The Congressional Budget Office on Tuesday released its latest projections on the long-term budget deficit, provoking the usual warnings about impending fiscal crisis. But just how big a problem is the deficit right now? What should we really do to reduce it—and when?

The New Republic

asked Brookings senior fellow Henry Aaron for the following guide to the federal budget deficit for its “QEDecide” series.

1. Let’s start with the very basics. What is the budget deficit?

The federal budget deficit is the difference between the government’s income (the money coming in) and its expenditures (the money going out). Usually we measure it over a period of one year.

Income comes from taxes, such as income taxes and payroll taxes, and fees, such as the premiums that people pay for Medicare benefits. Expenditures include pretty much everything that the government buys. That includes such items as the salaries paid to members of the military, to federal judges, and to air-traffic controllers. Expenditures include the cost of things that the government buys, such as equipment for the armed forces, purchases of land for national parks, and investments in flood control projects. Most federal spending now goes for cash payments or services provided directly to individuals. Cash payments include such items as Social Security, veterans pensions, grants to help students attend college, and subsidies to farmers. The most costly services are health benefits for the elderly, disabled, and poor.

Expenditures also include interest payments that the government must pay to those who loaned money to the government in the past to cover the gap between past government income and expenditures.

2. OK. That’s the deficit. What is government debt?

Government debt is the total of all past government deficits. For example, if the government runs deficits of $1 billion a year for ten years, the addition to debt is $10 billion.

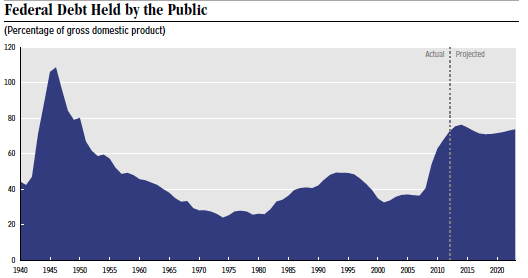

The federal debt held by the public, as a percentage of GDP, has increased since 2008.

In April 2014, the total government debt was $17.6 trillion, of which $5 trillion was held by various government agencies, the largest single part of which is the Social Security Administration. Of the remaining $12.6 trillion, $6 trillion or nearly half was held by foreign governments, people, and organizations and $6.6 trillion was held by U.S. based individuals, insurance companies, banks, and other organizations.

3. Generally speaking, why should deficits worry us?

There is no particular reason to worry about one year’s budget deficit. We might decide, as a country, to run temporary deficits for any number of good reasons—to finance a war or deal with a natural disaster, for example. Sometimes short-lived events, like serious economic slowdowns, will cause revenues to fall for a while. But if the government runs consistently high deficits, even when the economy is strong, there are two very real dangers.

One is financial. The government, like any borrower, must pay interest on all outstanding debt. If debt is growing faster than the economy as a whole or if interest rates are rising, and especially if both things are happening at the same time, then interest payments will grow faster than the nation’s total income. To keep up with those payments, the government will have to raise taxes, cut spending, or borrow still more just to cover the interest.

The other danger is that deficits can slow economic growth. Private saving can be used to pay for private investments or to cover government deficits; it can’t be used for both at the same time. When the government borrows more, it makes it harder for companies and individuals to finance new investments. Without those new investments, businesses cannot expand as quickly as market conditions would support or provide workers with more or better tools, like faster computers or the newest machinery, to boost their productivity. Higher deficits in one year don’t hurt productivity much. But higher deficits over a long period of time will have a real impact.

4. Are deficits ever good things?

Absolutely. In fact, during recessions, temporary deficits are very good things.

Recessions occur when demand for goods and services by consumers, investors, the government, and net demand from abroad is insufficient to pay for all of the output that workers are capable of producing. In that situation, factories go idle, and offices and businesses shutter, people are laid off or let go. When that occurs, demand can fall still more, creating a vicious cycle. During recessions, increased government spending can boost demand for the goods and services that workers produce, until consumers once again have the resources—and the confidence—to start buying more on their own again.

For example, during the most recent recession, when 10 percent of workers seeking employment could not find jobs, the federal government started spending a lot more—on unemployment insurance, grants to state and local governments, and other purposes. In addition it cut taxes to leave private consumers with higher after-tax incomes so that they could sustain or increase their own spending. These measures added to the government’s budget deficit. But they also increased demand and kept people at work; and they helped maintain incomes of those who lost jobs. That meant in turn that people could keep up payments on their home mortgages and pay other bills. They got to keep their homes and put food on their tables. Meanwhile, businesses that might otherwise have failed, were able to stay in business. Other federal government spending—such as that on roads, national defense, food stamps, and aid to state and local governments—provided direct benefits to people and businesses.

As private confidence increases and private spending grows, it becomes increasingly important to curb deficits so that debt does not indefinitely grow faster than income. But during bad times, federal budget deficits can help shore up the economy.

5. How big is the deficit right now?

If you want to know how big the deficit is, you can’t simply go by the raw number. Annual deficits are very big numbers, but the U.S. economy is very large too. The best way to get a sense of scale is to compare deficits to the total national economy, Gross Domestic Product or GDP. The Congressional Budget Office estimates that GDP will be $17.3 trillion in 2014 and that the federal budget deficit will be $506 billion. Do the math and you’ll see that it’s projecting a budget deficit equal to 2.9 percent of GDP.

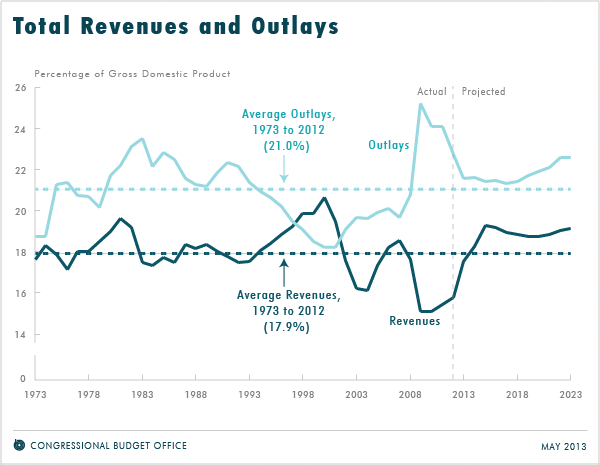

In May 2013, the Congressional Budget Office predicted that the budget deficit, as a percentage of gross domestic product, would decrease in the coming months.

The total outstanding debt held by the public—the sum of this year’s and all past deficits—is much larger than this year’s deficit alone. The total debt in 2014 is estimated to be equal to 73.8 percent of GDP in 2014. Projections suggest it will fall a bit next year, to 73.6 percent, because the economy itself will grow a little faster.

6. That sounds big—and I keep hearing about our “record” deficits. How does the current deficit compare to what it’s been in the past?

Throughout its history, the U.S. government has almost always had public debt. The first deficits occurred during the Revolutionary war. The Founding Fathers determined to pay them off. Thus, the United States was born with a public debt, and not a small one relative to its GDP—32 percent of GDP in 1792. For most of the succeeding decades, up to the Civil War, the debt was smaller relative to national income. By 1835, the government had paid off its debt completely.

Debt has typically soared during wars and recessions, because of the large sums the the federal government was borrowing at those times. In 1941, on the eve of World War II, federal government debt held by the public equaled 41.5 perrcent of GDP. By 1946, the year after the end of World War II, debt was up to 106 percent of GDP—precisely as you might expect following the most expensive war in the nation’s history.

Deficits continued even after the war, but they were small and national income grew rapidly both because productivity increased and because prices rose steadily. As a result, the ratio of debt to GDP fell by more than three-quarters, dropping as low as 24.5 percent in 1975. Between then and 1993 large deficits resulting from a combination of weak economic growth, increases in defense spending, and tax cuts, pushed debt back up to 47.8 percent. Then a succession of three budget agreements sharply lowered budget deficits and produced budget surpluses in 1999 and2000 lowering debt to 31.4 percent of GDP in 2001.

But the surpluses didn’t last. Two serious recessions, large tax cuts during the early years of the George W. Bush Administration, and increased defense spending from the wars in Iraq and Afghanistan increased deficits and, in turn, debt.

7. If nothing changes, what would the deficit look like in the future?

Future deficits and debt depend on projections of the difference between two very large numbers: government spending and government revenues. Even the most honest, most talented forecasters can’t be certain about deficit projections. Congress can and does change spending and tax policy. Both spending and revenues depend on events, such as wars and recessions, that no one can accurately forecast. Because the federal government pays for a sizeable fraction of total health care outlays, spending also depends on the rate at which health care spending changes, per person. Past projections of health spending have been particularly inaccurate.

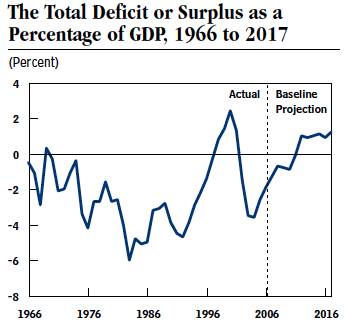

In 2008, the CBO predicted an $87 billion surplus. Then, the banking crisis and recession hit, prompting a deficit.

For these reasons, it’s best to use projections as a guide to what might happen, rather than what will happen, and to take seriously their inherent uncertainty. The most respected projections come from the Congressional Budget Office. CBO anticipates that the federal budget deficit, measured as a fraction of GDP will fall to 2.6 percent of GDP in 2015 and then rise gradually to 4 percent of GDP in 2022. Because CBO expects that the economy will grow just a little bit more slowly than the debt over the next decade, CBO projects that under current policy the ratio of debt to GDP will rise from 73.8 percent of GDP in 2014 to 78.1 percent in 2024.

Again, these projections are extremely sensitive to even small changes in policy and to unforeseable events like recessions and wars. Consider a year in the recent past—2012—and how much projections of that year’s deficit changed. In 2002, CBO projected that the government would be running a $641 billion surplus in 2012. By 2008, CBO was saying the surplus would be much smaller—just $87 billion. Then the banking crisis and recession hit, reducing revenue and prompting deficit spending to counter the recession. The result? Instead of the $641 billion surplus that CBO had once foreseen, the government in 2012 ran a deficit of $1.1 trillion—a swing of nearly $2 trillion.

8. Why do the CBO and all the other forecasters think the deficit will eventually rise?

Mostly because the baby boom generation will be retiring over the next couple of decades. But all of these projections depend sensitively on a number of assumptions. The most important is that current policies will continue. Based on past Congressional behavior, they think that the government will renew some tax policies that, on paper, are supposed to expire. The forecasters also think the economy will return to full employment in about three years—and they are not counting on any future recessions. That recessions are a thing of the past ishard to credit, but that is what is assumed.

Predictions about some demographic trends are pretty solid. The baby boomers are going to retire, and as they do, the number of people collecting Social Security and Medicare will rise. The cost of higher pensions is rather clear, but how much Medicare spending will rise is uncertain because no one can be predict reliably how much the per person cost of Medicare will go up. For roughly five decades, per person health care spending grew annually at a rate 2-2.5 percent higher than growth of per person income. Until recently, it seemed reasonable to assume that this trend would continue over the next decade. But, then, in 2007, this excess in the growth of health care spending vanished and per person health care spending has grown at about the same rate as per person income. During the first quarter of 2014, health care spending actually fell. Accordingly, CBO has reduced its projections for future Medicare and Medicaid spending. It may yet reduce them by even more.

9. How worried should we be about this?

According to current projections, the debt will grow only a bit faster than the economy for the next decade, but then a good deal faster. That’s not good, for the reasons stated above, and deficit reduction should be a goal of fiscal policy. But how we achieve that goal is at least as important as whether we achieve it. Sometimes the government spends money on projects, like building infrastructure or educating today’s children who will be tomorrow’s workers and voters, that will make the economy more productive. And sometimes the government spends money for purposes that provide immediate benefits, many of which are quite important, such as pensions for the elderly and disabled, national defense, health care for the indigent, and so on.

Conversely, trying to slash deficits too quickly or crudely—either by raising taxes or cutting spending—threatens real harm.

Consider those extra unemployment benefits that the federal government began offering at the start of the recession. That program just expired, despite efforts by Democrats and a handful of Republicans to extend it. It means the government is spending less money, marginally reducing this year’s deficit. But it also means that many people who are out of work and struggling to pay their bills will be less able to do so than they would had those benefits continued. Raising tax rates sharply before the economic recovery is well established and well advanced also carries risks. Sharply increased taxes could abort the recovery before full employment has been restored.

10. So if cutting the deficit too much or too fast now is risky, but long-term debt is worrisome, what’s a reasonable strategy for fiscal policy going forward? What steps should policymakers take to address the deficit?

Many analysts, from both political parties, agree that the federal government should do more now to spur economic growth and that it should simultaneously take steps to lower projected long-term deficits. Republicans and Democrats often don’t agree on the details. But here is one illustrative strategy that economists from both parties have endorsed. The first element is increased investment in what is called ‘infrastructure’—meaning roads, bridges, tunnels, harbors, and airports. Many are in need of repair, replacement, or expansion. Furthermore, interest rates are abnormally low just now, which means that borrowing is unusually inexpensive. When interest rates are low is the best time to undertake long-lived investments. Carrying out those repairs and improvements would put people to work now and improve productive capacity in the future. So would increased support for scientific research and increased spending to support post-high-school education of those who cannot now afford it. These measures would promote economic recovery right now and boost U.S. productivity in the future.

Steps to lower future deficits could also be undertaken now. Both Social Security and Medicare promise future benefits greater than future taxes called for under current law that are earmarked to support them can pay for. Closing these gaps would strengthen the long term finances of these highly popular programs. One can do so either by raising taxes to pay for currently promised benefits or by cutting benefits. So far, the two parties are divided on which of these two approaches to closing the projected funding gaps should be used.

As far as the rest of government is concerned, projected revenues and spending are very much in balance. So, closing the anticipated gaps in Social Security and Medicare would effectively prevent debt from growing faster than GDP. And by assuring financial markets that our nation is dealing with future fiscal challenges, these measures could actually help promote current economic recovery.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Op-edThe Ultimate, Definitive Guide to the Budget Deficit

July 16, 2014