As the United States enters its fifth month battling the COVID-19 pandemic, a patchwork of economic impacts and responses has materialized around the country. The coronavirus first hit large, globally connected cities, but is now spreading rapidly throughout the South and in smaller places. In northern states and on the West Coast, governments acted quickly and forcefully to shut down businesses and have generally been slower to reopen them. Shutdowns in the South lasted for a relatively short period, only to recommence recently as cases began to spike. Meanwhile, local economies that relied heavily on industries such as tourism, energy, retail, and small business have endured massive setbacks, while those focused in financial services and other global services industries have felt lesser impacts.

» Click here to explore the interactive dashboard.

Economists are now debating how long the COVID-19 economic crisis will last and how deep it will be. Much will depend on how the virus behaves in upcoming months, as well as how governments, businesses, and households respond. As University of Michigan economist Justin Wolfers observed in The Atlantic, the twin forces of suppression (short-term pullbacks in economic activity to reduce exposure to the virus) and recession (business closures and job losses that may reflect more permanent changes in demand) are colliding in ways that make the data difficult to interpret and the future hard to predict.

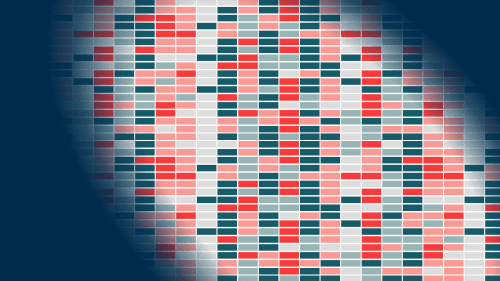

What is certain, however, is that the nature of the downturn and the road to recovery will differ widely across local economies. To that end, the new Metro Recovery Index presents data across a variety of indicators to provide a picture of the impact of the crisis (compared to a pre-crisis state) and the trajectory of recent change for both large and midsized metropolitan areas. The underlying data is mostly available each month, and Brookings Metro will update the tracker—and potentially add new indicators—as providers release new and relevant data.

While annual data sources from the U.S. Department of Commerce on regional economies, households, and businesses can provide the most detailed and authoritative information on these conditions, they only become available one to two years after the period they measure, so are not useful for informing real-time assessments and responses. Organizations such as Opportunity Insights are tracking local economic impacts as well; the Index complements those tools by using data sources that are, for the most part, publicly available. One trade-off in working with real-time public data is that these indicators reflect limited information about the distribution of economic activity and opportunity, even though we know that the initial impacts of the crisis have been uneven across income and race.

![]()

The Metro Recovery Index tracks economic impacts and trajectories in three major categories of indicators: the labor market, the real estate market, and other areas of economic activity (Table 1). This initial version contains 10 indicators, most of which are available for all metropolitan areas with at least 250,000 residents. (The Census Bureau’s Small Business Pulse Survey provides data for only the 50 largest U.S. metro areas.) In addition to providing interactive, indicator-level data for each metro area, the Index also provides a “heat map” table showing where metro areas rank on each indicator. Key patterns include:

The labor market: Through mid-May (the latest data available from the Bureau of Labor Statistics), no metro area had been spared job losses or increases in unemployment. The deepest impacts occurred in metro areas reliant on tourism (e.g., Las Vegas, Atlantic City, N.J., and Myrtle Beach, S.C.) and in states that shut businesses down earlier to suppress the virus (e.g., New York and Michigan). In May and early June, initial unemployment insurance claims fell sharply in Midwestern states (including Indiana, Kentucky, and Ohio), Arizona, and South Carolina as businesses began to reopen. Re-closures occurring now throughout the South may soon reverse that trend. Initial claims continued to rise in Florida, likely due to delays in processing earlier claims. Job postings, meanwhile, remained well below their levels from the prior year in nearly all metro areas, particularly in tourism-dependent cities such as Las Vegas and Reno, Nev., Miami and Orlando, Fla., and New Orleans.

The real estate market: For the most part, the impacts of the COVID-19 crisis were just beginning to filter through the housing market in April, May, and June. Notably, the typical metro area had 30% fewer active home sale listings in June 2020 than one year prior. Sellers in Pennsylvania metro areas and throughout inland California seemed to pull back particularly sharply, while many Sun Belt metro areas—particularly in Florida—saw only modest declines in listings. Median list prices remained higher in the typical metro area than in June 2019, although many of the same Florida metro areas where listings remained robust (e.g., Jacksonville, Miami, Orlando) saw prices decline, suggesting they may be experiencing excess supply.

Economic activity: Most large metro areas endured severe impacts to small business activity in March and April. By May and June, those impacts had begun to abate, and the share of small businesses experiencing closures or reducing their employees’ hours fell across the board, to around 15% to 25% of small businesses. This is still a significant share, but below the 30% to 50% figures one month prior. Travel by air and to workplaces remained well below baseline levels in June; passenger counts in international air hubs such as New York, Boston, San Francisco, and Washington, D.C. remained down more than 90% from a year prior, despite upticks from April and May. Even in less-impacted Sun Belt metro areas such as Dallas, Phoenix, and Tampa, Fla., air travel was down more than 70%. Travel to workplaces was more than one-third below baseline levels in the typical metro area, and even lower in very large metro areas such as San Francisco, Washington, D.C., Seattle, New York, and Boston, where large numbers of professional services workers are able to telecommute.

These patterns represent just a snapshot of the complicated economic dynamics playing out in metropolitan economies around the country. Nonetheless, this new tool can provide insights into how and why the forces of suppression and recession are affecting these local economies, and the need for tailored public policies to support economic relief and recovery while protecting public health.

Sarah Crump and MaryAnn Placheril provide research assistance for the Metro Recovery Index, and Alec Friedhoff provides interactive data design.

Commentary

The Metro Recovery Index: Tracking metropolitan economies through the COVID-19 crisis

July 10, 2020