Content from the Brookings-Tsinghua Public Policy Center is now archived. Since October 1, 2020, Brookings has maintained a limited partnership with Tsinghua University School of Public Policy and Management that is intended to facilitate jointly organized dialogues, meetings, and/or events.

I was living in Beijing when the global financial crisis started 10 years ago. China was not well integrated into the global financial system, so there was not much effect through financial channels. But as the impact of the crisis was felt in the United States and Europe, China was hit with a big shock through its trade sector. China’s exports declined by one-third in a few months, and the government estimated that 20 million workers were thrown out of their jobs—mostly in labor-intensive manufacturing and construction. China responded with a massive stimulus program aimed primarily at infrastructure (high-speed rail, expressways, wastewater treatment) and housing. China restored its GDP growth rate very quickly, but still the crisis has had a lasting effect on the economy and on U.S.-China relations.

In many ways, the seeds of the current trade war were sown in the financial crisis. The crisis had lasting impact by accelerating China’s catch-up with the United States, undermining U.S. fiscal strength, and slowing down China’s reform and opening.

Growth machine

China was growing rapidly before the financial crisis; in many ways the years immediately after China joined the World Trade Organization (WTO) in 2001 were the golden age of Chinese growth. Exports were expanding at more than 20 percent per year and GDP growth reached as high as 14 percent in 2007. Still, China was a small player in the world economy. U.S. GDP was 400 percent larger than China’s in 2006, measured in current dollars.

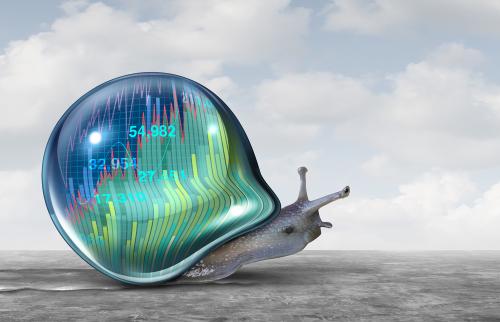

It was always likely that a reforming China would gradually catch up with the United States, but the crisis greatly accelerated the process. With its massive stimulus, China quickly rebounded to double-digit growth rates. The United States, on the other hand, was mired in slow growth for a decade. The U.S. financial system was the locus of the crisis and there is a large literature documenting that recovery from financial crisis is a long slog. In 2006, China’s GDP in current U.S. dollars was $2.8 trillion; by 2017, that had ballooned to $12.2 trillion. U.S. GDP in 2017 was only 58 percent larger than China’s. The International Monetary Fund (IMF) projects that China is likely to surpass the U.S. economy in size in about 10 years.

Ironically, both of these big economies experienced rising inequality both before and after the financial crisis. But, with the more rapid growth in China, the rising inequality there means that median household income has been growing at something like 6 percent in real terms, while in the United States the figure is close to zero. This has no doubt contributed to anxiety about China’s rise.

With the rapid rise of China’s position in the world economy has come an increase in its capabilities, to project naval power in the South China Sea or to fund infrastructure throughout the developing world through its Belt and Road Initiative. As I travel around Asia and Africa, I hear constantly about the rise of China and the relative decline of the United States.

The debt equation

Closely related to the differences in growth experiences are differences in fiscal trajectories. Both economies had large fiscal stimuluses in response to the crisis, which is a sensible Keynesian policy. The analysis in China is complicated by the fact that much of the borrowing and spending was done by local governments, off the formal balance sheet. Local governments set up infrastructure companies that borrowed and financed roads, wastewater, and other projects. IMF reports add these amounts into the government accounts to come up with an estimate of augmented government debt. By their reckoning, China’s government debt increased from 40 percent of GDP in 2006 to 60 percent in 2017. The central government has recently reined in the local government borrowing in order to stabilize public debt to GDP.

The United States went into the financial crisis with about 40 percent of GDP in federal debt, similar to China’s starting position. This doubled to 80 percent of GDP in 2017. The figure is now projected to increase steadily to over 100 percent within a few years because of the tax cuts and expenditure increases implemented last year. In the fiscal year about to end, the federal government will take on more new debt than accumulated in the first 200 years of the republic.

In the fiscal year about to end, the federal government will take on more new debt than accumulated in the first 200 years of the republic.

The problem for the United States is not that it used fiscal stimulus during the crisis, but rather that it has doubled down on fiscal stimulus at a time when the economy is running at full capacity. This will put the United States in a weaker position to deal with any new shocks. And even without shocks, the United States is on an unsustainable fiscal trajectory that itself will cause a crisis if not altered. Given the rising expenditures on social security and Medicare as the population ages, at some point the United States will have to face the fact that it needs higher taxes—on things like carbon and sugar that usefully can be discouraged, and on higher incomes because that is where most of the growth has been in recent years.

Urging openness

Early in the financial crisis, I gave a lecture to 500 local government officials from Hebei province, on the topic of how China should respond to the crisis. During Q&A, I was surprised by the comment that “up until now we thought that the U.S. was the model for everything. Now we don’t know what to think.”

Aside from the shock to the economy, the crisis was also a shock to faith in the market system. Up until then, China had been on a gradual but steady path of opening and reform. I was particularly involved in the financial sector and a useful metric of opening is the OECD’s foreign direct investment (FDI) restrictiveness index, which is calculated for major economies starting in 1997. On this index, 1 is completely closed to direct investment, and 0 is completely open. In financial services, it is hard to have international trade without direct investment establishing a presence. The norm for OECD countries is less than 0.1 on this index.

In China, financial services were almost completely closed in 1997 (0.8 on the index). By 2006, China had allowed foreign banks as strategic partners in the major Chinese banks and had opened some space for other types of financial services companies (investment banking, insurance). The OECD ranked it 0.5 on its index. Ten years later, in 2016, China has the same rating, 0.5. Chinese officials were naturally somewhat reform-shy after witnessing the meltdown on Wall Street. But 10 years is a long time to go without further reform of a financial system that had lots of restrictions and state intervention.

And financial services is just one example. China maintains investment restrictions in a wide range of services including telecom and social media, as well as in some high-tech manufacturing. These restricted environments put pressure on Western firms to make compromises in which they share their most advanced technologies with Chinese “partners” who will be soon be global competitors. Of the various trade complaints that the United States has with China, I feel that these investment restrictions and the associated technology transfer are the most serious.

How we got here

A final point is that we should not lionize China. It handled the financial crisis reasonably well and will probably emerge soon as the largest economy in the world. But it has plenty of problems of its own, from an aging population, to corruption in its state-owned enterprises, to an inefficient financial sector that has suffered from lack of reform. I argued above that China’s government is in good fiscal shape, but its local governments and corporate sector have taken on an excessive amount of debt and if the government has to bail any of that out, then its fiscal position would not look so good.

For me, all of this is the background to the current trade war. Because of the financial crisis, China is converging on the U.S. much more rapidly than anyone had anticipated. The unsustainable U.S. fiscal policies dim prospects for our future growth. There is a short-term sugar high (which ironically will lead to the biggest ever U.S.-China trade deficit this year, despite U.S. protectionism). But Americans are not very confident about the future, for good reason. Meanwhile, China’s lost decade of reform is an irritant and an easy distraction from America’s real problems.

Commentary

U.S.-China trade war has its seeds in the financial crisis

September 14, 2018