The national security establishment knows last year’s $250 billion CHIPS and Science Act mostly for its bold subsidies to encourage firms to build new semiconductor plants and thus compete with China on industrial strategy. Researchers and technology leaders, meanwhile, regard the legislation as the nation’s most significant innovation bill in decades, given its authorization of higher spending targets for the nation’s innovation ecosystem.

And yet, for all that, the law is something else as well, albeit underappreciated for it. Specifically, the CHIPS and Science Act is also a major workforce law. In this respect, the act remains under-recognized not just for its focus on higher-level STEM education, but also as a source of programs and resources for training the nation’s skilled technical workers without bachelor’s degrees—a workforce of great importance as the nation seeks to expand its high-value industrial base.

In light of that—and in hopes of further informing state and local implementors—this report provides a practical overview of the numerous but underdiscussed and sometimes indistinct workforce programs included in the CHIPS and Science Act. To do this, the report situates the act amid key workforce development trends and systems in the economy; inventories and analyzes the workforce programs the law contains (including ones focused on non-college offerings); and highlights issues for federal, state, and local implementors.

Overall, our analysis underscores that the CHIPS and Science Act represents a significant test of the nation’s commitment to train advanced STEM and critical non-college technical workers, and that a full delivery on the law’s potential will require significant additional work.

Advanced industries’ workforce gaps provide context for the CHIPS and Science Act’s training features

The importance of the CHIPS and Science Act to U.S. workforce training stems from its relevance to the nation’s drifting advanced industries sector.

The law isn’t simply an intervention in the chips industry, after all. Rather, the legislation—particularly the “and Science” part of it—includes a variety of initiatives relevant to boosting vitality in broader innovation and advanced industry clusters, with workforce provisions prominent.

As Brookings Metro has described and tracked, advanced industries such as auto manufacturing, pharmaceuticals, clean energy generation, and digital services are “advanced” because they leverage innovation to drive industrial dynamism. As such, these industries are the nation’s core innovation sector, in that they invest heavily in research and development and employ sizable numbers of scientists, engineers, and technicians to deploy the resulting new technologies for economic gains.

Yet here’s the problem: America’s advanced industries have been struggling, both as a nationwide sector and as local clusters—and workforce issues are a core reason.

Both the semiconductor industry specifically and the advanced sector more broadly report persistent challenges in securing sufficient science, technology, engineering, and math (STEM) professionals and technicians. In this vein, the U.S. faces an economy-wide shortage of skilled workers focused on two categories of skilled professionals: first, engineers and computer scientists with four-year and advanced degrees; and second, skilled technicians with two-year degrees or less and additional on-the-job or “earn and learn” training. Worsening these dynamics are persistent degree and certification shortfalls as well as stubborn racial and gender inequities, many of them exacerbated by the nation’s “college for all” approach to developing STEM talent and the paucity of paid, work-based pathways into advanced industries.

The upshot is that too few American students now pursue university STEM degrees and stick with STEM work, or train at community colleges and other settings to obtain the skills needed for technician roles in advanced industry work.

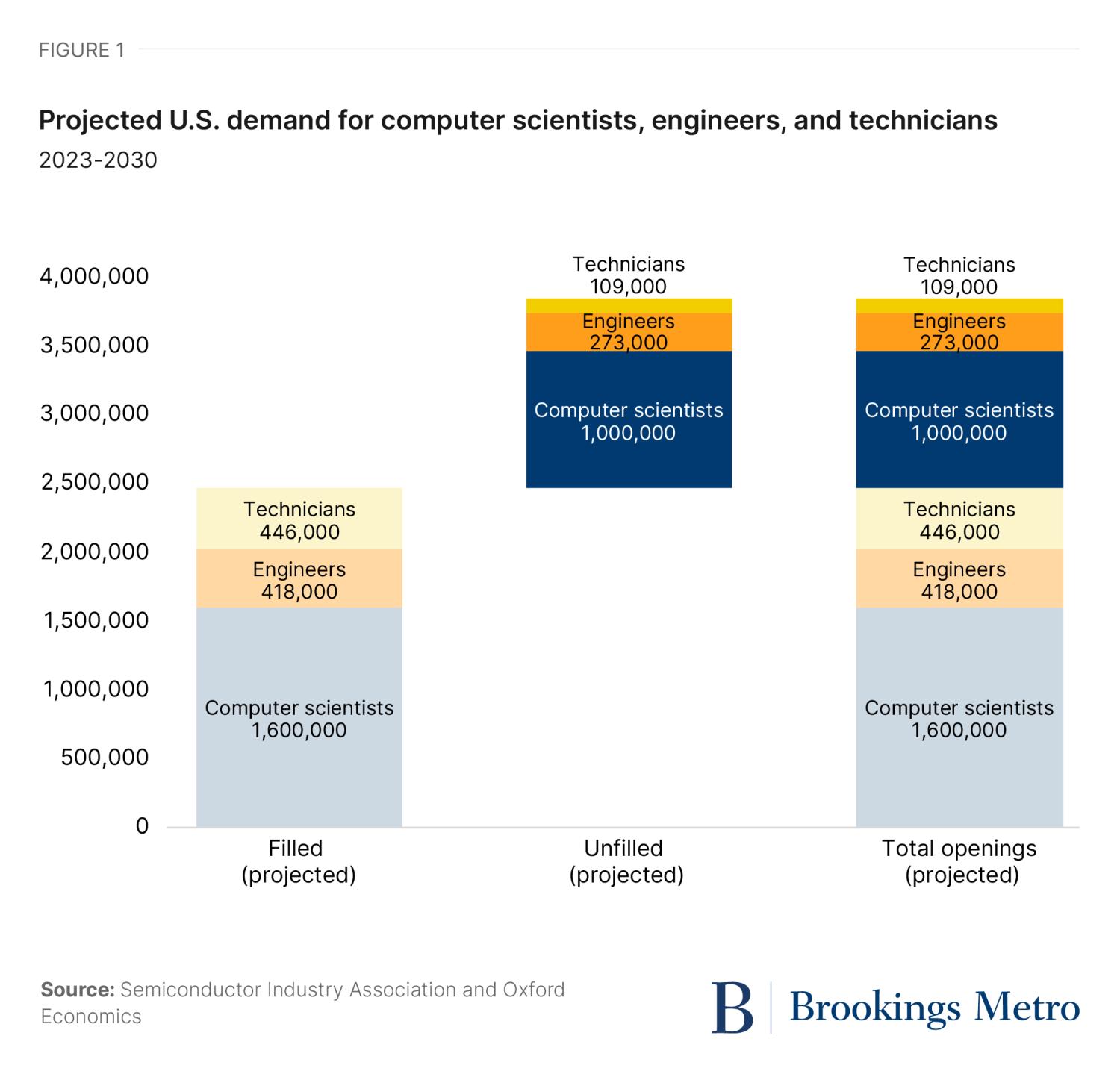

As a result, the Semiconductor Industry Association (SIA) and Oxford Economics have quantified sizable semiconductor-specific and economy-wide workforce gaps. Across the semiconductor sector, SIA and Oxford Economics found that 67,000 of the projected 115,000 new chip jobs expected by 2030 risk going unfilled given current trends. Of the unfilled positions, 61% will be computer scientists and engineers and 39% will be technicians, mostly with certificates or two-year degrees.

Turning to the economy as a whole, SIA and Oxford estimate that some 3.8 million additional STEM or technical jobs could be created in the U.S. by 2030. Of those, 1.4 million positions risk going unfilled, with most of the needed professionals being computer scientists and engineers, and more than 100,000 being technicians.

Understanding the CHIPS and Science Act’s workforce dimension

The CHIPS and Science Act directs the investment of roughly $250 billion over the next 10 years to build up U.S. semiconductor manufacturing and more broadly support advanced manufacturing, R&D, innovation, and workforce development.

More specifically, the law encompasses two components. Division A, also known as “the CHIPS Act of 2022,” focuses squarely on strengthening the semiconductor industry—particularly, manufacturing, R&D, and workforce development. Overall, Division A directs most of its funding to the Department of Commerce, but it also sends sizable amounts to the National Science Foundation (NSF) and the Department of Defense. Altogether, Division A appropriates more than $50 billion in federal spending, including what may be the law’s highest-profile provision: the CHIPS Incentives Program, which provides $39 billion in incentives to build, expand, or modernize semiconductor facilities and equipment. Some $200 million in appropriated resources are allotted here for a Workforce and Training Fund.

Division B, “Research and Innovation,” authorizes considerably more spending (about $170 billion) to support progress on broader national goals related to science, technology, commercialization, and manufacturing. To those ends, Division B directs much of its largesse to the NSF and Department of Energy. It also authorizes a much longer list of programs than Division A, touching on a wide range of industries and technologies. Although its authorizations are frequently not fully appropriated, they do offer significant potential resources for workforce activities.

Overall, the law’s first-order goals center on strengthening U.S. competitiveness in 10 “Key Technology Focus Areas” (KTFAs), which range from artificial intelligence and quantum computing to biotechnology, advanced energy technologies, and advanced materials science. Implicit in these priorities is enhanced investment in manufacturing, R&D, and technological innovation. But the law is also clear that broadening access to STEM careers is crucial if the nation is to reach those goals. Woven throughout the law, therefore, are provisions supporting formal education, experiential learning, workforce development, and expanded outreach to encourage more people to consider STEM jobs. Moreover, as the Biden administration works to implement the law, it is highlighting education and training outside the bounds of bachelor’s and graduate degree training to an extent that is unusual in most current technology- and innovation-oriented initiatives.

Workforce development funding opportunities in the CHIPS and Science Act

The CHIPS and Science Act holds out numerous and sizable opportunities for states, metro areas, and other actors to fund STEM and technician workforce development initiatives. In fact, it’s fair to say that the act likely amounts to the main event for funding such efforts in the U.S. for the next few years.

The law authorizes the NSF alone to spend $13 billion for STEM education and workforce development over the next five years, or about $2.6 billion per year. By comparison, the formula funding streams supporting training and employment activities for youth, adults, and dislocated workers in Title 1 of the Workforce Innovation and Opportunity Act totaled $3.2 billion in FY 2022—and only a fraction of that goes directly to training. In other words, the act’s workforce resources are on par in many areas with those in the established workforce development system.

Yet determining the exact amounts and programmatic nature of the resources available in the CHIPS and Science Act remains challenging in some cases and impossible in others. Not only have the law’s workforce elements been overshadowed by its chip subsidies, but in addition, the sheer number of sections and hard-to-parse provisions makes it hard to assess exactly what is or will be available for what purposes.

That isn’t all. In some cases, budget figures for particular workforce programs are not clear. In other cases, it’s impossible to separate the budget for education or workforce elements from wider programs. And in still other instances, approved funding has been under-appropriated, creating uncertainties. Meanwhile, as always, agencies retain a great deal of discretion in implementation, ensuring additional uncertainty at this early stage about how things will unfold.

As such, what we’ve previously observed of the even bigger and more complicated Infrastructure Investment and Jobs Act applies here: Such complexities—including ones caused in some cases by the difference between approved and appropriated resources—pose real hurdles to state and local planning and make it very difficult for regional leaders to understand programs’ specific nature, their eligibility requirements, and how the money will flow.

Given these challenges, the findings that follow aim to help state and local leaders assess the workforce components of the CHIPS and Science Act and begin to identify which will be most helpful in developing effective regional workforce development activities.

Finding #1: Thirty-three CHIPS and Science Act programs support STEM-related education, training, and outreach in at least some way

The 33 CHIPS and Science Act programs supporting STEM-related education, training, and outreach vary in scope and focus. Standalone education and training programs total $2.8 billion in authorized spending. Other programs incorporate workforce development into broader goals and total much larger sums, although the amount allocated to education and training is unknown and will probably be a fairly small share

Nonetheless, the numbers involved are so large that even a small share of a budget line can be a sizable dollar figure. For example, the law authorizes $53 billion toward semiconductor-focused programs as well as $33 billion toward programs supporting innovation and manufacturing, and programs in both categories incorporate workforce development elements. In any event, the programs fall into three main categories, discussed below.

Semiconductor programs with STEM education and workforce elements

The law’s largest budgetary items reside in the CHIPS for America package of investments in Division A. These initiatives focus on bolstering the semiconductor industry, and together account for almost $53 billion, all of which is appropriated.

The law’s workforce provisions regarding the semiconductor industry are more systematically organized than efforts related to other STEM fields. In providing context for such efforts in the law, the 2022 CHIPS for America strategy document highlights the shortage of workers for jobs in specialized construction, fab operations, and semiconductor design. It then declares: “The need to reimagine and scale education, training, and recruitment is one of the industry’s greatest challenges…The industry will need to significantly increase the intake of new workers annually to keep pace with new capacity. It is possible that up to $8 billion of investment may be needed over the next five years to substantially address the industry’s workforce needs.” Workforce development is viewed here as a “critical” priority of Division A. Details of these initiatives include:

- The Department of Commerce’s $39 billion in incentives to build semiconductor manufacturing facilities requires that applicants include detailed plans of how they’ll develop the workforce both to build and operate the facility. The first Notice of Funding Opportunity (NOFO), released in early 2023, highlights workforce development approaches such as sector partnerships, wraparound services, career and technical education at the high school and postsecondary level, and apprenticeships. It also notes the value of more emergent practices such as eliminating degree requirements and prioritizing job quality. Subsequently, the CHIPS for America office followed up the NOFO with an accompanying workforce development guide.

- Commerce is also leading an $11 billion research and development portfolio dedicated to reducing the time and cost of developing semiconductor technologies. The centerpiece of the effort will be a new National Semiconductor Technology Center (NSTC)—a nonprofit, public-private collaborative effort between the Department of Defense, Department of Energy, and the NSF. In addition to more traditional R&D goals of foundational research and prototyping, the NSTC also seeks to build and sustain a semiconductor workforce development ecosystem. One option under consideration is developing “workforce centers of excellence” that could build an industry-wide educational framework, increase awareness of semiconductor careers, and expand access to educational opportunities.

- The $2 billion Microelectronic Commons housed at the Department of Defense will build greater “lab to fab” capacity in the U.S. by strengthening pathways from R&D to commercialization, focusing on applications related to national defense. To achieve this, the Commons sets a goal of strengthening the microelectronics engineering and semiconductor workforce.

- The fourth provision of CHIPS for America, Division A, is the $200 million Workforce and Education Fund, housed at the NSF. This entails $200 million for semiconductor workforce education and training. This is a “signpost” investment to kick-start development of the domestic semiconductor workforce.

Two other provisions in separate sections of the legislation also focus on workforce development in the related field of microelectronics. One of these programs resides in the NSF (“Microelectronics workforce development activities”) and one in the Department of Energy (“Microelectronics research for energy innovation”).

Innovation, technology, and manufacturing programs with STEM education and workforce elements

Other workforce-related programs—concentrated in Division B of the package—weave STEM education and training into other agendas, and total $33 billion. Not always fully appropriated, these programs support strong partnerships between industry and education, and emphasize applied forms of learning such as registered apprenticeships, career and technical education, and hands-on learning experiences.

For example, the newly authorized Directorate for Technology, Innovation and Partnerships (TIP) within the NSF received $20 billion. As part of its mission, the CHIPS and Science Act charges TIP with accelerating key technologies and addressing pressing societal challenges—among them, workforce development, the skills gap, and inequitable access to education and opportunity. The NSF has historically supported a range of education and workforce programs (discussed further below), but the new directorate is poised to deepen and accelerate the agency’s commitment. One of TIP’s flagship efforts will be the Regional Innovation Engines program, authorized at $3.3 billion. The NSF describes the program as having three core purposes: generating use-inspired scientific and technical research, translating innovation to practice, and developing the workforce to grow and sustain regional innovation.

Within the Department of Commerce, the Regional Technology and Innovation Hubs (Tech Hubs) program—authorized at $10 billion and appropriated at $500 million— prominently incorporates workforce development into its goal of developing globally competitive technology and innovation hubs. The program’s NOFO also signals the importance of workforce development by assigning it 6 points at review and requiring that consortia applying for funds include labor and workforce training organizations. Other Commerce programs such as the Manufacturing Extension Partnership and the Manufacturing USA network also include workforce development among their services. And the Department of Energy’s Small Business Voucher Pilot Program supports small businesses in accessing a variety of services from the National Laboratories, including skills training and workforce development.

Standalone STEM education and workforce programs

Lastly, 20 legislative provisions support STEM education and workforce development as a goal in itself. They include programs for K-12, undergraduate (including community college), and graduate students as well as internships, fellowships, and informal learning activities. They also support a range of outreach and partnership efforts to expand access to STEM education for individuals of all backgrounds; diversify STEM teachers, faculty, and instructors; and strengthen the capacity of schools and other organizations to deliver STEM education. A handful focus on specific technologies, such as quantum networking, cybersecurity, clean energy, and nuclear technology. The majority of the standalone programs (14) are situated in the NSF, with four in the Department of Energy and two in the Department of Commerce.

We were able to identify authorizations totaling some $2.8 billion for this category, but that figure is an undercount given that we could not identify budget amounts for all of the provisions.

In sum, the CHIPS and Science Act authorizes multiple programs and substantial dollars to support STEM education and workforce development. There is $2.8 billion in dedicated STEM education and workforce funding; a $50 billion package supporting the semiconductor industry that prioritizes education and training along with R&D and new facilities; and $33 billion in a variety of programs and initiatives supporting regional economic development, innovation, and manufacturing that all incorporate workforce development. In short, the CHIPS and Science Act—while known mostly as a national security or innovation package—also stands as a massively consequential workforce development intervention.

Finding #2: Education and workforce funding in the CHIPS and Science Act is being allocated to multiple agencies and initiatives, with particularly prominent roles for the Department of Commerce and the National Science Foundation

More than half (18) of the 33 workforce programs inventoried here reside in the NSF, with eight residing in the Department of Commerce, six in the Department of Energy, and one in the Department of Defense. In dollar terms, the largest share goes to the Department of Commerce, which will manage $64 billion. The NSF accounts for about $22 billion, the Department of Defense $2 billion, and the Department of Energy about $1 billion.

At the same time, the law directs no funding to the Department of Labor, the public workforce development system, or the registered apprenticeship system—conventional mainstays of the U.S. workforce system. Given that, the new funding will flow through channels and into actors frequently separate from the standard state and local workforce boards. As such, the CHIPS and Science Act may well shift the contours of the U.S. workforce system, particularly in regions engaged in semiconductor manufacturing. There and elsewhere, the act will bolster the influence of new and different actors (such as the Commerce Department and NSF) in the workforce development universe in relation to the standard ones, while accentuating the nation’s focus on STEM and technician skills in relation to other priorities.

Finding #3: Significant CHIPS and Science Act funding for education and workforce goals prioritizes skilled technical jobs that do not require a bachelor’s degree

Overall, the CHIPS and Science Act’s most clearly articulated workforce priorities relate to the semiconductor workforce. Numerous provisions of the act speak to the need for more STEM graduates that can staff high-paying roles in the industry. Yet the law and related guidance from the Biden administration are especially emphatic about the need for programs to support workers in the semiconductor or other industries who require technical education and training but not a bachelor’s degree. This is an important new focus for national policy—one that federal agencies, states, and regions are now facing.

The 2022 report laying out the overall strategy for the CHIPS for America program lists a wide range of roles that need to be filled, including “process engineers, material scientists, industrial operations specialists, engineering technicians, equipment operators and installers, and specialty construction workers such as cleanroom architects, high-purity welders, and pipefitters.” These are all skilled technical positions, but they do not all require bachelor’s degrees. The document goes on to encourage “more paid training and experiential apprenticeship programs” and for employers “to hire based on skills, not just degrees.” This comports with research from Brookings Metro estimating that over 60% of semiconductor manufacturing roles require no bachelor’s degree, and that there is a broad need for expanded access to technical work in America.

In keeping with this technician-level focus, the CHIPS for America workforce planning guide offers supplemental information to assist companies in creating the workforce development plans required to support applications for manufacturing incentives. The guide encourages companies applying for manufacturing incentives to incorporate Registered Apprenticeships and pre-apprenticeships; partner with community colleges and high school career and technical education programs; and offer on the-job-training.

For its part, the NSF has issued several solicitations for proposals (some in partnership with Intel and the Micron Foundation) to train semiconductor and microelectronics workers through the agency’s various STEM education portfolios. These include the Advanced Technological Education (ATE) program, which supports community colleges in training the skilled technical workforce. ATE is a well-established program, and a number of recent and current awards have targeted the semiconductor industry, even before the CHIPS and Science Act. Another is the recently launched Experiential Learning for Emerging and Novel Technologies (ExLENT) program, which offers experiential learning opportunities in emerging technologies targeting a wide variety of learners, including youth and adults at any stage in their career development, and those who have faced barriers in accessing formal STEM education.

Both ATE and ExLENT support education in other technological areas as well, not only semiconductors and microelectronics. ATE supports education and training in advanced manufacturing, biotechnology, energy and environmental technologies, information technology, cybersecurity, and more. ExLENT will focus on emerging technologies such as advanced wireless, artificial intelligence, biotechnology, and quantum information science.

Overall, the NSF is increasing its investment in experiential learning and nontraditional paths into STEM careers. As it seeks to broaden access to these careers, the agency wants to develop pathways that combine education (both at the high school and postsecondary level) with internships, co-ops, or apprenticeships.

Other programs supported by the CHIPS and Science Act that develop skilled technical workers in a variety of fields include Manufacturing USA, which supported more than 20,000 workers completing a certificate, internship, or training program in FY 2022. Another is the Manufacturing Extension Partnership, which has sharpened its focus on workforce development in recent years while also broadening its work to help manufacturers act more strategically to attract, train, and retain workers (in addition to supporting individual workers increase their skills). Both programs will be major beneficiaries of the act.

Lastly, both the Regional Innovation Engines and Tech Hubs competitive grant programs support regional efforts to build industry clusters in technologies such as artificial intelligence, biotechnology, advanced manufacturing, and robotics. Both programs also emphasize the importance of developing diverse, skilled workforces. The Engines funding solicitation prompts applicants to think broadly about the workforce to be developed, focuses on varying educational levels and roles (technicians, practitioners, researchers, and entrepreneurs), and highlights strategies such as internships, co-ops, and vocational training. The Tech Hubs solicitation more explicitly calls out non-college education and training programs by spotlighting Registered Apprenticeships, labor management training programs, career and technical education programs, and community colleges. Additionally, consortia applying for funds are required to include labor and workforce training organizations.

Finding #4: Through chips manufacturing subsidies and the Tech Hubs and Regional Innovation Engines programs, the CHIPS and Science Act advances a pathbreaking effort to integrate economic and workforce development as interconnected investments

Requirements in the Tech Hubs and Regional Innovation Engines programs require awardees to fully integrate technology development and workforce efforts. Meanwhile, the semiconductor incentives program takes a new approach to supporting workforce development by giving private sector actors decisionmaking authority over funding decisions and encouraging state and local governments to make matching investments in education and training. This approach is a promising model that marks a break from “train and pray” scenarios in which workforce investment decisions remain divorced from job placement and hiring activities. Instead, the companies receiving the CHIPS and Science Act’s manufacturing subsidies will determine how to support related workforce development efforts—a direct application of the principle that workforce development should be driven by employer demand.

Of course, employers won’t be able to do it alone. They will need to partner with area organizations such as community colleges, workforce development boards, apprenticeship programs, unions, nonprofit training providers, and others. What’s more, the funding opportunity for manufacturing incentives for commercial fabrication facilities explicitly prioritizes applications that include state and local incentives benefiting regional semiconductor ecosystems, not just one firm. Rather than only tax breaks for companies, the CHIPS office is looking for incentives such as workforce and education investments. Several states have already announced investments in semiconductor-related education and training, including Minnesota, Michigan, Arizona, New York, and Ohio.

Finding #5: The CHIPS and Science Act will likely engage with a significant number of metropolitan and rural areas, although its reach will not be universal

The CHIPS and Science Act will touch down most visibly in specific locations through its manufacturing incentives and the three major competitive grant programs: Regional Innovation Engines, Tech Hubs, and the Recompete Pilot Program. In this respect, the act will have broad reach across the country, though its presence will be uneven. The reason: Much of the act’s funding is contingent upon organizations or coalitions in regions applying for specific place-based grants or incentives, rather than receiving automatic and broadly distributed flows of funding through set channels.

As of August 2023, the CHIPS for America program had received more than 450 statements of interest from companies across 42 states seeking incentives to invest in semiconductor facilities.

For its part, the NSF has already awarded Regional Innovation Engines planning grants to 44 regional coalitions across the country and is now considering 16 coalitions as finalists—representing places such as Fargo, N.D.; Lexington, Ky.; Albuquerque, N.M.; El Paso, Texas; East Lansing, Mich.; and Kissimmee, Fla. The funding announcement noted the NSF’s particular interest in regions without well-established innovation ecosystems, suggesting they are hoping to invest places other than superstar metro areas such as Seattle, San Jose, Calif., and Boston.

Regarding the Tech Hubs program, the act calls for “geographic diversity and representation” in awards, specifying that at least one-third of the grants should “significantly benefit a small and rural community” and at least two-thirds should benefit “underserved communities in and near metropolitan areas.” The Commerce Department recently designated 31 regions as Tech Hubs and awarded strategy development awards to consortia in another 18 areas. Designated places include Tulsa, Okla.; Kansas City, Mo.; Baltimore; Birmingham, Ala.; Baton Rouge, La.; and Reno, Nev.

The manufacturing incentives, Regional Innovation Engines, and Tech Hubs are all notable for treating economic and workforce development as interconnected activities. While they are primarily economic development projects, workforce development is a key investment tool.

Another Department of Commerce program—the Distressed Area Recompete Pilot Program—targets persistently economically distressed communities to create and connect people to good jobs. More specifically, it targets communities with below-average employment rates for people of prime working age (25 to 54). Commerce received more than 560 applications in response to a June 2023 NOFO, and in December, the agency designated 22 finalists and awarded 24 strategy development grants. Existing networks such as the Manufacturing Extension Partnership (MEP) and Manufacturing USA also have broad reach. MEP centers operate in all 50 states and Puerto Rico, and the Manufacturing USA network is comprised of 17 public-private institutes across the country, with up to three more semiconductor institutes authorized under the CHIPS and Science Act.

Lastly, the myriad NSF and Department of Energy programs supporting STEM education and workforce development will land in dozens of community colleges, universities, K-12 systems, and other entities across the country.

Overall, the STEM and technician development system supported by the CHIPS and Science Act appears likely to be widely distributed across the nation, but dotted across the map and oriented to the nation’s existing and emerging advanced industry clusters.

How leaders can maximize this once-in-a-generation opportunity for workforce development in technical industries

The CHIPS and Science Act stands out not just as an international security, technology, or innovation strategy landmark, but as a watershed in U.S. workforce development. Once-in-a-generation funding levels have at last been authorized to support STEM-related workforce education and training. At the same time, the new industrial policy package integrates progressive workforce development concepts, such as a strong focus on non-college training, experiential learning, and stackable credentials. As such, the act stands out as a milestone for advancing a modern pairing of industry development and workforce training.

Yet for all this promise, the CHIPS and Science Act remains an imperfect work-in-progress—the success of which will depend on sustained follow-through. Several challenges could hobble the program’s workforce initiatives:

Following through on funding

New analysis from the Federation of American Scientists on the gap between appropriations and authorizations for the “and Science” portion of the act are even more troubling than those from earlier last year—with serious implications for the workforce dimensions of the law.

Most notably, a number of STEM education activities at the NSF—while enjoying important funding gains—nevertheless fell a collective $600 million short of their $1.4 billion authorized level in the FY 2023 omnibus spending package, and $1.1 billion short in the FY 2024 budget request. Appropriations are even lower in the House and Senate FY 2024 bills.

Multiple other programs that include workforce features face funding shortfalls. Funding for the MEP and Manufacturing USA programs has come in 32% and 47% below their generous authorized levels, respectively. Worse, the Tech Hubs program—authorized at $10 billion over five years—received just $500 million in the FY 2023 omnibus, or one-quarter of its authorized level for the year. This will greatly limit the resources available to the Economic Development Administration for “development” grants, including the required workforce initiatives. Similar shortfalls may hobble the NSF’s Regional Innovation Engines program, with its focus on provisions for workforce training.

In short, federal appropriators need to deliver on the intended investment levels set out in the CHIPS and Science Act in order to deliver on the law’s true vision.

Following through on coordination

At the same time, the complexity of the law’s setup and mechanics makes it imperative for state and local actors—and the relevant federal agencies—to engage in an unprecedented level of coordination and intentional planning and execution.

Effective workforce development is inherently complex, given the necessary involvement of an array of actors that includes employers, training providers, workforce and economic development organizations, community-based groups, education and training institutions, labor unions, and other stakeholders, who must all work together. Yet with the CHIPS and Science Act, a new vision will need to be implemented through 33 programs and four federal agencies, with much program design left for the future and with wide scope for decentralized implementation, including through numerous challenge grants.

Overall, the law is likely to support creative innovation, but the multiplicity of agencies could also create confusion about who is responsible for what, and so diffuse impact. More adjustment will be required due to the channeling of CHIPS and Science Act investments through the NSF, Commerce Department, and Department of Energy rather than through the Labor Department. Preexisting state and local workforce boards and apprenticeship programs will need to develop new relationships and collaborations with the entities receiving CHIPS funding, who themselves may be unfamiliar with the public workforce system and apprenticeship options. The Education Department and its programs will also be important given the relevance of community colleges and high school career and technical education (CTE) to technician training. An expansion of short-term Pell Grants and the Perkins program for high school CTE could help transition the CHIPS and Science Act’s initial investments in new non-college programs and infrastructure if they prove their value.

For its part, the National Semiconductor Technology Center is poised to act. Its vision and strategy document states, “The NSTC is envisioned to serve as a coordinating body and center of excellence to help scale the technical workforce—including scientists, engineers, and technicians—while leveraging the many semiconductor-related workforce activities funded by the U.S. government.” The report notes that the CHIPS Research and Development Office will release a workforce strategy at a later date. Of course, it faces the difficulty of executing on said plan at the exact moment the field is experiencing surging demand for workers.

The field of cybersecurity may offer some lessons in developing and executing a workforce strategy for specific technological fields. In July, the White House released a National Cyber Workforce and Education Strategy, building upon years of work by federal agencies and others that has led to such outputs as the NICE Workforce Framework for Cybersecurity, which sets out a common language to describe the tasks, knowledges, and skills necessary to work in the field. More such work organized across other sectors will clearly be necessary.

Beyond the federal challenge, equal portions of coordination and collaboration need to be hammered out at the state and local level. Regardless of the novel context and new programs and resources available to them, states and regions need to rapidly establish high-quality collaborations based on the core best practices of such systems. That means major employers as well as organizations such as state workforce development boards urgently need to:

- Articulate shared, evidence-based narratives of need and response that raise awareness of in-demand careers and recruit participants for training.

- Align labor unions, higher education institutions, local workforce boards, and training providers to deliver programs—including both classroom training and work-based learning.

- Convene and engage employers to articulate labor market needs and mobilize as partners in building talent pipelines.

- Provide and coordinate wraparound support services.

- Align career opportunities with Good Jobs Principles such as recruitment and hiring, DEIA (diversity, equity, inclusion, and accessibility), organizational culture, and family-sustaining pay.

The CHIPS and Science Act’s vision of a reinvented STEM and technical workforce system depends heavily not just on the coordination of federal agencies and programs, but also on effective collaboration among key state and regional stakeholders, as well as the private sector. In short, the success of Congress’ compelling workforce strategy hinges on interagency links and sub-national implementors.

Conclusion

Not just a national security or an innovation measure, the CHIPS and Science Act contains nearly three dozen programs that require, emphasize, or allow workforce development activities. These programs—scattered throughout a multifarious 400-page piece of industrial policy legislation—together represent a major opportunity for the nation’s advanced industries to address their glaring needs for STEM and technician talent so as to deliver on broad revitalization.

However, federal, state, and local actors have much work to do to seize the opportunity the act presents. Congress needs to build out the funding base for the new skills surge. And the relevant federal agencies need to continue communicating a set of principles and best practices while coordinating their own activities in support of the workforce development mission.

For their part, state and local officials need to step up beyond just welcoming new the new federal programs and resources. They also need to assemble and build out sustainable partnerships and systems that serve employers and workers differently from business-as-usual, and that can last beyond the law’s current investment in training. Above all, they need to become co-investors in the construction of a new system.

In any event, the CHIPS and Science Act holds out useful programs and once-in-a-generation resources that—if urgently and cohesively leveraged—can drive a sea change in STEM education and technical training.

-

Appendix: List of programs in CHIPS and Science that support STEM education and training

Legislative section Program Agency 102-103 CHIPS for America – Incentives DOC 102-103 CHIPS for America – R&D DOC 102-103 CHIPS for America – Workforce and Education Fund NSF 102-103 CHIPS for America – Defense Fund and Microelectronic Commons DOD 10111 Increased collaboration with teachers and scientists DOE 10235 Dr. David Satcher Cybersecurity Education Grant Program DOC 10241 Educational outreach and support for underrepresented communities DOC 10251-55 Manufacturing Extension Partnership DOC 10261-63 Manufacturing USA DOC 10311 PreK-12 STEM Education NSF 10312 Undergraduate STEM education NSF 10313 Graduate STEM Education NSF 10316 Federal cyber scholarship for service program NSF 10318 Microelectronics workforce development activities NSF 10319 Incorporation of art and design into certain STEM education NSF 10321 Programs to address the STEM workforce NSF 10322 Robert Noyce Teacher Scholarship program update NSF 10323 NSF Eddie Bernice Johnson INCLUDES Initiative NSF 10328 Research and dissemination to increase the participation of women and underrepresented minorities in STEM fields NSF 10329 Activities to expand STEM opportunities NSF 10381-99A NSF Directorate for Technology, Innovation, and Partnerships (TIP) NSF 10388 Regional innovation Engines (TIP) NSF 10393 Scholarships and fellowships (TIP) NSF 10395 Scaling innovations in preK-12 STEM education (TIP) NSF 10512 Rural STEM activities NSF 10525 Tribal colleges and universities NSF 10621 Regional Technology and Innovation Hubs DOC 10621 RECOMPETE Pilot Program DOC 10661 Quantum networking and communications DOE 10714 Clean energy technology university prize competition DOE 10718 Small business voucher program DOE 10731 Microelectronics research for energy innovation DOE 10745 Science education and human resources scholarships, fellowships, and research and development projects (nuclear) DOE

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).