This commentary launches the Global Economy and Development program’s new biweekly blog series “Global Economy and Markets.”

At the IMF/World Bank Annual Meetings in Marrakech six months ago, much of the debate revolved around Russia’s invasion of Ukraine and how to fund spending for big challenges like climate change. Both things threaten “global economic security,” which we define as a state of the world where forceful sanctions implementation and low debt maximize medium-term global growth. Ahead of next week’s IMF/World Bank Spring Meetings, this commentary lists several measures to improve global economic security. There is no sugarcoating what is involved. They involve taking economic pain up front, both in terms of tighter sanctions enforcement and debt reduction. The medium-term advantages are clear. Strong enforcement of Russia sanctions may shorten the war in Ukraine and send a signal of deterrence to other bad actors. Debt reduction will give policymakers more flexibility to respond to unexpected shocks, especially in the European Union (EU) where the current push for joint debt issuance underscores how every shock descends into haggling over who pays. A famous expression goes that “freedom isn’t free.” The same is true for growth. We must plant the seeds today for strong medium-term growth with policies that maximize global economic security.

A famous expression goes that 'freedom isn’t free.' The same is true for growth.

Global economic security and Russia sanctions

When Russia first invaded Ukraine, the West quickly imposed financial sanctions on Russian banks, including the central bank. However, it did not sanction all banks. Because the EU needed to import Russian gas, some banks had to remain unsanctioned for the EU to make payment. As a result, financial flows into Russia simply got rerouted via non-sanctioned banks. Russia’s earnings power—determined by its energy exports—stayed the same.

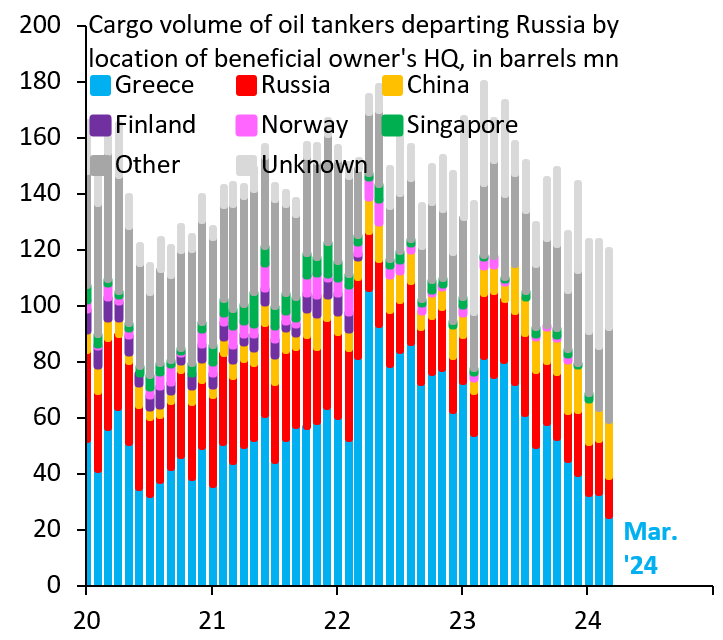

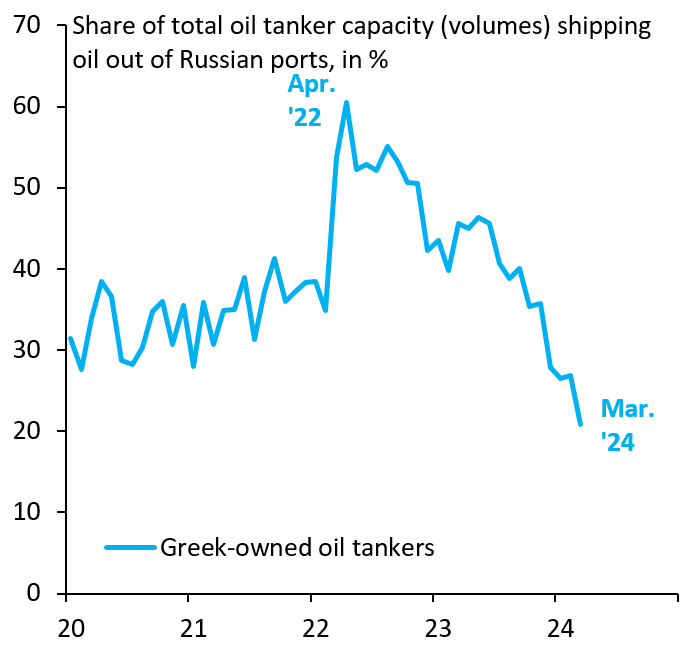

The G7 oil price cap was the logical response to this, limiting the amount of money Russia gets for every barrel of oil it exports. Unfortunately, the sale of Western-owned oil tankers to undisclosed buyers—likely Russia’s “shadow fleet”—is undermining the cap. Figures 1 and 2 compile Bloomberg data on the ownership of oil tankers leaving Russian ports, identifying “true” ownership regardless of where ships are flagged. In March 2022, 60% of capacity was controlled by Greek owners. As of March 2024, this was down to 20%, as many Greek ships were likely sold to the “shadow fleet,” giving Russia the capacity to export outside the cap. While the exact size of the shadow fleet is uncertain, the grey bars in Figure 1 give an idea how much it has likely grown.

It is not too late. A lot of the ships sold to the shadow fleet are old with short service lives. Prohibiting the sale of Western oil tankers to undisclosed buyers may thus still be impactful. Much of this responsibility falls on the EU, given the size of the Greek oil tanker fleet. This means overriding lobbying from large ship owners (i.e., paying a political cost in the near-term for better medium-term security).

Figure 1. Cargo volume of tankers departing Russia by location of beneficial owner’s HQ, in barrels mn.

Figure 2. Share of total oil tanker capacity (volumes) shipping oil out of Russian ports, in %

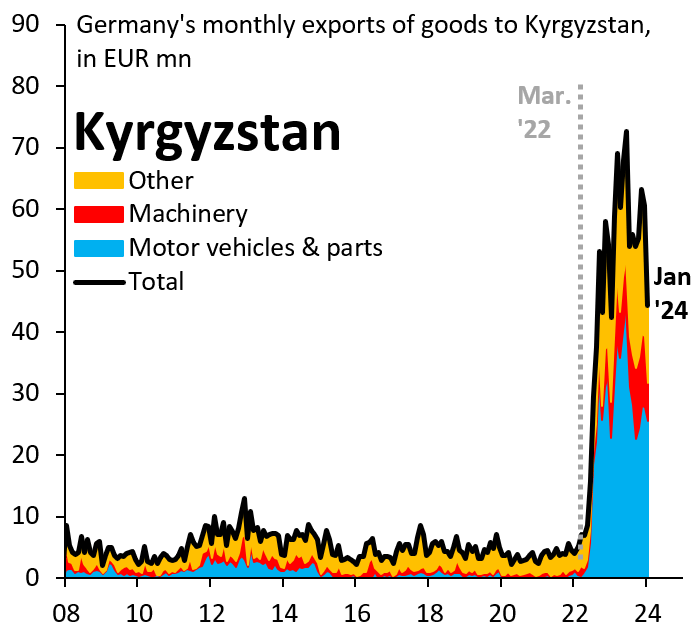

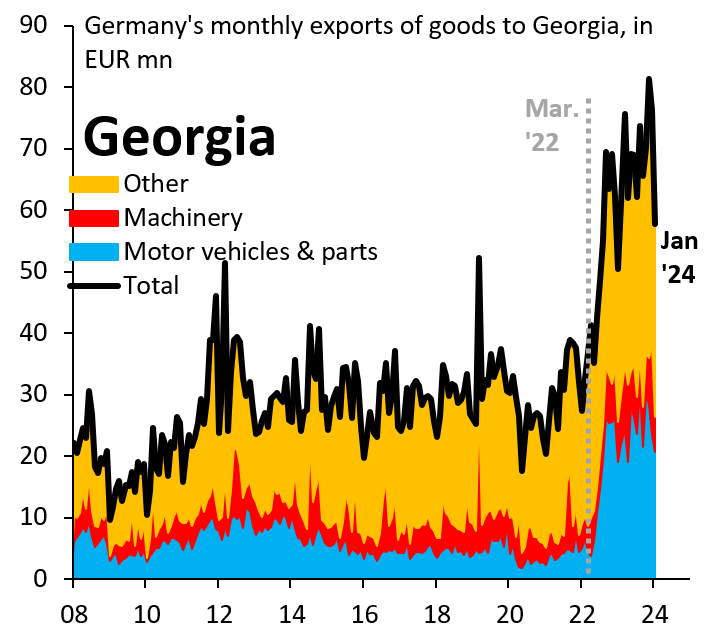

The same is true for surging EU exports to Central Asia and the Caucasus. Figures 3 and 4 show German monthly exports to Kyrgyzstan and Georgia, respectively. These Figures show export values, not volumes, but it is likely that the surge reflects mainly volumes. Similar surges are happening across all the EU to all of Central Asia and the Caucasus, so Germany is just one example among many in the EU. Other countries with notable export surges are Poland, Italy, Czech Republic, and the Baltics. Taken together, these exports offset about one-third of the drop in direct EU exports to Russia (i.e., provide a material loophole for Western goods heading to Moscow). Again, governments in the EU need to stand up their exporters in the interest of medium-term economic security.

Figure 3. Germany’s monthly exports of goods to Kyrgyzstan, in EUR mn

Figure 4. Germany’s monthly exports of goods to Georgia, in EUR mn

Global economic security and high debt levels

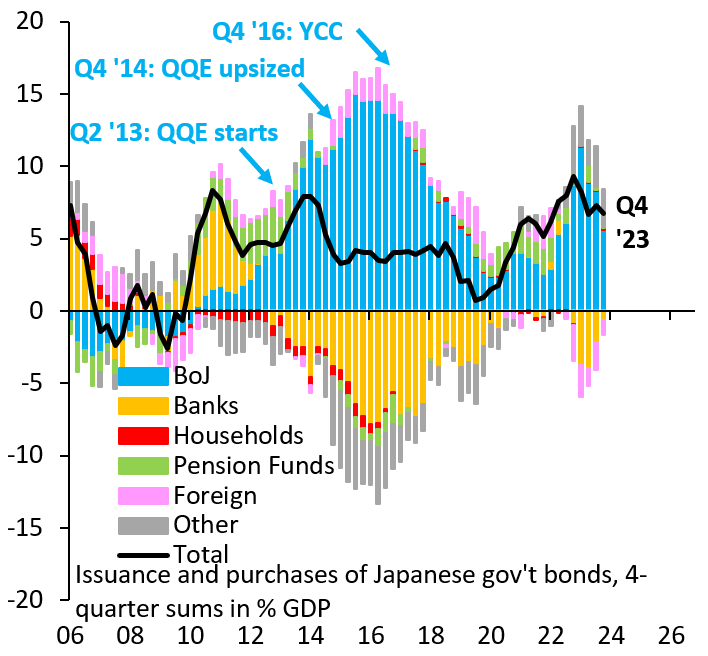

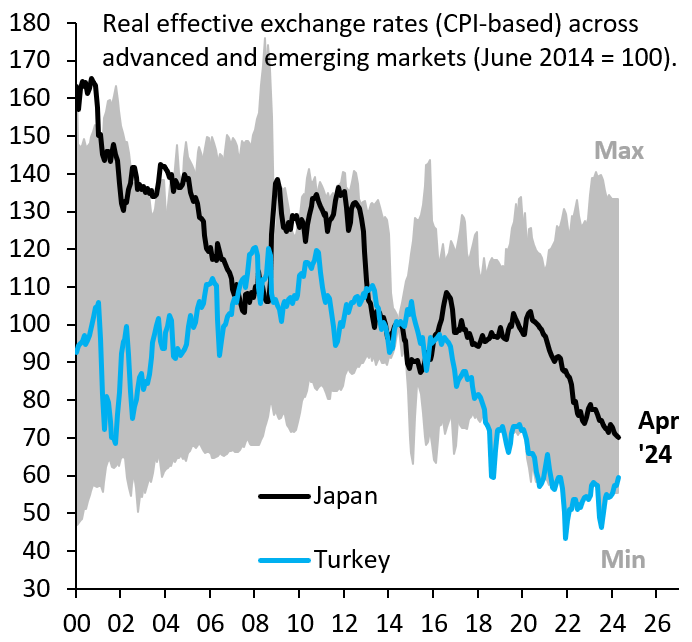

It is a widely held view that advanced economies have ample fiscal space, but the list of bond market “accidents” is growing rapidly, including the U.S. in March 2020, the eurozone in June 2022, and the U.K. in September 2022. In each case, yields spiked sharply, forcing central banks to intervene to bring interest rates back down. Japan is a cautionary tale in this regard. The Bank of Japan (BoJ) caps yields by buying almost all net new debt issuance (Figure 5). This prevents yields from rising, but at the cost of a very large currency depreciation as interest rate differentials move against the yen. Japan’s yen in real effective terms is down 30% since 2019, which is more than the 20% drop of the Turkish lira over the same period (Figure 6). In effect, BoJ intervention to cap bond yields transferred fiscal stress from the bond market to the currency.

Figure 5. Issuance and purchases of Japanese government bonds, 4-quarter sums in % GDP

Figure 6. Real effective exchange rates (CPI-based) across advanced and emerging markets (June 2014 = 100)

The matter of scarce fiscal space is especially acute in the eurozone, where high debt countries are now pushing for joint debt issuance to fund assistance for Ukraine or fight global warming. This slows any crisis response because such joint funding is politically contentious. Absent fiscal union, the only remedy is debt reduction, which will help make EU foreign policy nimbler and more effective.

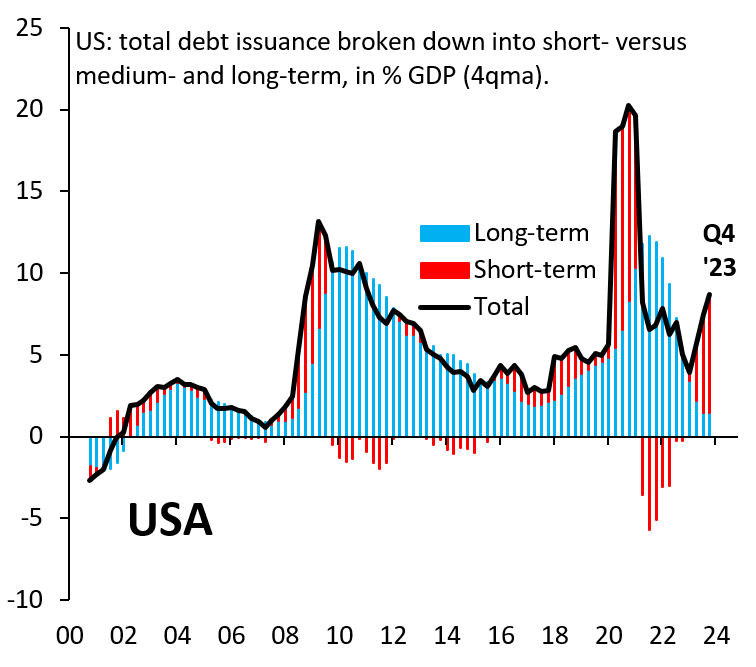

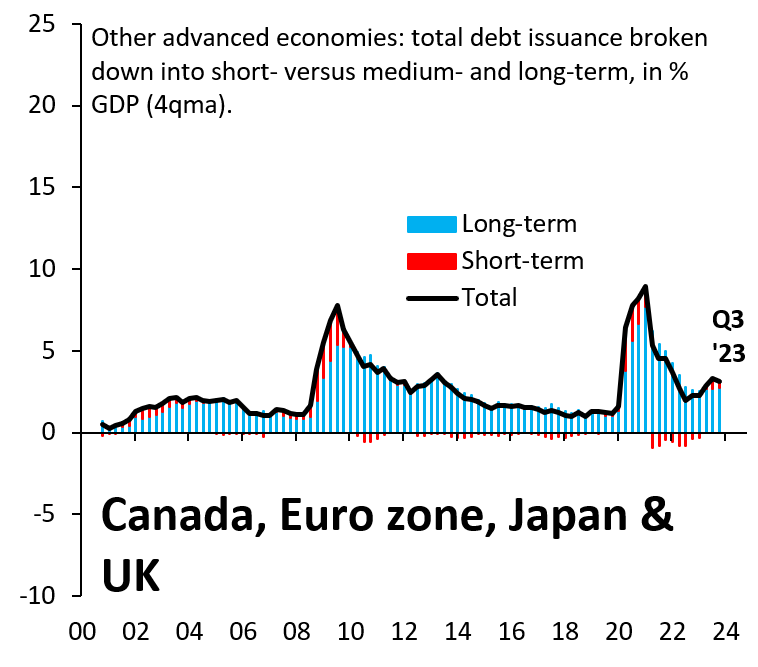

Even the U.S. is not immune. Debt issuance has been primarily at the very short end of the yield curve recently, putting less upward pressure on long-term yields (Figure 7). This shift to short-term issuance is unprecedented in U.S. history outside of economic crises and unrivaled across other advanced economies (Figure 8). If interest rates do not fall soon—or if they resume their rise—this issuance shift may expose the U.S. to a higher interest expense, which could constrain policy flexibility in the future.

Figure 7. United States: Total debt issuance broken down into short- vs. medium- and long-term, in % GDP (4qma)

Figure 8. Other advanced economies: Total debt issuance broken down into short- vs. medium- and long-term, in % GDP (4qma)

Source: Statistics Canada, European Central Bank, U.K. Office for National Statistics, and Bank of Japan

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Threats to global economic security: Weak sanctions implementation and high debt

April 11, 2024