The United States has undergone a revolution in social policy over the past decade, but part of it’s been so quiet that hardly anyone noticed. Most Americans are somewhat aware of welfare reform—after all, caseloads nationally are down by nearly half since 1994—yet virtually no attention has been paid to the extraordinary increases in government supports for low-income workers and their families.

In truth, social policy has not been abandoned but transformed, with aid being taken away from single parents who stay at home to care for children and handed over instead to those who go out to work. Whatever the merits of welfare reform, it seems U.S. policy has finally taken note of the working poor. Yet the financial stability of most low-wage working families remains precarious, and much remains to be done to provide real security for those in the lower income tier who follow the rules but often lose out anyway.

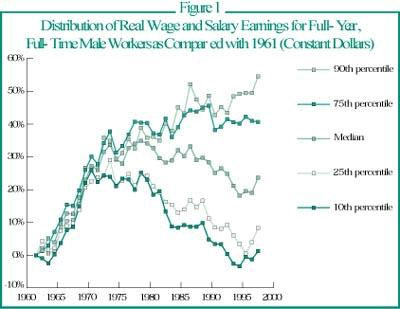

In the decades right after World War II, the fortunes of American workers across the economic spectrum rose and fell more or less together. Since 1979, however, that pattern has changed for full-time male workers employed year-round—the segment traditionally considered the heart of the U.S. labor force.

Figure 1 displays the changes in the inflation-adjusted earnings of workers at different points along the national income distribution scale since 1961. In earlier times, when the nation was prosperous, the rising tide lifted all boats; wages for workers at all levels grew at roughly the same rate, a trend that continued into the 1960s. But beginning in the 1970s and accelerating through the ’80s and early ’90s, the fortunes of working Americans at the opposite ends of the income ladder have panned out very differently. By 1994, full-time male workers in the bottom 10 percent of the national income scale were earning no more than their counterparts of nearly 35 years before. Workers with incomes in the top 10 percent, meanwhile, were doing far better than the same group did in decades past. The strong economy of the last few years has sparked some rebound in the wages of bottom-tier working men, but a substantial gap remains between their incomes and those of male workers whose earnings are closer to the national average.

Source: Author’s tabulations of annual March Current Population Survey data.

These ongoing disparities in the fortunes of American workers have inspired considerable economic research, most of which suggests that today’s technological advances, declines in heavy industry, weakened unions, growing international trade, and demographic changes due to immigration all work to the disadvantage of less skilled jobholders. Nearly all the studies agree that more, better, and earlier education is critical to solving these inequities, but there is little consensus on how to make real improvements. A successful program would take a generation even to begin to make an impact. Meanwhile, the more immediate concerns are what current policies have done to aid low-income working families, and what additional efforts ought to be considered.

From Welfare to Work

The much-heralded welfare reforms of the past five years signaled a sharp change in U.S. social policy. Time limits were imposed on benefits. The Aid to Families with Dependent Children (AFDC) program was transformed into Transitional Assistance for Needy Families (TANF). Considering the already weak financial condition of so many low-skilled workers, analysts feared that this new set of aid cutbacks would only make the situation worse.

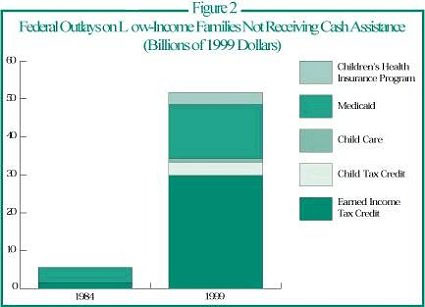

However, at the same time that welfare reform was being implemented, various other changes in policy were combining with the exceptional strength of the U.S. economy to improve the lot of low-wage workers. Within days of President Bill Clinton’s signing the wide-ranging 1996 welfare reform bill providing for welfare through block grants to the states and ending guaranteed federal subsidies to poor people with children, a higher minimum wage was enacted. More important, the federal government dramatically increased non-welfare supports for low-income working families with children. As Figure 2 shows, federal spending on low-income families not on welfare soared from less than $6 billion in 1984 to a projected $51.7 billion in 1999.

Figure 2 is modeled on a graph created with data from the August 1998 Congressional Budget Office report “Policy Changes Affecting Mandatory Spending for Low-Income Workers Not Receiving Cash Welfare,” by Ron Haskins for “Welfare in a Society of Permanent Work,” Committee on Ways and Means, U.S. House of Representatives, August 1999.

The biggest growth occurred in the federal Earned Income Tax Credit (EITC). The EITC functions like a pay raise for the working poor. A family with two children and one adult working at a low-paying job gets as much as a 40 percent boost in income from this refundable federal tax credit—up to a limit topping $3,800. A family earning $9,500 qualifies for the full credit, which is gradually phased out as the family’s annual income grows. Families with earnings up to around $30,000 still qualify for minimum assistance under the EITC.

The federal Medicaid program providing health care to the poor also has been dramatically expanded. Today, every state must cover at least children under 15 in families with incomes below the federal poverty levels of roughly $13,000 for three-member families and just under $17,000 for families of four. The recently enacted Children’s Health Insurance Program (CHIP) gives still more money to states to cover children in families with incomes up to twice the poverty levels, through either Medicaid or a separate CHIP program.

Taken together, these policy changes have had a major positive impact on the economic prospects of many families at high risk of financial collapse. In 1986, a two-parent family of four with a single minimum-wage worker averaged an effective after-tax income of less than $13,000 (in inflation-adjusted 1997 dollars), including food stamps, and their children rarely qualified for Medicaid. By 1997 such a family earned more than $16,000 on average—thanks in large part to the expanded EITC—and the children did qualify for Medicaid.

As shown in Figure 3, the changes in Medicaid eligibility have been even more striking for single-parent families. In 1986, a non-working single mother with two children would have received roughly $8,500 in welfare and food stamps in an average state, and the whole family would have been covered by Medicaid. But if she took a full-time, minimum-wage job, after accounting for the loss of welfare, the cost of child care, and additional taxes, her family’s income would have grown by only about $2,000, and she and her children would have lost their Medicaid coverage. Working or not, the family would be poor. In 1997, by contrast, the non-working mother would qualify for only $7,500 in benefits and for only a limited time. But if she got a full-time, minimum-wage job, her net income would jump to $14,600 and her children would keep their Medicaid coverage. By working, such a mother can now pull her family above the poverty line, if not far above it.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Single parents have responded to the opportunity by working more—much more. In the mid-1970s and for the 20 years thereafter, between 50 and 55 percent of single parents were working. Starting in the mid-1990s, however, their employment rates began to soar, reaching 67 percent in 1998. The change was particularly dramatic among low-skilled single parents, whose employment rates rose from less than 35 percent throughout the 1980s and early ’90s to more than 50 percent today.

The Fragility of Low-Income Working Families and Their Children

The news is not all good. One August 1999 study from the Center on Budget and Policy Priorities suggests that people whose family situations make working outside the home difficult have been left behind by the recent welfare reforms, and the plights of many are growing increasingly bleak. Yet even for the group that is the focus of this brief—those able to work and find jobs—the financial outlook may be less rosy than it first appears.

It is true that low-income working families now qualify for the Earned Income Tax Credit, food stamps, Medicaid, and sometimes subsidized child care. To get the EITC, working parents need only file a tax return with the appropriate form. Information about the credit, which once seemed hard to come by, is now readily available in low-income communities, and participation rates are very high—in sharp contrast to those for Medicaid and food stamps.

In the past, Medicaid was linked to welfare; eligibility was generally automatic for welfare recipients. Recent policy changes have sought to “de-link” the two programs, so that the working poor can get Medicaid as well. Yet this is where the problem comes in: as welfare caseloads have dwindled, so too has participation in Medicaid, even though eligibility theoretically has been greatly expanded. In most states, Medicaid and CHIP remain a hodgepodge of interlocking programs reflecting incremental expansions. Over time people in need find themselves shunted from program to program, sometimes facing very different rules and administrative requirements, sometimes losing aid altogether, and often failing to realize that they might qualify for support under yet another program. Low-income working families applying for Medicaid usually still must provide considerable documentation of their income, assets, living arrangements, and family relationships. The process is frustrating, time-consuming, and all too often humiliating.

Similarly, even though virtually every poor and near-poor American qualifies for food stamps, participation in the program has dropped much faster than the poverty rate. As welfare offices have pushed to get people off government-funded assistance, many families apparently have dropped off food stamps as well, even though they remain eligible for the program. In addition, some low-income workers who know they are eligible may avoid applying because of the continuing stigma attached to food stamps as well as the hassles of procuring them.

In the case of Medicaid in particular, there is a lesson to be learned from the success of the Earned Income Tax Credit. If the process is simple, people will enroll. At a minimum, the program should be straightforward and seamless within every state. Making this so may well mean starting from scratch on the procedures for determining Medicaid eligibility for working families. Perhaps the same tax form now used to assess EITC eligibility could be put to use for a national Medicaid program as well. In any case, without major changes Medicaid may never escape its welfare roots, and thus will continue to fail at providing health care to poor working families.

As more and more households send all their adults out to work, the question of child care becomes paramount. At present, the arrangements low-income working parents make for their children’s day care are often informal, unreliable, and even unsafe. Meanwhile, the evidence mounts that high-quality, developmentally oriented child care can go far to enhance the prospects of the children lucky enough to get it. Nevertheless, an odd schism exists among policymakers that is reflected in the programs they craft for children: those who promote work for poor parents often regard child care primarily as a means to that end; the implicit goal is to remove an excuse for not working by providing adequate care, but at the lowest possible cost. Policymakers concerned with child development, on the other hand, look first to the best ways to meet the needs of the child, often with little regard for the work situation of the parent. These contrasting concepts collide not only on the question of cost, but also on that of coverage. The generally successful federal Head Start program, for example, was built on a part-day child care model requiring heavy parental involvement, which may not be practical for many working parents.

At the very least, today’s growing emphasis on supporting working parents will require increased spending on child care. Both the federal and many state governments are starting to boost their funding for such initiatives. Programs like Head Start are beginning to create all-day “wrap-around” services to better accommodate the needs of working parents. Ultimately, however, Americans will have to answer a critical question: Do we simply want to ensure the minimum custodial care for children in low-income working families, or are we willing to pay for the kind of day care that opens brighter futures to these children?

The Perils of Economic Downturns and Unemployment

When the economy stumbles, the working poor fall. Among the greatest dangers in the recent strategy of doing more to support low-income working families and less for those without workers is that the employed but poor will become the unemployed and destitute in bad times for the overall economy.

The United States’ primary means of supporting its out-of-work citizens is unemployment insurance (UI). Unfortunately, this system has not proven very effective at helping low-wage workers. To qualify for UI, formerly employed workers must meet minimum income levels over several quarters and satisfy a number of other requirements, including an appropriate reason for separation from their last job. A 1998 study by Cynthia Gustafson and Philip Levine estimated that only about a third of low-skilled men over 21 who had recently separated from a job met all the conditions for receiving unemployment benefits. An even smaller percentage of low-skilled female workers passed the tests.

One possible alternative to UI would be the provision of some form of community or public service jobs, at least to welfare recipients whose benefits are running out during an economic downturn. A number of states already have modest programs in place to support welfare recipients who can’t find private sector work in hard times. Unfortunately, the fiscal demands on state welfare systems are apt to skyrocket in the event of a falloff in the nation’s economy. Most observers think that in such circumstances the federal government’s modest Transitional Assistance for Needy Families reserve fund would quickly prove inadequate, just as the states would be facing dwindling resources for all programs. It is disturbing how little evidence there is that either the states or the federal government are doing any serious planning for a future recession and its likely impact on poor working families.

Accumulating Adverse Incentives

The new emphasis on supporting low-income workers has created another set of potential problems: work and marriage penalties. The push to accord more benefits to poor but working families is without doubt a strong incentive for households to send at least one adult into the workforce. But these benefits are designed to phase out as income rises, which sometimes creates a powerful disincentive to work extra hours or send another family member into the job market. In fact, some evidence suggests that this disincentive for second workers may be encouraging some mothers in two-parent families not to work. Some policymakers may actually welcome this development if the EITC allows some married mothers to stay home with their children. Still, the accumulating incentives are a legitimate source of concern.

Another consequence of targeted benefits is marriage penalties and rewards. Programs like the EITC support low-earning families with children. Thus they offer a reward for marriages between non-working mothers and working men—her children and his earnings allow the couple to qualify for the EITC—and among childless couples contemplating getting married and raising a family for the first time. But for low-income adults who are already working parents, these supports can actually serve as a deterrent to marriage: a working single parent who marries another worker usually will suffer a substantial reduction in benefits, because the couple’s combined income reduces what they can receive. The loss can range as high as 15 percent or more of their combined income. Although there is little evidence that the EITC and other worker supports have had much if any impact on marriage rates, Congress was sufficiently concerned about marriage penalties in the tax system that it recently sought to eliminate them—for everyone but low-income working taxpayers. The idea that the nation should use its budget surplus to remove marriage penalties for all but the most vulnerable workers seems both morally questionable and foolish.

Supports for the Future

Increased government support for low-income workers has been critical in shoring up economically marginal families in the face of growing income inequities and welfare reforms aimed at getting recipients off public assistance and into the workforce. Despite these programs, however, many working families remain poor or close to it. To help them out of poverty, a number of states have begun to adopt EITCs of their own and to expand other supports. At the federal level, another push is on to raise the minimum wage, which could help at least some working families.

Now it is time to look for ways to make existing support programs such as Medicaid and food stamps work better for employed recipients. We ought to seek to reduce marriage penalties. The next recession will force Americans to confront the unpleasant features of a social policy focused primarily on assisting those with jobs. More to the point, if the income disparities of the 1980s and ’90s continue to widen into the next century, the financial stability of the nation’s low-wage working families will become ever more tenuous.