Leaders in cities, metropolitan areas, and states across the country continue to seek ways to reenergize the American economy in a way that works better for more people. To support those efforts, this report provides an update on the changing momentum and geography of America’s advanced industries sector—a group of 50 R&D- and STEM (science-technology-engineering-mathematics)-worker intensive industries the vitality of which will be essential for supporting any broadly shared prosperity in U.S. regions.

What emerges from the update is a mixed picture of progress and drift that registers continued momentum in the manufacturing sub-sector; a major slump in energy; and strong, widely distributed growth in high-tech services— all of which adds up to a somewhat narrowed map of growth overall.

Three major findings emerge:

- The aggregate sector continued to expand between 2013 and 2015 despite global headwinds.

- Growth, however, emanated from a narrower set of auto manufacturing and “tech” service industries in the last two years. In fact, just three auto industries and four digital services industries accounted for more than 60 percent of the nation’s advanced-sector growth over the time period.

- The sector’s distribution grew more uneven across the country between 2013 and 2015. While a solid minority of the nation’s largest 100 metros achieved strong advanced-sector growth, some 59 saw advanced sector output or employment slow in those years.

Overall, these trends reveal both the value and evolving distribution of advanced economic activity and the need for federal and state-local strategies focused on boosting the sector’s growth and broadening its reach.

Interactive Data

Introduction

Summer 2016 finds the U.S. economy still performing only modestly well.

Output growth remains positive but middling, given sluggish labor productivity that limits the possibility for fast gains in standards of living.

Employment growth remains steady if unspectacular, but more than one-half of the nation’s hiring since 2010 has been concentrated in lower-wage industries with pay levels under $52,000 a year.

And otherwise, many are frustrated as the nation continues to debate what a rebuilt American economy that works better for more people might look like.

Which is why the Metropolitan Policy Program at Brookings has for the last several years been arguing that to truly rebuild America’s drifting economy, city and metropolitan area leaders—supported by their states and Washington—must work to build an “advanced economy that works for all.”[i]

What would such an economy look like? An advanced economy that works for all would achieve a higher trajectory of long-run growth by improving the productivity of individuals and firms in ways that raise the standards of living for all people while reducing racial, spatial, and income disparities.

How might cities, metro areas, and the nation build such an economy? One step is certain: Along with improved innovation and training initiatives, stronger labor standards, and a rewoven social safety net, a key element of the needed reconstruction is a metro-by-metro rejuvenation of the nation’s high-tech “advanced industries” sector.

The importance of these high-value innovation and technology industries to any future shared prosperity is why the Metro Program began to focus on the sector in the wake of the 2008 economic crisis. Likewise, the centrality of these advanced industries’ progress to the nation’s long-run productivity and economic inclusion is why the program formally defined and began to track the growth of the sector, beginning with the 2015 report “America’s Advanced Industries: What They Are, Where They Are, and Why They Matter.” That report outlined 50 “advanced” industries that conduct inordinate amounts of R&D and employ large STEM (science, technology, engineering, and mathematics) workforces—key determinants of high-value economic enterprise.

Hence this expansion of that report. By adding two more years of data to the earlier trend analysis, this update looks beyond the immediate recovery years and into what has been a restive “new normal” characterized by a U.S. high-tech boom shadowed by a global trade slowdown, an oil and gas glut, and stubbornly high rates of poverty and disaffection.

In this fashion, the following analysis takes a fresh look at the changing momentum and geography of 50 industries whose vitality will be essential to any future a broadly shared prosperity in U.S. metropolitan areas. Output and employment growth data for the years 2013–2015 are compared to those for 2010–2013 for the 50 advanced industries at the national level, across all 50 states, and in the largest 100 metropolitan areas. New trends are identified across both industries and places.

What emerges is a mixed picture of continued progress in the manufacturing sector; a slump in energy; and rapid, accelerating, and widely distributed growth in high-tech services. Given these developments, the report depicts a somewhat narrowed map of growth overall. At the same time, the strong and surprisingly wide dispersion of digital services industries suggest the potential for broad gains through the diffusion of technology.

To present this story, the report first explains what advanced industries are and why they matter. It next charts the changing momentum and geography of the sector, with a special focus on these trends as they surface in larger metropolitan areas. Finally, a discussion section offers some takeaways for regional and national policymakers and economic development leaders. Maps, charts, and individualized state and metropolitan area “trend profiles” are available on the report website.

Overall, the trends reveal both the value and evolving distribution of advanced economic activity and the need for urgent federal as well as state and local efforts to boost their growth and broadening their reach.

Background

Before assessing the location and performance of the nation’s advanced industries, it bears discussing what advanced industries are and why they matter.

What advanced Industries are

This analysis like its predecessor asserts that a particular set of high-tech, high-skill technical industries constitutes the nation’s highest-value commercial sector—and so sets out to identify and track those industries.

Accordingly, the report reprises the definition employed in “America’s Advanced Industries” to designate as “advanced” those industries that conduct significant R&D and employ a disproportionate number of STEM workers. More precisely, advanced industries are those in which R&D spending per worker ranks among the top 20 percent of industries and the share of workers with a high level of STEM knowledge exceeds the national average. (See Chapter 3 and the methodology appendix of “America’s Advanced Industries” for more background on this definition and related analytic issues.)

On the basis of this definition, the U.S. advanced industries supersector encompasses 50 diverse industries, including 35 manufacturing, 3 energy, and 12 service industries. These industries include advanced manufacturing industries like aerospace, auto, medical devices, and pharmaceuticals, energy-oriented industries such as oil and gas extraction and electric power generation, and high-tech service activities such as computer system design, R&D services, software, and telecommunications.

As such, the supersector includes a wide array of industries using a wide variety of technologies. Yet, despite the variety, the flow of technology use and business transformation among the advanced industries appears to be erasing conventional industry and sector distinctions and turning the super-sector into the leading focal point of technology convergence in developed economies.

Along these lines, the advanced sector can be characterized as the nation’s prime site for technology development, application, and hybridization. Multiple developments in this supersector reveal this nexus:[ii]

- The physical and digital worlds are converging in these industries as the “digitization of everything” pervades all of its fields, transforming nearly all enterprises with software, “big data,” and connectivity to the internet

- The related Internet of Things (IoT)—the convergence of industrial machines, sensors, data, and the internet—is unleashing new ways to optimize the functionality, efficiency, and reliability of physical systems

- Advanced robotics, artificial intelligence, and machine learning are making it possible to automate more and more worker tasks, opening the possibility of both productivity gains and labor market disruption

- Applied physics, materials science, and chemistry are interacting to develop advanced materials with radically useful attributes, including incredible strength, conductivity or the ability to “remember” previous states

- Next-generation genomics is bringing low-cost genetic analysis and “editing” to bear to improve medical diagnostics, accelerate drug discovery, and develop drought- and pest-resistant crops

In sum, the advanced industries sector is the portion of the economy that is at once developing and utilizing the nation’s most transformative technologies.

Why Advanced Industries Matter

The advanced sector’s special value stems from its inordinate role in generating prosperity.

That generative role begins with the industries’ defining characteristics of R&D spending and STEM workers. These industries are the nation’s main locus of industrial innovation and technical skills.

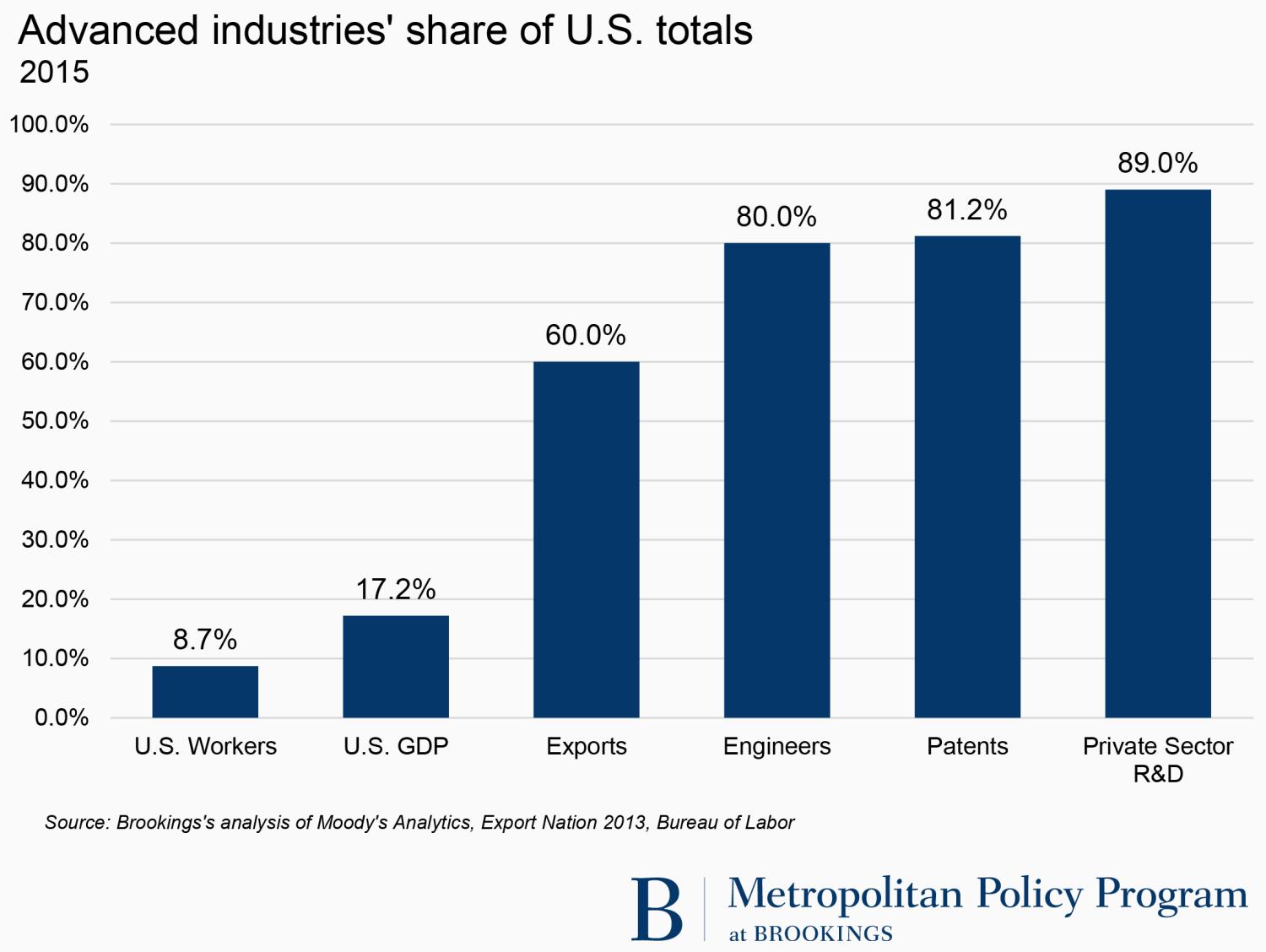

The sector’s innovation capacity matters because technology advancement represents the most viable way for nations, states, regions, companies, and workers to increase their productivity and continue to improve their standards of living.[iii] Given that, the advanced sector is critical to U.S. local and national prosperity because it conducts 89 percent of the nation’s private-sector R&D and generates more than 80 percent of the nation’s patents. As such, the sector represents the nation’s main source of the technical advances that drive increased productivity, which in turn generates increased profits and market share for firms, growth for industries, and potentially broader economic benefits for households, regions, and the nation.

Likewise, the advanced industries sector trains and employs much of the nation’s critical STEM workforce. STEM workers—from aerospace engineers and plant scientists to petroleum geologists, software developers, and skilled technicians—matter because they invent and install the technical innovations that sustain innovation and growth.[iv] At the professional level, highly trained scientists and engineers keep firms and industries on the cutting-edge through inventions and entrepreneurship. At the sub-bachelor’s level, skilled technicians produce, install, maintain, repair, and operate the systems designed and patented by researchers, allowing firms and industries to reach their markets, maximize sales, create process innovations, and enhance productivity. That advanced industries employ 80 percent of the nation’s engineers underscores the sector’s role as America’s main storehouse of its most economically valuable technical workers.

In keeping with its R&D and STEM-worker intensiveness, the sector generates multiple economic benefits:

- Because it is innovative and skilled, the sector is highly productive, which makes it competitive and profitable. Overall, the advanced industries sector has increased its aggregate productivity by about 2.7 percent annually since 1980, far faster than has the rest of the economy, which has managed annual productivity growth of just 1.4 percent[v]

- Because the sector is competitive it generates an outsized 60 percent of U.S. exports despite representing less than 10 percent of the nation’s employment

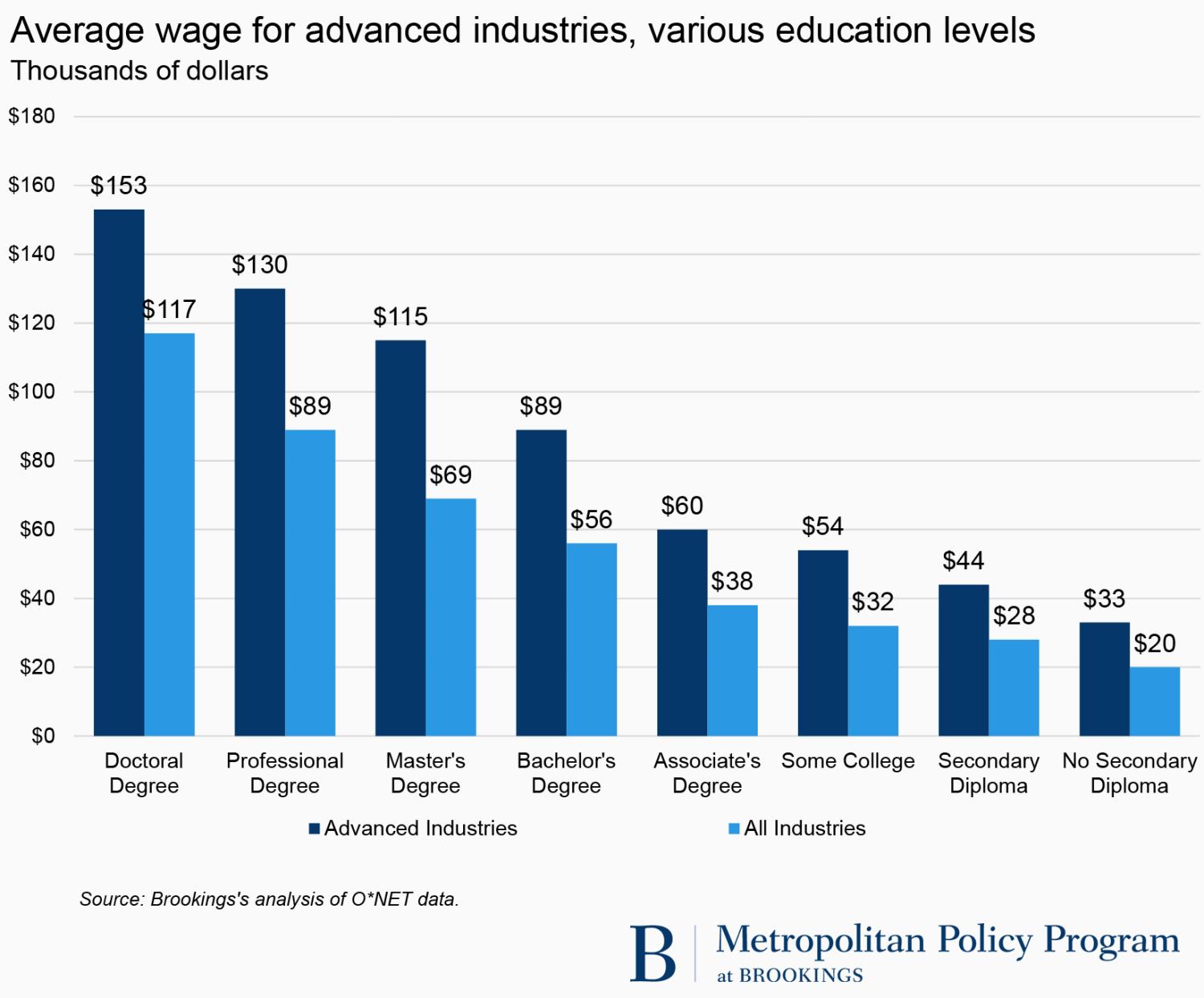

- And for similar reasons, the sector pays well. Because the sector is highly productive, each worker generates approximately $214,000 worth of output compared with $108,000 for the average worker outside the sector.[vi] That allows for high and rising salaries, which contrast strikingly with those in the rest of the economy. In 2015, the average advanced industries worker earned $95,000 in total compensation, or nearly double that ($53,000) of the average worker in other sectors. The compensation reflects a 68 percent increase between 1975 and 2015, after adjusting for inflation. That compares with just a 25 percent pay raise outside the sector. Moreover, the pay premium extends to workers of all education and skill levels in the sector. A worker with an associate’s degree earns approximately $58,000 a year in the sector compared with about $38,000 outside it.

Beyond those industry specific contributions, the sector’s positive impacts radiate outward through the economy:

- Given the sector’s long supply chains, the sector’s substantial “multiplier effect” means that every new advanced industries job creates 2.2 additional jobs domestically: 0.8 jobs locally and 1.4 outside the region. That ensures that the sector supports some 39 million jobs nationally—one quarter of all private employment. These impacts are more than twice the size of those associated with other industries and reflect that advanced industries purchase some $236,000 in goods and services per worker from other businesses annually compared with $67,000 spent by other types of businesses[vii]

- At the same time, the sector is the nation’s prime source of the technology and productivity diffusion, by which innovations spread through the economy to benefit workers, firms, industries, and regions.[viii] In this regard, the technical innovations and productivity of the advanced sector make the rest of the economy more innovative and productive as the sector’s technologies, tools, and processes diffuse outward through industry networks, customer and supplier relationships, and the labor market.[ix] These benefits accrue across the country as advanced sector innovations spread through formal sales, investments, imitation, and worker “job hopping.” In some cases—as with information and communications technology (ICT) products and services—advanced sector technologies have turned out to be “general purpose technologies” (GPTs) that have enabled major productivity advances through the economy.[x] Nothing shows this better than the wide adoption of ICT technology in the late 1990s and early 2000s. During the period technology developed by an advanced industry employing just 2.5 percent of the workforce was responsible for two-thirds of U.S. productivity growth across multiple industries. That impact improved the standard of living for almost everyone by driving the economy toward full employment. Given that, many economists are currently hoping for similarly broad productivity gains as advances in robotics, machine learning, and data science roll out across more industries. For now, though, the clear fact is that nation’s anemic productivity growth would be far worse today without the diffusion of advanced industry technology and productivity. Likewise, the wider diffusion of existing and future advanced industries innovations will likely be crucial to improving U.S. productivity growth.[xi]

In sum, although all jobs and industries matter, none matter more than those in the advanced industries sector. Which raises an important final point: Advanced industries’ vitality and growth will be essential to delivering on the advanced economy aspiration.

As the Metro Program’s “Metro Monitor” suggested earlier this year, an advanced economy that works for all will deliver economic expansion (growth) that also raises local standards of living (prosperity) for all people (inclusion). Yet as it happens, the advanced industries sector contributes heavily to all three of these goals as suggests its performance on many “Monitor” balanced-growth indicators.

As sources of growth, advanced industries contribute modestly to national and local job creation but are outsized contributors to output and wage growth.

As sources of prosperity, the industries are the nation’s leading sources of productivity growth, wage growth, and output per worker.

As sources of inclusion, the industries’ high median wages; accessible, quality jobs; and substantial wage premiums and skills training at all levels of employment compare favorably to other sectors.

In short, the vitality and growth of America’s advanced industries sector will be essential if the United States is to build an advanced economy that works for all.

Findings: Recent trends in America’s Advanced Industries Sector

So how, then, are America’s advanced industries doing? A new analysis of the growth and geography of the sector’s 50 industries covering the period from late 2013 to late 2015 finds that multiple high-tech service industries were booming as a “new normal” set in even as growth in advanced manufacturing and energy industries slowed slightly or in the latter case ceased.

Three major findings emerge:

1. The advanced industries sector continued to expand between 2013 and 2015 despite global headwinds, and it now employs 500,000 more workers than before the recession

Since 2013 and the previous Brookings analysis, America’s high-value advanced industries sector has continued to grow faster than the rest of the economy, despite several challenges.

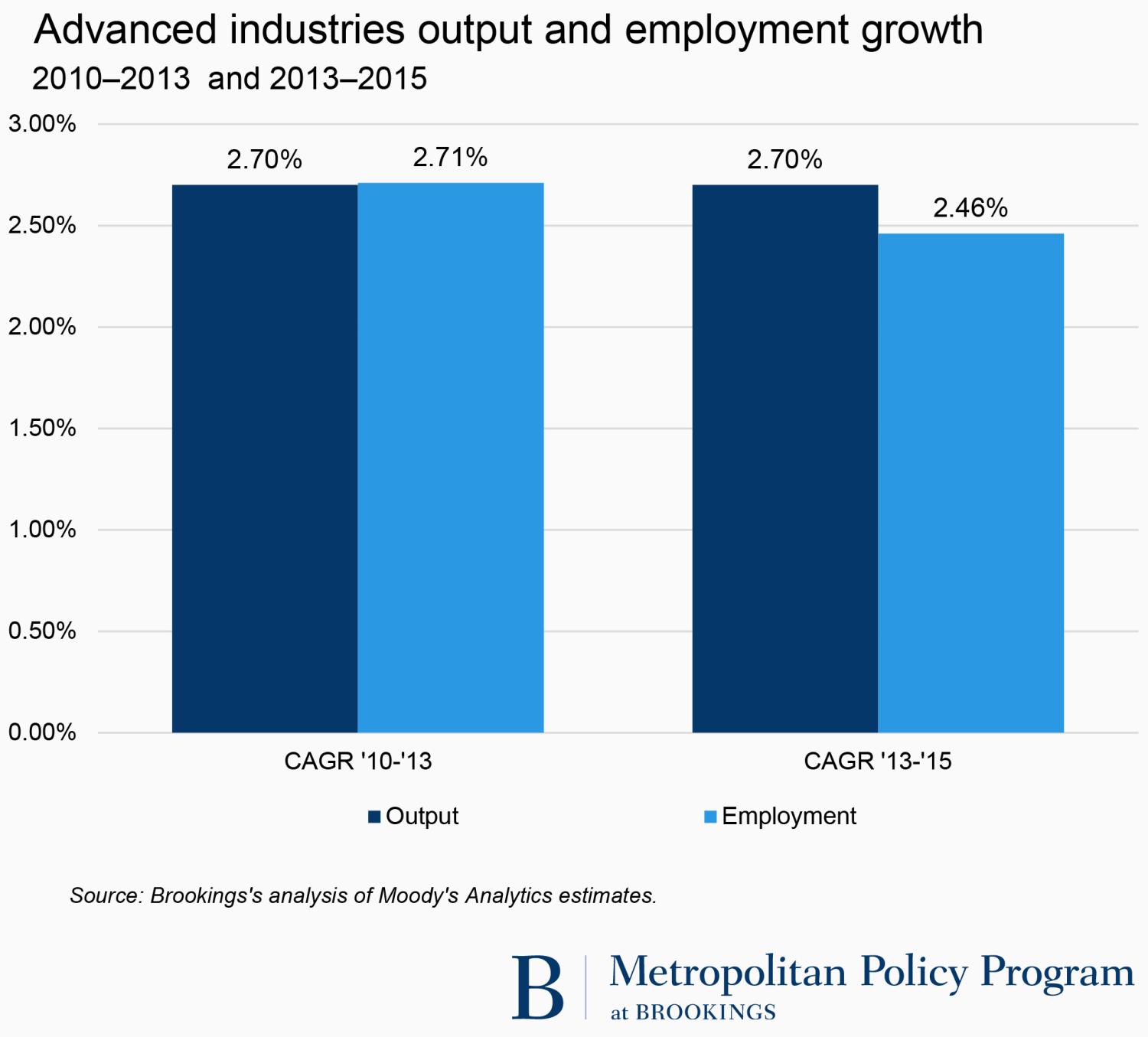

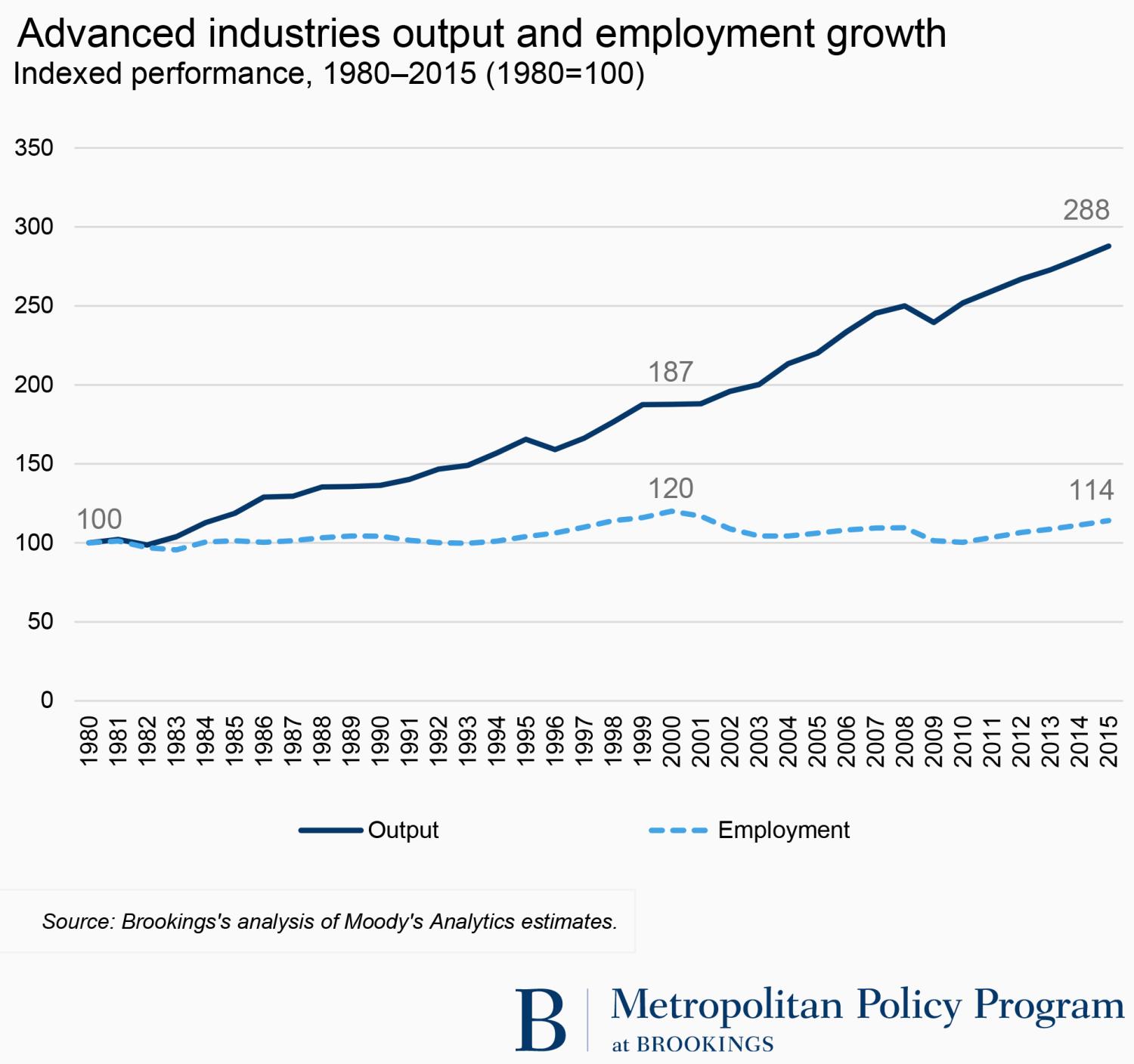

In aggregate, the sector added $143 billion to U.S. gross domestic product (GDP) in 2013–2015, and accounted for more than 20 percent of the growth of the economy. This output maintained the sector’s 2.7 percent compound annual growth rate (CAGR) since the Great Recession and again exceeded the growth of the overall economy, although by a slimmer 0.4 percent annual rate.

Overall, the sector’s recent rate of progress reflects both the continued steady recovery of the U.S. economy in 2014 and 2015, as well as the onset of weaker global demand (especially in China) and a global oil and gas glut. The interplay of these positive and negative factors allowed for stability but likely limited potentially greater output growth.

Nonetheless, the continued positive performance of the advanced industries sector raised brought it to its highest share of the U.S. economy in 30 years. By the end of 2015, U.S. advanced industries’ output accounted for 17.2 percent, or $2.8 trillion, of U.S. GDP, a share roughly twice its employment share that underscores the sector’s high productivity.

Employment trends, meanwhile, tracked with output, albeit with somewhat reduced job creation. During the two-year period (2013–2015), the aggregate sector added 611,500 jobs, reflecting a slight slowdown in hiring, from 2.7 percent to 2.5 percent CAGR.

Still, the sector accounted for 11.3 percent of all U.S. job growth in 2013–2015—an outsized share of the nation’s growth given the sector’s size, though a smaller share than the sector recorded in the immediate post-recession period. As a result, 12.9 million American workers are now employed in U.S. advanced industries, some 500,000 more than in 2008. These workers compose 8.7 percent of the total U.S. workforce. Factoring in the sectorwide multiplier effect suggests that the sector supports another 28.4 million jobs beyond direct employment. That means that the sector directly or indirectly employs 41.3 million workers, or as much as 28 percent of the American workforce.

Stepping back from these most recent trends, it is worth recalling that recent developments reflect a long-term disconnection between continued rapid output growth and modest employment growth in the aggregate advanced sector. Since 1980, U.S. advanced industries’ output has grown by 4.3 percent annually while employment has grown by just 0.5 percent annually (although it is growing faster now). The bifurcation reflects rapid productivity growth and potentially automation in the sector combined with substantial employment reductions in manufacturing industries.

Given these trends, the advanced industries sector now accounts for a larger share of U.S. GDP than it has at any time since 1980, even though employment remains slightly below its 1980 share of the economy, despite the recent employment uptick.

2. Growth in the advanced sector, however, emanated from a narrower set of auto manufacturing and “tech” service industries in the last two years than in the previous three

Notwithstanding the sector’s continued expansion, the industry base of that growth narrowed between 2013 and 2015. Immediately following the recession, advanced industries employment and output grew solidly, driven by the sector’s three major subsectors: advanced manufacturing, energy, and services. This reflected not only the long-term rise of the services subsector simultaneous to long-term employment losses in manufacturing, but also an oil and gas boom between 2010 and 2013 driven by unconventional hydraulic fracturing (“fracking”) in the energy sector.

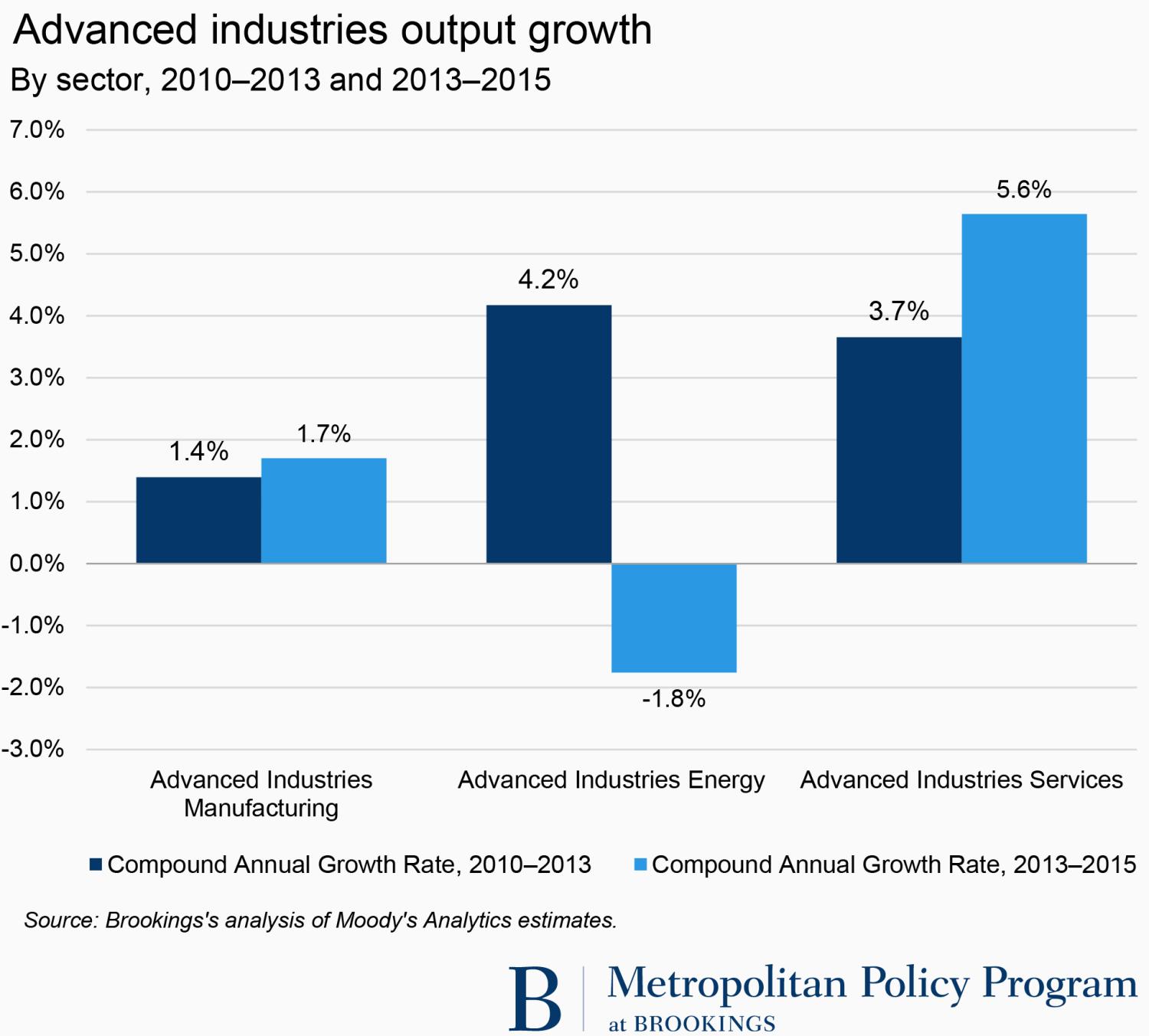

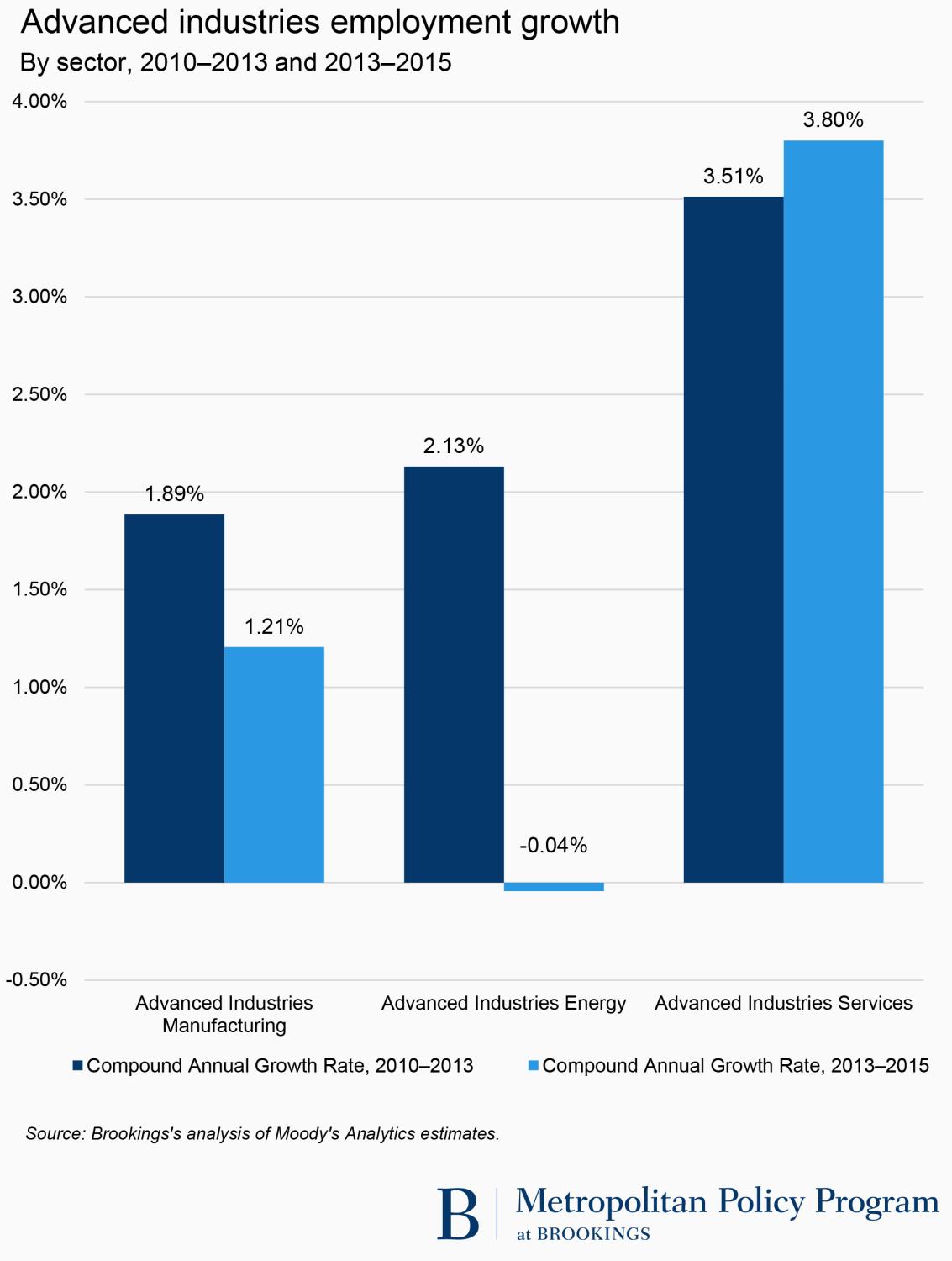

In the 2010–2013 period, these and other trends—including rapid export growth fueled by Asian demand—ensured that the advanced manufacturing, energy, and services subsectors each contributed solidly to growth, with annual output gains of 1.4, 4.2, and 3.7 percent, respectively, and employment gains of 1.9, 2.1, and 3.5 percent, respectively.

However, in 2013–2015 this relatively balanced pattern of growth shifted. With manufacturing exports depressed by a global economic slowdown and a strong dollar and a world oil and gas glut depressing the energy sector, a digital and technology services boom took center stage as the main engine of advanced industries’ growth. Meanwhile, advanced manufacturing employment growth slowed slightly (although output rose) and energy employment and output growth disappeared or declined.

Reflecting these trends, the locus of growth narrowed, as high-tech service industries emerged as the nation’s leading source of advanced industries’ growth between 2013 and 2015.

Altogether, the service subsector in advanced industries added 500,000 new jobs, or approximately 80 percent of the sector’s total growth between 2013 and 2015. That share was up from the subsector’s 64.5 percent share in the same period. By contrast, advanced manufacturing industries contributed just 132,000 jobs while advanced energy industries contributed none.

Looking across the entire sector, 29 of the 50 advanced industries saw both output and employment growth at once. Likewise, 16 of the 50 advanced industries saw output and employment growth accelerate.

Reflecting these trends, the locus of growth narrowed, as high-tech service industries emerged as the nation’s leading source of advanced industries’ growth between 2013 and 2015.

Altogether, the service subsector in advanced industries added 500,000 new jobs, or approximately 80 percent of the sector’s total growth between 2013 and 2015. That share was up from the subsector’s 64.5 percent share in the same period. By contrast, advanced manufacturing industries contributed just 132,000 jobs while advanced energy industries contributed none.

Looking across the entire sector, 29 of the 50 advanced industries saw both output and employment growth at once. Likewise, 16 of the 50 advanced industries saw output and employment growth accelerate.

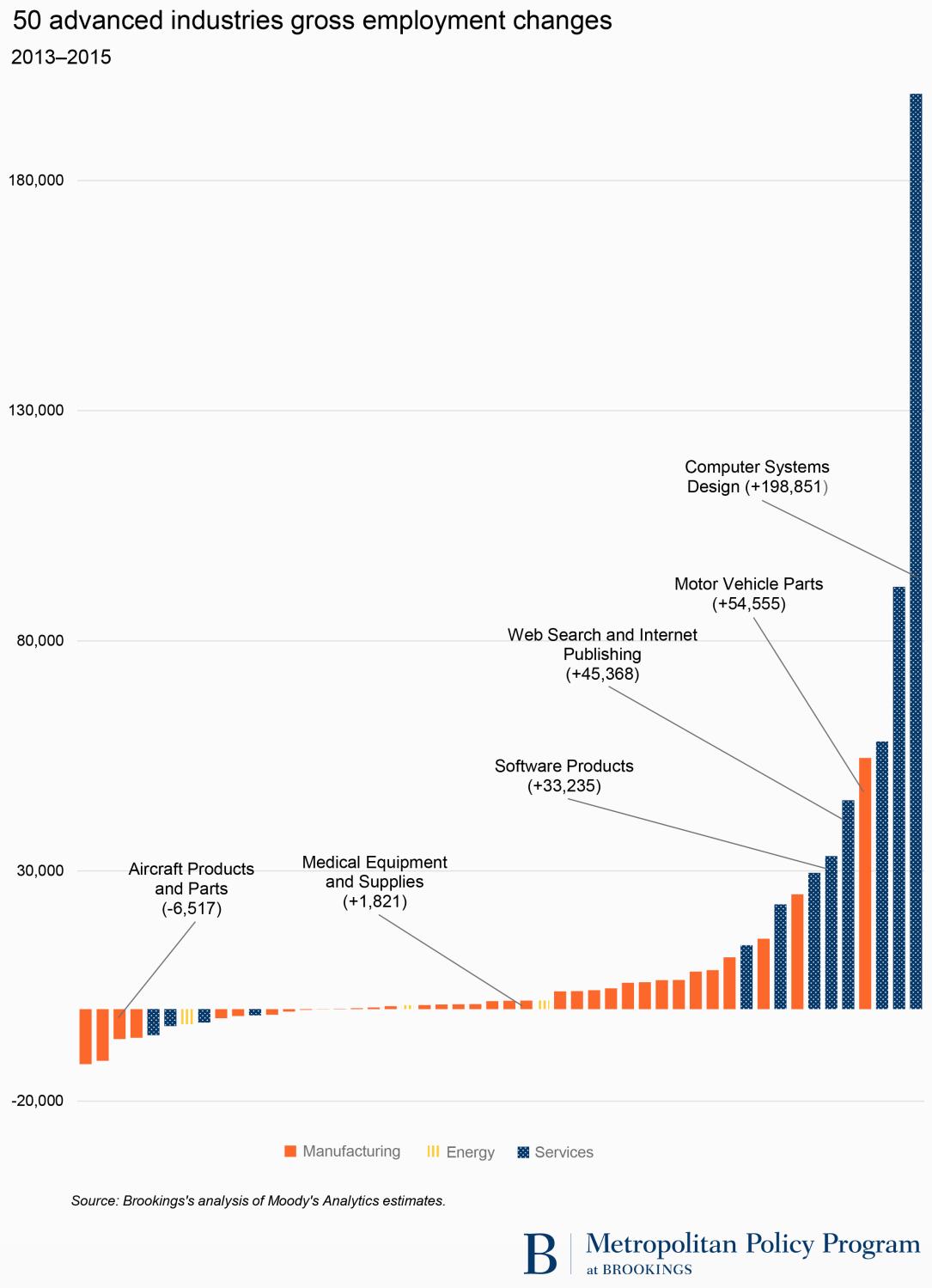

Turning to the industry-specific components of growth, the surge of the services subsector between 2013 and 2015 had a strong digital orientation while auto industries kept the manufacturing subsector growing even as energy’s contributions disappeared.

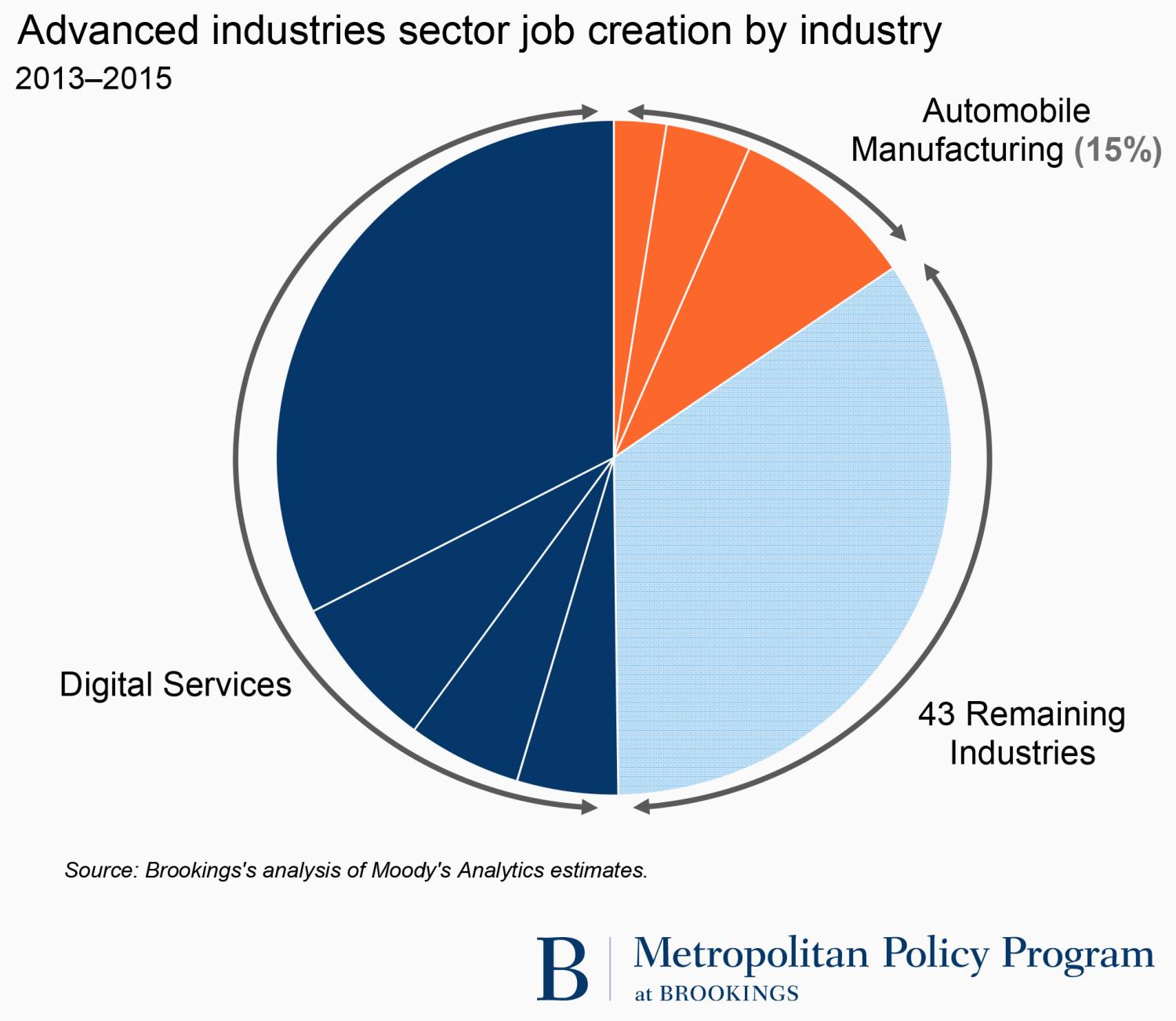

High-tech advanced service industries dominated the growth trends between 2013 and 2015 amid a wave of excitement about new software-based opportunities in social media, sharing platforms, digital health and “fin-tech,” automation, the Internet of Things, and big data.[xii] Consequently, although nearly four-fifths of advanced-sector employment growth (480,000 jobs) from 2013 to 2015 emerged from the services subsector, nearly two-thirds of that growth (307,000 jobs) originated in just four fast-growing digital services: computer systems design; web search and internet publishing; software products; and data processing and hosting. Employment in all of these industries grew by 5 percent CAGR from 2013 to 2015, and three of the four accelerated their growth over the pace during 2010–2013. Management consulting, engineering, and R&D services also continued to add jobs and grow quickly. Overall, 9 of the 12 industries in the advanced services subsector picked up the pace of their output and job growth (or slowed job losses) in the recent period compared with the prior one.

At the same time, progress among advanced manufacturing industries slowed somewhat between 2013 and 2015 as the solid expansion following the recession (2010–2013) ran into headwinds. This slowdown reflected the combination of a strong dollar and a major slowing of global demand for U.S. commodity and machinery exports. These factors led to a significant slowing of output and employment growth in a variety of materials and machinery industries, ranging from iron and steel and aluminum products to agriculture, construction, mining machinery, and engine and power equipment. In this regard, although advanced manufacturing industries still managed to contribute more than 20 percent of advanced-sector employment growth (132,200 jobs) between 2013 and 2015, nearly 70 percent of that growth (95,000 jobs) originated in the three auto-related industries: motor vehicle parts, motor vehicles, and motor vehicle body and trailers. Several of these industries saw slower output growth, and output growth slowed in 18 of the 35 advanced manufacturing industries. Meanwhile, 9 of the 35 manufacturing industries lost jobs between 2013 and 2015 while 20 experienced slower employment growth between 2013 and 2015 than between 2010 and 2013. Nonetheless, output growth for the advanced manufacturing sector as a whole increased (owing to gains in petroleum, chemicals, pharmaceuticals, industrial machinery, appliances, and medical equipment) even as employment growth slowed.

Finally, the advanced energy industries group slumped as the U.S. “fracking” boom led to an oil and gas glut and energy demand stagnated worldwide. Given those trends, both the oil and gas extraction and mining industries saw precipitous output and employment growth slowdowns. Given these pull-backs, the energy subsector shifted from being a significant contributor to the nation’s advanced industries economy to a nonfactor.

Overall, slower hiring in advanced manufacturing and a recession in the energy sector left the nation’s advanced industries economy increasingly reliant in 2013–2015 on a narrowed growth base.

Reflecting these trends, the locus of growth narrowed, as high-tech service industries emerged as the nation’s leading source of advanced industries’ growth between 2013 and 2015.

Altogether, the service subsector in advanced industries added 500,000 new jobs, or approximately 80 percent of the sector’s total growth between 2013 and 2015. That share was up from the subsector’s 64.5 percent share in the same period. By contrast, advanced manufacturing industries contributed just 132,000 jobs while advanced energy industries contributed none.

Looking across the entire sector, 29 of the 50 advanced industries saw both output and employment growth at once. Likewise, 16 of the 50 advanced industries saw output and employment growth accelerate.

Turning to the industry-specific components of growth, the surge of the services subsector between 2013 and 2015 had a strong digital orientation while auto industries kept the manufacturing subsector growing even as energy’s contributions disappeared.

High-tech advanced service industries dominated the growth trends between 2013 and 2015 amid a wave of excitement about new software-based opportunities in social media, sharing platforms, digital health and “fin-tech,” automation, the Internet of Things, and big data.[xii] Consequently, although nearly four-fifths of advanced-sector employment growth (480,000 jobs) from 2013 to 2015 emerged from the services subsector, nearly two-thirds of that growth (307,000 jobs) originated in just four fast-growing digital services: computer systems design; web search and internet publishing; software products; and data processing and hosting. Employment in all of these industries grew by 5 percent CAGR from 2013 to 2015, and three of the four accelerated their growth over the pace during 2010–2013. Management consulting, engineering, and R&D services also continued to add jobs and grow quickly. Overall, 9 of the 12 industries in the advanced services subsector picked up the pace of their output and job growth (or slowed job losses) in the recent period compared with the prior one.

At the same time, progress among advanced manufacturing industries slowed somewhat between 2013 and 2015 as the solid expansion following the recession (2010–2013) ran into headwinds. This slowdown reflected the combination of a strong dollar and a major slowing of global demand for U.S. commodity and machinery exports. These factors led to a significant slowing of output and employment growth in a variety of materials and machinery industries, ranging from iron and steel and aluminum products to agriculture, construction, mining machinery, and engine and power equipment. In this regard, although advanced manufacturing industries still managed to contribute more than 20 percent of advanced-sector employment growth (132,200 jobs) between 2013 and 2015, nearly 70 percent of that growth (95,000 jobs) originated in the three auto-related industries: motor vehicle parts, motor vehicles, and motor vehicle body and trailers. Several of these industries saw slower output growth, and output growth slowed in 18 of the 35 advanced manufacturing industries. Meanwhile, 9 of the 35 manufacturing industries lost jobs between 2013 and 2015 while 20 experienced slower employment growth between 2013 and 2015 than between 2010 and 2013. Nonetheless, output growth for the advanced manufacturing sector as a whole increased (owing to gains in petroleum, chemicals, pharmaceuticals, industrial machinery, appliances, and medical equipment) even as employment growth slowed.

Finally, the advanced energy industries group slumped as the U.S. “fracking” boom led to an oil and gas glut and energy demand stagnated worldwide. Given those trends, both the oil and gas extraction and mining industries saw precipitous output and employment growth slowdowns. Given these pull-backs, the energy subsector shifted from being a significant contributor to the nation’s advanced industries economy to a nonfactor.

Overall, slower hiring in advanced manufacturing and a recession in the energy sector left the nation’s advanced industries economy increasingly reliant in 2013–2015 on a narrowed growth base.

In contrast to the recovery years of 2010–2013, by 2013–2015 no less than one-half of the nation’s advanced industries’ employment growth was from a booming computer systems design industry and the three auto industries. With a few more digital services such as software and web search / internet publishing, just seven advanced industries in the digital services and auto domains generated two-thirds percent of the nation’s advanced sector growth between 2013 and 2015. That share was up from 55 percent in the previous three years. In short, the nation has grown more dependent on continued auto sector progress and a short list of rapidly growing high-tech services for output and employment growth.

3. U.S. advanced industries’ growth trends grew more uneven across the country between 2013 and 2015

Advanced industries remain widely dispersed across the United States. Every region, state, and metropolitan area contains at least a few thousand advanced sector jobs. Given that, most areas of the country have had a toehold in the sector.

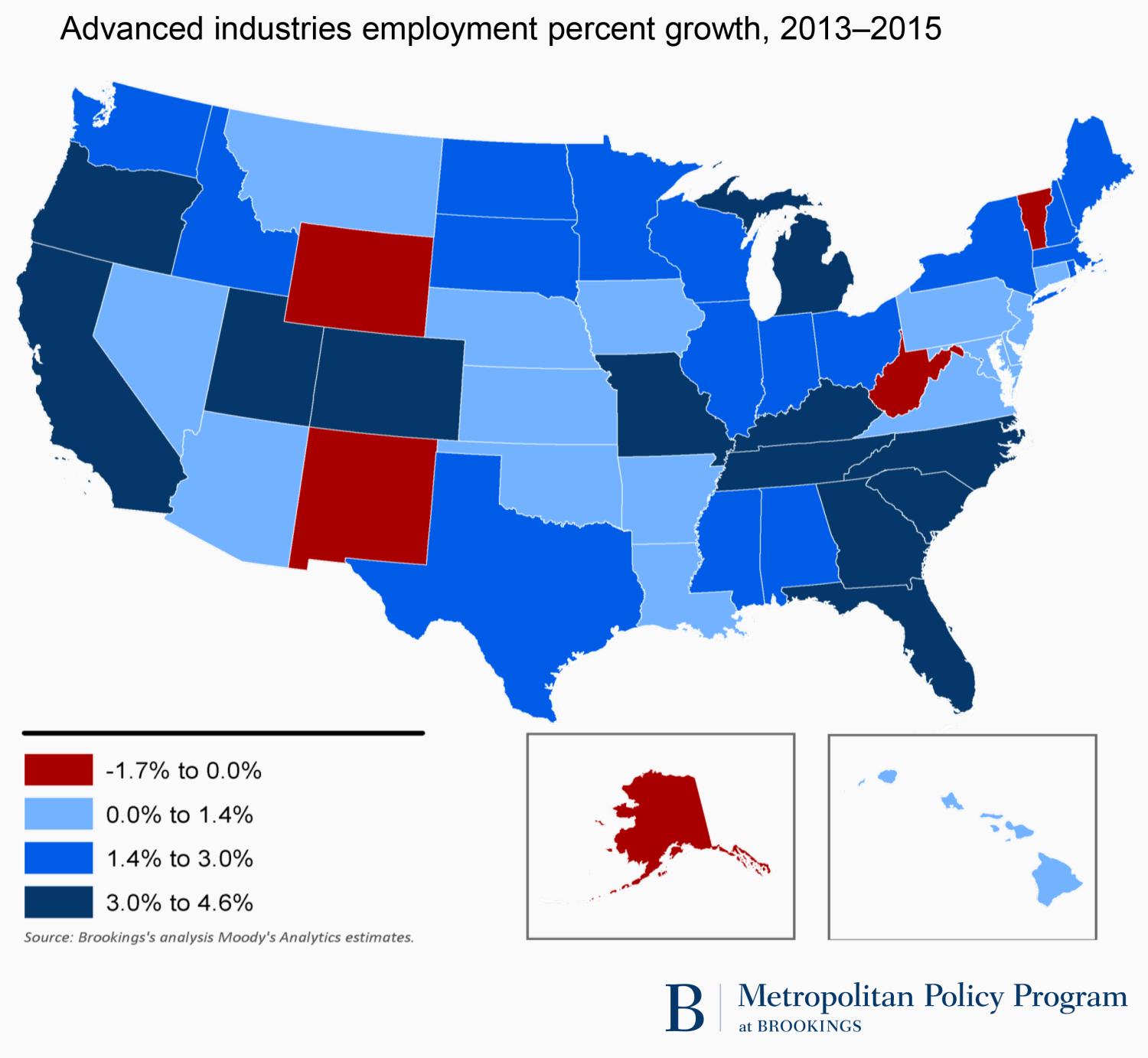

In keeping with that a wide portion of the country has continued to see growth in the sector. Between 2013 and 2015, all but seven states saw both output and employment expansions, as did 80 of the largest 100 metropolitan areas. Nonetheless, the shifting fortunes of the sector’s various industries are altering and, to an extent, narrowing the geography of advanced industries’ growth.

At the broadest level, the accelerated growth of high-tech services industries combined with the slowed or nonexistent growth in the advanced manufacturing and energy industries has shifted more growth to states in the West and Northeast (states traditionally strong in tech services).

Reflecting these trends, the locus of growth narrowed, as high-tech service industries emerged as the nation’s leading source of advanced industries’ growth between 2013 and 2015.

Altogether, the service subsector in advanced industries added 500,000 new jobs, or approximately 80 percent of the sector’s total growth between 2013 and 2015. That share was up from the subsector’s 64.5 percent share in the same period. By contrast, advanced manufacturing industries contributed just 132,000 jobs while advanced energy industries contributed none.

Looking across the entire sector, 29 of the 50 advanced industries saw both output and employment growth at once. Likewise, 16 of the 50 advanced industries saw output and employment growth accelerate.

Turning to the industry-specific components of growth, the surge of the services subsector between 2013 and 2015 had a strong digital orientation while auto industries kept the manufacturing subsector growing even as energy’s contributions disappeared.

High-tech advanced service industries dominated the growth trends between 2013 and 2015 amid a wave of excitement about new software-based opportunities in social media, sharing platforms, digital health and “fin-tech,” automation, the Internet of Things, and big data.[xii] Consequently, although nearly four-fifths of advanced-sector employment growth (480,000 jobs) from 2013 to 2015 emerged from the services subsector, nearly two-thirds of that growth (307,000 jobs) originated in just four fast-growing digital services: computer systems design; web search and internet publishing; software products; and data processing and hosting. Employment in all of these industries grew by 5 percent CAGR from 2013 to 2015, and three of the four accelerated their growth over the pace during 2010–2013. Management consulting, engineering, and R&D services also continued to add jobs and grow quickly. Overall, 9 of the 12 industries in the advanced services subsector picked up the pace of their output and job growth (or slowed job losses) in the recent period compared with the prior one.

At the same time, progress among advanced manufacturing industries slowed somewhat between 2013 and 2015 as the solid expansion following the recession (2010–2013) ran into headwinds. This slowdown reflected the combination of a strong dollar and a major slowing of global demand for U.S. commodity and machinery exports. These factors led to a significant slowing of output and employment growth in a variety of materials and machinery industries, ranging from iron and steel and aluminum products to agriculture, construction, mining machinery, and engine and power equipment. In this regard, although advanced manufacturing industries still managed to contribute more than 20 percent of advanced-sector employment growth (132,200 jobs) between 2013 and 2015, nearly 70 percent of that growth (95,000 jobs) originated in the three auto-related industries: motor vehicle parts, motor vehicles, and motor vehicle body and trailers. Several of these industries saw slower output growth, and output growth slowed in 18 of the 35 advanced manufacturing industries. Meanwhile, 9 of the 35 manufacturing industries lost jobs between 2013 and 2015 while 20 experienced slower employment growth between 2013 and 2015 than between 2010 and 2013. Nonetheless, output growth for the advanced manufacturing sector as a whole increased (owing to gains in petroleum, chemicals, pharmaceuticals, industrial machinery, appliances, and medical equipment) even as employment growth slowed.

Finally, the advanced energy industries group slumped as the U.S. “fracking” boom led to an oil and gas glut and energy demand stagnated worldwide. Given those trends, both the oil and gas extraction and mining industries saw precipitous output and employment growth slowdowns. Given these pull-backs, the energy subsector shifted from being a significant contributor to the nation’s advanced industries economy to a nonfactor.

Overall, slower hiring in advanced manufacturing and a recession in the energy sector left the nation’s advanced industries economy increasingly reliant in 2013–2015 on a narrowed growth base.

In contrast to the recovery years of 2010–2013, by 2013–2015 no less than one-half of the nation’s advanced industries’ employment growth was from a booming computer systems design industry and the three auto industries. With a few more digital services such as software and web search / internet publishing, just seven advanced industries in the digital services and auto domains generated two-thirds percent of the nation’s advanced sector growth between 2013 and 2015. That share was up from 55 percent in the previous three years. In short, the nation has grown more dependent on continued auto sector progress and a short list of rapidly growing high-tech services for output and employment growth.

3. U.S. advanced industries’ growth trends grew more uneven across the country between 2013 and 2015

Advanced industries remain widely dispersed across the United States. Every region, state, and metropolitan area contains at least a few thousand advanced sector jobs. Given that, most areas of the country have had a toehold in the sector.

In keeping with that a wide portion of the country has continued to see growth in the sector. Between 2013 and 2015, all but seven states saw both output and employment expansions, as did 80 of the largest 100 metropolitan areas. Nonetheless, the shifting fortunes of the sector’s various industries are altering and, to an extent, narrowing the geography of advanced industries’ growth.

At the broadest level, the accelerated growth of high-tech services industries combined with the slowed or nonexistent growth in the advanced manufacturing and energy industries has shifted more growth to states in the West and Northeast (states traditionally strong in tech services).

Along these lines, Northeastern and Western states captured larger shares of the nations’ 2013–2015 advanced sector growth than they did in the previous three years thanks in large part to their specializations in fast-growing high-tech services ranging from computer systems design to R&D. In the Northeast, for example, tech-intensive New York, Massachusetts, Rhode Island, Maine, New Hampshire, and Connecticut all saw significant quickening of their output and employment growth. Similarly, tech-oriented Western states, including Utah, Oregon, Colorado, California, and Idaho, also saw rapid, accelerating growth on both measures.

States in the Midwest and South experienced mixed trends, by contrast. Many saw a diminished pace of advanced sector growth, given slowing manufacturing growth and the energy contraction. Manufacturing-intensive Michigan continued to rank high on absolute employment and output measures but experienced a significant slowing of growth between 2013 and 2015. So did other manufacturing states such as Ohio, Indiana, Wisconsin, Illinois, and Iowa (although Indiana and Illinois saw quickened output growth, in a sign of underlying strength). Likewise, Midwestern “fracking” states like North Dakota and Oklahoma, saw significant losses of momentum on both employment and output. At the same time, slowing growth in numerous advanced manufacturing industries began to affect some, but not all, of the fast-growing states in the South. To be sure, no less than six of the fastest growing 10 advanced-sector states based on employment growth continued to lie south of the Mason-Dixon line in 2013–2015. However, four of those states (Tennessee, Georgia, South Carolina, and Kentucky) saw either their rapid job growth or solid output growth between 2010 and 2013 slow after 2013, thanks to slowing expansion in various advanced manufacturing industries, especially auto industries.

In short, the state growth map depicts an unsettled geography of momentum. Although advanced sector output accelerated across a healthy 33 states, only 20 states saw the pace of their advanced industries’ employment growth accelerate between 2010 and 2013. That means that 30 states saw employment growth slow, which adds to the many questions about the robustness of the nation’s overall advanced industries economy.

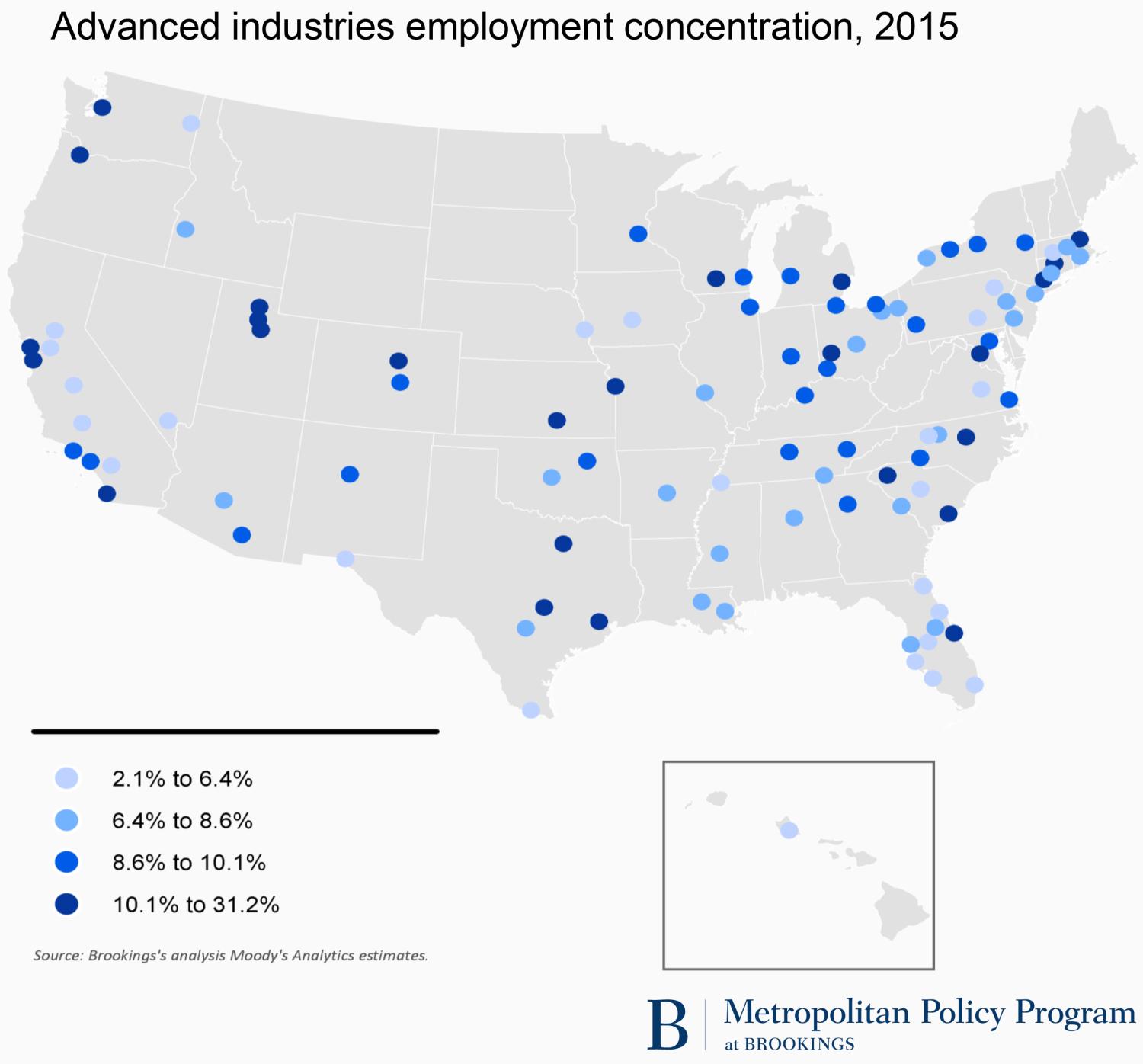

Turning to the metropolitan geography of the sector’s evolution, it remains important to note that advanced industries’ production takes place principally in metropolitan areas, where the universities, technology innovation assets, supply chains, STEM workers, and industry clusters on which the sector depends reside.[xiii] Altogether, the country’s 100 largest metropolitan areas contained 74 percent of all U.S. jobs in the advanced industries sector in 2015 while the country’s full list of 381 metropolitan areas contained 89 percent of those jobs. Large metropolitan areas contained at least four of five U.S. workers in 17 individual advanced industries, among them management and technical consulting services, data processing and hosting, and software publishing. Given these facts and the sector’s importance to prosperity, the distribution and nature of the sector’s growth in metro areas remain critical the economic health of the nation.

What do recent trends in the urban distribution of advanced sector growth say about the nation’s economic trajectory?

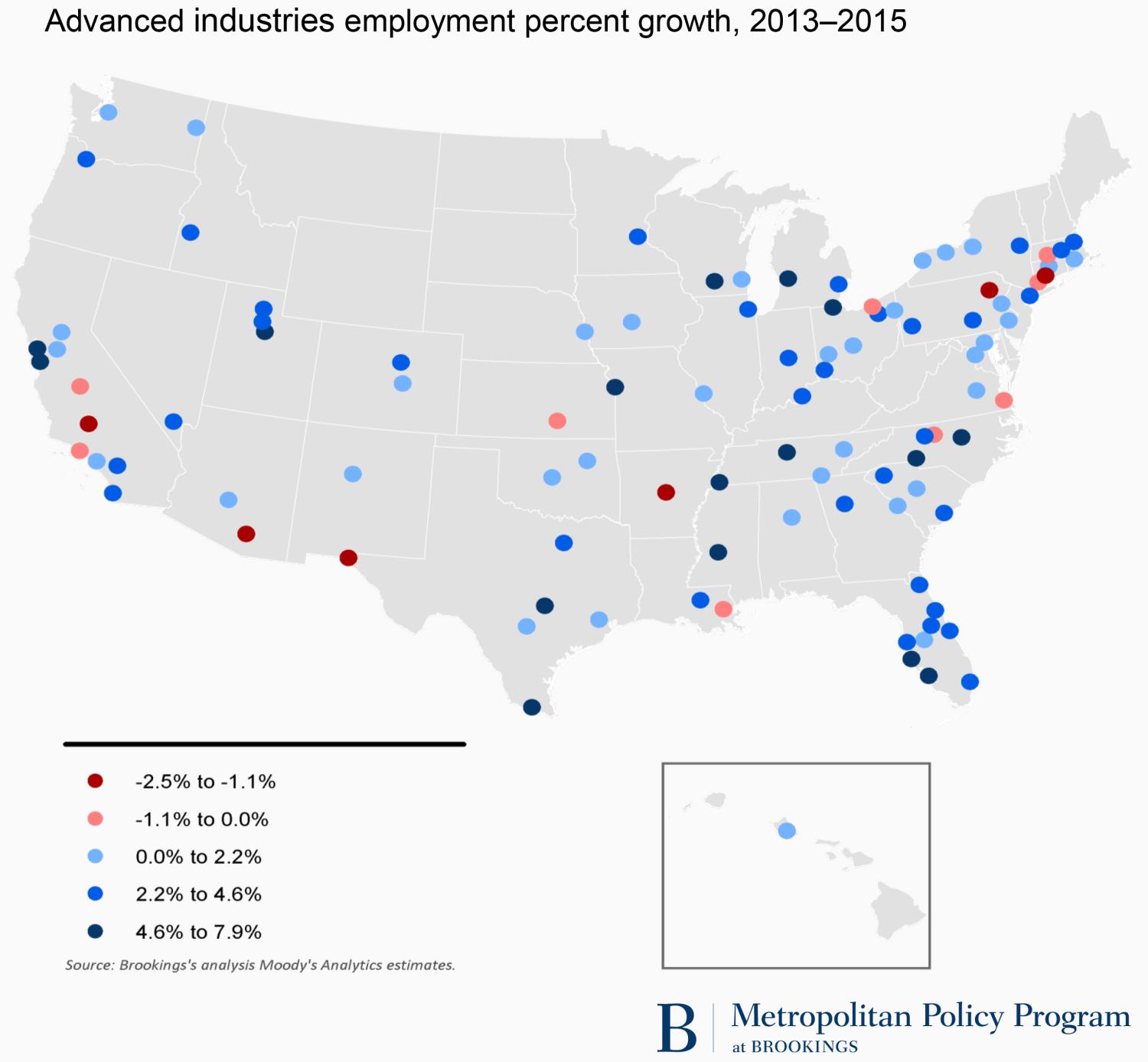

To start with, recent trends reflect the wide dispersal of advanced industries in metropolitan America. Many metros in many states and regions continued to maintain solid advanced industry enterprises as the national economic recovery settled into a “new normal” of economic performance between 2013 and 2015.

Reflecting these trends, the locus of growth narrowed, as high-tech service industries emerged as the nation’s leading source of advanced industries’ growth between 2013 and 2015.

Altogether, the service subsector in advanced industries added 500,000 new jobs, or approximately 80 percent of the sector’s total growth between 2013 and 2015. That share was up from the subsector’s 64.5 percent share in the same period. By contrast, advanced manufacturing industries contributed just 132,000 jobs while advanced energy industries contributed none.

Looking across the entire sector, 29 of the 50 advanced industries saw both output and employment growth at once. Likewise, 16 of the 50 advanced industries saw output and employment growth accelerate.

Turning to the industry-specific components of growth, the surge of the services subsector between 2013 and 2015 had a strong digital orientation while auto industries kept the manufacturing subsector growing even as energy’s contributions disappeared.

High-tech advanced service industries dominated the growth trends between 2013 and 2015 amid a wave of excitement about new software-based opportunities in social media, sharing platforms, digital health and “fin-tech,” automation, the Internet of Things, and big data.[xii] Consequently, although nearly four-fifths of advanced-sector employment growth (480,000 jobs) from 2013 to 2015 emerged from the services subsector, nearly two-thirds of that growth (307,000 jobs) originated in just four fast-growing digital services: computer systems design; web search and internet publishing; software products; and data processing and hosting. Employment in all of these industries grew by 5 percent CAGR from 2013 to 2015, and three of the four accelerated their growth over the pace during 2010–2013. Management consulting, engineering, and R&D services also continued to add jobs and grow quickly. Overall, 9 of the 12 industries in the advanced services subsector picked up the pace of their output and job growth (or slowed job losses) in the recent period compared with the prior one.

At the same time, progress among advanced manufacturing industries slowed somewhat between 2013 and 2015 as the solid expansion following the recession (2010–2013) ran into headwinds. This slowdown reflected the combination of a strong dollar and a major slowing of global demand for U.S. commodity and machinery exports. These factors led to a significant slowing of output and employment growth in a variety of materials and machinery industries, ranging from iron and steel and aluminum products to agriculture, construction, mining machinery, and engine and power equipment. In this regard, although advanced manufacturing industries still managed to contribute more than 20 percent of advanced-sector employment growth (132,200 jobs) between 2013 and 2015, nearly 70 percent of that growth (95,000 jobs) originated in the three auto-related industries: motor vehicle parts, motor vehicles, and motor vehicle body and trailers. Several of these industries saw slower output growth, and output growth slowed in 18 of the 35 advanced manufacturing industries. Meanwhile, 9 of the 35 manufacturing industries lost jobs between 2013 and 2015 while 20 experienced slower employment growth between 2013 and 2015 than between 2010 and 2013. Nonetheless, output growth for the advanced manufacturing sector as a whole increased (owing to gains in petroleum, chemicals, pharmaceuticals, industrial machinery, appliances, and medical equipment) even as employment growth slowed.

Finally, the advanced energy industries group slumped as the U.S. “fracking” boom led to an oil and gas glut and energy demand stagnated worldwide. Given those trends, both the oil and gas extraction and mining industries saw precipitous output and employment growth slowdowns. Given these pull-backs, the energy subsector shifted from being a significant contributor to the nation’s advanced industries economy to a nonfactor.

Overall, slower hiring in advanced manufacturing and a recession in the energy sector left the nation’s advanced industries economy increasingly reliant in 2013–2015 on a narrowed growth base.

In contrast to the recovery years of 2010–2013, by 2013–2015 no less than one-half of the nation’s advanced industries’ employment growth was from a booming computer systems design industry and the three auto industries. With a few more digital services such as software and web search / internet publishing, just seven advanced industries in the digital services and auto domains generated two-thirds percent of the nation’s advanced sector growth between 2013 and 2015. That share was up from 55 percent in the previous three years. In short, the nation has grown more dependent on continued auto sector progress and a short list of rapidly growing high-tech services for output and employment growth.

3. U.S. advanced industries’ growth trends grew more uneven across the country between 2013 and 2015

Advanced industries remain widely dispersed across the United States. Every region, state, and metropolitan area contains at least a few thousand advanced sector jobs. Given that, most areas of the country have had a toehold in the sector.

In keeping with that a wide portion of the country has continued to see growth in the sector. Between 2013 and 2015, all but seven states saw both output and employment expansions, as did 80 of the largest 100 metropolitan areas. Nonetheless, the shifting fortunes of the sector’s various industries are altering and, to an extent, narrowing the geography of advanced industries’ growth.

At the broadest level, the accelerated growth of high-tech services industries combined with the slowed or nonexistent growth in the advanced manufacturing and energy industries has shifted more growth to states in the West and Northeast (states traditionally strong in tech services).

Along these lines, Northeastern and Western states captured larger shares of the nations’ 2013–2015 advanced sector growth than they did in the previous three years thanks in large part to their specializations in fast-growing high-tech services ranging from computer systems design to R&D. In the Northeast, for example, tech-intensive New York, Massachusetts, Rhode Island, Maine, New Hampshire, and Connecticut all saw significant quickening of their output and employment growth. Similarly, tech-oriented Western states, including Utah, Oregon, Colorado, California, and Idaho, also saw rapid, accelerating growth on both measures.

States in the Midwest and South experienced mixed trends, by contrast. Many saw a diminished pace of advanced sector growth, given slowing manufacturing growth and the energy contraction. Manufacturing-intensive Michigan continued to rank high on absolute employment and output measures but experienced a significant slowing of growth between 2013 and 2015. So did other manufacturing states such as Ohio, Indiana, Wisconsin, Illinois, and Iowa (although Indiana and Illinois saw quickened output growth, in a sign of underlying strength). Likewise, Midwestern “fracking” states like North Dakota and Oklahoma, saw significant losses of momentum on both employment and output. At the same time, slowing growth in numerous advanced manufacturing industries began to affect some, but not all, of the fast-growing states in the South. To be sure, no less than six of the fastest growing 10 advanced-sector states based on employment growth continued to lie south of the Mason-Dixon line in 2013–2015. However, four of those states (Tennessee, Georgia, South Carolina, and Kentucky) saw either their rapid job growth or solid output growth between 2010 and 2013 slow after 2013, thanks to slowing expansion in various advanced manufacturing industries, especially auto industries.

In short, the state growth map depicts an unsettled geography of momentum. Although advanced sector output accelerated across a healthy 33 states, only 20 states saw the pace of their advanced industries’ employment growth accelerate between 2010 and 2013. That means that 30 states saw employment growth slow, which adds to the many questions about the robustness of the nation’s overall advanced industries economy.

Turning to the metropolitan geography of the sector’s evolution, it remains important to note that advanced industries’ production takes place principally in metropolitan areas, where the universities, technology innovation assets, supply chains, STEM workers, and industry clusters on which the sector depends reside.[xiii] Altogether, the country’s 100 largest metropolitan areas contained 74 percent of all U.S. jobs in the advanced industries sector in 2015 while the country’s full list of 381 metropolitan areas contained 89 percent of those jobs. Large metropolitan areas contained at least four of five U.S. workers in 17 individual advanced industries, among them management and technical consulting services, data processing and hosting, and software publishing. Given these facts and the sector’s importance to prosperity, the distribution and nature of the sector’s growth in metro areas remain critical the economic health of the nation.

What do recent trends in the urban distribution of advanced sector growth say about the nation’s economic trajectory?

To start with, recent trends reflect the wide dispersal of advanced industries in metropolitan America. Many metros in many states and regions continued to maintain solid advanced industry enterprises as the national economic recovery settled into a “new normal” of economic performance between 2013 and 2015.

In that regard, it bears noting that—as with the states—nearly all large metropolitan areas (80 of 100) enjoyed output and employment growth in advanced industries since 2013.

Reflecting these trends, the locus of growth narrowed, as high-tech service industries emerged as the nation’s leading source of advanced industries’ growth between 2013 and 2015.

Altogether, the service subsector in advanced industries added 500,000 new jobs, or approximately 80 percent of the sector’s total growth between 2013 and 2015. That share was up from the subsector’s 64.5 percent share in the same period. By contrast, advanced manufacturing industries contributed just 132,000 jobs while advanced energy industries contributed none.

Looking across the entire sector, 29 of the 50 advanced industries saw both output and employment growth at once. Likewise, 16 of the 50 advanced industries saw output and employment growth accelerate.

Turning to the industry-specific components of growth, the surge of the services subsector between 2013 and 2015 had a strong digital orientation while auto industries kept the manufacturing subsector growing even as energy’s contributions disappeared.

High-tech advanced service industries dominated the growth trends between 2013 and 2015 amid a wave of excitement about new software-based opportunities in social media, sharing platforms, digital health and “fin-tech,” automation, the Internet of Things, and big data.[xii] Consequently, although nearly four-fifths of advanced-sector employment growth (480,000 jobs) from 2013 to 2015 emerged from the services subsector, nearly two-thirds of that growth (307,000 jobs) originated in just four fast-growing digital services: computer systems design; web search and internet publishing; software products; and data processing and hosting. Employment in all of these industries grew by 5 percent CAGR from 2013 to 2015, and three of the four accelerated their growth over the pace during 2010–2013. Management consulting, engineering, and R&D services also continued to add jobs and grow quickly. Overall, 9 of the 12 industries in the advanced services subsector picked up the pace of their output and job growth (or slowed job losses) in the recent period compared with the prior one.

At the same time, progress among advanced manufacturing industries slowed somewhat between 2013 and 2015 as the solid expansion following the recession (2010–2013) ran into headwinds. This slowdown reflected the combination of a strong dollar and a major slowing of global demand for U.S. commodity and machinery exports. These factors led to a significant slowing of output and employment growth in a variety of materials and machinery industries, ranging from iron and steel and aluminum products to agriculture, construction, mining machinery, and engine and power equipment. In this regard, although advanced manufacturing industries still managed to contribute more than 20 percent of advanced-sector employment growth (132,200 jobs) between 2013 and 2015, nearly 70 percent of that growth (95,000 jobs) originated in the three auto-related industries: motor vehicle parts, motor vehicles, and motor vehicle body and trailers. Several of these industries saw slower output growth, and output growth slowed in 18 of the 35 advanced manufacturing industries. Meanwhile, 9 of the 35 manufacturing industries lost jobs between 2013 and 2015 while 20 experienced slower employment growth between 2013 and 2015 than between 2010 and 2013. Nonetheless, output growth for the advanced manufacturing sector as a whole increased (owing to gains in petroleum, chemicals, pharmaceuticals, industrial machinery, appliances, and medical equipment) even as employment growth slowed.

Finally, the advanced energy industries group slumped as the U.S. “fracking” boom led to an oil and gas glut and energy demand stagnated worldwide. Given those trends, both the oil and gas extraction and mining industries saw precipitous output and employment growth slowdowns. Given these pull-backs, the energy subsector shifted from being a significant contributor to the nation’s advanced industries economy to a nonfactor.

Overall, slower hiring in advanced manufacturing and a recession in the energy sector left the nation’s advanced industries economy increasingly reliant in 2013–2015 on a narrowed growth base.

In contrast to the recovery years of 2010–2013, by 2013–2015 no less than one-half of the nation’s advanced industries’ employment growth was from a booming computer systems design industry and the three auto industries. With a few more digital services such as software and web search / internet publishing, just seven advanced industries in the digital services and auto domains generated two-thirds percent of the nation’s advanced sector growth between 2013 and 2015. That share was up from 55 percent in the previous three years. In short, the nation has grown more dependent on continued auto sector progress and a short list of rapidly growing high-tech services for output and employment growth.

3. U.S. advanced industries’ growth trends grew more uneven across the country between 2013 and 2015

Advanced industries remain widely dispersed across the United States. Every region, state, and metropolitan area contains at least a few thousand advanced sector jobs. Given that, most areas of the country have had a toehold in the sector.

In keeping with that a wide portion of the country has continued to see growth in the sector. Between 2013 and 2015, all but seven states saw both output and employment expansions, as did 80 of the largest 100 metropolitan areas. Nonetheless, the shifting fortunes of the sector’s various industries are altering and, to an extent, narrowing the geography of advanced industries’ growth.

At the broadest level, the accelerated growth of high-tech services industries combined with the slowed or nonexistent growth in the advanced manufacturing and energy industries has shifted more growth to states in the West and Northeast (states traditionally strong in tech services).

Along these lines, Northeastern and Western states captured larger shares of the nations’ 2013–2015 advanced sector growth than they did in the previous three years thanks in large part to their specializations in fast-growing high-tech services ranging from computer systems design to R&D. In the Northeast, for example, tech-intensive New York, Massachusetts, Rhode Island, Maine, New Hampshire, and Connecticut all saw significant quickening of their output and employment growth. Similarly, tech-oriented Western states, including Utah, Oregon, Colorado, California, and Idaho, also saw rapid, accelerating growth on both measures.

States in the Midwest and South experienced mixed trends, by contrast. Many saw a diminished pace of advanced sector growth, given slowing manufacturing growth and the energy contraction. Manufacturing-intensive Michigan continued to rank high on absolute employment and output measures but experienced a significant slowing of growth between 2013 and 2015. So did other manufacturing states such as Ohio, Indiana, Wisconsin, Illinois, and Iowa (although Indiana and Illinois saw quickened output growth, in a sign of underlying strength). Likewise, Midwestern “fracking” states like North Dakota and Oklahoma, saw significant losses of momentum on both employment and output. At the same time, slowing growth in numerous advanced manufacturing industries began to affect some, but not all, of the fast-growing states in the South. To be sure, no less than six of the fastest growing 10 advanced-sector states based on employment growth continued to lie south of the Mason-Dixon line in 2013–2015. However, four of those states (Tennessee, Georgia, South Carolina, and Kentucky) saw either their rapid job growth or solid output growth between 2010 and 2013 slow after 2013, thanks to slowing expansion in various advanced manufacturing industries, especially auto industries.

In short, the state growth map depicts an unsettled geography of momentum. Although advanced sector output accelerated across a healthy 33 states, only 20 states saw the pace of their advanced industries’ employment growth accelerate between 2010 and 2013. That means that 30 states saw employment growth slow, which adds to the many questions about the robustness of the nation’s overall advanced industries economy.

Turning to the metropolitan geography of the sector’s evolution, it remains important to note that advanced industries’ production takes place principally in metropolitan areas, where the universities, technology innovation assets, supply chains, STEM workers, and industry clusters on which the sector depends reside.[xiii] Altogether, the country’s 100 largest metropolitan areas contained 74 percent of all U.S. jobs in the advanced industries sector in 2015 while the country’s full list of 381 metropolitan areas contained 89 percent of those jobs. Large metropolitan areas contained at least four of five U.S. workers in 17 individual advanced industries, among them management and technical consulting services, data processing and hosting, and software publishing. Given these facts and the sector’s importance to prosperity, the distribution and nature of the sector’s growth in metro areas remain critical the economic health of the nation.

What do recent trends in the urban distribution of advanced sector growth say about the nation’s economic trajectory?

To start with, recent trends reflect the wide dispersal of advanced industries in metropolitan America. Many metros in many states and regions continued to maintain solid advanced industry enterprises as the national economic recovery settled into a “new normal” of economic performance between 2013 and 2015.

In that regard, it bears noting that—as with the states—nearly all large metropolitan areas (80 of 100) enjoyed output and employment growth in advanced industries since 2013.

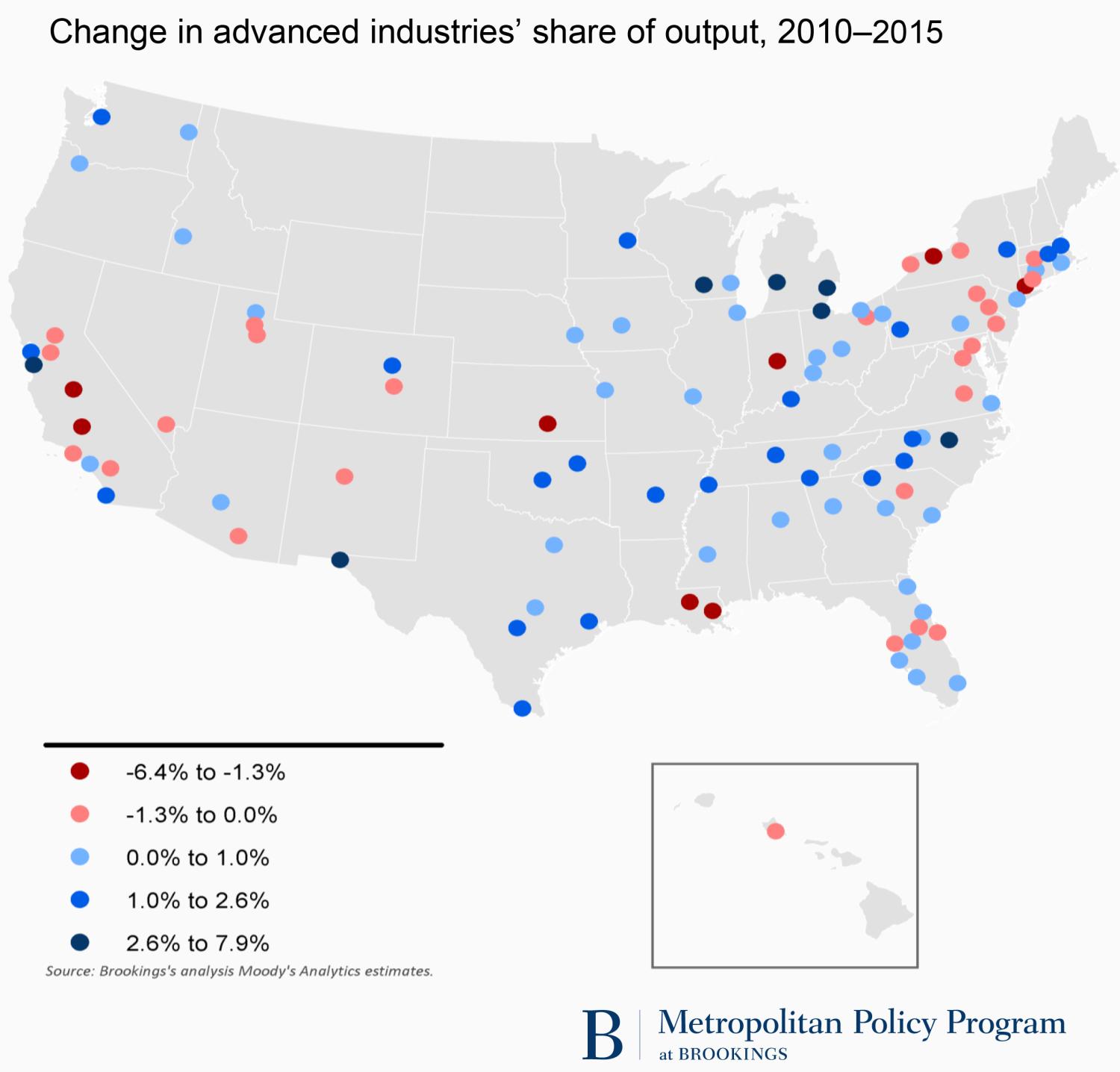

At the same time, though, the list of metro areas with strong momentum narrowed between 2013 and 2015—influenced again by changing trends in the industries. At the broadest level, while almost all large metro areas continued to grow on one or the other dimension of advanced industry growth, 59 saw either advanced sector output or employment growth slow between 2013 and 2015. Output growth slowed in 42 of these metropolitan areas; employment growth slowed in 49 of them.

Looking beyond the aggregate, meanwhile, the changing dynamics of industry-by-industry momentum reoriented the metro growth map as high-tech services rose, the automotive boom crested, and the energy crash set in.

To begin with, the nation’s decidedly mixed distribution of advanced economy growth in recent years means that some places boomed while others lost ground between 2013 and 2015. Some 18 large metropolitan areas generated advanced industries’ output gains of 5 percent CAGR in those years, while 16 metros delivered employment growth that fast. In Provo, Utah; San Francisco, Calif.; San Jose, Calif.; and Madison, Wisc., annual output growth topped 8 percent, while in Nashville, Tenn.; San Francisco; Jackson, Miss.; Cape Coral, Fla.; Kansas City, Mo.; and Raleigh, N.C., employment growth exceeded 7 percent a year. However, 10 metros saw their output contract and 15 shed jobs between 2013 and 2015. Output in Bakersfield, Calif. slumped by 10.9 percent while Bakersfield; Tucson, Ariz.; and New Haven, Conn., all shed more than 1.5 percent of their job bases.

Table 1. Fifteen Best-Performing Large Metro Areas by Employment Growth Rate, 2013–2015

| Output (in $ billions) | Employment | |||||||||

| 2010 | 2013 | 2015 | CAGR, 2010-2013 | CAGR, 2013-2015 | 2010 | 2013 | 2015 | CAGR, 2010-2013 | CAGR, 2013-2015 | |

| Nashville, Tenn. | $8.7 | $11.5 | $12.7 | 9.6% | 5.0% | 56,011 | 70,545 | 82,206 | 8.0% | 7.9% |

| San Francisco, Calif. | $65.3 | $74.1 | $88.1 | 4.3% | 9.0% | 255,585 | 298,646 | 347,802 | 5.3% | 7.9% |

| Jackson, Miss. | $2.3 | $2.4 | $2.6 | 1.2% | 4.6% | 14,945 | 16,204 | 18,756 | 2.7% | 7.6% |

| Cape Coral, Fla. | $1.3 | $1.5 | $1.6 | 4.9% | 2.6% | 7,098 | 8,800 | 10,184 | 7.4% | 7.6% |

| Kansas City, Mo./Kan. | $13.3 | $13.7 | $15.2 | 0.9% | 5.4% | 86,447 | 95,090 | 109,208 | 3.2% | 7.2% |

| Raleigh, N.C. | $11.7 | $12.9 | $15.3 | 3.3% | 9.0% | 55,010 | 64,545 | 73,881 | 5.5% | 7.0% |

| Charlotte, N.C./S.C. | $15.8 | $18.6 | $20.1 | 5.6% | 3.8% | 81,916 | 93,213 | 106,203 | 4.4% | 6.7% |

| Memphis, Tenn./Miss./Ark. | $4.8 | $5.3 | $5.9 | 3.3% | 5.6% | 29,095 | 31,792 | 35,955 | 3.0% | 6.3% |

| Toledo, Ohio | $4.5 | $5.3 | $5.8 | 5.6% | 4.9% | 22,593 | 27,795 | 31,427 | 7.2% | 6.3% |

| Provo, Utah | $3.4 | $3.6 | $4.3 | 1.4% | 9.8% | 21,064 | 24,945 | 28,195 | 5.8% | 6.3% |

| Madison, Wisc. | $5.4 | $6.3 | $7.3 | 4.9% | 8.1% | 34,215 | 39,257 | 44,143 | 4.7% | 6.0% |

| Austin, Texas | $20.5 | $24.2 | $28.1 | 5.7% | 7.8% | 94,333 | 113,534 | 127,514 | 6.4% | 6.0% |

| San Jose, Calif. | $56.9 | $74.8 | $87.8 | 9.5% | 8.3% | 260,441 | 293,743 | 329,409 | 4.1% | 5.9% |

| Grand Rapids, Mich. | $6.3 | $8.2 | $8.8 | 9.1% | 4.2% | 37,714 | 46,817 | 52,154 | 7.5% | 5.5% |

| McAllen, Texas | $1.2 | $1.6 | $1.8 | 11.2% | 5.4% | 4,495 | 4,903 | 5,450 | 2.9% | 5.4% |

|

CAGR = Compound Annual Growth Rate Source: Brookings’s analysis of Moody’s Analytics estimates. |

||||||||||

Variations of the local industry mix lie behind much of the unevenness of the metro growth map.

Accentuating the continued growth of the nation’s production subsector, the 26 metropolitan areas especially oriented toward advanced manufacturing saw their aggregate advanced industries’ output grow at a steady 2.17 percent CAGR between 2013 and 2015 (compared with 0.88 percent between 2010 and 2013) while employment growth doubled to 3.38 percent.[xiv] This group of advanced manufacturing-oriented metros ranges from the highly specialized Wichita, Kan.; Toledo, Ohio; and Grand Rapids, Mich.; to Ogden, Utah; Boise, Idaho; and Providence, R.I. Fourteen of these 26 metro areas saw the pace of their output growth increase, and a slightly different 14 saw the pace of their employment growth pick up.

And yet, the aggregate performance of the manufacturing metro areas masked varied local growth stories influenced by particular industry dynamics. Auto-focused metros such as Nashville, Tenn.; Jackson, Miss.; Grand Rapids, Mich.; and Toledo, Ohio, continued to enjoy rapid growth in output and employment, albeit with some slowing. Meanwhile, manufacturing regions with other production specializations saw gains. Indianapolis, Ind.; Worcester, Mass.; Ogden, Utah; and Boise, Idaho, all saw significant output and employment growth acceleration driven at least in part by their diverse specializations in auto parts and medical equipment, pharmaceuticals, precision instruments, aircraft parts, or semiconductors. By contrast, three manufacturing-focused metros saw their output shrink between 2013 and 2015 while five experienced employment losses. These losses are largely the result of contractions in specific advanced manufacturing industries in which these metros are highly specialized: chemical products manufacturing in Rochester, N.Y., and Oxnard, Calif., and iron and steel production in Cleveland, Ohio.

For their part, a smaller group of 11 advanced energy-focused metros had a more sharply divided experience.[xv] These metros either specialize in oil and gas extraction (Oklahoma City, Okla.; Bakersfield, Calif.; Tulsa, Okla.; and New Orleans, La.) or host large power-generation plants (Birmingham, Ala.; Columbia, S.C.; Syracuse, N.Y.; Augusta, Ga.; Little Rock, Ark.; and Scranton, Penn.)—and performed accordingly. The oil and gas regions absorbed an abrupt slowing of job growth, reflecting rapid layoffs in fracking locations, while metro areas with power plants tended to bump along with more mixed outcomes. As a group, these metro areas saw below-average output growth of 1.3 percent CAGR between 2013 and 2015 and negligible employment growth.

By contrast, and not surprisingly, the 15 metropolitan areas oriented toward advanced services surged.[xvi] Ranging from San Francisco, Calif.; Kansas City, Mo.; and Raleigh, N.C., to Provo, Utah; Boston, Mass.; New York, N.Y.; Washington, D.C.; and Philadelphia, Penn., these metros profited from rapid services growth. Advanced industries’ output grew solidly in 14 of the 15 metros and was accelerating in 13 of them. All the metros saw employment grow, sometimes rapidly, and in 11 places, employment growth accelerated. What was driving the growth? In 12 of the 15 locations, computer systems design was the largest advanced industry and the largest source of new advanced industry jobs, although software, web hosting, and data processing figured in places like Provo, Raleigh, and Atlanta. Accordingly, growth was rapid in these locations. Advanced sector output exceeded 9 percent CAGR in Provo, Raleigh, and San Francisco, while annual employment growth topped 3 percent in eight of these metro areas. Of these service-oriented metros, only Albuquerque, N.M., saw shrinking output. Overall, output growth nearly tripled, to 4 percent CAGR between 2013 and 2015, and employment growth nearly doubled, to 3.7 percent.

HIGHLIGHT: The Computer Systems Design Economy IS Not So Narrow After All

Reflecting these trends, the locus of growth narrowed, as high-tech service industries emerged as the nation’s leading source of advanced industries’ growth between 2013 and 2015.

Altogether, the service subsector in advanced industries added 500,000 new jobs, or approximately 80 percent of the sector’s total growth between 2013 and 2015. That share was up from the subsector’s 64.5 percent share in the same period. By contrast, advanced manufacturing industries contributed just 132,000 jobs while advanced energy industries contributed none.

Looking across the entire sector, 29 of the 50 advanced industries saw both output and employment growth at once. Likewise, 16 of the 50 advanced industries saw output and employment growth accelerate.

Turning to the industry-specific components of growth, the surge of the services subsector between 2013 and 2015 had a strong digital orientation while auto industries kept the manufacturing subsector growing even as energy’s contributions disappeared.

High-tech advanced service industries dominated the growth trends between 2013 and 2015 amid a wave of excitement about new software-based opportunities in social media, sharing platforms, digital health and “fin-tech,” automation, the Internet of Things, and big data.[xii] Consequently, although nearly four-fifths of advanced-sector employment growth (480,000 jobs) from 2013 to 2015 emerged from the services subsector, nearly two-thirds of that growth (307,000 jobs) originated in just four fast-growing digital services: computer systems design; web search and internet publishing; software products; and data processing and hosting. Employment in all of these industries grew by 5 percent CAGR from 2013 to 2015, and three of the four accelerated their growth over the pace during 2010–2013. Management consulting, engineering, and R&D services also continued to add jobs and grow quickly. Overall, 9 of the 12 industries in the advanced services subsector picked up the pace of their output and job growth (or slowed job losses) in the recent period compared with the prior one.

At the same time, progress among advanced manufacturing industries slowed somewhat between 2013 and 2015 as the solid expansion following the recession (2010–2013) ran into headwinds. This slowdown reflected the combination of a strong dollar and a major slowing of global demand for U.S. commodity and machinery exports. These factors led to a significant slowing of output and employment growth in a variety of materials and machinery industries, ranging from iron and steel and aluminum products to agriculture, construction, mining machinery, and engine and power equipment. In this regard, although advanced manufacturing industries still managed to contribute more than 20 percent of advanced-sector employment growth (132,200 jobs) between 2013 and 2015, nearly 70 percent of that growth (95,000 jobs) originated in the three auto-related industries: motor vehicle parts, motor vehicles, and motor vehicle body and trailers. Several of these industries saw slower output growth, and output growth slowed in 18 of the 35 advanced manufacturing industries. Meanwhile, 9 of the 35 manufacturing industries lost jobs between 2013 and 2015 while 20 experienced slower employment growth between 2013 and 2015 than between 2010 and 2013. Nonetheless, output growth for the advanced manufacturing sector as a whole increased (owing to gains in petroleum, chemicals, pharmaceuticals, industrial machinery, appliances, and medical equipment) even as employment growth slowed.

Finally, the advanced energy industries group slumped as the U.S. “fracking” boom led to an oil and gas glut and energy demand stagnated worldwide. Given those trends, both the oil and gas extraction and mining industries saw precipitous output and employment growth slowdowns. Given these pull-backs, the energy subsector shifted from being a significant contributor to the nation’s advanced industries economy to a nonfactor.

Overall, slower hiring in advanced manufacturing and a recession in the energy sector left the nation’s advanced industries economy increasingly reliant in 2013–2015 on a narrowed growth base.

In contrast to the recovery years of 2010–2013, by 2013–2015 no less than one-half of the nation’s advanced industries’ employment growth was from a booming computer systems design industry and the three auto industries. With a few more digital services such as software and web search / internet publishing, just seven advanced industries in the digital services and auto domains generated two-thirds percent of the nation’s advanced sector growth between 2013 and 2015. That share was up from 55 percent in the previous three years. In short, the nation has grown more dependent on continued auto sector progress and a short list of rapidly growing high-tech services for output and employment growth.

3. U.S. advanced industries’ growth trends grew more uneven across the country between 2013 and 2015

Advanced industries remain widely dispersed across the United States. Every region, state, and metropolitan area contains at least a few thousand advanced sector jobs. Given that, most areas of the country have had a toehold in the sector.

In keeping with that a wide portion of the country has continued to see growth in the sector. Between 2013 and 2015, all but seven states saw both output and employment expansions, as did 80 of the largest 100 metropolitan areas. Nonetheless, the shifting fortunes of the sector’s various industries are altering and, to an extent, narrowing the geography of advanced industries’ growth.

At the broadest level, the accelerated growth of high-tech services industries combined with the slowed or nonexistent growth in the advanced manufacturing and energy industries has shifted more growth to states in the West and Northeast (states traditionally strong in tech services).

Along these lines, Northeastern and Western states captured larger shares of the nations’ 2013–2015 advanced sector growth than they did in the previous three years thanks in large part to their specializations in fast-growing high-tech services ranging from computer systems design to R&D. In the Northeast, for example, tech-intensive New York, Massachusetts, Rhode Island, Maine, New Hampshire, and Connecticut all saw significant quickening of their output and employment growth. Similarly, tech-oriented Western states, including Utah, Oregon, Colorado, California, and Idaho, also saw rapid, accelerating growth on both measures.

States in the Midwest and South experienced mixed trends, by contrast. Many saw a diminished pace of advanced sector growth, given slowing manufacturing growth and the energy contraction. Manufacturing-intensive Michigan continued to rank high on absolute employment and output measures but experienced a significant slowing of growth between 2013 and 2015. So did other manufacturing states such as Ohio, Indiana, Wisconsin, Illinois, and Iowa (although Indiana and Illinois saw quickened output growth, in a sign of underlying strength). Likewise, Midwestern “fracking” states like North Dakota and Oklahoma, saw significant losses of momentum on both employment and output. At the same time, slowing growth in numerous advanced manufacturing industries began to affect some, but not all, of the fast-growing states in the South. To be sure, no less than six of the fastest growing 10 advanced-sector states based on employment growth continued to lie south of the Mason-Dixon line in 2013–2015. However, four of those states (Tennessee, Georgia, South Carolina, and Kentucky) saw either their rapid job growth or solid output growth between 2010 and 2013 slow after 2013, thanks to slowing expansion in various advanced manufacturing industries, especially auto industries.

In short, the state growth map depicts an unsettled geography of momentum. Although advanced sector output accelerated across a healthy 33 states, only 20 states saw the pace of their advanced industries’ employment growth accelerate between 2010 and 2013. That means that 30 states saw employment growth slow, which adds to the many questions about the robustness of the nation’s overall advanced industries economy.

Turning to the metropolitan geography of the sector’s evolution, it remains important to note that advanced industries’ production takes place principally in metropolitan areas, where the universities, technology innovation assets, supply chains, STEM workers, and industry clusters on which the sector depends reside.[xiii] Altogether, the country’s 100 largest metropolitan areas contained 74 percent of all U.S. jobs in the advanced industries sector in 2015 while the country’s full list of 381 metropolitan areas contained 89 percent of those jobs. Large metropolitan areas contained at least four of five U.S. workers in 17 individual advanced industries, among them management and technical consulting services, data processing and hosting, and software publishing. Given these facts and the sector’s importance to prosperity, the distribution and nature of the sector’s growth in metro areas remain critical the economic health of the nation.

What do recent trends in the urban distribution of advanced sector growth say about the nation’s economic trajectory?

To start with, recent trends reflect the wide dispersal of advanced industries in metropolitan America. Many metros in many states and regions continued to maintain solid advanced industry enterprises as the national economic recovery settled into a “new normal” of economic performance between 2013 and 2015.