Private Medicare Advantage plans more efficient than traditional fee-for-service program

Mark Duggan of Stanford, Jonathan Gruber of MIT, and Boris Vabson of Nuna Health find that beneficiaries forced out of privately managed Medicare Advantage plans and into traditional fee-for-service increased hospital utilization by roughly 60 percent, with a particularly strong effect on elective visits. Importantly, there was no evidence of change in the quality of care or in mortality rates, suggesting that Medicare Advantage plans were delivering care more efficiently by using fewer hospital resources.

Little evidence that risks of global contagion have strengthened since financial crisis

Constructing a measure of financial contagion and applying it to 10 advanced and 21 emerging market economies, Piti Disyatat of the Bank of Thailand and Phurichai Rungcharoenkitkul of the Bank for International Settlements find that the negative impact of globalization on central banks’ ability to conduct domestic monetary policy has been overstated. The authors add that there is little evidence to suggest that susceptibility to global financial contagion has increased since the onset of the global financial crisis.

Higher union membership increases size of middle class and boosts intergenerational mobility

Using Panel Study of Income Dynamics and federal income tax data, Richard Freeman of NBER, Eunice Han of Wellesley College, and David Madland and Brendan V. Duke of the Center for American Progress find a strong link between unions and the size of the middle class and intergenerational mobility. Specifically, they conclude that union workers are disproportionately more likely to be in the middle-income group or higher, and that the children of union workers have higher income than the children of otherwise similar non-union parents.

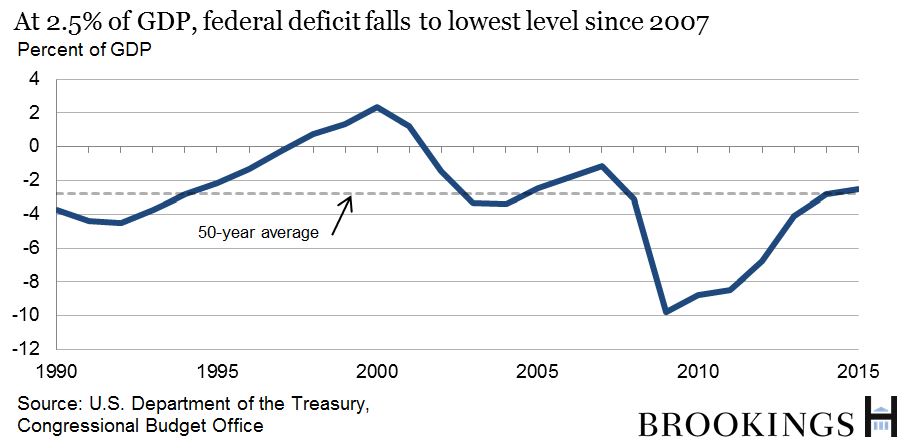

Chart of the week:

Quotes of the week: Is the Fed ready to raise rates? Fed bank presidents disagree

Based on my current assessment of the outlook and the risks around the outlook, I believe the economy can handle an increase in the fed funds rate and that it is appropriate for monetary policy to take a step back from the emergency measure of zero interest rates. A small increase in interest rates from zero is not tight monetary policy.

—Loretta J. Mester, President and CEO, Federal Reserve Bank of Cleveland

How does this asymmetric assessment of risks to achieving the dual mandate goals influence my view of the most appropriate path for monetary policy over the next three years? It leads me to conclude that a later liftoff and a gradual normalization of our monetary policy framework will best position the economy for the potential challenges ahead.

—Charles Evans, President and CEO, Federal Reserve Bank of Chicago

Commentary

Hutchins Roundup: Medicare Advantage, financial contagion, and more

October 22, 2015