In the world of higher education, two issues have remained at the forefront of public and scholarly debate in recent years: so-called “free college,” and concerns over the cost and value of for-profit colleges and universities (FPCUs). The recent creation of New York state’s Excelsior Scholarship is one example of a program intended to provide free tuition for in-state residents at public colleges. Although the impact Gov. Andrew Cuomo’s new initiative will have on the state’s neediest residents has been hotly debated, little consideration has been given to its potential impact on for-profit institutions in the state. However, my analysis of College Scorecard data suggests that the program in New York may not just draw students from FPCUs to state universities, but may disproportionately affect some of the lowest-performing for-profits.

What is the Excelsior Scholarship?

The Excelsior Scholarship is a last-dollar award, given after Pell and Tuition Assistance Program (TAP) grants are subtracted from the tuition bill, to cover the remaining tuition costs at SUNY and CUNY campuses. The program received about 75,000 applicants for the fall of 2017.

The plan provides little additional help to the neediest members of society because Pell and TAP already cover all the tuition for virtually all of the lowest-income students; it is primarily middle-income families making between $80,000 and $125,000 that will benefit the most from the free tuition offer. Moreover, the plan does not provide any support for housing or living expenses, which are significantly more than tuition prices at SUNY and CUNY schools and often prohibitively high for low-income students. Finally, the 30 credit hour per year requirement limits part-time students’ ability to access the scholarship, and adds a barrier for those who need to take noncredit remedial coursework. These students are often those in most need of financial assistance.

What impacts might it have on private institutions?

Some are concerned that private nonprofit colleges will suffer under this plan. Because middle-class students stand to gain the most, there is a concern that students who may have attended private nonprofit colleges will now be swayed to attend a state college for the potential financial windfall. If middle-income students start choosing free tuition at a SUNY rather than upward of $50,000 per year at a private nonprofit, many tuition-dependent private schools will face hard times. In fact, many of these schools are already struggling to meet enrollment goals, in part due to a declining number of high school graduates in the state.

However, the state has offered private nonprofit colleges access to the Enhanced Tuition Award Program. Similar to the Excelsior Scholarship, this additional aid uses the same income restrictions and acts as a last-dollar award. The maximum amount is $6,000, half to be paid by the state and half to be paid by the college, and requires institutions to freeze tuition for recipients. The Enhanced Tuition Award Program was intended to placate some of the concerns of private nonprofit colleges by providing additional aid that will keep these independent institutions competitively priced. However, only 30 private nonprofit colleges, out of nearly 100 in the state, opted into the program.

Absent from this conversation, however, has been the impact of the Excelsior Scholarship on private for-profit colleges. Despite lobbying efforts, FPCUs have not been included in the Enhanced Tuition Award Program. Without this safeguard, the potential shift in enrollment toward public colleges could adversely impact proprietary schools.

A potential shift in enrollment away from FPCUs

According to College Scorecard data, proprietary colleges served about 65,000 students in New York as of the fall of 2014. Although the for-profit sector generally enrolls more working adults, single mothers, and low-income students who often attend part-time, there are some FPCUs that cater to more traditional college students.

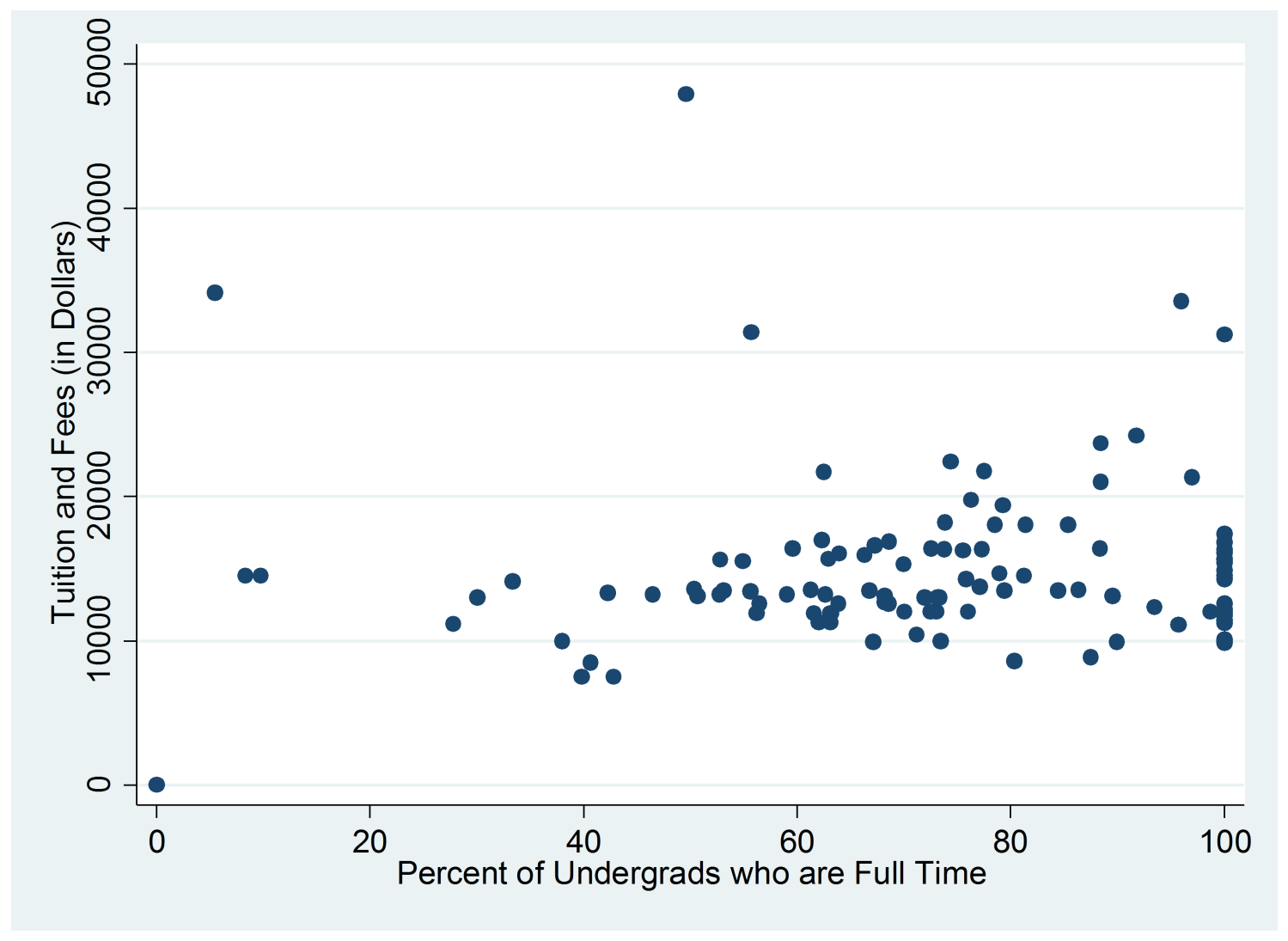

In my examination of the data, I focused on for-profit institutions in New York state for which data across all College Scorecard elements are reported, leaving 113 campuses. Figure 1 shows just how many FPCUs in New York enroll large portions of full-time students. It is clear that the vast majority of FPCUs charge more than $10,000 in tuition and fees, and that institutions that enroll large shares of full-time students are among the most expensive. These types of institutions stand to lose a number of students in the same way as private nonprofit colleges, especially those campuses relatively close to existing SUNY and CUNY locations.

Figure 1: Tuition and fees by proportion of full-time undergraduates

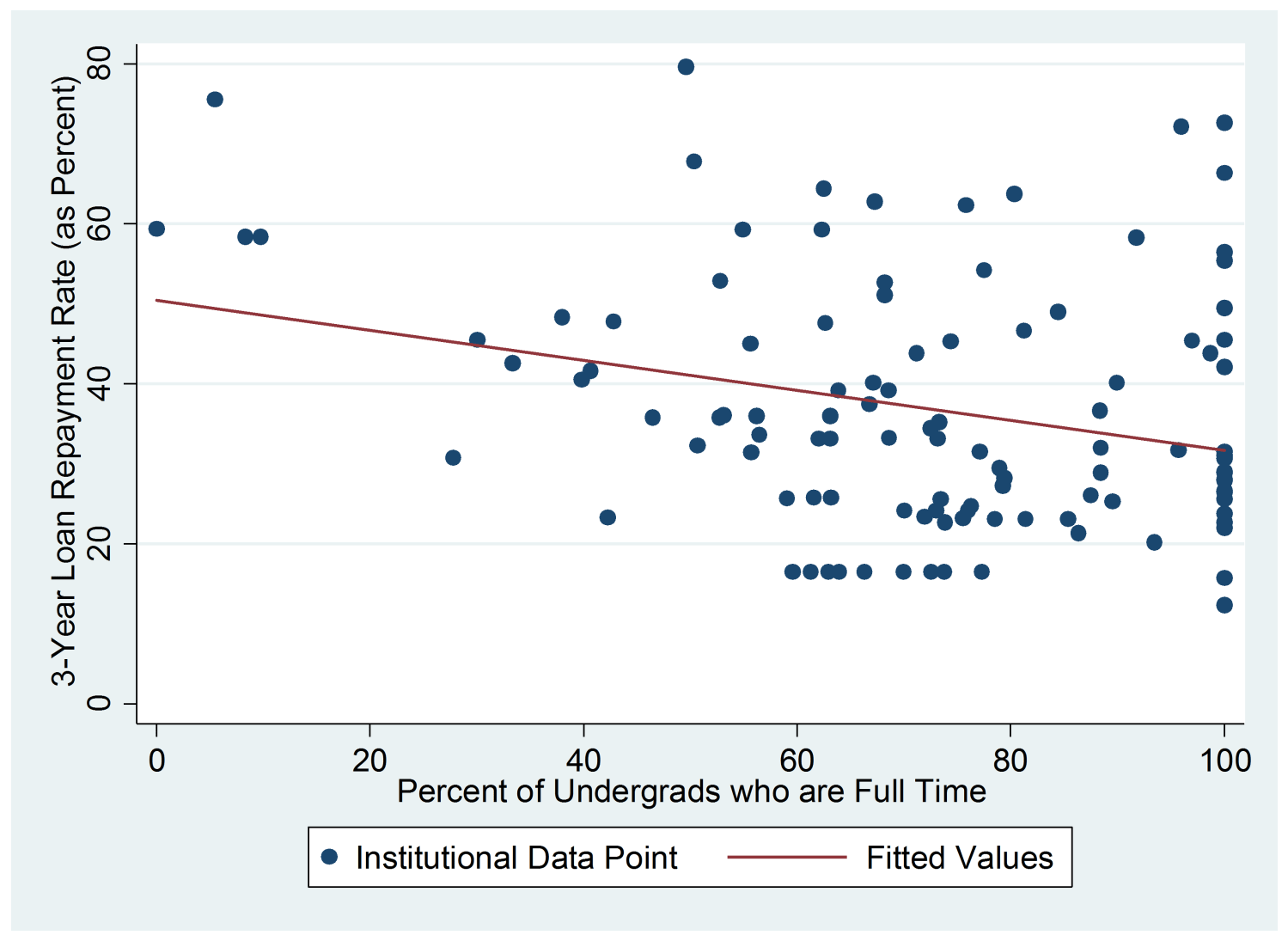

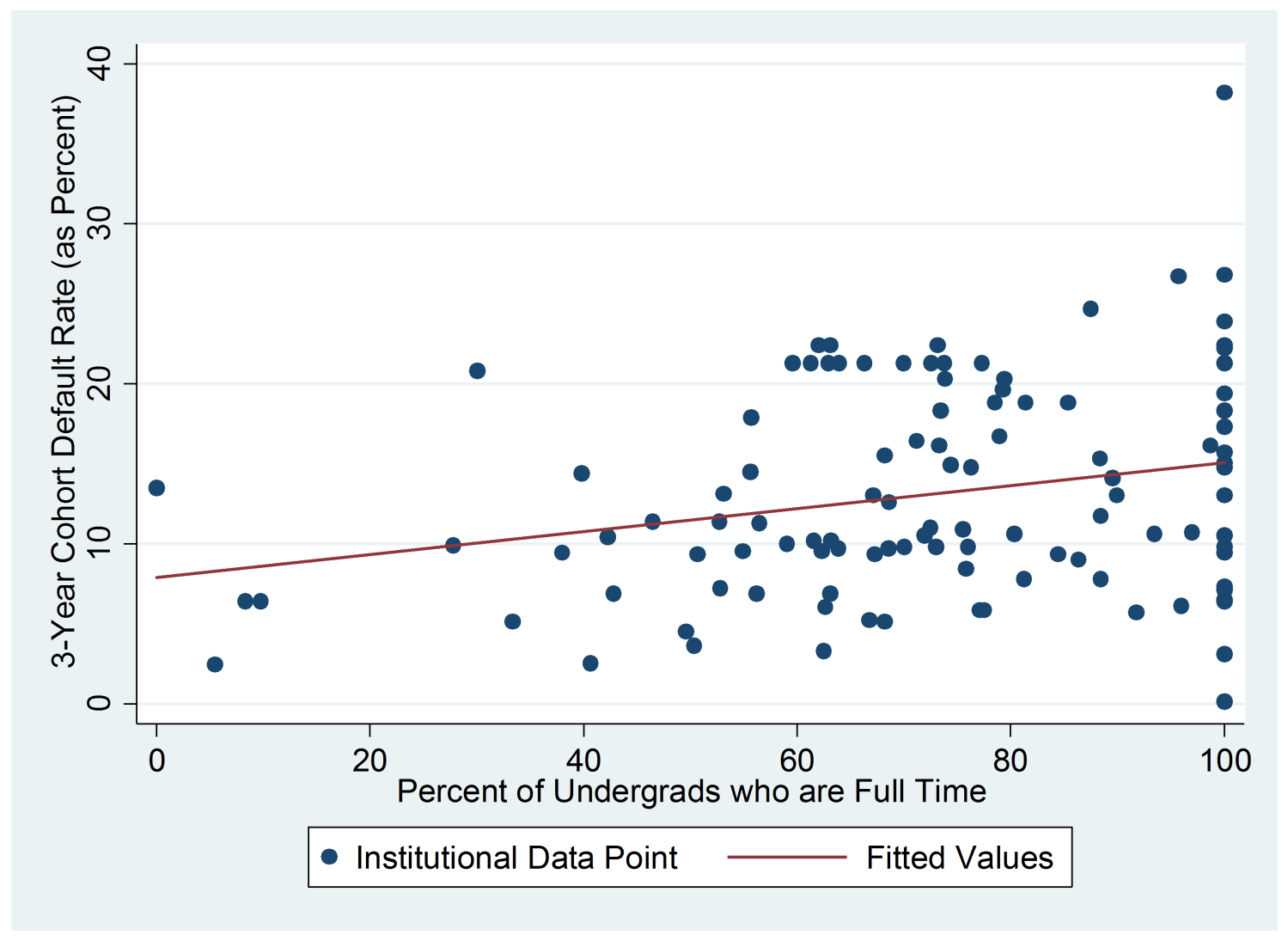

Because FPCUs that primarily enroll full-time students stand to be harmed by reduced tuition at SUNY campuses, it is useful to understand what these institutions look like. As seen in Figures 2a and 2b, FPCUs in New York that have greater proportions of full-time students have lower loan repayment rates and higher default rates.

Figure 2a: Loan repayment by proportion of undergraduates enrolled full time

Figure 2b: Cohort default rates by proportion of undergraduates enrolled full time

Why does this matter? Given the restrictions on the Excelsior Scholarship, full-time students enrolled at FPCUs are the most likely to be persuaded to attend a SUNY or CUNY. Based on observations of New York state for-profits, the schools which stand to be impacted the most are those graduating students who go on to have high default rates and low loan repayment rates. Although we cannot pinpoint exactly why these students struggle to repay their loans, many critics of the for-profit industry suggest the students are underprepared for the labor market or take on too much debt. The Excelsior Scholarship restrictions on credit completions suggest that students who attend FPCUs that do not perform well on default and repayment metrics will be those most incentivized to attend a state college.

The potential movement of students due to “free college” rests on the assumption that price is a primary factor in enrollment decisions. However, the flexible course schedules, program availability, and marketing tactics of FPCUs may play a large role in this decision, and could deter students from taking advantage of the Excelsior Scholarship. Nevertheless, it is worth considering that at least some prospective FPCU students may end up at public institutions, and the draw of “free college” could effectively reroute students away from FPCUs that perform poorly on objective metrics. A rerouting of students away from FPCUs with low loan repayment and high default rates may be the silver lining of a “free college” policy that has garnered quite a bit of negative pushback from the higher education community.

Commentary

The unintended consequences of ‘free college’ on New York’s for-profit universities

August 8, 2017