Today’s labor shortages make it an auspicious moment for companies ready to measure and improve labor conditions. To do so, corporate boards and management need a clear way to manage retention by understanding its link to job quality.

The economic recovery from the COVID-19 pandemic has created a uniquely tight labor market with millions of unfilled job postings.1 Though shutdowns and business restrictions hit low-wage workers especially hard, evidence suggests that, in this recovery, they have options.2 Many low- and high-wage workers alike have seized the moment and quit their jobs in search of higher quality work and economic mobility.3

Employers who have seen workers leave and who have been unable to rehire feel the costs of attrition. For example, one large food distributor found the labor crunch reduced their ability to respond to customers’ demand, which led to cuts in production, distribution routes, and ultimately lost market share. Stories like this show how dramatic costs can explicitly result—in a short timeframe—from poor working conditions and high turnover.

As a result, many companies find they are playing catch-up to their competitors who made employee retention and well-being a priority years ago.4 Beyond the promise of higher returns to companies with positive culture and high rates of retention, forward-looking companies may benefit from taking steps now in anticipation of the growing call for SEC mandated human capital disclosures.5

Additional disclosures, by way of Environmental, Social and Governance (ESG) indicators, are meant to hold companies accountable toward socially beneficial goals—from reducing carbon footprints to promoting economic inclusion. The indicators proposed here are ideal contributors to the “S” in ESG, social impact, as they track companies’ progress in countering trends that have eroded workers’ well-being: a lack of good paying, stable jobs, and limited and inequitable mobility.

This report provides simple, evidence-based outcome metrics that promote good quality jobs. Different companies will tackle the metrics differently depending on their industry structure and creativity of their management. Regardless, an important starting point is clarity about which metrics matter when it comes to improving job quality and how to measure progress against them.

In the U.S. labor market, many workers churn from one low-paid, low-quality job to the next.6 Despite their willingness to work hard, workers find it difficult or impossible to advance. And across all sectors of the economy, historical inequities continue to drive down wages and economic mobility of female, Black, and Hispanic workers.7

Data gathering can help determine whether progress toward these challenges, captured in these metrics, also leads to cost savings in hiring, retention, and overall performance. This way, progress at the firm level can also lead toward greater shared prosperity; the metrics below are a first step in that direction.

Key metrics: Job quality, mobility, and equity

Metrics overview and rationale

Job quality

In the last decades, low wage work has become increasingly pervasive and precarious, and at the same time stagnant wages have left many full-time workers unable to afford basic living expenses, forcing them to work multiple jobs. Many have little cushion for emergencies, leading to constant churn and short job tenures.

To track their social impact on job quality, companies can measure the share of their workforce paid living wages and with healthcare. The living wage depends on the cost of housing, health insurance, childcare, and other necessities. The national living wage is $16.54 an hour.8 We estimate that in 2019, 29 percent of workers earned a living wage, accounting for geographical differences in the cost of living.9

Likewise, unexpected health-related expenses can spell disaster for uninsured workers. Healthcare is an important component of job quality as it promotes stability and facilitates mobility. Nine percent of workers in 2019 did not have health insurance.10

Improving wages may seem like an intractable proposition in tight margin industries. However, some companies have made bold commitments, such as Bank of America, which last year raised its minimum wage to $20 an hour.11 The bank and other companies such as Google and Microsoft have also shown willingness to raise wages of workers employed by their vendors, allowing companies that provide food and janitorial services, for example, to pass on the cost of wage increases to their more community focused customers. Other companies are experimenting with profit sharing agreements for employees across the wage spectrum.12 Profit sharing strategies can increase worker engagement particularly when workers already earn more than a living wage. Whatever the strategy, and despite perceived limited flexibility when it comes to wages, measuring outcomes can help identify strategies for progress that also make business sense.

|

Job quality metrics

1. What percent of workers earn a living wage, as defined by their geographical location?13 How many have healthcare?

2. How many new jobs are created each year in each quintile with a living wage? |

Economic mobility

Many low-wage workers churn from one low-wage job to the next, seeing little wage growth. Research shows that ‘stepping stone’ jobs that have historically helped workers transition from low to high wages are becoming a smaller share of all jobs.14 Companies that have more of these stepping stone jobs are not only contributing to a robust middle class and more stable workforce, but also can benefit from a more diverse pipeline of entry level workers and improved retention. Increasing internal mobility can also be good for a company’s bottom line, since internal hires are often less expensive and more productive than external hires.15

Internal promotions are not the only way workers move up. The organizational structure of a company may make it impractical to expect every frontline worker be able to move up internally. This will be increasingly the case as firms outsource low-wage work to contract firms that can offer little mobility to their workers. Companies that help low-wage workers transition to higher wages even when they leave the company can also make a company more attractive to prospective employees. Walmart’s recent program offering trade skills (among them plumbing certificates) is a bet in that direction.16

Companies can improve mobility rates by paying higher wages, offering training opportunities and unlocking barriers to more promising jobs.17 Doing so can attract talent, alleviate workers’ competing stressors and increase their skillsets; in turn, they can work more autonomously and be more productive.18

Rapidly churning through jobs makes it difficult for workers to accumulate the know-how required for experience to translate to better opportunities. Rapid churn also makes workers expensive to companies. Increasing a worker’s minimum tenure at a company can translate into upward economic mobility—though very long tenures can also result in stagnation. Mobility rates tend to grow over a low-wage worker’s first three years with a company before falling thereafter.19 In turn, lower turnover rates, decreased absenteeism, and lower replacement costs all help a company’s bottom line.20

|

Economic mobility metrics

3. What percentage of workers that started in the lowest paid quintile (those that make less than $12.31 an hour) moved to above living wage ($16.54 an hour) each year?21

4. What percentage of your lowest paid workers left before the one-year mark? How many left before the two year mark? |

Job equity

Gender and racial inequities appear in both the share of workers in high-quality, high-paying jobs and in the share of workers who see economic mobility.

Research into “occupational segregation” has long shown that women, Black, and Hispanic workers are often disproportionately underrepresented in higher-paying occupations. Due to their underrepresentation in the highest quintile of occupations, we estimate that women, Black, and Hispanic workers annually underearn by $106 billion, $153 billion, and $310 billion, respectively.22

Many companies have set representation goals for themselves for diversity at the board and different levels of the organization. But they often find themselves competing for a small pool of diverse talent within their company. Using the right metrics can help by breaking down the problem to look at the talent building process.

For example, to unlock diversity at the top, managers may want to look at mobility rates in their company across demographics. Across the economy, we find race and gender mobility gaps hold some workers back. When female, Black, and Hispanic workers switch occupations, they move up less often than their male, white, and Asian counterparts. These mobility gaps are only partly explained by workers’ education levels, for the gaps persist even among highly educated workers.

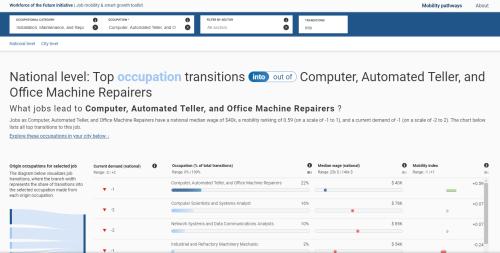

This type of analysis can also help firms diversify their highest paid occupations, specifically if they can diversify the pipeline of entry-level positions and unlock bottlenecks to make sure all workers progress through the company. Our research shows that some barriers to economic mobility exist along specific pathways from one occupation to the next. Even well-traveled pathways from low- to mid- and high-wage work are marked by racial, ethnic, and gender disparities. Pinpointing exactly where these barriers exist within a company is the first step to alleviating them. (See example below.)

How companies can make mobility gaps actionable: Unlocking pathways to high-paying jobs in healthcare

Companies can measure the most frequent sources of promotion for their workforce. For example, a grocery retailer might examine the pathway from grocery bagger to cashier to assistant manager. They can look at the rates of promotion at each step and then compare the rates of different groups. The example below shows a common pathway in the healthcare sector. It shows how mobility rates vary between white, Black, and Hispanic workers as they transition from licensed practical nurses (LPNs) to registered nurses. White LPNs move up to nurses at twice the rate of Black and Hispanic LPNs. |

|

Job equity metrics

5. What is the demographic composition in the company’s high-wage occupations? How does it compare to that of the labor force in your region?

6. What are the mobility gaps in each of the company’s wage quintiles? |

The key metrics highlighted above are important for companies to track because they connect directly to labor market trends that affect workers’ access to good jobs, mobility, and equity. Managers that are able to measure and track progress across them are likely to see increased job quality and the engagement and loyalty it engenders. Broad adoption of the metrics will also add to the evidence base for successful practices and their impact on performance—ultimately contributing to an effective human capital disclosure scheme that constantly adapts and improves with the times.

The Job Quality Metrics project includes Ethan Rouen, Natalie Geismar, Jay Garg, and Ian Seyal. It is informed by a working group in 17 Rooms and part of Leadership Now’s Business for Racial Equity Pledge signed by more than 1,000 private sector leaders.

Expanded list of workforce composition questions and company metrics

To get started, below is a tailored set of practical and actionable metrics that most companies can realistically begin measuring and tracking. Compiling workforce metrics will allow firms to track metrics on job quality, mobility, and equity; assess their baseline, measure impact, and set goals accordingly.

Workforce composition metrics

- Total number of workers (including full-time, part-time, and contract workers)

- Percent of workers, by wage quintile, who are full-time employees, part-time employees, and contract workers

- Gender and racial breakdown of employees at each wage quintile

- Gender and racial breakdown of employees in each job title, occupation, or job level

- Breakdown of educational attainment for each wage quintile

- Corporate EBITDA and revenue (to assess impact of metrics on firm performance)

Job quality metrics

- Percent of workers, by wage quintile, with a living wage, as defined by their geographical location, and employer-sponsored healthcare benefits

- Number of new jobs created by wage quintile.

- Number of new jobs created with a living wage and healthcare benefits by wage quintile

- Median annual wage, by wage quintile

- Median training expenditure per year per employee, by wage quintile

- Median training expenditure per employee, excluding job-related trainings (e.g., compliance training), by wage quintile

Economic mobility and job equity metrics

- What percentage of workers that started in the lowest paid quintile (those that make less than $12.31 an hour) moved to above living wage ($16.54 an hour) each year?

- What percentage of your lowest paid workers crossed the one-year mark? How many crossed the two-year mark?

- Internal promotion rate, by wage quintile, race, and gender

- Horizontal job change rate, by wage quintile

- Average wage gain per promotion, by wage quintile

- Voluntary and involuntary turnover rate, by wage quintile, race, and gender

- Number of jobs posted that do not require a bachelor’s degree (BA) and the percentage of those postings actually filled by workers without BAs

Qualitative practices

- Presence of rotational or cross-training programs to promote learning new skills

- Presence of internship, mentorship, and/or apprenticeship programs

- Presence of career development programming, through HR or other sources

- Does your company consider the work practices of contracted (B2B) companies and/or vendors? If so, how?

- Are open positions promoted internally through internal job boards or other mechanisms?

- Tracking common occupation pathways within the company (see the example above on unlocking pathways in healthcare)

- Do senior employees participate in creating curricula with external reskilling organizations (community colleges, non-profits, vendors) for entry-level positions or mid-level roles?

- Do you follow workers after they leave, did they receive a wage upgrade?

-

Footnotes

- Long, H. (2021, August 18). The U.S. could be on the verge of a productivity boom, a game-changer for the economy. Washington Post. https://www.washingtonpost.com/business/2021/08/18/us-productivity-boom/

- Porter, E. (2021, July 20). Low-Wage Workers Now Have Options, Which Could Mean a Raise. The New York Times. https://www.nytimes.com/2021/07/20/business/economy/workers-wages-mobility.html

- Ember, S. (2021, June 20). How Do They Say Economic Recovery? ‘I Quit.’ The New York Times. https://www.nytimes.com/2021/06/20/business/economy/workers-quit-jobs.html

- Tayeb, Z. (2021, September 18). This cafe chain owner who pays $15 an hour says his commitment to treating staff fairly helped him avoid the labor shortage. Business Insider. https://www.businessinsider.com/bluestone-lane-cafe-labor-shortage-pandemic-fair-wages-employees-2021-9; Tayeb, Z. (2021, July 11). This pizza chain owner who pays $16 an hour says there’s no labor shortage, just a shortage of businesses willing to pay a decent wage. Business Insider. https://www.businessinsider.com/pizza-chain-ceo-says-theres-no-labor-shortage-if-you-pay-well-2021-7?r=US&IR=T; Sainato, M. (2021, June 9). The US restaurants tackling staff shortages: ‘We have to pay more.’ The Guardian. https://www.theguardian.com/environment/2021/jun/09/restaurants-labor-shortage-wage-increase

- Sustainability Research. (2021, January). Culture Quant Framework. https://www.morganstanley.com/im/publication/insights/articles/article_culturequantframework_us.pdf?1634828499510

- Escobari, M., Seyal, I., & Daboin Contreras, C. (2021). Moving Up: Promoting workers’ economic mobility using network analysis. Brookings Institution. https://www.brookings.edu/wp-content/uploads/2021/06/Moving-Up.pdf

- Ibid.

- Living Wage Calculator. (2020, May 17). MIT.Edu. https://livingwage.mit.edu/articles/61-new-living-wage-data-for-now-available-on-the-tool: “The living wage in the United States is $16.54 per hour, or $68,808 per year, in 2019, before taxes for a family of four (two working adults, two children)”

- We compare the earnings of representative sample of workers in households with two working adults and two children from the 2019 one-year ACS (IPUMS USA) with a national living wage of $16.54/hour, which comes from MIT’s living wage calculator, and which we adjust for local prices using the BEA’s RPPs.

- Source: 2019 1-year ACS, IPUMS USA

- Bank of America Increases US Minimum Hourly Wage to $25 by 2025. (2021, May 18). Bank of America. https://newsroom.bankofamerica.com/content/newsroom/press-releases/2021/05/bank-of-america-increases-us-minimum-hourly-wage-to–25-by-2025.html

- Karsh, M. (2021, August 16). In New Twist, Private Equity Shares Its Windfall with Hourly Employees. Bloomberg. https://www.bloomberg.com/news/articles/2021-08-16/kkr-hands-500-million-to-ingersoll-rand-workers-after-162-gain

- Workers’ hourly wages can include cost of healthcare if companies provide it to account for the living wage calculations including the cost of healthcare.

- Escobari, M., Seyal, I., & Daboin Contreras, C. (2021). Moving Up: Promoting workers’ economic mobility using network analysis. Brookings Institution. https://www.brookings.edu/wp-content/uploads/2021/06/Moving-Up.pdf

- Bidwell, M. (2011). Paying More to Get Less: The Effects of External Hiring versus Internal Mobility. Administrative Science Quarterly. https://doi.org/10.1177/0001839211433562

- Glover, H. (2021, September). Study shows the benefits of Walmart Education Effort. Lumina Foundation. https://www.luminafoundation.org/wp-content/uploads/2021/09/lf-lbu-program-proofv9.pdf

- Escobari, M., Seyal, I., & Daboin Contreras, C. (2021). Moving Up: Promoting workers’ economic mobility using network analysis. Brookings Institution. https://www.brookings.edu/wp-content/uploads/2021/06/Moving-Up.pdf

- Wolfers, J., & Zilinsky, J. (2015, January 13). Higher Wages for Low-Income Workers Lead to Higher Productivity. PIIE. https://www.piie.com/blogs/realtime-economic-issues-watch/higher-wages-low-income-workers-lead-higher-productivity

- Schultz, M. A. (2019). The Wage Mobility of Low-Wage Workers in a Changing Economy, 1968 to 2014. RSF: The Russell Sage Foundation Journal of the Social Sciences, 5(4), 159–189. https://doi.org/10.7758/RSF.2019.5.4.06

- Harter, J. K., Schmidt, F. L., & Hayes, T. L. (2002). Business-unit-level relationship between employee satisfaction, employee engagement, and business outcomes: A meta-analysis. The Journal of Applied Psychology, 87(2), 268–279. https://doi.org/10.1037/0021-9010.87.2.268

- Note: Due to the structure of their business or industry, many companies employ few low-wage workers, but mobility still matters to their entry-level workforce. Managers in higher paying industries can adapt this metric to their business, for example, by measuring the rate at which workers in the company’s first wage quintile move above the company’s median wage.

- We use the ACS to estimate the share of female, male, Black, white, and Hispanic workers in the highest paying quintile of occupations (median wage greater than $34.98/hr, 93 occupations). For each demographic group, we take the number of workers needed (taking either positive values if the group is underrepresented or negative values if the group is overrepresented) in the occupation for the group to be proportionately represented, and we multiply it by the average annual income of the occupation. This can be interpreted as missing income in cases where the demographic group is underrepresented. One can aggregate across all high-wage occupations to give a total.