Surprise out-of-network bills arise when a consumer receives care from an out-of-network provider in a situation she cannot reasonably control, such as being treated by an out-of-network anesthesiologist at an in-network hospital. These bills are common for emergency and ancillary care — studies suggest that about 20 percent of emergency department visits and 10 percent of elective inpatient care stays involve at least one out-of-network provider.

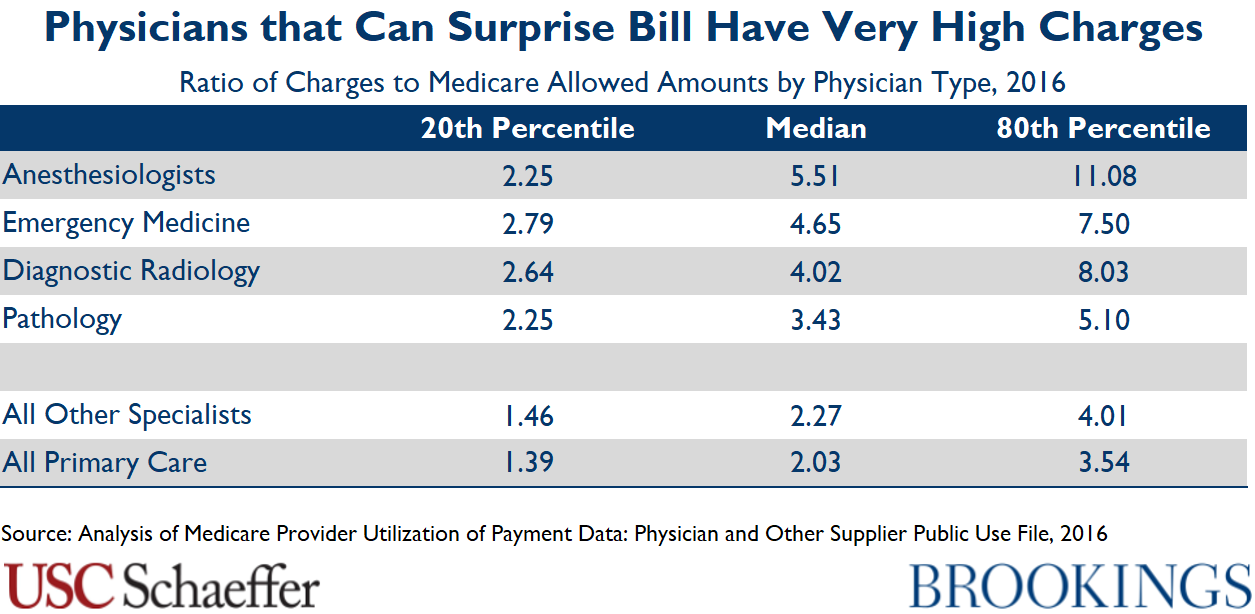

Surprise billing reflects a market failure: patients do not choose their emergency and ancillary physicians, so the flow of patients these physicians receive depends on the hospital in which they practice, not the prices they charge or whether they join insurer networks. As a result, they have an out-of-network billing opportunity not available in other specialties, and many leverage that option not only to send large surprise bills, but also to demand very high in-network payment rates when they do enter insurers’ networks.

Federal and state policymakers are considering steps to end surprise billing, but leading proposals often do not go far enough to reduce excess spending. In fact, some proposals intended to address surprise billing could actually end up increasing spending on the services most vulnerable to surprise bills. On the other hand, well-crafted proposals can both protect patients from surprise bills and bring down premiums.

Loren Adler, Kathleen Hannick, Sobin Lee

October 13, 2020

Erin Duffy, Bich Ly, Loren Adler, Erin Trish

September 11, 2020

Erin Fuse Brown, Erin Trish, Bich Ly, Mark Hall, Loren Adler

June 11, 2020

Erin Duffy, Loren Adler, Paul B. Ginsburg, Erin Trish

April 16, 2020

Christen Linke Young, Matthew Fiedler, Loren Adler, Sobin Lee

August 1, 2019

2019

Brookings Institution, Washington DC

Friday, 9:30 am - 12:00 pm EDT

Loren Adler, Matthew Fiedler, Paul B. Ginsburg, Mark Hall, Erin Trish, Christen Linke Young, Erin Duffy +2 more

February 19, 2019

Matthew Fiedler, Loren Adler, Benedic Ippolito

March 16, 2021

Loren Adler, Matthew Fiedler, Paul B. Ginsburg, Mark Hall, Benedic Ippolito, Erin Trish +1 more

February 4, 2021

Benjamin L. Chartock, Loren Adler, Bich Ly, Erin Duffy, Erin Trish

January 5, 2021

Loren Adler

October 24, 2019

Loren Adler, Erin Duffy, Bich Ly, Erin Trish

September 26, 2019

Loren Adler, Erin Duffy, Paul B. Ginsburg, Mark Hall, Erin Trish, Christen Linke Young +1 more

July 16, 2019

Loren Adler, Matthew Fiedler, Paul B. Ginsburg, Christen Linke Young

June 6, 2019

Loren Adler, Matthew Fiedler, Paul B. Ginsburg, Christen Linke Young

May 29, 2019

Loren Adler, Matthew Fiedler, Benedic Ippolito

May 23, 2019

Loren Adler, Paul B. Ginsburg, Mark Hall, Erin Trish

May 22, 2019

Loren Adler, Paul B. Ginsburg, Mark Hall, Erin Trish

May 14, 2019

Loren Adler, Paul B. Ginsburg, Mark Hall, Erin Trish, Benjamin Chartock

October 19, 2018

Loren Adler, Paul B. Ginsburg, Mark Hall, Erin Trish

September 25, 2018

Margaret Darling, Caitlin Brandt, Loren Adler, Mark Hall

August 8, 2017

Mark Hall

December 14, 2016

Christen Linke Young

July 1, 2019

Christen Linke Young, Loren Adler, Paul B. Ginsburg, Mark Hall

May 10, 2019

Christen Linke Young

April 3, 2019

Mihir Dekhne, Loren Adler, Kyle Sheetz, Karan Chhabra

February 25, 2019

Loren Adler, Mark Hall, Caitlin Brandt, Paul B. Ginsburg, Steven M. Lieberman

February 1, 2017

Mark Hall, Paul B. Ginsburg, Steven M. Lieberman, Loren Adler, Caitlin Brandt, Margaret Darling +1 more

October 13, 2016

Mark Hall, Paul B. Ginsburg, Steven M. Lieberman

October 13, 2016

2016

Brookings Institution, Washington DC

Thursday, 9:00 am - 12:00 pm EDT