Yesterday’s release of CoreLogic’s negative equity report showed that in the first quarter of 2012 there were 11.4 million residential properties with a mortgage in negative equity, which is 23.7 percent of residential mortgaged properties. This is lower than the 12.1 million (25.2 percent) from the fourth quarter of last year.[1] The CoreLogic data show wide variation across states in the percentage of mortgage holders that are underwater. Nevada leads the list with 61 percent of all of its mortgaged properties underwater, followed by Florida (45 percent), Arizona (43 percent), Georgia (37 percent), and Michigan (35 percent).

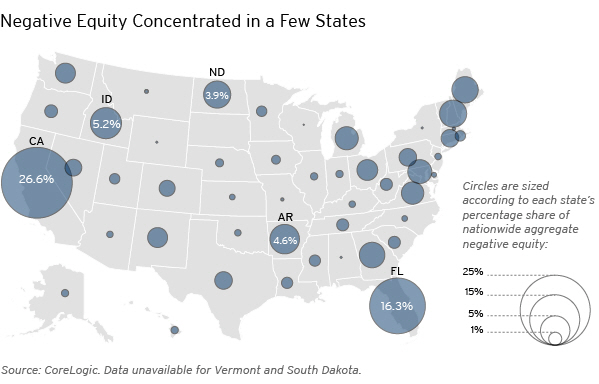

The average underwater borrower has about $61,000 of negative equity, which yields an aggregate debt overhang of approximately $692 billion nationwide. This aggregate burden varies widely across states. The figure below shows each state’s share of the national mortgage debt overhang. While Nevada has the highest proportion of mortgage holders that are underwater, it is the eighteenth highest state in terms of aggregate negative equity. California has about 2 million mortgaged properties underwater, with an average amount of negative equity across these properties of approximately $89,000. This translates into mortgage debt overhang of about $184 billion, which is the highest among the states and about 27 percent of the total national mortgage debt overhang. Florida has the next highest share of the total national mortgage debt overhang at about 16 percent. The aggregate amount of negative equity in five states (California, Florida, Idaho, Arkansas, and North Dakota) makes up about 57 percent of the approximately $692 billion of nationwide negative equity overhang.

[1] Note that these historical numbers have been updated to reflect the change in methodology used by CoreLogic.

Commentary

Negative Equity Concentrated in a Few States

July 12, 2012