Below is a Viewpoint from Chapter 1 of the Foresight Africa 2021 report, which explores top priorities for the region in the coming year. This year’s issue focuses on strategies for Africa to confront the twin health and economic crises created by the COVID-19 pandemic and emerge stronger than ever. Read the full chapter on the great reset.

As Africa looks to recover from the economic devastation created by the COVID-19 pandemic, the time is right to prioritize green transformations in that recovery. Indeed, as Milton Friedman said—and the African Development Bank emphasized in its COVID-19 Rapid Response Facility document—a crisis is needed to appreciate when “the politically impossible becomes the politically inevitable.” If Friedman is right, we should not waste this crisis, since the world, including Africa, needs drastic change.

As Africa looks to recover from the economic devastation created by the COVID-19 pandemic, the time is right to prioritize green transformations in that recovery. Indeed, as Milton Friedman said—and the African Development Bank emphasized in its COVID-19 Rapid Response Facility document—a crisis is needed to appreciate when “the politically impossible becomes the politically inevitable.” If Friedman is right, we should not waste this crisis, since the world, including Africa, needs drastic change.

Three things are needed from African leaders to successfully accomplish the daunting twin tasks of economic recovery and green transformation: 1) generation of funds for investments in sustainable solutions; 2) creation of incentives that ensure that all actors contribute to building an inclusive green economy, and 3) establishment of human capital in institutions tailored to implement those transformations.

Given the complexity of this challenge, leaders must enact policies that both raise funds and provide the right incentives for green growth, preferably alongside short-term poverty alleviation. Pigouvian taxes—taxes that correct the market failure that stems from actors not paying the full cost of their actions on others (e.g., carbon taxes)— on polluting activities do that. There are several compelling arguments for implementing such policies in Africa now.

First, carbon pricing (reduced subsidies) can raise substantial revenues. Fossil fuel subsidies in Africa amounted to $36.5 billion in 2019. Since the pandemic has contributed to reductions in global oil prices, policymakers have room to implement reforms without significantly increasing prices compared to pre-COVID-19 levels. For many countries, a $75 per ton carbon tax—the level of carbon tax needed to contain global warming to below 2°C—would increase pump prices by less than the recent collapse in global oil prices—17 U.S. cents per liter. Given the current oil consumption in Africa of about 4 million barrels per day, this policy would open up about $40 billion per year for investing elsewhere, most notably in a recovery and sustainability program. Green transformations of the transport and energy sectors are possible today, but demand large up-front investments.

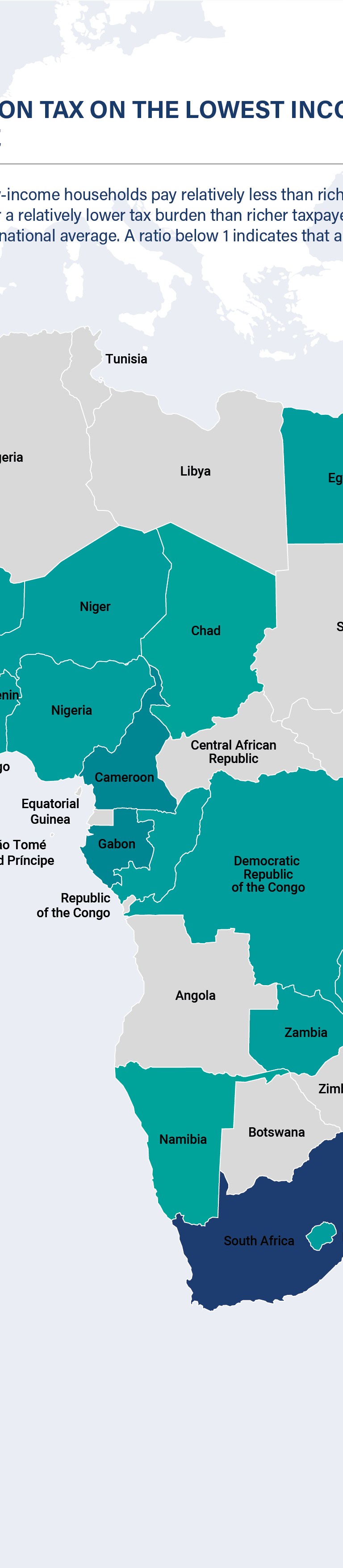

The tax base for upstream carbon pricing on fossil fuels is broad and includes the informal sector. While being administratively easier and harder to evade compared to other taxes, implementation of such a tax is still sensitive to public acceptance and, at times, meets popular resistance. (The most notable African case being the riots in Nigeria in 2012 that forced President Goodluck Jonathan to reverse gasoline subsidy cuts.) At first glance, such a tax could seem to hurt the poor, but, if leaders invest the resulting revenues in pro-poor policies, the impact of the tax is more than offset by the resulting gains in other areas. For Africa, Figure 1.5 shows that the consumption incidence (before redistribution) of a carbon tax would actually be progressive in all countries except South Africa. In fact, globally, for countries with per capita incomes below $15,000 per year, carbon pricing has, on average, progressive income effects, reducing income inequality, largely because of the small proportion of transport and modern fuels in the consumption basket of the poorest people in the poorest countries. Moreover, the distributional impact can be made even more pro-poor in the allocation of the tax returns.

By getting the prices right and taxing the negative environmental impacts, policymakers can create strong incentives toward a low-carbon economy. As African economies look to recover from the negative shocks of the pandemic and grow fast, a price on carbon is essential for that growth to not also lead to rapidly growing greenhouse gas emissions, which are on the rise anyway (Figure 1.6). While population and GDP growth underpin these increases, the increased carbon intensity in the transport sector has been a main driver, and investments in new coal-fired power generation can drive future emissions. Getting prices right is therefore essential, since they affect production and consumption choices of all stakeholders, particularly those in industry, transport, and, of course, energy.

In sum, a carbon tax is the obvious choice for an African policymaker in the wake of the COVID-19 pandemic. It can raise much-needed substantial revenues for progressive recovery packages with a broad tax base. It has short-term balance-of-payment benefits and incentivizes long-term green investments. It is, therefore, the perfect post-COVID, inclusive, green-growth policy.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Recipe for a green recovery: Carbon taxes

March 1, 2021