What’s happening in fiscal and monetary policy right now? The Hutchins Roundup is a new feature to help keep you informed on the latest research, charts, and speeches.

The time is right for infrastructure spending

In its 2014 World Economic Outlook, the International Monetary Fund suggests that given low borrowing costs and weak demand, the time is right for increased government spending on infrastructure. IMF economists find that in advanced economies, a one percentage point increase in infrastructure spending leads to a 0.4 percent boost to output in the first year and a 1.5 percent increase four years out.

Current multiplier estimates are understated

Daniel Riera-Crichton of Bates College, Carlos Vegh of Johns Hopkins University, and Guillermo Vuletin of the Brookings Institution argue that government spending multipliers are higher than the existing literature suggests. They note that economies do not respond to increases and decreases in government spending symmetrically. In a recession, when spending is increasing, the multiplier is roughly 2.3, whereas the previous research – which does not distinguish between increasing and decreasing spending – estimates a multiplier of 1.3.

The Treasury and the Fed working at cross-purposes

In a paper presented here at the Hutchins Center for Fiscal and Monetary Policy, Harvard’s Robin Greenwood, Samuel Hanson, Joshua Rudolph and Lawrence Summers find that by extending the average duration of its debt, the Treasury offset roughly one-third of quantitative easing’s impact on long-term yields and the economy. The authors suggest that the Treasury and Fed issue an annual joint strategy statement on debt management to avoid working against each other in the future.

Watch a panel debate the author’s findings on the Brookings Youtube channel »

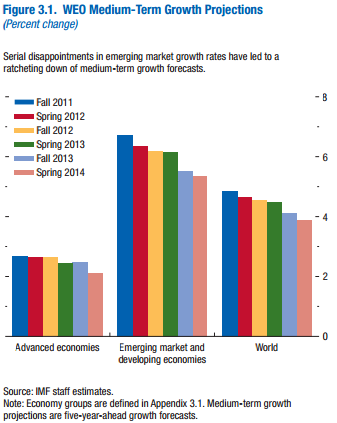

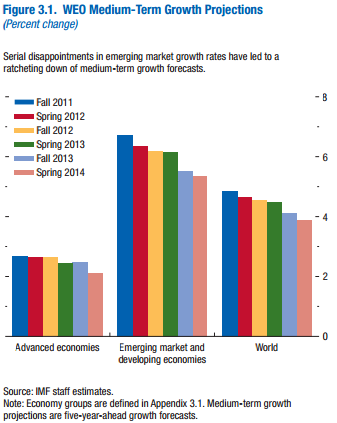

Chart of the week: Growth forecasts continue to fall, particularly in the emerging markets

Speech of the week: Fed policy heading towards a new normal

“The steps taken by the U.S. Federal Reserve, the central bank closest to the epicenter of the crisis, prevented the crisis and subsequent recession from being much worse. And they continue to support the U.S. and global economies through that long healing process. The Fed’s unconventional monetary policies affected Canada through various channels, notably by pushing down market interest rates worldwide. By the same token, as Fed policy returns to normal – which is likely to be a different state than before the crisis – that will tighten financial conditions in Canada. But this will be happening against the backdrop of stronger economic growth.”

-Timothy Lane, Deputy Governor, Bank of Canada

Commentary

The Hutchins Roundup: Infrastructure Spending, the Government Spending Multiplier, and Government Debt Management

October 2, 2014