Labor market slack is much greater than the standard employment gap suggests

David G. Blanchflower of Dartmouth College and Andrew T. Levin of the International Monetary Fund argue that, rather than focusing only on the difference between the unemployment rate and natural rate of unemployment, the Federal Reserve should consider underemployment and hidden unemployment. That measure shows the U.S. still 3.3 million full-time jobs shy of full employment. The authors also find that hidden unemployment and underemployment place significant downward pressure on wages.

Medicare Part D significantly reduces cardiovascular-related mortality rates

Using prescription drug coverage and mortality data from just before and just after the implementation of Medicare Part D in 2006, Abe Dunn of the Bureau of Economic Analysis and Adam Hale Shapiro of the Federal Reserve Bank of San Francisco find that Medicare Part D prevented between 19, 000 and 27,000 cardiovascular-related deaths in its first year. Assuming that each additional year of life is worth $200,000, the authors note that the benefits gained as a result of the program outweigh the increased spending.

Between 1980 and 2000, immigration was a net job creator

Gihoon Hong of Indiana University South Bend and John McLaren of the University of Virginia find that, by increasing demand for local services, increased immigration can create jobs and increase wages. Hong and McLaren conclude that between 1980 and 2000, immigration increased wages for non-tradable service jobs (haircuts, food services, etc.), and that for every new immigrant, roughly 1.2 new jobs were created.

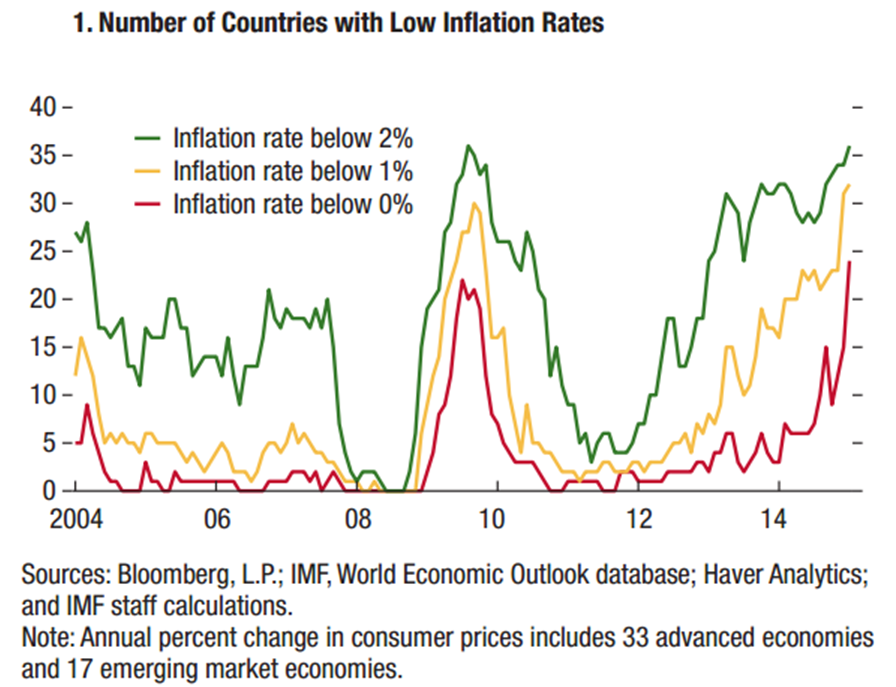

Chart of the week: Number of countries with inflation below 0 percent up sharply since the start of 2014

Quote of the week: Greek default on IMF loans would be detrimental to the Greek people

There has been speculation that the Greek government might not pay the next installment to the IMF. What would the consequences of such a move be?

“…[I]t would constrain the ability of banks to support the economy: if the government were to default on its debt, then obviously the value of government bonds would be negatively affected. This would make it more difficult for banks to obtain liquidity, because at the moment they rely for that on government bonds which they use as collateral, both in the market and with the Eurosystem. So it would impair the ability of banks to provide credit, which would be detrimental to the Greek people in general.”

— Benoît Cœuré, Member of the Executive Board of the European Central Bank

Commentary

Hutchins Roundup: Employment gap, immigration, and more

April 30, 2015