In preparing to teach a course on trade and development recently, I was struck by how much views on the subject had changed since I first took a course on development economics 50 years ago. To pursue this idea further, I consulted the 1970 edition of “Leading Issues in Development Economics” by Gerald Meier. This book contained extracts of articles by academics and practitioners, as well as notes by Professor Meier. Through a broad sampling of selections, it performed the role of a representative contemporaneous survey.

What we knew then

Structuralism

Structuralism was an influential body of thinking in the 1950s and 1960s that saw a built-in bias against developing countries in the structure of international trade. Writing in the mid-20th century, prominent structuralists like Gunnar Myrdal, Hans Singer, and Raúl Prebisch observed no tendency for convergence of per capita incomes among rich and poor countries that was predicted by neoclassical trade theory. They argued this was due to structural features among these economies that prevented the poor from benefiting from trade with countries with substantially higher productivity. First, developing countries could mostly export primary products; second, such products faced limited and inelastic demand in global markets. Improvements in the productivity of producing such goods would lead to a decline in prices that would benefit rich countries and not the poor.

Import substitution was a natural outcome of this thinking. Impose high tariffs against selected manufactured imports to induce domestic production of the same. Proponents noted that European countries, followed by the U.S. and Japan, had also begun industrialization behind high tariff barriers. However, even 50 years ago, much had been learned about import substitution in practice, especially in Latin America. The results were not reassuring. High economic growth rates had not translated into relief from balance of payments pressures or strong employment gains. Instead, some highly protected industrial sectors had been created whose benefits flowed largely to a politically connected elite. Even Prebisch wrote scathingly about these undesirable outcomes of import substitution, as noted here.

Export pessimism

Of course, structuralist thinking was strongly contested by neoclassical thinking at the time, represented by academics like Gottfried Haberler and Ragnar Nurkse. However, even within this strain of thinking, some were pessimistic about the possibility of high growth among developing countries arising from trade with industrialized countries. First, the trading role of the dominant economy in the 20th century (the U.S.) seemed to be different from that of the dominant economy in the nineteenth (the U.K.). It was thought that the U.S. would not prove a sufficiently strong growth engine and, as a result, global trade growth during the last half of the 20th century would not reach the 13 percent per annum average of the 1850-1910 period. Second, it was thought that synthetic products would continue to substitute for primary products and depress the market for developing countries. The first half of the 20th century had seen both an expansion of synthetic products and a decline in global trade growth.

Note that, as of 1970, few were writing about the potential for labor-intensive manufactured exports from developing countries. It was not until the mid-70s that the surge in such exports from Korea, Singapore, Taiwan, and Hong Kong began to be noticed and written about. China was, of course, still a Maoist country and India still followed a planned, import-substituting industrialization strategy.

Trade and inequality

The structuralists believed that trade between rich and poor countries would increase international inequality. Rather than leading toward convergence of incomes, Myrdal argued that the process would tend to “award its favors to those who are already well-endowed and even to thwart the efforts of those who happen to be in regions that are lagging behind.” More politically oriented structuralists argued that transnational capitalism embodied in trade exacerbated domestic inequality in developing countries by displacing a range of local economic activities.

What we know now

Role of primary products

Export pessimism proved unfounded. In practice, many countries that have relied on primary product exports (oil, minerals, cash crops) have done reasonably well by them. Where broad-based prosperity has not been achieved from primary products, the reasons are more likely to be found in domestic governance arrangements than in export elasticities. For while primary products have experienced volatile price cycles at times, they have not been associated with a deteriorating secular trend, not even with the continuous expansion of synthetic products.

Potential of manufactured exports

Many developing countries, mostly based in East Asia, developed principally by exporting manufactures. Their exports had one thing in common: reliance on local supplies of labor rather than minerals or cash crops. Furthermore, many diversified their exports over time, starting with products based on low-wage labor but moving on to products requiring higher skills and paying higher wages. Korea, Taiwan, Malaysia, and Singapore are the best examples of this phenomenon. China, India, Bangladesh, and Vietnam have also been moving along this path recently.

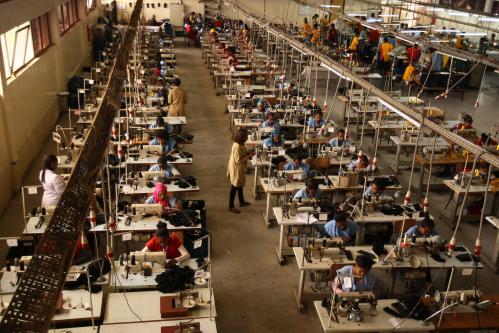

Impact on workers in developing countries

The impact of export-led growth on the lives of the low wage population of East Asian countries has been dramatic. Poverty rates declined substantially as real wages rose. East Asian economies have been converging with western economies for several decades now. Inequality may have increased in some countries, such as China, but the impressive gains in prosperity at the bottom of the income distribution cannot be denied. Of course, industrialization has brought about other concerns, such as pollution, land degradation, urban congestion, indigenous rights, labor rights, water scarcity, and so on. These were not prominent in development debates 50 years ago but are salient now.

Impact on workers in developed countries

There was not much discussion at all 50 years ago about the impact of global trade on workers in rich countries. In part, this was because there had been no prior experience of substantial competition in manufactured goods from low-wage countries. The experience of the 19th and early 20th centuries was largely confined to trade in manufactures among similar-wage countries of Europe and the United States. Consequently, most empirical projections suggested relatively small net effects of trade on workers’ earnings.

In the event, this turned out to be a major blind spot, at least for the U.S. economy. Even small net effects have been a major social and political concern—notably in those communities that have borne the brunt of globalization during the last few decades, as described, for example, by recent studies of the China shock. The effects have been worse in the U.S. possibly because of a less effective social safety net.

Ironically, structuralist concerns about the asymmetric distribution of job losses and gains across locations, sectors, and skill types, originally raised for poor countries, seem to have come true in some rich countries.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Trade and development: The view from 50 years ago

May 14, 2021