EXECUTIVE SUMMARY

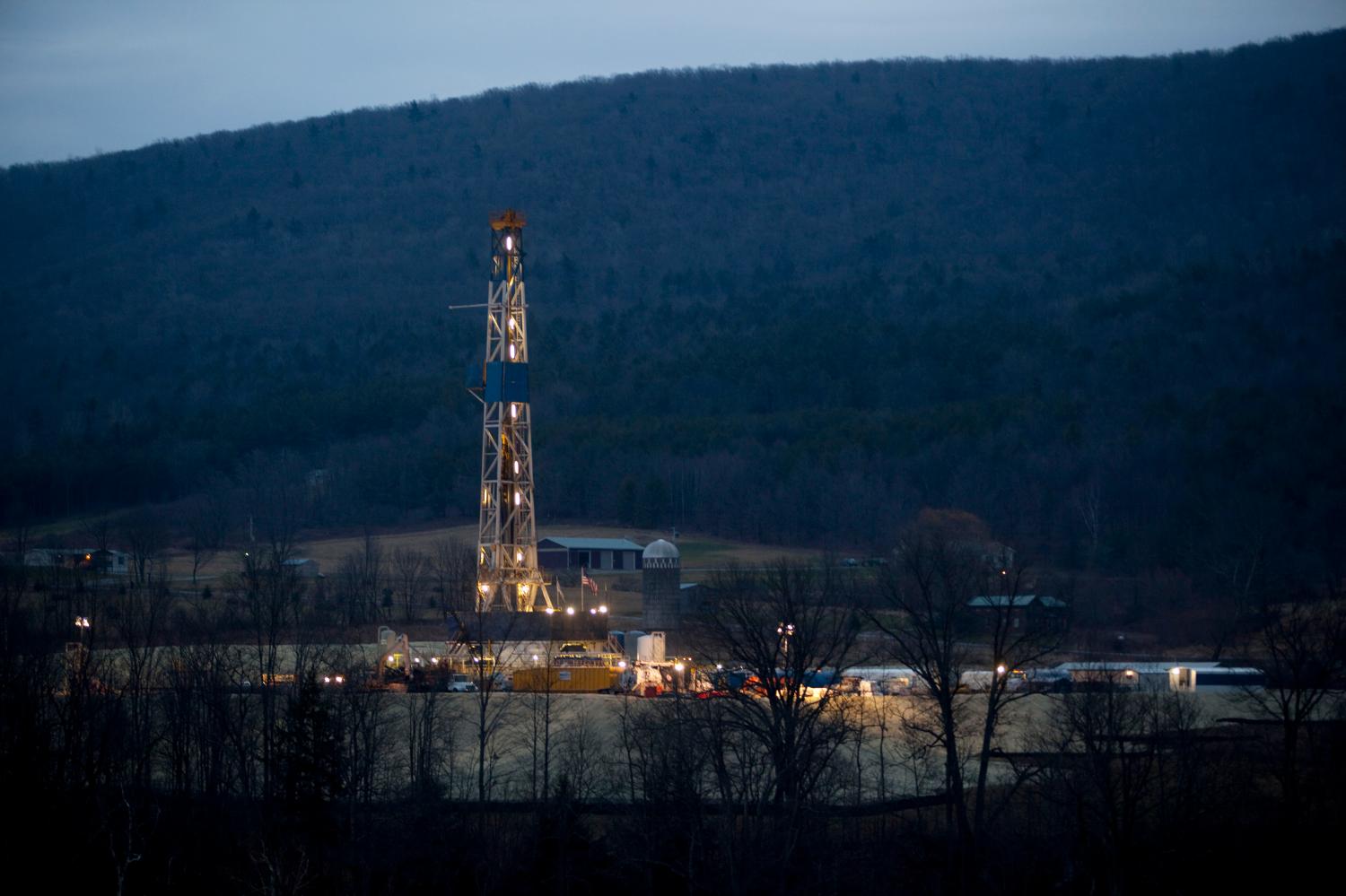

Driven by technological breakthroughs in unconventional gas production, major increases in U.S. natural gas reserves and production have led to supply growth significantly outpacing forecasts in recent years. As a result, natural gas producers have sought new and additional sources of demand for the newfound volumes. One proposed end-use is the exportation of U.S. natural gas in the form of liquefied natural gas (LNG). While the United States already exports modest quantities of natural gas, mostly via pipeline, current proposals, some of which have already received full or partial approval from the federal government, would increase substantially the volume of LNG exports. There is a growing debate between policymakers, industry, and energy analysts as to the merits of exporting greater quantities of U.S. natural gas. Some domestic natural gas consumers contend that exporting U.S. gas would result in an increase in domestic natural gas prices and therefore in higher prices for businesses and households. Proponents of natural gas exports argue that they would provide valuable foreign exchange and would be a source of economic growth and job creation.

This report, the result of a year-long study, addresses the merits of increased LNG exports through an examination of the feasibility of exports and their likely implications. It concludes that, given current information on resources, increased LNG exports from the United States are technically feasible. While new policies may serve to change the logistics or economics of shale gas production, under current circumstances, the challenges to LNG exportation, including physical and human capacity and demands for natural gas from competing domestic sectors, are not insurmountable. It also finds that, in light of current global supply and demand projections, some amount of U.S. LNG exports is likely to be competitive in global markets. The study finds that U.S. LNG exports are likely to have a modest upward impact on domestic prices, and a limited impact on the competitiveness of U.S. industry and job creation. It finds that U.S. LNG is likely to make a positive, albeit relatively small, contribution to the U.S. gross domestic product (GDP), trade balance, and that the potential for U.S. LNG exports to make a positive impact on global greenhouse gas emissions is minimal. It further finds that there is potential for positive foreign policy impacts from U.S. entry in the global gas market, through both increased supply diversity for strategic gas-importing allies, and as a contributory factor in weakening the oillinked contract pricing structure that works to the advantage of rent-seeking energy suppliers.

The study recommends that U.S. policy makers should refrain from introducing legislation or regulations that would either promote or limit additional exports of LNG from the United States. The nature of the LNG sector, both the costs associated with producing, processing, and shipping the gas, and the global market in which it will compete, will place upper bounds on the amount of LNG that will be economic to export. Incremental increases in the price of domestic gas (as a result of domestic demand or export) negatively impact the economics of each additional proposed export project, which even with government approval will still require private financing and interested buyers. Efforts to intervene in the market by policy makers are likely to result in subsidies to consumers at the expense of producers, and to lead to unintended consequences. They are also likely to weaken the position of the United States as a supporter of a global trading system characterized by the free flow of goods and capital.