Over the past several weeks student loan interest rates have been a hotly debated issue among politicians who are trying to pass legislation to prevent the increase in rates set to occur next week. Last month President Obama stood in the Rose Garden at the White House and warned that allowing interest rates to double on July 1 would be equivalent to a $1000 tax hike – a frightening prospect for cash-strapped college students. Senator Durbin, a co-sponsor of the Democratic proposal in the Senate, argued that action is necessary in order to prevent the student loan market from falling into a crisis like the one seen in mortgage lending. The rhetoric surrounding this debate would have you believe that the stakes are incredibly high. Many have begun to worry that the consequences of inaction could be catastrophic. I’m pleased to say, however, that this is quite far from the truth.

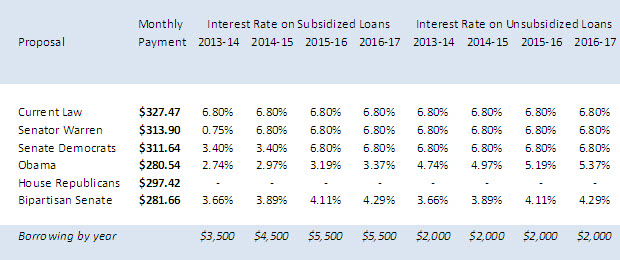

The most surprising aspect of this debate is the high degree of similarity between the possible outcomes. Recent analysis by Jason Delisle and Clare McCann at the New America Foundation made this point clear. They ran the numbers to show how various proposals would impact an average borrower’s monthly payment. They concluded that the bipartisan Senate proposal currently in the works would create savings for borrowers compared to the other options on the table. Most striking, however, was how similar the existing proposals really are.

In order to illustrate this point, I built an Excel spreadsheet that calculates a borrower’s monthly loan payments based on a variety of assumptions. To extend the work done by Delisle and McCann, the calculator has built in predictions of future treasury rates, which are based on the current yield curve. The calculator allows for changes to the borrower profile, including total borrowing and fraction of borrowing in subsidized loans. It also identifies each of the primary legislative proposals and allows the user to compute monthly payments using different parameters (i.e. the spread over treasury rates). The table below shows the monthly payments that an average borrower would face under different policy options. Download the spreadsheet to explore the policy options yourself.

The undeniable conclusion from this exercise is that student loan interest rates don’t matter – at least when you are only considering the options that are currently on the table. For a borrower with $27,000 in federal student loan debt, the difference between the most and least generous proposals is $33 per month when borrowing the maximum allowable for both subsidized and unsubsidized loans over four years. Over the life of the loan, this amounts to $3,400 (discounted value). In terms of monthly payments, the differences between the proposals become even smaller when you take into account the possibility that many borrowers will participate in repayment plans that extend the term of the loan beyond ten years.

Regardless of whether you think that $33 is a large sum, it is clear that we don’t need to worry if the outcome of this political battle will leave future borrowers in dire straits. Instead, let’s focus on what is important in federal student loan policy. First of all, we need to get congress out of the business of setting interest rates. Thankfully most policy makers are in agreement on this and have endorsed legislation that pegs student rates to the market. Second, we need to ensure that the federal lending program is fiscally responsible. Lending to students at cost, as proposed by Senators Reed and Durbin[i], is the best way to achieve this. Since the government has the ability to borrow at low rates through the treasury, loans that are costless to the government will have rates that are well below what private lenders can charge. Constructing a budget neutral lending program will ensure that loans will be available for future generations of students. While it is easy to understand why many will favor the interest rate proposals that provide savings to the borrower over the life of the loan, we need to consider the benefit of delivering those same dollars to students through Pell grants instead. A cash transfer at the time of enrollment will likely have a greater impact on enrollment than an equally costly subsidy delivered through interest rates after a student has graduated. This is especially true for low income students who may have an aversion from borrowing that discourages them from enrolling in college.

Revisiting this debate year after year provokes a fear of borrowing among prospective college students, which may discourage some from pursuing degrees at all, and wastes the valuable time of our policy makers. Given that all of our options are in the same ball park, it’s time to quit bickering over a few percentage points and pass legislation that will provide a long term solution.

![]() Click here to download the student loan interest rate calculator (Excel) »

Click here to download the student loan interest rate calculator (Excel) »

[i] Estimates of monthly payments are not available for this proposal because the spread over market rates is based on administrative costs to be calculated by the Department of Education.