The Vitals

Patients often receive health care in cases where they cannot choose which provider delivers their care. If this happened to you, there is a chance you could end up with costly surprise out-of-network medical bills. Some providers also use the threat of sending surprise bills to extract high prices from insurers, which leads to higher premiums for all health care consumers.

-

Even when patients select an in-network hospital, they still may receive out-of-network care from anesthesiologists, radiologists, or other specialists.

-

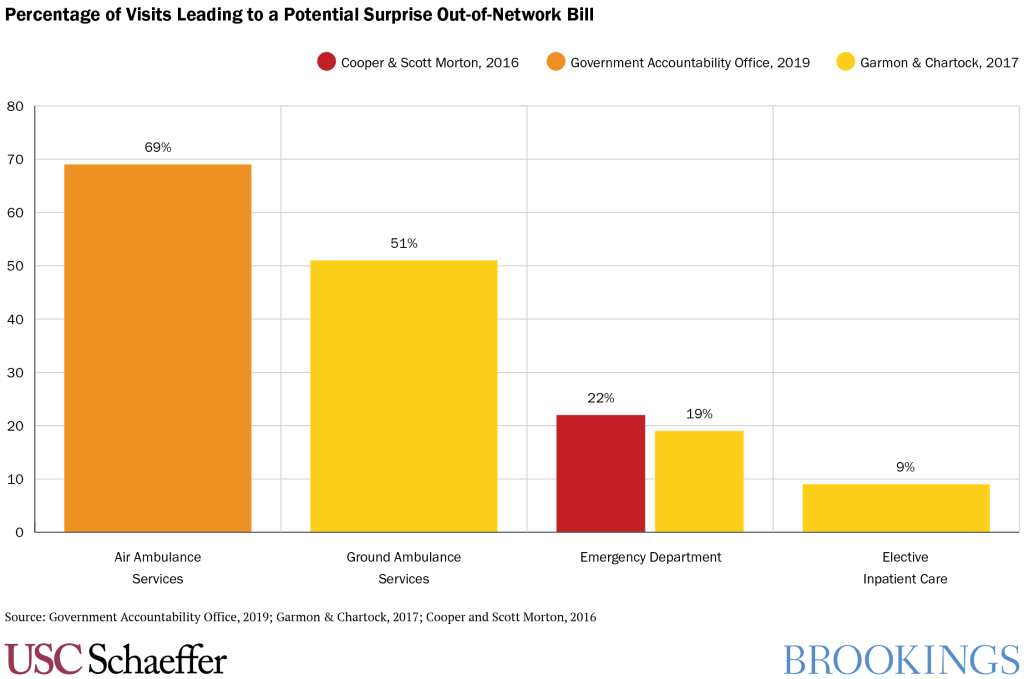

About 20% of emergency department visits involve care from at least one out-of-network provider.

-

Physician specialists who patients do not choose can leverage the fact that they can remain out-of-network to receive much higher prices than their peers.

A Closer Look

High health care costs are a major concern for many

families. One specific concern is surprise out-of-network billing, where

consumers are blindsided by charges from a provider outside of their health

insurance network that they did not themselves choose to see. When these bills

arrive, they are costly and sometimes financially devastating for families who expected

to receive care only from providers within their health insurer’s network because

they did not choose to go out of network.

Polls suggest that three quarters of Americans favor

policies that would protect consumers from surprise bills, and President Trump,

many members of Congress of both parties, as well as many Democratic

presidential candidates have discussed the importance of addressing the issue, and

lawmakers in Washington and in state capitols are considering action.

What is “surprise billing”?

When people need medical care, they generally seek providers

who are in-network for their insurance. But in some situations, patients are

unable to choose which provider treats them, and thus may end up unexpectedly

receiving care from an out-of-network provider. While patients typically select

an in-network hospital and lead doctor for planned hospital care (like a

scheduled surgery or the birth of a baby) and sometimes even choose a hospital

in emergency situations, they do not choose every member of their care team.

Instead, hospitals direct ancillary providers like anesthesiologists,

radiologists, and emergency room doctors to play a role in the care that the

patient receives. These providers may be out-of-network even though the

hospital is in-network. And in other emergency situations, patients may be

taken to the nearest hospital, whether or not that hospital is in-network, and

ambulance transportation may also be out-of-network.

When patients receive care from out-of-network providers whom

they did not choose, they may receive a “surprise” out-of-network bill. The

insurance company will often pay some amount to the out-of-network provider,

but typically less than the provider’s list price (or “charge”) for the

services. In many such cases, the provider then “balance bills” the patient for

the difference between their list price and the insurer’s payment.

How big are surprise balance bills?

Surprise bills can be very large. Providers’ list prices are

not negotiated between insurance companies and providers, and because consumers

are not choosing the provider in these circumstances, they have no ability to

shop around to avoid providers with high list prices. That means these list

prices are not constrained by market forces and can be very high. Indeed, the

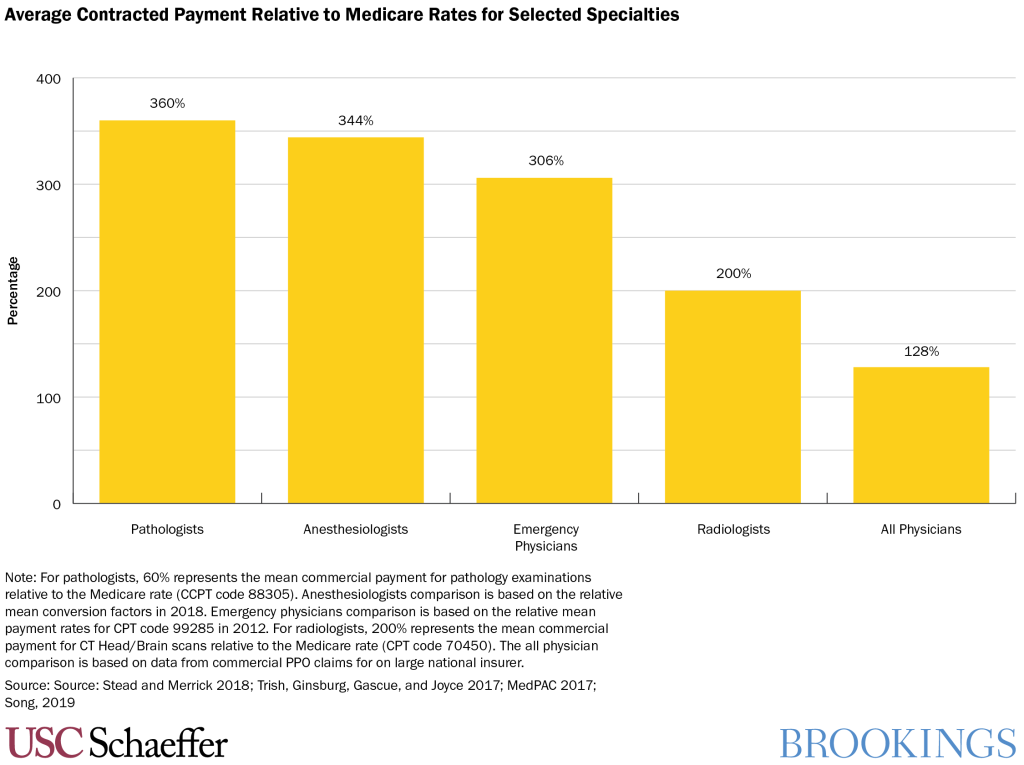

data show that the physician specialties that have the most opportunity to send

surprise balance bills also have much higher list prices (as a percentage of

what Medicare pays for those services) than other types of physicians.

How common are situations that can lead to surprise billing?

Out-of-network care delivered in situations that patients cannot reasonably avoid is fairly common. Researchers find that about 20% of emergency department visits involve care from at least one out-of-network provider. Similarly, about 9% of elective inpatient admissions involve at least one out-of-network provider. And studies suggest that between half and two-thirds of ambulance rides are out-of-network.

Why does it happen so often?

Surprise billing reflects efforts by providers to exploit a

market failure: the fact that patients do not choose their emergency and

ancillary providers who contract independently with insurance plans. That gives

these physicians a lucrative out-of-network billing opportunity; they can

remain out-of-network, collect some amount directly from insurance companies,

and balance bill patients after the fact up to a list price that is much higher

than what they might receive if they agreed to join an insurer’s network.

Importantly, this option is only available for providers whom

patients do not choose. In other specialties (like surgery, obstetrics, or

primary care), providers generally face strong pressure to enter at least some

insurance company networks, since few patients would choose an out-of-network

doctor. But providers whom patients do not choose can leverage the fact that

they can remain out-of-network to receive very large payments relative to their

peer physicians.

How does this affect health care consumers?

Patients who receive a surprise balance bill can be charged hundreds, thousands, or even tens

of thousands of dollars. But surprise billing also leads to higher premiums for

all health care consumers.

Because these providers can credibly threaten to remain

out-of-network and balance bill patients, they are able to demand very high

rates from insurance companies when they do go in-network. As the figure below

shows, specialists like anesthesiologists and emergency medicine physicians

receive payment rates roughly double what their peer physicians get (as a

percent of what Medicare would pay for the same service) when they do go

in-network.

That means all consumers with private insurance pay higher

premiums because this relatively small group of providers is able to exploit a

market failure. Extrapolating from Congressional Budget Office estimates, if

these providers were paid more in line with other specialists relative to

Medicare rates, commercial insurance premiums would be roughly 5% lower than

they are today.

What can a consumer who receives a surprise balance bill do?

In some states, commercially insured consumers may be protected by a state law that aims to prevent or limit surprise billing. Consumers in 27 states may be able to obtain assistance from their state insurance department, though state law protections may not cover all surprise billing situations, and may not cover people with insurance through their job.

Consumers who are not protected by a state law can contact

their insurance company and the provider who sent the bill. The provider may

agree to write-down a portion of the payment or to schedule a repayment plan

over time. Consumers may be able to appeal to their insurance company to argue

that the insurer should pay a greater portion of the bill. The state insurance

department or their employer’s HR

department may also be able to provide some advice.

What can policymakers do?

Policymakers can address the market failure and put an end

to surprise billing, but they should take care to ensure that their solution to

the surprise billing problem does not increase health care costs for everyone. There

are two types of policy approaches to this problem billing regulation, which

limits how much providers can collect out-of-network, and contracting

regulation, which prevents providers from being out-of-network.

The first, “billing regulation,” would require insurance companies and providers to charge the patient only the amount she would have paid had she seen an in-network provider. This ensures that the patient will have the same costs regardless of whether the provider selected for her is in-network or out-of-network.

Policymakers using this framework may also wish to specify a

mechanism to decide how much the insurance company must pay the provider for

the care received. There are many options: providers could be paid a rate based

on what Medicare would pay for the service, a rate based on what insurers pay

other providers for the service, or there could be an arbitration process. We

believe it is important that policymakers choose a rate that is relatively low:

this group of providers are today receiving higher payments than peer

physicians, and policymakers have an opportunity to address this imbalance (or

at least refrain from making it worse). For more information on options for

setting this rate, see our

analysis of different billing regulation approaches.

Another type of solution (termed “contracting regulation”)

would prevent these types of providers from being out-of-network in the first

place. This includes “network

matching” policies that require doctors to join the same networks as

the hospitals in which they practice, or prohibiting emergency

and ancillary clinicians from billing insurers or patients directly for their

services, instead making them reliant on the facility they work at for payment—similar

to how nurses are paid today.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

What is surprise billing for medical care?

October 15, 2019