Let us consider three countries:

Country 1: Its approach to industrialization has relied heavily on a very large public sector that accounts for well over 40 percent of GDP, and on aid financing from richer countries. The country has no fiscal discipline, running a deficit exceeding 13 percent of GDP. Rather, leaders have focused more on ensuring adequate compensation for civil servants and providing a generous social safety net, including retirement at a young age. And transparency and integrity have not been a top priority, contributing to high corruption. This financial mis-governance has resulted recently in the downgrading of their sovereign risk ratings by commercial risk rating agencies.

Country 2: Like Country 1, it also has had numerous governments hailing from the left-of-center; but in contrast, it pays attention to good governance, anti-corruption, and integrity. The state owns some of the country’s large corporations and commercial banks. It has also focused on improvements in health, education and poverty alleviation. Further, fiscal discipline is prioritized more highly than in Country 1 (even if that is not saying much). Consistent with its strategy, the country instituted a very aggressive and generous fiscal stimulus plan during the global crisis, which amounted to over 2 percent of GDP.

Country 3: Like Country 2 (but unlike Country 1), it emphasizes governance and integrity. But unlike the other countries, it promotes free trade, openness, competition, FDI and global competitiveness, as well as private ownership (including pensions and schools). It pursues a very conservative macroeconomic policy—in fact fiscal responsibility is enshrined in law. Moody’s, the commercial risk-rating agency, upgraded its sovereign debt ratings last year in the midst of a global financial crisis.

There are two ways to classify these three countries. One option is to classify them by their ideology-in-government: the first two countries pursue left-of-center polices, while the third pursues policies that are right-of-center. The second option is to classify these three countries according to their institutional quality/governance: while the second and third countries have good governance, the first has weak governance.

So, which countries are we depicting here? The first is Greece, and both the second and the third are actually the same country—Chile—during the past two decades.

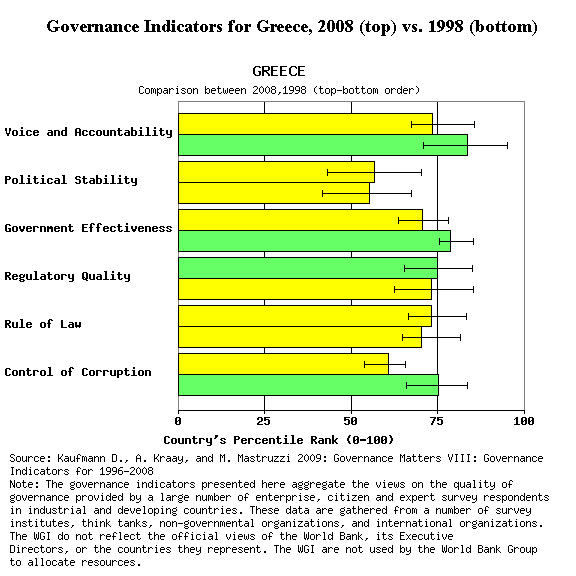

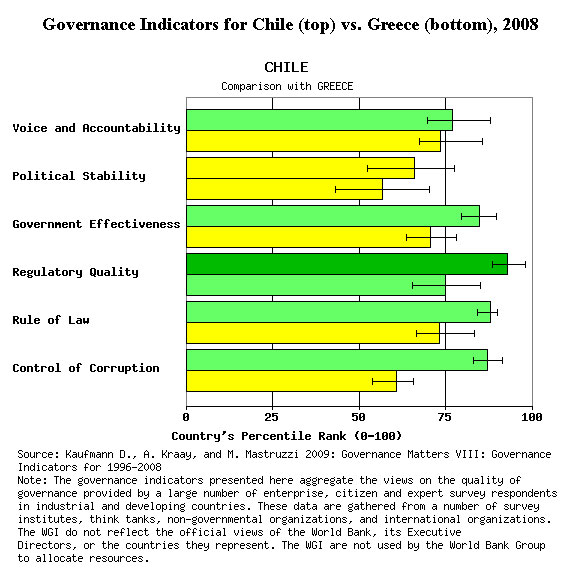

Greece’s deteriorating performance on governance is depicted in the figure above, while Chile’s performance, compared with Greece, is depicted below. The results motivate us to challenge conventional wisdom about global development and governance. Let us focus briefly on six particular myths:

Myth 1: Initial conditions and external factors determine governance outcomes. Wrong. The contrast between Greece and Chile demonstrates the importance of domestic factors and cautions against exaggerating external factors and initial conditions. Greece’s history, its location, EU membership and aid received all provide favorable initial and external conditions for the emergence of strong institutions. In contrast, Chile’s geographical location and geological faults (and not belonging to the EU), points to less auspicious initial and external conditions.

Yet, Chile has stronger governance and thus pursues better policies. More generally there is growing evidence that concurrent domestic factors are highly significant determinants of country success, initial conditions, history, and external factors notwithstanding. Unfortunately, historical and cultural determinism, as well as external factors, are often used to excuse countries’ failures. Similarly, many continue to believe that large (and often indiscriminate) infusions of external financial assistance will make help countries achieve development outcomes and sustained growth.

Myth 2: Economic ideology still matters. Not very much. The riddle about Chile at the outset may have suggested the existence of two countries pursuing different economic policies. However, Chile is an example of one country simultaneously implementing market-led strategies, macro-economic discipline, and progressive social policies with a substantial state role. In Chile nowadays, basic principles of good governance dominate tired ideological divides. For two decades, left-of-center governments in Chile have successfully implemented hard-nosed and conservative economic reforms, coupled with strong social programs and poverty alleviation, showing that we can transcend ideological divides. There is a consensus among the recent generation that macroeconomic stability, economic efficiency, poverty alleviation and good governance are not substitutes for each other but can be integrated together, and that they are key to achieving sustained growth and development. Disagreement about details on the role of the state vis-à-vis social programs and some regulations may persist across the main political coalitions, but they do so at the margin.

Myth 3: In today’s globalized world, states no longer matter; the focus ought to be on regions and global institutions. At least not for a while. Both Greece and Chile illustrate the dangers of focusing excessively on global and regional governance at the expense of national-level governance. Also, they illustrate that regional generalizations are misleading. Denmark and Greece may both be members of the EU, but they are light-years apart in terms of governance, for instance. Likewise, generalizations about Latin America are not telling.

Myth 4: The quality of a country’s governance is not as important as other factors in determining its long-term success. Wrong. The evidence to the contrary is substantial; including the research work that has been done showing that improved governance is a crucial and causal determinant of sustained growth and socio-economic development. We have found that on average there is about a 300 percent development dividend for good governance: a country that substantially improves, say, the effectiveness of its government, rule of law, and/or corruption control, can expect a tripling of its per capita income in the long run. In the case of Chile, for example, such tripling in per capita income, and enormous reduction in poverty, has taken place over a couple of decades.

Myth 5: Good governance is a luxury good. Not at all. Higher incomes or financial resources cannot ”buy” good governance. The contrast between Greece and Chile also shows that a country’s membership to the ”rich” nations club is not an assurance of sustaining good governance, or of high integrity and strong leadership. Conversely, mis-governance and corruption are not synonymous with emerging and developing economies. There is enormous variation in the quality of governance across neighboring emerging economies and developing countries.

Myth 6: One fights corruption by “fighting corruption:” creating more Anti-Corruption Commissions and redrafting laws and regulations. Not really. Many Anti-Corruption (A-C) strategies are ill advised, focusing on A-C campaigns, new A-C commission, and redrafted A-C laws (which lack enforcement). Instead, as in Chile, the focus ought to be on improving institutions and governance more generally, both on the supply side (e.g. procurement, civil service, financial management) and on the demand side (democratic accountability and integrity of elections, free press, civil society and private sector involvement). Notably, while Chile’s efforts have contributed to its low-level corruption (see chart comparison with Greece), it lacks an A-C Commission. Good governance is not embedded in particular anti-corruption commissions (there is none), rather it is embedded in the core institutions of the state.

In conclusion, challenging these myths about governance and growth result in a few reflections.

The good news is that no country is a prisoner of its history—yes, history, culture and external factors do matter, but they are not the main determinants of country success. Having strong leadership, good governance, and adequate reforms makes a huge difference.

The challenging news is that while countries may not be prisoners of their past, they do have to be active stewards of their future, which implies hard and continuous efforts to improve institutions, governance, civil society activism, transparency, and leadership. These are not merely technocratic solutions but deeply political phenomena.

Lastly, let us conclude with a reminder of the ”Chilean Miracle,” a common description of Chile’s achievements. Over the past decade, Chile’s poverty rate has declined from 44 percent of the population living below the poverty line to 12 percent. The country just joined the ranks of the OECD. It routinely ranks in the top 20-30 countries in the world, not only in terms of governance and anticorruption but also in global competitiveness, contrasting Greece, for instance, whose global competitiveness index ranking has deteriorated from 47th in 2006, to 71st among 134 countries ranked in 2009 by the World Economic Forum. Surely there are challenges ahead in Chile, but these enormous accomplishments are real. Yet describing them as a “miracle” is misleading; they are after all not acts of God, but of the people and their leaders.

And on a somber note, the tragic earthquake in Chile over this weekend brings these issues to the forefront. The catastrophic mega-earthquake, of a magnitude of 8.8 on the Richter scale (or hundreds of times more powerful than other major earthquakes over the past 20 years and about the fifth most powerful since records have been kept) may have taken the lives of about a 1,000 people. Every single death is painful; yet, if this figure roughly stands it would constitute a very tiny fraction of the numbers that perished in recent and less powerful earthquakes elsewhere. This is not a “miracle” either, as will be discussed in a forthcoming editorial on the Chilean earthquake. Chile’s good governance and leadership has made a difference.

While imperfect, this institutional environment is homegrown resulting from hard work. And Chile will not require a massive international aid rescue effort. Greece will.

Note: this editorial is an abridged version of the opening keynote presentation given by the author at the Annual Policy Forum Armenia, held at the Cosmos Club in Washington, DC on Sunday February 28, 2010.

Commentary

Op-edNational Disasters Teach Unorthodox Lessons on Governance

March 2, 2010