, and Oshkosh in Wisconsin. Others, however, have slipped considerably since 2009, such as Charleston, W.Va., Davenport, Iowa, and Springfield, Ill.

Hardest-hit. These 76 places experienced steep drops of at least 15 percent in median household income since 1999—more than three times the national average (Figure 5). They include a mixture of small and large places, with a largely shared geography and economic history. They represent many of the nation’s older manufacturing communities, clustered in the Midwest and Southeast. Notwithstanding modest 3.5 percent median income growth since 2009, metro Detroit ranks near the bottom of the list with a 22 percent decline since 2000. Its Michigan neighbor Flint suffered the second-worst income loss among all urban areas over that period, topped only by small Marion, Ind. Indeed, 47 of the 76 hardest-hit urban areas are located in one of just five states: Indiana, Michigan, North Carolina, Ohio, and Wisconsin. Four of those five swung from the Democratic to the Republican column between the 2012 and 2016 presidential elections.

The hardest-hit urban areas highlight the important role that manufacturing decline played in long-term income decline. For the typical urban area in that category, the share of workers employed in manufacturing (as reported by the Census Bureau) dropped 5.3 percentage points from 2000 to 2016, well above the average of 3.9 percent for all urban areas. Many of those places overlap with the communities my colleague Mark Muro finds have been most affected by the increasing presence of industrial robots, and the difficult labor market transitions and economic anxiety their arrival may bring.

The plight of the American middle class is receiving well-deserved attention, and has been an influential factor not only in the election but also in major national policy debates this year over health care, taxes, trade, and financial regulation. As these five urban Americas make clear, much of the hard work to achieve a lasting middle-class recovery must take shape in our distinctive local communities, through efforts to stimulate innovation, grow good jobs, prepare skilled workers, and connect places to the national and global marketplace.

Cecile Murray provided valuable research assistance for this analysis.

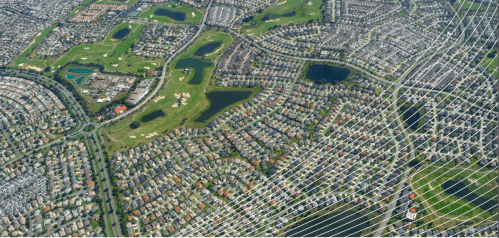

Cover photo credit: Michael Kappel/Flickr.

-

Footnotes

- Median household income represents the total income received by a household in the exact middle of the income distribution for the relevant geography. Changes in median household income over time reflect not only changes in incomes for existing households, but also changes in the underlying number and types of households living in the given geography. The Census Bureau only reports estimates for geographies with populations of at least 65,000 in one-year ACS results.

- For 2000 data, the analysis sums categorical county-level household income data to match 2016 metropolitan and micropolitan geographic definitions, then uses Pareto interpolation to calculate a median for those data.

- The analysis focuses on 289 metropolitan and micropolitan areas that recorded statistically significant changes, and 8 with insignificant changes for which the 90 percent confidence interval ranged between -5 and +5 percent. It also references 2009 ACS estimates where available.

- A portion of that 0.6 percent increase is attributable to a change in the CPS in 2013 that had the effect of increasing reported household income by $1,700. Accounting for that adjustment, real median household income in 2016 from the CPS would likely be lower than that in 1999.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).