Abstract

With the expiration of many tax cuts and unmet climate targets, 2025 could be a crucial year for climate policy in the United States. Using an integrated model of energy supply and demand, this paper aims to assess climate policies that the U.S. federal government may consider in 2025 and to evaluate emissions reductions, abatement costs, fiscal impacts, and household energy expenditures across a range of policy scenarios. The model shows several key findings. First, the emissions reductions of the Inflation Reduction Act (IRA) are significantly augmented under scenarios that add a modest carbon fee or, to a lesser extent, that implement a clean electricity standard in the power sector. Second, net fiscal costs can be substantially reduced in scenarios that include a carbon fee. Third, expanding the IRA tax credits yields modest additional emissions reductions with higher fiscal costs. Finally, although none of the policy combinations across these scenarios achieve the U.S. target of a 50-52 percent economy-wide emissions reduction by 2030 from 2005 levels, the carbon fee and clean electricity standard scenarios achieve these levels between 2030 and 2035.

Introduction

Because much of U.S. climate policy currently operates through the tax code, 2025 could prove to be a crucial year for U.S. climate policy choices: At the end of 2025, a large number of Tax Cuts and Jobs Act (TCJA) provisions are scheduled to expire. Policymakers across the political spectrum have expressed support for extending at least some of the expiring tax cuts and a desire to put new tax policy ideas on the negotiation table.

That creates an opportunity for pragmatic evaluation of the trade-offs that result from—among other factors—lower tax revenues and continued incentives to invest in decarbonization. In particular, a full extension of TCJA provisions would come at a large revenue cost, estimated to approach $4 trillion over 10 years (Clausing and Sarin 2023), in a time of already high deficits and rising debt. In addition, further action is needed to meet the United States’ Paris Agreement commitment to decarbonization. The Inflation Reduction Act (IRA), which has been described as the largest piece of climate legislation in U.S. history, relies on tax credits, loans, and direct spending to help meet that commitment. But even that package is projected to bring the United States only part way toward its commitment of 50–52 percent economy-wide greenhouse gas (GHG) reductions in emissions by 2030 relative to 2005 (Bistline et al. 2023).

The combination of scheduled expirations of lower tax rates, fiscal pressures, and unmet climate targets suggests that a range of climate policy options could be under consideration as policymakers debate future tax policy. In a recently released NBER working paper, John Bistline, Kimberly Clausing, Neil Mehrotra, James Stock, and Catherine Wolfram (Bistline et al. 2024) analyze seven potential climate policy scenarios facing the U.S. federal government in 2025 and their associated trade-offs.

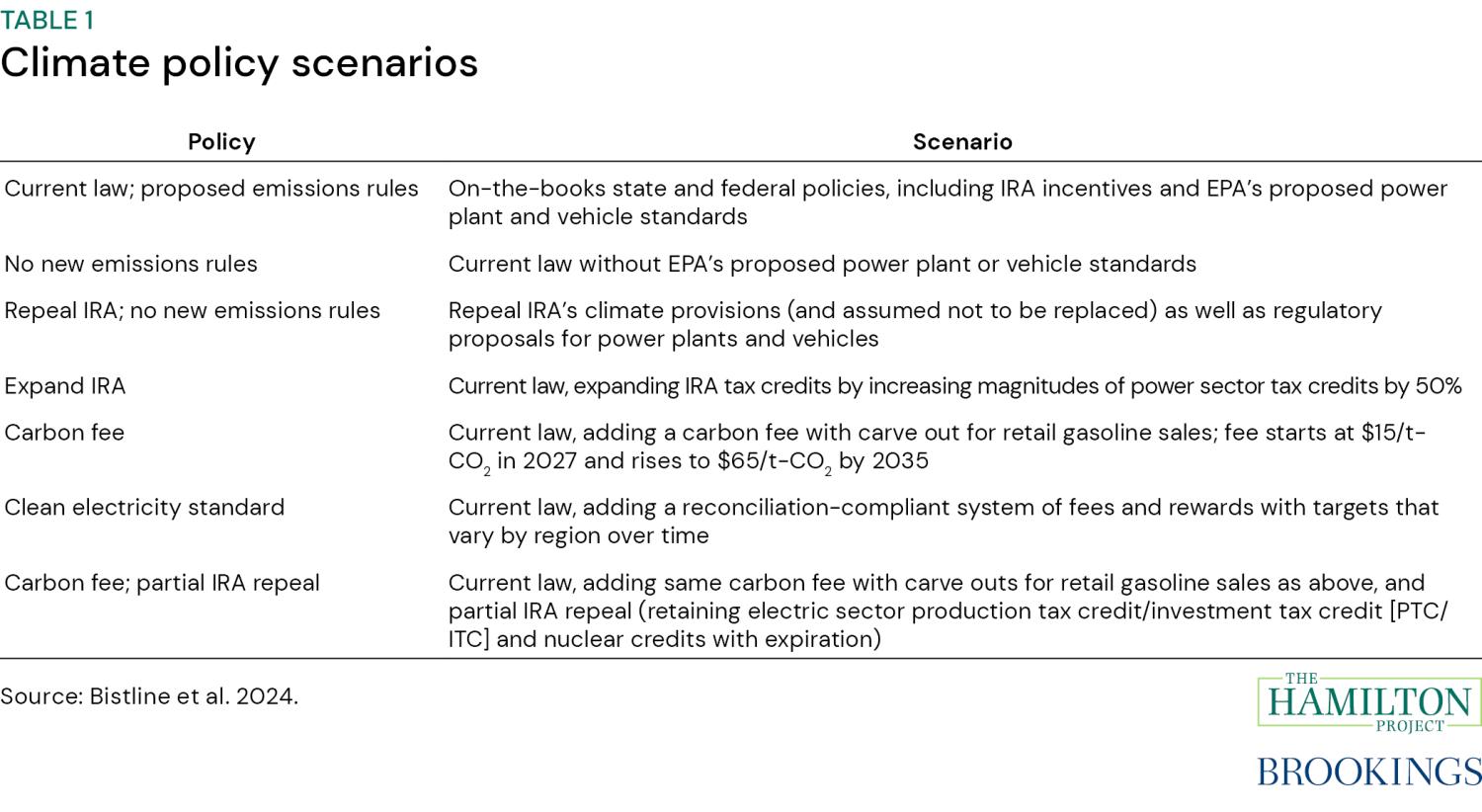

Climate policy scenarios

The seven scenarios considered here are (a) policies that could plausibly be under consideration in 2025, although consideration of each is more or less likely depending on outcomes of the 2024 elections and on future economic conditions; and (b) tax and expenditure policies with potentially major fiscal and/or emissions impacts. To analyze these policy options, Bistline et al. (2024) use the Electric Power Research Institute’s (EPRI) U.S. Regional Economy, Greenhouse Gas, and Energy (US-REGEN) model (EPRI 2021). These climate policy scenarios are summarized in table 1.

The first scenario (“Current law; proposed emissions rules”) is the baseline under current law. Within that scenario, Bistline et al. (2024) assume that two major proposed climate regulations have been finalized: Both EPA’s tailpipe carbon dioxide (CO2) emissions standards for light-, medium-, and heavy-duty vehicles; and EPA’s power plant rule under Section 111 of the Clean Air Act (CAA) are on schedule to be finalized in 2024. This baseline scenario assumes that those two proposed regulations have been finalized and implemented.

However, because the fate of those two regulations is uncertain, the second scenario (“No new emissions rules”) incorporates a different assumption. Both regulations are likely to be subject to litigation and could be withdrawn by a subsequent administration and replaced by less-stringent regulations. To reflect this regulatory uncertainty, the second scenario assumes that neither regulation is present but otherwise follows current law.

The third scenario (“Repeal IRA; no new emissions rules”) assumes that neither regulation is present; unlike scenario two, however, scenario three also repeals the IRA.

Bistline et al. (2024) model three additional scenarios that entail expansions to current law. Scenario four (“Expand IRA”) enhances the IRA by increasing magnitudes of power sector tax credits by 50 percent. Scenarios five (“Carbon fee”) and six (“Clean electricity standard”) keep the IRA in place and add a carbon fee or a clean electricity standard.

Scenario seven (“Carbon fee; partial IRA repeal”) is a possible compromise scenario that adds a carbon fee but repeals many IRA energy provisions, with the exceptions of the electric sector production tax credit/investment tax credit (PTC/ITC), and the nuclear provisions.

As described below, the authors evaluate these seven climate policy scenarios on three dimensions related to key policy goals. The first dimension is outcomes for emissions reductions. The second dimension is economic efficiency, which is measured as the economy-wide costs (incorporating costs to businesses and households) per ton of CO2 abated. That commonly used measure helps to inform both policy sustainability as well as effects on energy affordability and social welfare. The third dimension is each scenario’s fiscal impact.

Additional dimensions are explored in the NBER working paper (Bistline et al. 2024) but are not described here; the working paper considers the effects of these scenarios on the distribution of income as well as on how the U.S. policy stance might influence climate policy adoption in other countries.

Projected emissions reductions

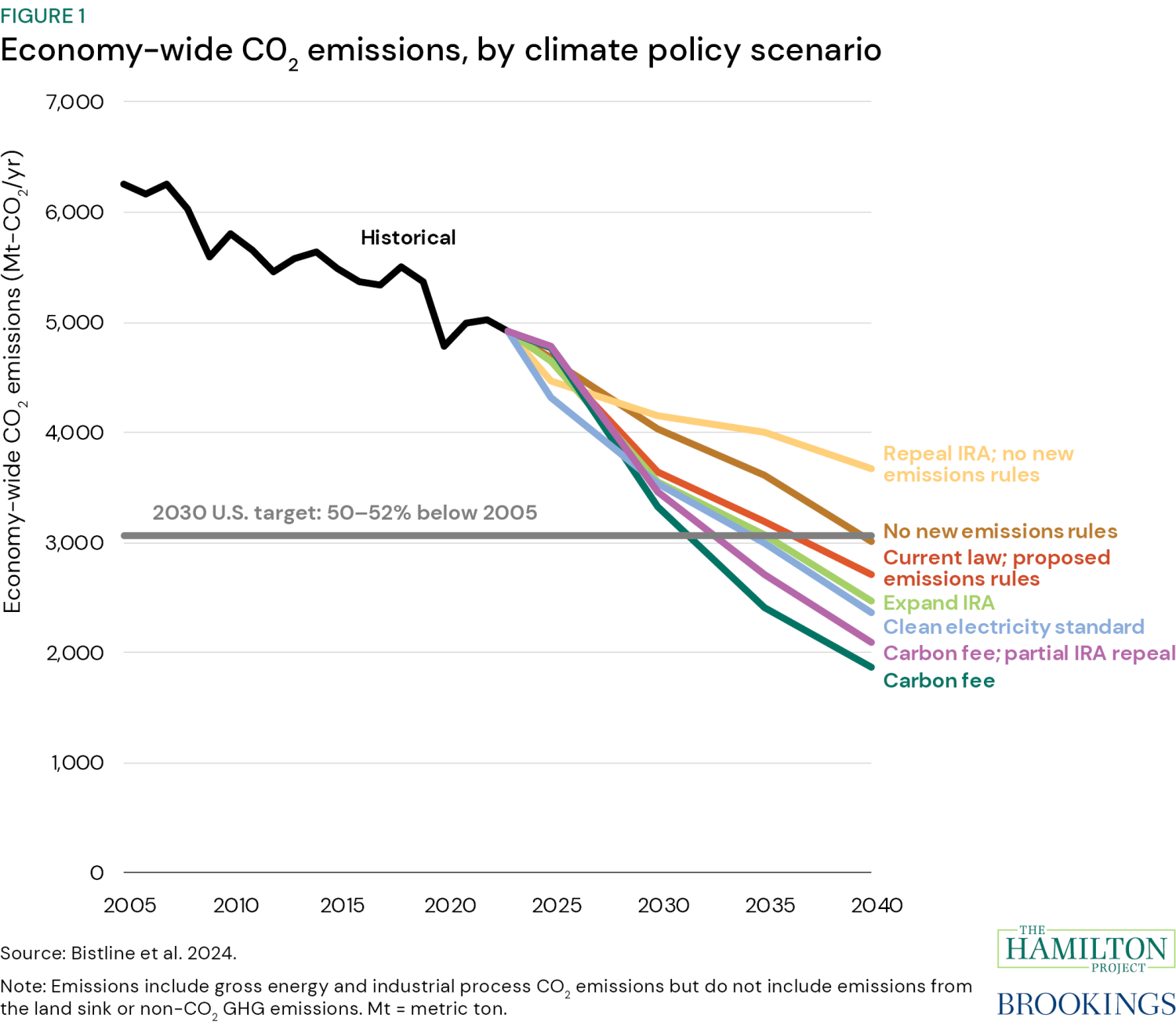

Figure 1 depicts projected economy-wide CO2 emissions through 2040 for each climate policy scenario measured as metric tons (Mt) of CO2 per year. The modeled emissions paths do not diverge substantially for several years; however, large differences appear in the emissions paths starting in the 2030s.

Emissions under scenario one (“Current law; proposed emissions rules”) decline over time and reach 49 percent below 2005 levels by 2035, which is lower than they are under scenarios two (“No new emissions rules”) or three (“Repeal IRA; no new emissions rules”), which would be 42 and 36 percent reductions by 2035, respectively.

All scenarios that augment the IRA and existing regulations result in additional emissions reductions relative to the baseline, though the scale of those reductions varies. According to the modeling, the deepest emissions reduction scenarios are those that extend current policies with a carbon fee (scenario five, “Carbon fee” and scenario seven, “Carbon fee; partial IRA repeal”), which drive deeper reductions in the power sector and more investment in CO2 removal. The carbon fee scenarios lower CO2 emissions from 2005 levels by 45–47 percent by 2030 and 57–62 percent by 2035, which is 8–13 percentage points below the current law baseline (scenario one, “Current law; proposed emissions rules”). Notably, the expansion of the IRA tax credits modeled (scenario four, “Expand IRA”) would be less effective in reducing emissions than augmenting the IRA by either a carbon fee or a clean electricity standard, or than repealing many IRA provisions and introducing a carbon fee.

Across the seven scenarios, the power sector is the most sensitive to policy choices and achieves near-zero emissions in 2040 through scenario six (“Clean electricity standard”) and the two scenarios that include a carbon fee, scenarios five (“Carbon fee”) and seven (“Carbon fee; partial IRA repeal”). Low emissions in the power sector also support cleaner transportation sectors in these three scenarios due to the prominence of transport electrification. By contrast, emissions in the power sector expand to over a gigaton by 2035 and continue to grow under scenario three (“Repeal IRA; no new emissions rules”). The two scenarios that involve a carbon fee also support CO2 removal starting in 2035, which the model suggests could come from both bioenergy with carbon capture and storage for fuels and direct air capture.

Abatement costs and energy price effects of climate tax policy scenarios

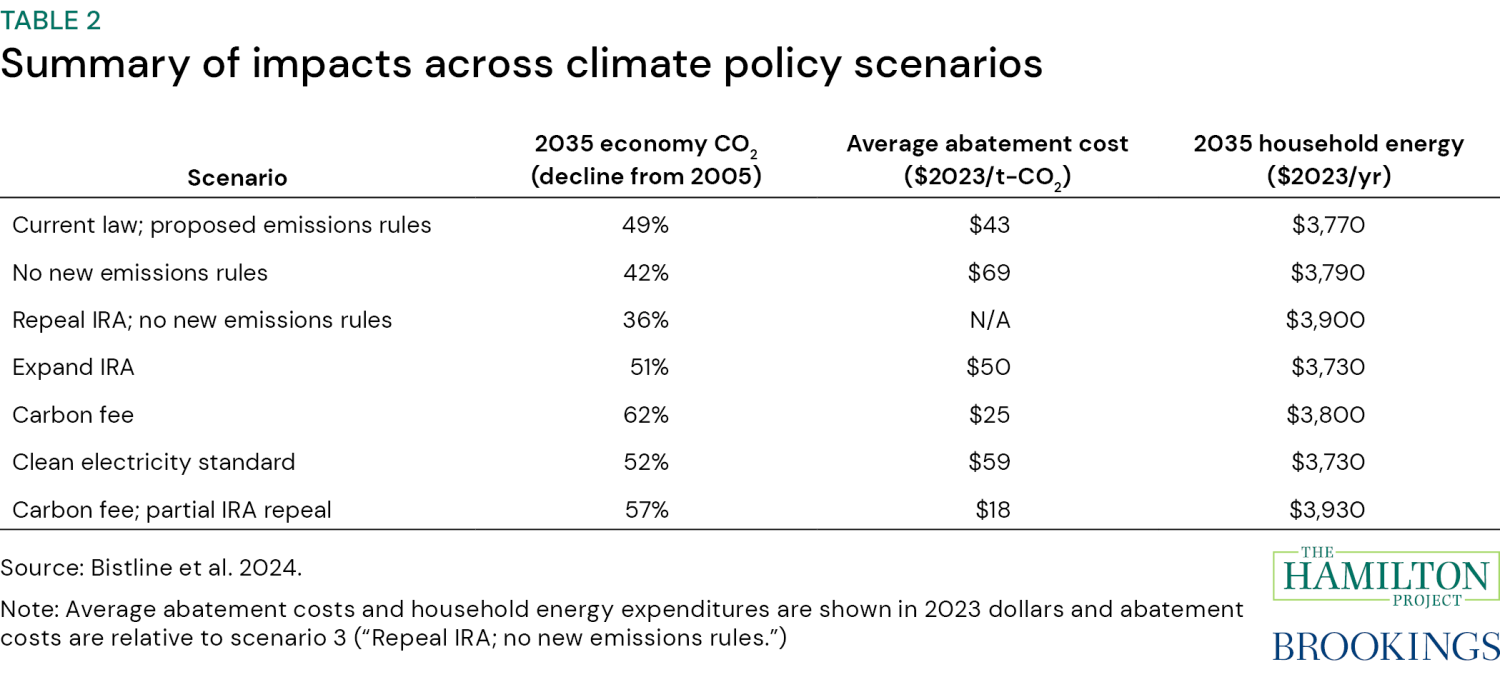

Table 2 summarizes three outcomes with respect to the seven climate policy scenarios. The first column shows emissions in 2035 expressed as a percentage reduction from 2005 emissions. The second column reports the average abatement cost of each scenario relative to scenario three (“Repeal IRA; no new emissions rules”). Those relative costs are a ratio of two measures. In the numerator is the net present value (in 2023 dollars) of the additional costs stemming from the change in the energy system relative to that under scenario three. The denominator is the cumulative reduction in CO2 relative to scenario three. The third column is projected household spending in 2035 on electricity, petroleum, natural gas, and other fuels (in 2023 dollars).

Abatement costs in the first two scenarios—“Current law; proposed emissions rules” and “No new emissions rules” ($43 and $69 per ton of CO2, respectively)—are similar to the range of IRA abatement costs in a recent multi-model study (Bistline et al. 2023). Proposed EPA power plant rules assumed to be implemented in scenario one lower abatement costs by targeting reductions in coal generation in the power sector, which are among the lowest cost abatement options. Expanding the IRA and adding a clean electricity standard accelerates power sector investments and increases costs relative to the current law scenario from $43 per ton to $50 and $59 per ton, respectively.

Adding a carbon fee lowers average abatement costs to $25 per ton, and to $18 per ton with partial IRA repeal. The relatively low average abatement costs in the carbon fee scenarios reflect several factors, including the low abatement costs in the power sector and the additional use of biofuels, both of which are sources of decarbonization that are made more profitable by the fee.

Household energy expenditures show annual spending on electricity, petroleum, natural gas, and other fuels. Notably, direct energy costs borne by households have limited variation across climate policy scenarios, varying by less than 5 percent in 2035. In all scenarios, energy spending declines steadily from 2023 through 2035 and then further over time (not shown in table 2), primarily driven by reduced gasoline use. With the increasing adoption of electric vehicles, spending on electricity increases over time in most periods and scenarios, but not by as much as gasoline expenditures fall. Household expenditures are slightly higher than the current law scenario with either a carbon fee or IRA repeal.

Fiscal impacts of climate tax policy scenarios

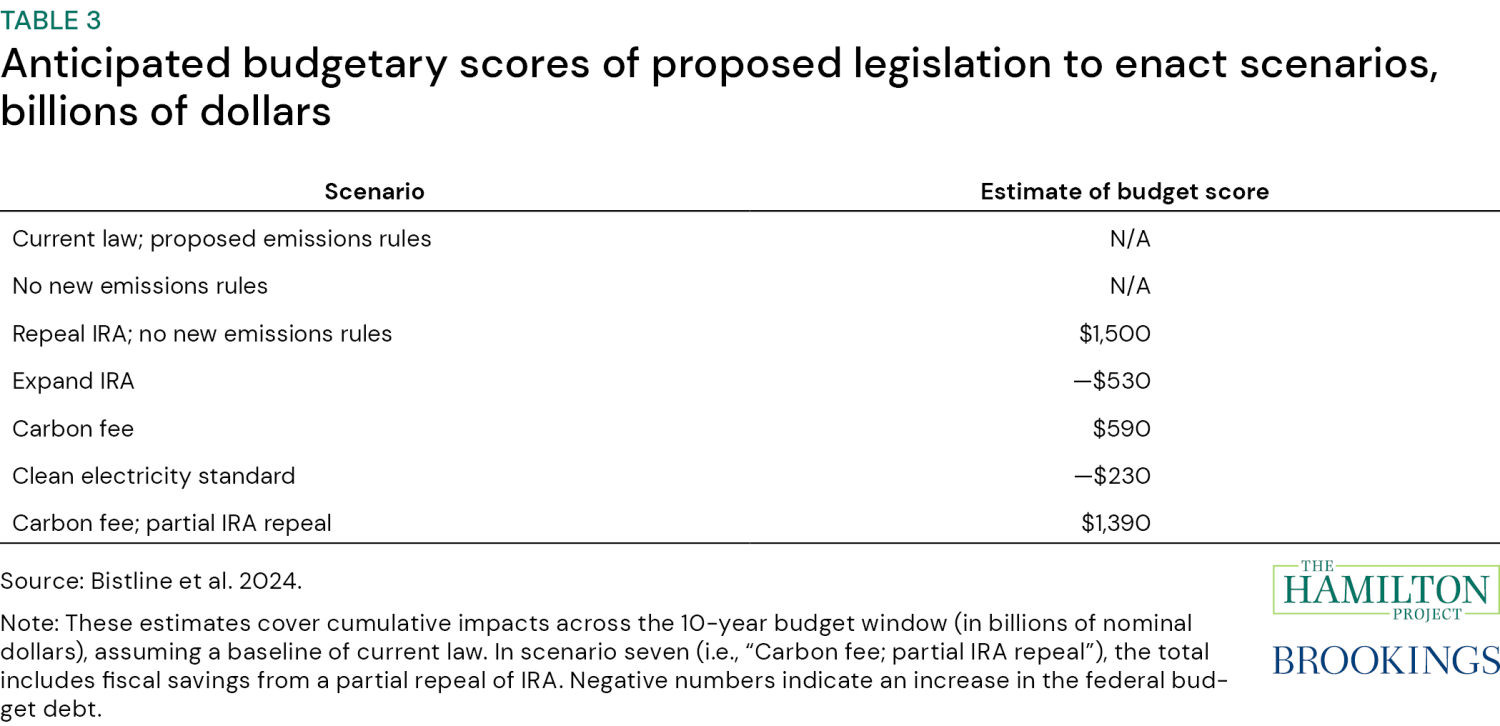

Table 3 shows the anticipated budgetary scores of proposed new legislation to enact the climate tax policy scenarios three through seven in nominal dollars. Scenario one is current law, with proposed emissions rules, and does not require new legislation. Scenario two is also current law but assumes the new emission rules are withdrawn, which would also not require new legislation. The other scenarios would be enacted only through legislation, and the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT) would analyze proposed legislation to score the budgetary effects over a 10-year window relative to a current-law baseline. Table 3 shows the authors’ estimates of those scores. For this table, the authors do not model the effects of the carbon fee on IRA subsidy uptake, do not consider offset effects that might affect tax revenues elsewhere in the system, and omit both revenues from a carbon border adjustment that might accompany the scenarios with carbon fees and revenues from fossil fuel exports. As the authors note, these revenues could be quite large, substantially increasing revenues for a carbon fee.

Table 3 shows widely varying budgetary impacts from these scenarios: Carbon fees and partial or full IRA repeal would lead to budgetary savings, while expanding IRA or adding a clean electricity standard would lead to increased budgetary expenditures.

These fiscal impact estimates may differ from those of official scorekeepers (CBO and JCT) in important ways. For instance, the most recent JCT estimates of IRA tax provisions still show a lower fiscal cost than many outside analyses, due in large part to lower clean energy deployment. If JCT assumptions are unchanged, official scores of the carbon fee may be higher than those presented here. On the other hand, interaction effects with IRA provisions, as well as offset effects, would lower these estimates. In addition, although the IRA’s estimated fiscal impacts implied by our modeling exceed current estimates from JCT across many of the scenarios, net fiscal costs remain quite sensitive to policy design.

Additional considerations for climate tax policy negotiations

The climate policy choices that will be made in the years ahead could have important consequences for emissions reductions, economy-wide carbon abatement costs, and government fiscal balances. Beyond these factors, the distributional consequences of these climate policy scenarios are also important and require additional analysis to fully evaluate. Still, if these policy choices occur in the context of other, broad changes to tax policy, there could be other levers to offset, or more than offset, any adverse distributional effects from particular climate policy choices. For example, negative impacts on household energy expenditures could be offset by lower tax rates, expanded earned income tax credits, or child tax credits.

Beyond the upcoming tax reform debate, other factors could also shape U.S. climate policy, including policy developments in other countries. Because climate change is a global collective action problem, U.S. policymakers might consider how their choices influence policy choices around the world, and how innovation in the U.S. could improve outcomes elsewhere. Finally, climate policy debates are likely to be influenced by many unknowns lying ahead, including projected and actual impacts from climate change, macroeconomic developments, and geopolitical events.

There are also many areas where future research could inform the trade-offs discussed here. In that regard, continued analysis of the early experience with IRA tax subsidies, and how these provisions interact with regulatory and state-level policies, as well as company and household behavior, will be particularly informative. For example, as experience with the IRA unfolds, we could learn more about the cost-effectiveness of each provision in achieving emissions reductions.

References

Bistline, John, Geoffrey Blanford, Maxwell Brown, Dallas Burtraw, Maya Domeshek, Jamil Farbes, Allen Fawcett, et al. 2023. “Emissions and Energy Impacts of the Inflation Reduction Act.” Science 380 (6652): 1324–27.

Bistline, John, Kimberly Clausing, Neil Mehrotra, Jim Stock, and Catherine Wolfram. 2024. “Climate Policy Reform Options in 2025.” Working Paper 32168. National Bureau of Economic Research, Cambridge, MA.

Clausing, Kimberly, and Natasha Sarin. 2023. “The Coming Fiscal Cliff: A Blueprint for Tax Reform in 2025.” The Hamilton Project, Brookings Institution, Washington, DC.

Electric Power Research Institute (EPRI). 2021. “US-REGEN Model Documentation.” Electric Power Research Institute, Palo Alto, California.

-

Acknowledgements and disclosures

Acknowledgements

We are grateful to Joseph Aldy, Adrian Bilal, Tatyana Deryugina, Matthew Kotchen, and Robert Stavins for helpful suggestions. All remaining errors are our own. The views expressed in this paper are those of the authors and do not represent the Federal Reserve System or the Federal Reserve Bank of Minneapolis.

Wolfram is on the board of directors of Resources for the Future. Bistline is affiliated with the Electric Power Research Institute. The authors did not receive financial support from any firm or person for this article or, other than the aforementioned, from any firm or person with a financial or political interest in this article. Other than the aforementioned, the authors are not currently an officer, director, or board member of any organization with a financial or political interest in this article.

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).