2024

The American Rescue Plan Act expands the Earned Income Tax Credit (EITC), to include younger Americans ages 19 to 24 and increases both the salary cap and the value of the credit for adults without children. This expansion will help more than 17 million low-income Americans, according to the Center on Budget and Policy Priorities. Some states, including Maryland and New Mexico, have also expanded state-level EITC provision.

So, what’s next? Should the EITC expansion be made permanent? What are the pros and cons, both at a state and federal level?

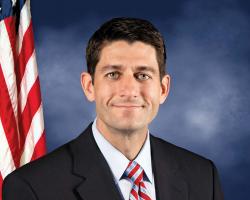

The Center on Children and Families at Brookings and the American Enterprise Institute hosted an event on Thursday, April 22 to hear from a range of policymakers and experts at both the federal and state level. The event opened with remarks from Senator Michael Bennet (D-Colo.) and closed with remarks from former Speaker of the House Paul Ryan.

Viewers submitted questions for speakers by emailing [email protected] or via Twitter using #EITCExpansion.

In Partnership With

Agenda

-

April 22

-

Welcome and introduction

-

Remarks and Q+A

-

Fireside chat

-

Expert panel

Moderator

Isabel V. Sawhill Senior Fellow Emeritus - Economic Studies, Center for Economic Security and Opportunity @isawhill

Isabel V. Sawhill Senior Fellow Emeritus - Economic Studies, Center for Economic Security and Opportunity @isawhillPanelist

Christopher Faricy Associate Professor of Political Science - Maxwell School of Citizenship and Public Affairs, Syracuse University @cgfaricy

Christopher Faricy Associate Professor of Political Science - Maxwell School of Citizenship and Public Affairs, Syracuse University @cgfaricy Diane Schanzenbach Director, Institute for Policy Research; Margaret Walker Alexander Professor of Human Development and Social Policy - Northwestern University @dwschanz

Diane Schanzenbach Director, Institute for Policy Research; Margaret Walker Alexander Professor of Human Development and Social Policy - Northwestern University @dwschanz Michael R. Strain Director and Arthur F. Burns Scholar in Political Economy - Economic Policy Studies, American Enterprise Institute @MichaelRStrain

Michael R. Strain Director and Arthur F. Burns Scholar in Political Economy - Economic Policy Studies, American Enterprise Institute @MichaelRStrain -

Closing remarks

-