Capital controls increase the cost of capital and reduce investment

Laura Alfaro of Harvard University, Anusha Chari of the University of North Carolina at Chapel Hill, and Fabio Kanczuk of the University of São Paulo find that, following capital control announcements in Brazil, the cost of capital rose, the availability of external finance dropped, and firm-level investment fell. They note that smaller firms and those firms dependent on external finance were most adversely affected.

Medium-term spending multipliers are much higher during protracted recessions

In a sample of 17 OECD countries, Salvatore Dell’Erba, Ksenia Koloskova, and Marcos Poplawski-Ribeiro of the International Monetary Fund find that during protracted recessions, medium-term fiscal multipliers are significantly above 1. Specifically, they conclude that a decrease in the deficit of 1 percent of GDP leads to at 2 percentage point reduction in output, a 3 percentage point decrease in the employment ratio, and a 1.5 percent increase in unemployment.

A higher supply of short term, safe assets from central banks can improve financial stability

Mark Carlson of the Bank of International Settlements, Burcu Duygan-Bump, Fabio Natalucci, William Nelson, Marcelo Ochoa, and Skander Van den Heuvel of the Federal Reserve Board, and Jeremy Stein of Harvard University conclude that increasing the amount of short-term, safe instruments supplied by central banks may crowd out similar instruments created by the private sector, and improve the stability of the financial system.

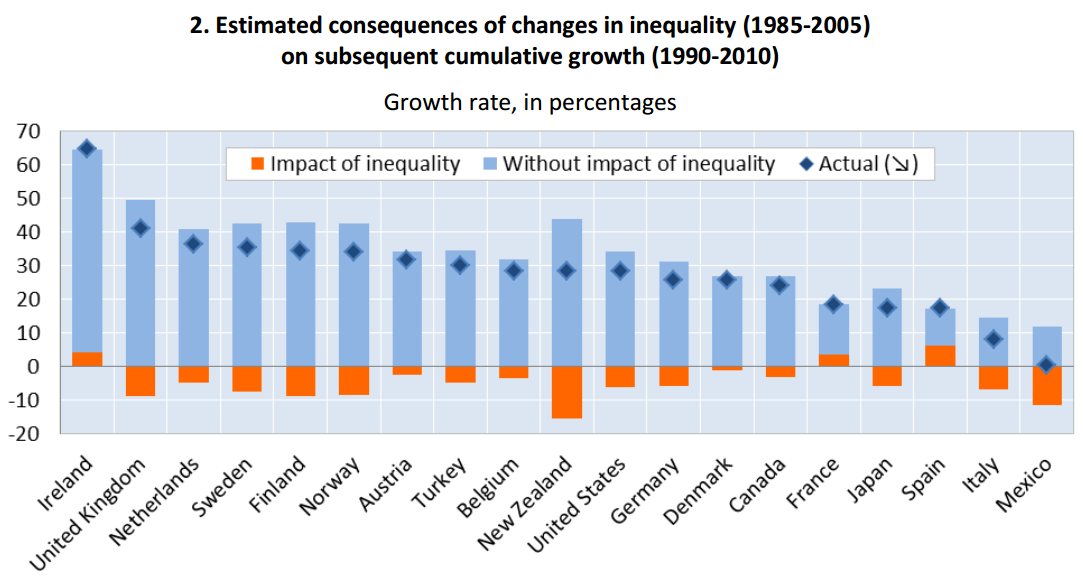

Chart of the week: Increased income inequality in the U.S. reduced GDP growth by about 15 percent between 1990 and 2010

Speech of the week: European Central Bank “unanimous in its commitment” to fight prolonged low inflation

“Taken together, our measures will have a sizeable impact on our balance sheet, which is intended to move towards the dimensions it had at the beginning of 2012… Should it become necessary to further address risks of too prolonged a period of low inflation, the Governing Council remains unanimous in its commitment to using additional unconventional instruments within its mandate. This would imply altering early next year the size, pace and composition of our measures.”

Peter Praet, Member of the Executive Board of the European Central Bank

Commentary

Hutchins Roundup: Capital Controls, Fiscal Multipliers, and More

December 11, 2014