3:30 pm EDT - 5:00 pm EDT

Past Event

3:30 pm - 5:00 pm EDT

1775 Massachusetts Avenue NW

Washington, DC

20036

Throughout the 2000s, Chinese demand for primary goods like oil, iron, copper, and zinc helped Africa reduce poverty more than it had in decades. Even so, China’s total investment in the continent’s natural resources has been smaller than many imagine, and, with growth shifting away from manufacturing and toward consumption, China’s appetite for raw materials will continue to diminish. China’s shifting economic growth model aligns with sub-Saharan Africa’s imminent labor force boom, presenting a significant opportunity for both sides. Maximizing mutual gain will depend on China and Africa cooperating to address a host of challenges: Can African countries limit the flow of Chinese migrants and foster domestic industries? Will Chinese investors adopt global norms of social and environmental responsibility? Where does the West fit in?

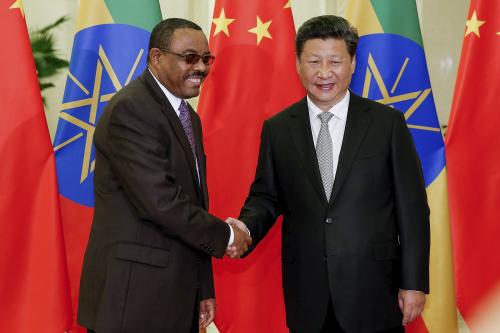

On July 13, 2016, the John L. Thornton China Center and the Africa Growth Initiative (AGI) at Brookings launched Senior Fellow David Dollar’s new report, “China’s Engagement in Africa: From Natural Resources to Human Resources.” Dollar presented key findings from the study, and AGI Director Amadou Sy moderated a discussion with Dollar, Ambassador Oliver Wonekha of Uganda, and Wenjie Chen of the International Monetary Fund on the larger issues of China’s trade and investment in Africa, how it has benefited the continent, what could make it more effective, and lessons for the next phase of engagement.

Related Content

David Dollar

July 13, 2016

David Dollar

July 11, 2016

David Dollar, Heiwai Tang, Wenjie Chen

August 12, 2015

Yun Sun

July 5, 2016

Emily Gustafsson-Wright, Elyse Painter

May 8, 2024

Richard Dion

May 6, 2024

Anwar Aridi, Jeong-Dong Lee

May 1, 2024