Although the U.S. economy has gradually recuperated over the past few months, a record new wave of COVID-19 cases—most notably in the Midwest and Northeast—began to take hold in October. That wave appears to have slowed the rate of economic recovery, as some localities and states consider reimposing lockdown restrictions while consumers pull back. The latest numbers from our Metro Recovery Index point to a weakening regional economic picture, even ahead of the alarming caseload and hospitalization peaks occurring in November.

A nationwide COVID-19 surge in October, especially in the Midwest and Northeast

After declining in most metro areas in August and September, the average daily number of new COVID-19 cases rose in 146 of the nation’s largest 192 metro areas in October. This fall uptick was most pronounced in Midwestern metro areas, which saw an additional 11 cases per 100,000 population each day in October versus September. The largest increases in cases over the month occurred mostly in midsized metro areas across the Midwest and Texas, including El Paso, Texas (73% increase), Sioux Falls, S.D. (61% increase), Green Bay, Wis. (36% increase) and Rockford, Ill. (36% increase). By October, Midwestern metro areas shot well past the South’s metro areas in their combined daily per capita case rate (Figure 1).

The Northeast also experienced a significant uptick in COVID-19 cases over October, with an additional five cases per 100,000 population each day. Though still well below the Midwest’s rate of increase, the upticks in these regions parallel with health-expert predictions that cold weather would force more activities indoors, accelerating the virus’s spread.

Job growth slowed, especially in some regions heavily affected by the virus

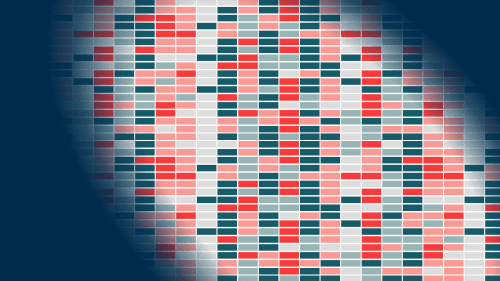

After plummeting in April, U.S. job totals bounced back in May and June. But job growth tapered throughout the summer—a pattern that looks to have continued into the fall. Across the metro areas tracked in the Index, nonfarm employment increased by just 0.58% in October, down from 0.74% in September. In most metro areas—155 of the 191 where jobs data was available—employment increased from September to October, but no metro area exceeded 2.5% job growth, and most failed to meet even 1% growth (Figure 2). Just two of the 191 metro areas—Ocala, Fla. and Ogden, Utah—had recovered to their pre-pandemic February 2020 employment levels.

Job growth flattened most across Midwestern (0.39%) and Northeastern (0.34%) metro areas in October amid rising case counts (Figure 3). Steady (if unspectacular) job growth continued in metro areas in the South and West. And while there did not appear to be a relationship between the trajectory of COVID-19 cases and employment in metro areas in October (perhaps because job counts were recorded in mid-October, before cases began to spike again in many metro areas), major COVID-19 hot spots such as Sioux Falls, S.D. and Green Bay, Wis. ranked among regions suffering the most significant job declines that month.

Job postings continue to increase over the month of October

Job postings continue to increase over the month of October

Despite slowed growth in employment, job postings grew significantly in October. In all but seven of the 192 largest metro areas, job postings increased from September to October; in 51 of them, postings increased by at least 10% (Figure 4). These increases did not seem attributable to seasonal fluctuations—in 2019, postings dropped by nearly 5% from September to October. Rather, demand for workers in fields that tend to post positions online appears strong, with more than half of the 192 metro areas registering more postings in October than in February, before the pandemic.

Moreover, postings rose most rapidly in the West and Northeast’s metro areas, while growth lagged somewhat in the Midwest. Rising postings in October signaled some employer optimism about the need for workers, but it is unclear whether employers will ultimately hire for those positions with so much uncertainty on the horizon amid climbing case counts in November.

Small business activity has not noticeably improved since August

Small business activity has not noticeably improved since August

The latest Index data indicates that the COVID-19 recovery is leaving many small businesses behind. Across the nation’s 50 largest metro areas, about 20% of small businesses in operation pre-pandemic have remained closed since August.

However, there were differences in small business trajectories across metro areas (Figure 5). In Northeastern and Midwestern metro areas where COVID-19 cases began to rise rapidly in October (e.g., Boston, Chicago, Indianapolis, Minneapolis, Providence, R.I.), the share of small businesses open dropped. In the West and South’s metro areas where cases had yet to spike (e.g., Houston, Memphis, Tenn., Portland, Ore., Raleigh, N.C., San Francisco), the share of small businesses open increased.

In this area—as in many others—the October data may portray the calm before the storm. Looking at the early November data on small businesses, some analysts are projecting a possible loss of jobs nationwide. Heading into winter with record COVID-19 case counts and hospitalizations, city and state officials are reinstating a variety of lockdown restrictions on social gatherings and business activities in order to quell the virus’s spread. These new restrictions on consumers and businesses—and more so, a third wave of the pandemic—could undermine the momentum of the nation’s tepid economic recovery, making renewed federal financial support to struggling households and businesses even more critical.

Commentary

October’s weak economic recovery could be the calm before an even worse storm

November 24, 2020