After the September 11, 2001 terrorist attacks that destroyed the World Trade Center, many people wondered if Manhattan’s Financial District—a place that helped coin the American English word “downtown”—could ever recover. Cities throughout the country also questioned whether dense, high-rise districts could be sustained. That same year, San Francisco was reeling from the dot-com collapse as thousands of jobs disappeared, office vacancies climbed to over 20%, and rents eventually fell by over 60%. But within a few years, office demand returned, and these central business districts refilled with workers and activity.1

Today, many U.S. downtowns are facing a similar crisis in the wake of COVID-19. With the pandemic-induced shift to remote work and the slow return of office workers, the demand for downtown real estate—particularly office space—has plummeted. Office utilization averages less than 50% across major U.S. downtowns. Vacancy rates are 27% in San Francisco and over 16% in New York, and increasing. The downtown business ecosystem is also threatened as many small businesses (such as restaurants) are struggling or closing due to lack of customers. Some urban transit systems have lost half their ridership and face a fiscal crisis.

This is not the first time cities have seen a glut of office vacancies. What is unprecedented is both the speed at which this glut has happened, and how it has occurred at a time of low unemployment and rising interest rates.

Many are arguing that the conversion of vacant office space into housing is a key strategy for addressing these challenges and revitalizing downtowns. Proponents of office-to-residential conversion note that since remote work is here to stay, office demand will never fully return to pre-pandemic levels, and the vacant office space can be repurposed into what cities currently need: housing. Moreover, they argue that the expense and complexity of conversions justify public sector intervention and subsidy.

This raises a fundamental question: To what extent are current high office vacancies a market problem whose burden falls on the private sector (property owners and investors) and to what extent do they represent a market failure and policy problem to which government must respond with financial support from the public?

In this report, we argue that office-to-residential conversions are one potential remedy in some circumstances. But the public interest in conversion and the potential beneficiaries must be clearly defined in order to justify any public financial support. It is still early in the shift to hybrid work and many market forces (e.g., office buildings repricing to lower rents) have yet to play out. Governments rushing to provide financial support for conversions could inadvertently subsidize the wrong behavior. Office-to-residential conversions are not a panacea, but rather one tool in a much broader toolkit for downtown revitalization.

This report begins by identifying the five common arguments made by proponents for converting offices into housing. It then evaluates the myths and realities of each argument, using data from cities across the United States. It concludes with six recommendations for what cities should do about conversions and what other long-term strategies they could adopt.

Common arguments for converting offices into housing

The conventional wisdom is that since a high percentage of office workers will continue to work remotely, and downtowns and office buildings are bereft of people, converting empty or near-empty office buildings into housing will add needed foot traffic and breathe new life into downtown and cities.

The common arguments go as follows:

- “Offices are over.” This argument presumes that remote work is here to stay, as most employees with office jobs prefer the flexibility of working from home. Many no longer have to endure difficult commutes, which not only saves money but also gives them more time with their family and community. Therefore, going forward, it’s thought that few employers will require workers to be in the office full time, and a hybrid work week of two to three in-office days will result in a permanent reduction in demand for office space.

- “Too many offices are bad.” The downtown central business districts that proliferated in the mid-20th century are largely single-use office districts. Many argue that these office agglomerations are a monoculture and anachronistic, and no longer appropriate for the dynamic nature of work in the 21st century.

- “Mixed use is better.” The lack of housing and residents make the traditional central business district dead in evenings and on weekends. So, the argument goes: More residents downtown will support a wider diversity of small businesses (such as grocery stores, hardware stores, cafes, and restaurants) and bring needed life to downtown in the off hours.

- “Cities are about to go broke.” This take contends that the decline in office building valuations threatens local government revenues, as lower office values reduce commercial property tax receipts. With high housing demand, conversions will allow cities to maintain or increase property values.

- “Office conversions can solve the housing crisis.” Finally, proponents of office-to-residential conversions say that amid the ongoing nationwide housing shortage, downtowns can be an important part of meeting those needs.

It is clear that some office-to-residential conversions make sense given the number of such projects that have already happened in cities of diverse market strengths and regional contexts nationwide. The critical questions now are: Would public sector intervention to catalyze more conversions be a good thing for downtowns that are struggling with commercial vacancies? If so, how much and what kind of intervention? Are there any potential unintended consequences that could negatively impact cities and metropolitan regions in the long run? And ultimately, if conversions are not the most effective or needed tool for downtown revitalization, what is?

Office-to-housing myths, debunked

Let’s dispel the myths behind the arguments on office-to-residential conversion one point at a time.

Myth: Offices are over.

Reality: Office use continues.

The first argument is that “offices are over” because of remote work. While we have all gotten the memo that going to the office isn’t everyone’s favorite thing, and it is true that in some U.S. cities (including New York, Los Angeles, and Dallas) offices are half empty, that also means that they are half full. And across markets as varied as Austin, Texas (where the weekday with the highest office usage since March 2020 was 74% of the pre-pandemic level) and San Jose, Calif. (where the highest daily rate was only 46% of the pre-pandemic level), data suggests that office utilization rates have not plateaued, but are simply increasing very gradually.

In some places, office demand remains high. Downtown Salt Lake City is busier than ever, and ridership on the Utah Transit Authority system is up 26% from pre-pandemic levels. Globally, industry sources assess that office utilization is much closer to pre-pandemic levels in markets such as Paris and Seoul. It is particularly interesting to note that among major Australian cities, there is a 35 percentage point spread in office occupancy between the lowest (Melbourne and Canberra) and highest (Adelaide and Perth, at around 80%) utilization markets.

In the medium and long term, the office-using sector of the economy is growing. While tech layoffs are currently getting a lot of headlines, the long-term trend of the last 80 years is that professional and business services have doubled their job share. Even if hybrid work stays the norm, most people with office jobs will still go into an office a few times a week, whether because it’s required by their employer, to get away from their home, for at-work amenities, or for the productivity and innovation benefits that result from face-to-face interactions.

There is also evidence of demand for new construction, even in places with high office vacancies. Instead of all offices being over, there is a bifurcation in the office market itself. Some downtown office stock—particularly older offices from the 1980s—is facing serious difficulty keeping or securing office tenants. This product is likely to be continually outcompeted by newer and more modern office buildings (known as the “flight to quality”). Thus, even in markets with high vacancy, some cities are seeing new office projects continue to break ground.

Myth: Downtowns have too many offices.

Reality: Downtowns have too little of everything else.

But what about the argument that too many offices are bad for downtowns? Downtowns thrive on being dense centers of activities, and office jobs are very conducive to densification. In fact, office work has grown 22% more dense in the 10 largest U.S. office markets since 1990, with a median of 390 square feet per worker in 2019 (and far less in some buildings). American per capita housing consumption, however, is trending in the opposite direction, dramatically increasing over time. In 2010, the U.S. had 800 square feet of residential space per capita. Inevitably, office-to-residential conversions produce a de facto permanent reduction in the density of downtown. For example, a 500,000 square foot office building would have space for over 2,000 workers. But if converted into housing, it might produce fewer than 500 housing units. Even if every housing unit had two people, that would be more than a 50% reduction in density.

It is true that office utilization is very low right now, and was far from 100% even before the pandemic. No office building is ever “full.” However, with proposals to shift to hot desks and lease sharing, it is also possible a 500,000 square foot office building could support more workers than ever, especially if each worker was only in the office a few days a week. The needed adaptation in many cases is to how office buildings are managed to accommodate different work patterns.

Ultimately, the issue is not that downtowns have too many offices. It’s that there is too little of many other activities. The reduction in in-person office workers has impacted the small businesses that serve them. However, this decline in customers can be solved by adding other destinations or economic activities to bring sufficient people.

Myth: Mixed-use downtowns primarily mean more housing.

Reality: Mixed use can strengthen office demand, but that means range of activities in addition to housing.

People do all kinds of things besides work or stay at home. Cities should make it easier to convert offices into everything else, including housing. Because one thing is absolutely true: Mixed use is better.

In downtowns especially, traditional office buildings could be converted to co-working facilities. Empty basements could house nightclubs. Near universities or hospitals, surplus offices could house campus expansions or life sciences spaces. What was once a small office on the 23rd floor could one day become a distinctive bar or restaurant

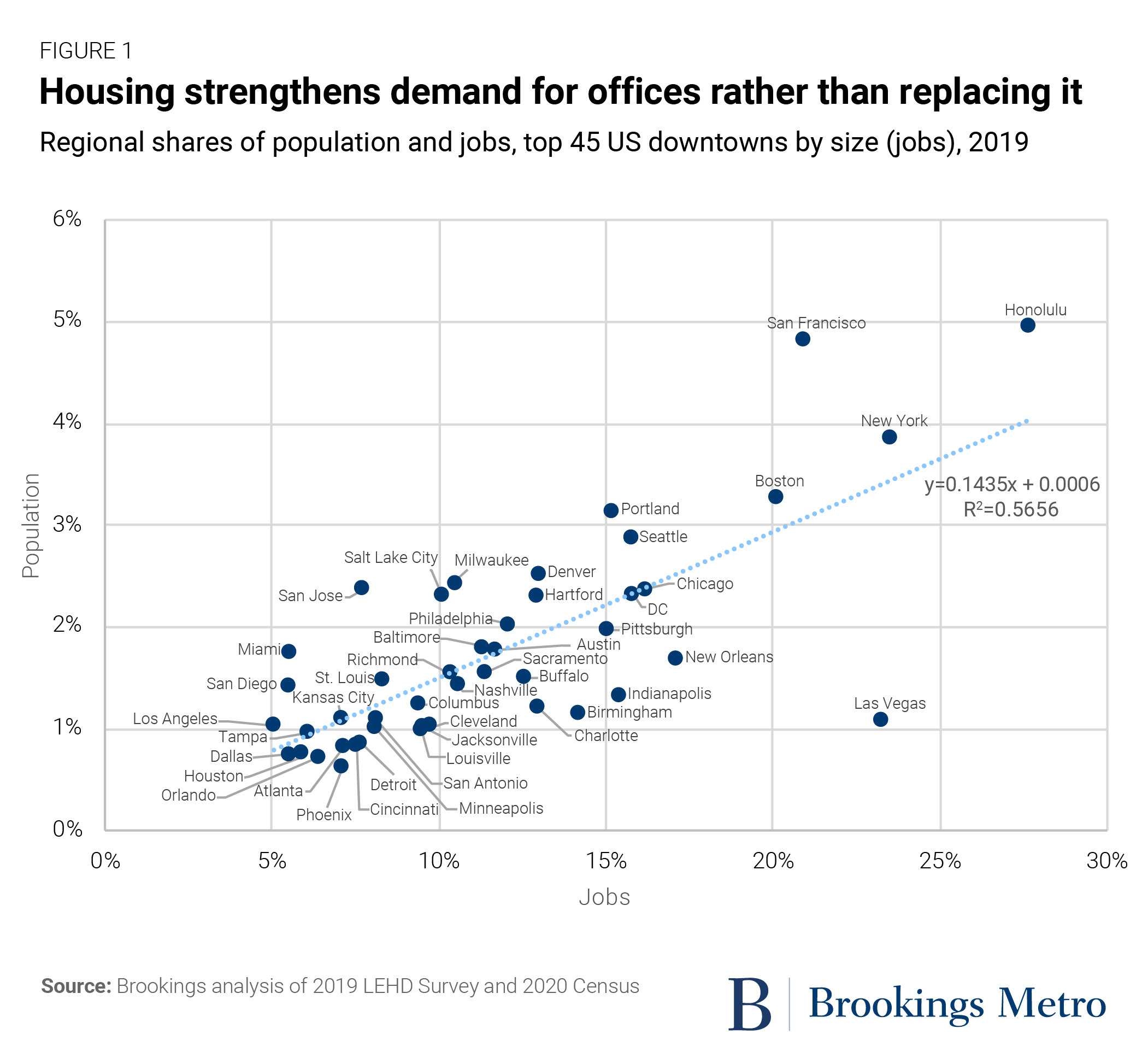

The nuance here is that mixed use is better not just for retailers serving the area, but for office demand as well. As shown in Figure 1, across the 45 largest U.S. downtowns by job count, there is a strong positive correlation (R2 = 0.57) between downtown job market share and downtown population share. In plain terms, these numbers suggest downtowns do better as job centers when they have more people living in and around them.

In short, building housing near jobs and amenities is good, but it’s not a substitute for jobs. For example, even after the gradual wave of conversions that followed 9/11, the New York City Financial District has six jobs for every one resident (a live-work ratio of .16).

Myth: Vacant offices will be the cause of a new urban fiscal crisis.

Reality: Most cities are not going broke, and for many cities, commercial property taxes bring in less than residential.

What about the issue of municipal finances and whether vacant offices will contribute to the dreaded “urban doom loop”? On this point, it’s important to note that the extent to which cities depend on commercial property taxes varies considerably

Figure 2 shows that in most large U.S. cities, real property taxes from commercial real estate are a smaller share of own-source revenue than residential real estate. (Note: Figure 2 is based on an analysis of 25 major cities for which we were able to collect data on the distribution of real property assessed value.)2 Thus, for most cities, swings in the taxable value of housing are of equal or in some cases far greater cause for concern over the long run than the current commercial downturn, and commercial revenues are relatively easier to replace with new revenues, either from increased residential levies or creative new sources.

Some cities, such as Washington, D.C. and Chicago, have very serious cause for concern about commercial valuations, and thus the most urgency about diversifying and strengthening their tax base. Others are reliant on employment in other ways (such as Philadelphia’s wage taxes) not shown in Figure 2. Across the board, it is a good idea even for cities with strong residential tax bases to shore up and strengthen other revenue sources (such as commercial real estate) to maintain diversity in the tax base.

The question then is not a fiscal tradeoff between offices and housing, but rather a right-sized adaptation of offices and housing downtown to strengthen demand for the remaining office inventory, therefore creating a stronger downtown that anchors a stronger city and region. The broader imperative is to rehabilitate municipal tax bases so that they are bigger, more diversified, and more resilient to fluctuations in demand from any one sector.

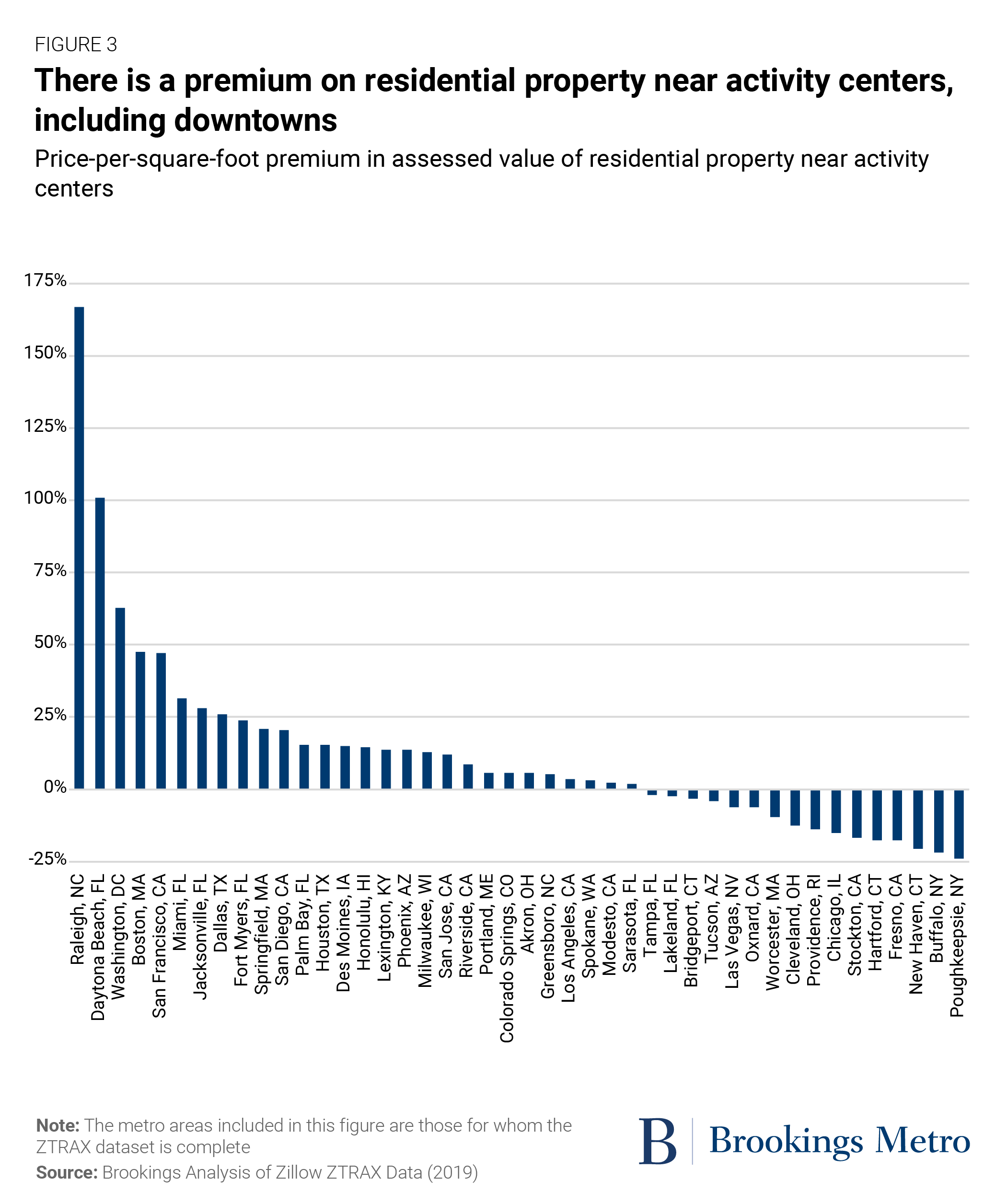

Further, the value of residential property in cities is based on proximity to those cities’ economic activity and amenities. Figure 3 shows that in many economically thriving cities, there is a price-per-square-foot premium for residential property near activity centers (including downtowns). The cities that do not have the same relationship between residential property value and economic activity (i.e., where the value of residential properties is lower near activity centers) include many former “rust belt” cities and economically struggling cities in inland California. These are communities that have suffered steep declines in economic activity as well as high rates of urban disinvestment and outmigration away from the city center. This downward spiral is the outcome we want to avoid for central business districts and their surrounding regional economies.

A decline in cities’ attractiveness as workplaces and economic centers will lead to a decline in residential property values, which will then have a disproportionate impact on fiscal stability. Falling city revenues could lead to cuts in public services and urban amenities, and thus erode the benefit of being in the city (leading to the aforementioned urban doom loop).

Myth: Office-to-residential conversion is key to solving the housing crisis.

Reality: Office conversion is a very pricey way to add just a fraction of the housing we need.

If governments direct public interventions to ensure jobs are a key part of the future of downtowns, does that mean missing an opportunity to solve the housing crisis? Absolutely not.

Downtowns are a tiny fraction of land in most U.S. cities. The solution to the housing crisis in cities requires adding new housing in all neighborhoods. While downtowns are generally the area that allows for the greatest amount of density and mixture of uses, they are but one neighborhood.

Office-to-residential conversions would account for a small share of needed housing units in many cities. For example, a recent estimate indicates that Denver needs between 13,148 and 30,930 more housing units to meet demand. However, potentially convertible office buildings offer only 1.5 million square feet of space, or 1,500 apartments with an average of 1,000 square feet each. That is 11% of the low-end estimate of Denver’s housing needs—helpful, but far from a complete solution, and one that would require significant public funding. Similarly, a study of downtown San Francisco identified 12 office buildings that were suitable for residential conversion, which would yield 2,700 total housing units. This is just above 3% of the 82,000 units the city is required to plan for by 2030, per state law.

Office conversions are also economically challenging and often not possible without significant public funding. A newer study of downtown San Francisco identified the potential for more housing units from office conversions (between 4,200 and 11,200 if as much as 40% of vacant space was converted). But the study noted that such conversions are costly (between $472,000 to $633,000 per unit before necessary seismic upgrades) and “given current economic conditions and development costs, most conversions of underperforming office buildings to housing are not financially feasible.” In other words, the costs to convert are too high to occur without significant public funding.

Over recent decades, numerous cities have provided public support and subsidies for office-to-residential conversion, and evidence suggests that these interventions produced a public benefit. In post-9/11 New York, the conversion of 20 million square feet of office space into housing was part of doubling the residential population of Lower Manhattan. Downtown Los Angeles experienced a renaissance after the passage of an “Adaptive Reuse Ordinance” in 1999 that allowed conversions of older commercial buildings without adding parking, resulting in the direct creation of over 12,000 units of housing over 20 years. More direct financial subsidy includes the recent Calgary incentive program that provides $75 per square foot to convert offices into housing, or Philadelphia’s prior 10-year tax abatement that converted 8.2 million square feet from over 40 office buildings, increasing the Center City neighborhood’s population by 54% between 2000 and 2020. These experiences demonstrate the potential of adaptive reuse. But they vary considerably in their exact details, which merits careful consideration.

Six real estate recommendations for revitalizing downtowns

The debunked myths above demonstrate that office-to-residential conversion won’t be the cure-all for revitalizing downtowns or solving the housing crisis on its own. But there are still many ways to advance the conversation about office conversions to incorporate other ideas and considerations that can better address these challenges. Below are six actions leaders should take, and advice on how to tailor these actions to particular city contexts.

- Make it easier to build new housing on vacant and underutilized lots in downtowns and surrounding neighborhoods.

While the economics of office-to-residential conversions are not positive in many cases, adding housing in and around downtown remains a key strategy for cities. As noted above, office demand is closely tied to housing demand, so new construction will face more market challenges in and near downtowns with high vacancies. Therefore, it makes sense for cities to do everything they can from a regulatory perspective to make it easier to build new housing for all income levels. In downtowns, regulatory relief for building on vacant and underutilized lots could ultimately produce more new housing than conversion. As a start, cities should make sure that existing zoning allows for housing as-of-right within the downtown.

- Provide tax incentives for conversions only when they are also available for new construction.

If cities are considering tax incentives for housing, they should only provide them for both conversions and new construction. Prioritizing new construction—and then making sure there is a clear need and fiscal justification for additional production, including conversion, downtown or elsewhere—helps cities understand how to find the “Goldilocks” amount and type of incentives to facilitate conversions, how they should be targeted, and what public interests conversion serves and thus should be structured into the incentives. Incentives for new construction should be carefully structured to avoid using them to tear down and replace existing historic assets.

- Only consider public funding for conversions in the form of forgone tax revenues, not direct subsidy, and make sure any subsidies are tied to public benefits.

Cities should also clearly distinguish between tax abatements (a form of subsidy that requires no expenditure on the public side and is financed by forgoing tax revenue that would not otherwise exist) and direct subsidy of any other kind.

Cities should not invest limited direct subsidy resources into subsidizing office conversions. In the near term, direct subsidies for conversion might inadvertently subsidize a property owner who is sitting on the sidelines and has yet to reprice their property or rents to better match changed market conditions.

Instead, in cases where it makes sense, cities should use place- or project-specific foregone tax revenue, such as tax abatements or tax-increment financing, to facilitate conversion. They should also incentivize the production of affordable housing as part of the deal to make downtowns more inclusive. The city of Chicago’s LaSalle Reimagined structure is a great example of this.

Additionally, most real estate investment trusts (REITs) are not able to avail themselves of tax credits (e.g., abatements). Since REITs own perhaps 10% of all American commercial real estate, in order for tax incentives to be effective, there may need to be changes to local and state law to enable such incentives to function. Cities and states may need to structure any abatements and credits so that REITs can access them, such as by making the tax credit refundable.

- Identify opportunities for office conversions in all districts, not just downtown.

Surplus, dated, and obsolete office space is not only found in downtowns—it exists throughout metropolitan regions. From the perspective of the city confronting obsolete offices, converting offices located outside of the strongest job centers and consolidating jobs to the remaining centers makes more sense. For this reason, local or federal incentives for office conversion should not exclusively target downtowns.

- Make it easier to build new buildings and change existing ones.

The key for cities’ recovery is flexibility. It’s fine to make it easier to convert office buildings to residential uses, but why not just make it easier to convert any building (like an old warehouse) to another use (such as to entertainment, co-working, advanced manufacturing, or experiential retail)?

Cities should also make it easier to build a new building or to open and grow a new business. Streamlining reviews or making the permitting process more transparent while reducing unnecessary fees can make a real difference.

In an age in which the pace of economic and demographic change is faster than ever, there are also other kinds of complimentary solutions related to how the built environment is constructed, regulated, and managed. These solutions are needed across downtowns, suburbs, and rural areas, and should increase flexibility, ease of adaptation, and, therefore, resilience. Examples include zoning reform (to ease conversions; add bonus entitlements to incentivize conversions; and eliminate requirements for residential buildings to include commercial space), promoting the use of Open Building design approaches in commercial construction that ease adaptive reuse, and land value taxes. Some cities have also suggested imposing vacancy taxes as a way to tax a bad (vacant) space, generate revenue, and accelerate the pace of transition.

Tax incentives and subsidies for conversion should also be available to all kinds of commercial real estate. The lack of flexibility in the built environment is a systematic problem, not limited to office buildings, downtowns, or urban areas. Many communities have dead shopping malls, which are great candidates for conversion to housing and mixed-use environments. And while cities consider offering their own incentives and subsidies, the federal government should also consider offering a tax credit that would be available in both urban and rural areas, as rural areas have the same need to adapt to a changing economy.

- Leverage downtowns’ locational advantages for a range of other strategies to revitalize them.

Housing and adaptive reuse is only one part of the downtown revitalization toolkit. If cities want to invest in the long-term success of their downtowns, they should focus their resources and attention on improving overall quality of life and emphasizing downtowns as a place of destinations and economic activity. These critical considerations for downtown revitalization include:

- Ensuring the ongoing economic role of downtowns in anchoring a productive and innovative economy, including capturing new industries and uses while supporting and growing new talent (i.e., finding ways to fill vacant office space with economic activities). This could include economic development in the form of investing in the workforce and in new high-growth industries that will create jobs and generate demand for office space.

- Prioritizing downtown as a place of diverse destinations (arts, entertainment, work, health care, retail, etc.) that draw visitors, residents, and workers from across the city and region. This could include encouraging the location of higher education and other education facilities downtown and creating and promoting experiences for visitors (such as festivals and major activations).

- Undertaking adaptations necessary to improve downtown livability, especially in public safety, governance, transportation, and placemaking. This could include preventing crime with proven solutions that keep communities safe, creating and managing high-quality public spaces, improving conditions for pedestrians and cyclists, strengthening transit infrastructure and operations, and creating hyperlocal governance capacity in downtowns and neighborhoods

Conclusion

In sum, office-to-residential conversion is an option in some circumstances, but cities need to be smart about it. In addition, conversions are not a substitute for what cities need to do in order to make downtowns attractive as destinations and make sure that the opportunities and amenities that downtowns offer are accessible to all kinds of residents.

Cities need an “all-hands-on-deck” strategy to revitalize downtowns. Rushing to reduce the current challenge of office vacancy with a one-size-fits-all solution of office-to-residential conversion will create its own set of problems. This is a critical moment to recognize the unique benefits of centrally located, economically productive, and dense downtowns as job centers, social and activity destinations, as well as places for living. The task ahead is to find creative ways to ensure their ongoing vitality and relevance.

Matthew Pruitt provided valuable research assistance to this work. The authors thank Jennifer S. Vey (Brookings), Fred Cerullo (Grand Central Partnership), Ted Egan (city of San Francisco), Anne Fadullon (city of Philadelphia), Paul Levy (Center City District), and Samir Mayekar (city of Chicago) for their review and critiques of earlier drafts of this work. Any errors or omissions are solely those of the authors.

-

Footnotes

- For example, downtown San Francisco rents nearly tripled between 2003 and 2019 and the commercial core added almost 90,000 jobs (representing 24% growth) between 2011 and 2019, based on the authors’ analysis of 2011 and 2019 U.S. Census Bureau Longitudinal Employer-Household Dynamics (LEHD) Origin-Destination Employment Statistics (LODES) data, using previously published Brookings definitions of commercial cores.

- We reviewed public comprehensive financial reports from city financial officers and tax assessment authorities in order to obtain the share of taxable value from commercial/industrial real property and residential property and relative millage rates for those jurisdictions with different classes of property. We used the Lincoln Institute of Land Policy’s Fiscally Standardized Cities FY2020 database (https://www.lincolninst.edu/research-data/data-toolkits/fiscally-standardized-cities) to obtain the share of property tax within own-source revenue. This is a non-representative sample, but it does include more than half of all U.S. metropolitan areas with populations over 1 million.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).