Studies in this week’s Hutchins Roundup find that the mass deportation of Mexicans and Mexican Americans in the 1930s had negative impacts on (other) native employment and wages; England’s system of high college tuition with targeted aid increased enrollment and funding while reducing inequalities, and more.

Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Deporting Mexicans and Mexican Americans did not increase native employment

In the 1930s, the United States government deported about 500,000 Mexicans and Mexican Americans, reasoning that deportations would give jobs to other Americans and ease the effects of the Great Depression. Examining deportation rates across cities, Jongkwan Lee from the Korea Development Institute, Giovanni Peri from UC Davis and Vasil Yasenov from UC Berkeley find that, on the contrary, the deportation of Mexicans was associated with small decreases in (other) native employment and small wage reductions. They find that the largest employment losses were in jobs that were complementary to the low-skilled jobs taken by Mexicans, suggesting that when companies lost workers, they had to cut other positions. They also argue that the deportations lowered local demand, leading to a reduction in economic activity and job losses.

England’s move to raise tuition and couple it with targeted aid increased enrollment and funding, reduced inequality

Responding to concerns about falling university quality and a widening gap in educational attainment by income, England went from providing free college to charging tuition (about 18% more than the average U.S. public four-year institution) along with targeted financial aid. Richard Murphy from the University of Texas and co-authors argue that shifting the costs of higher education from taxpayers toward graduates led to better school funding and quality. Further, deferring all tuition fees until after graduation, increasing assistance to cover students’ living expenses, and enrolling all graduates in an income-contingent loan repayment system mitigated the negative effects of tuition on college access and enrollment. The authors compare school outcomes before and after various reforms, and find that the transition from tuition-free college led to more funding per student, increased enrollment rates, and a decrease in the participation gap between advantaged and disadvantaged students.

Vertical integration of physicians has anticompetitive effects

Close relationships between generalist and specialist physicians can improve the communication and coordination of care, but might also enhance providers’ market power and increase prices. Using data on 40 million commercially insured individuals to construct zip code level physician prices for 2008-2012, Laurence Baker, Kate Bundorf, and Daniel Kessler from Stanford find that generalist physicians charge higher prices when they are in a practice with specialist physicians, and that the effect of such integration is larger in uncompetitive specialist markets. Similarly, they find that specialists charge higher prices when they are integrated with generalists, and the effect is stronger in uncompetitive generalist markets. They conclude that multispecialty physician practices have anticompetitive effects.

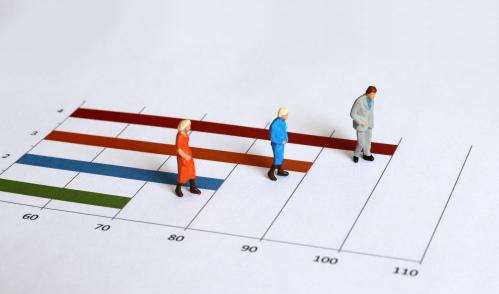

Chart of the week: High school dropout rate for Hispanics and Blacks has fallen sharply in the past two decades

Quote of the week:

“[T]he case for monetary policy independence set out in the 1990s remains sound…it is also clear that central bank responsibilities other than policy rate decisions–specifically, the lender-of-last-resort function and financial stability–are closely connected with monetary policy and that these responsibilities play a prominent role in macroeconomic stabilization…while the crisis and its aftermath motivated central banks to reappraise and adapt their tools, institutions, and thinking, future challenges will doubtless prompt further reforms,” says Fed Vice Chair Stanley Fischer.

“Or, if I may be permitted a few final words on my way out the door, the watchwords of the central banker should be ‘Semper vigilans,’ because history and financial markets are masters of the art of surprise, and ‘Never say never,’ because you will sometimes find yourself having to do things that you never thought you would.”

Commentary

Hutchins Roundup: Deportations and native employment, tuition-free college, and more

October 5, 2017