Two years ago, Brookings Institution scholars William Galston and Clara Hendrickson highlighted signs that U.S. antitrust enforcement was undergoing a “serious re-evaluation.” Around that time, members of both the House and Senate introduced antitrust bills, the Senate Judiciary Committee held a hearing to evaluate the consumer welfare standard, and the Department of Justice filed an appeal to the proposed AT&T and Time Warner merger.

But since then, even more signs have emerged. Last month, the Federal Trade Commission (FTC) sent special orders to Alphabet, Apple, Amazon, Facebook, and Microsoft, requesting that each company submit detailed documentation regarding previously unreported acquisitions from 2010 to 2019. Under the Hart-Scott-Rodino Act (HSR) of 1976, businesses are required to file premerger notification for mergers and acquisitions (M&A) above a certain monetary threshold. However, the lack of reporting requirements for smaller transactions has historically omitted the majority of startup or small business acquisitions from federal antitrust review.[1]

The Federal Trade Commission sent these special orders pursuant to its authority under Section 6(b) of the FTC Act, which allows the agency to solicit information from businesses for research or non-enforcement purposes. These 6(b) orders are especially significant as economists and government officials consider how M&A activity might affect the market dynamic between large technology companies and startups. For technology startups, mergers and acquisitions could present both an obstacle and an opportunity: while it can contribute to the market dominance of incumbent companies, it could also give venture capital (VC) investors stronger incentives to finance new businesses entering the market. This dichotomy is both debated and difficult to quantify, but the requested new data could potentially help the FTC look into the relationship between M&A and competition—and how this relationship has affected hundreds of acquired startups over the previous decade.

Competition concerns in the technology industry

Rising consolidation in the overall U.S. economy has prompted concerns that M&A activity could strengthen the market power of larger, established companies relative to small businesses. Last year, the FTC concluded a series of competition hearings in which some participants discussed concerns that mergers and acquisitions can stifle competition. In other words, allowing companies to purchase or merge with direct competitors could increase their market share, while simultaneously help them gain additional data, intellectual property, end users, and human capital.

A 2018 Hamilton Project report suggests that M&A activity has become more prevalent over the past four decades, while startup formation in the United States has concurrently declined. According to the Bureau of Labor Statistics, the share of total U.S. companies under two years old has decreased from approximately 13 percent in 1985 to eight percent in 2014. Additional barriers to entry for startups might exist in the technology sector, as technology companies require large amounts of data to develop algorithms, target advertisements, and improve services. In addition, network effects—where the utility or value of certain products or services increase with the number of users—could give incumbents an advantage over market newcomers. As such, new businesses without an established customer base or massive datasets might face unique challenges in the digital economy; M&A could further increase this asymmetry by enabling established businesses to easily acquire these assets.

Promoting investment and business growth

However, an equally important consideration is whether M&A provides an initial economic incentive for venture capitalists to invest in startups. New businesses often depend on VC investments to procure infrastructure, hire personnel, and finance other initial costs. Because the majority of new businesses do not reach financial sustainability, early-stage investors often look to exit strategies, and especially M&A, in order to realize capital gains. Exit strategies are commonly-cited motives for startup founders as well—a 2016 survey by Silicon Valley Bank shows that 53% of startups mentioned acquisition as their long-term goal, compared to 16% that hoped to go public and 18% that wished to stay private.

Some researchers, such as Gordon Phillips of Dartmouth College and Alexei Zhdanov of Penn State University, conclude that M&A boosts investment in startups by enabling venture capitalists to monetize their portfolios. Phillips and Zhdanov analyzed VC investments in 48 countries between 1985 and 2014, finding that pro-acquisition legislation had a positive correlation with VC activity during this time period while anti-acquisition legislation had a negative correlation.

Conclusion

Given the possibility of multiple competing effects, federal antitrust enforcers face the challenge of preventing potentially anticompetitive transactions without substantially diminishing the overall capacity of M&A to motivate startup investment. To meet this challenge, it is time to question whether Hart-Scott-Rodino is still effective in the digital economy today.

First, we should ask whether current HSR filing requirements and exemptions give the FTC enough information to monitor M&A activity in the technology market. Second, it is important to consider whether HSR has clear benefits for technology startups, in addition to consumers and established companies. Third, we must recognize the costs of merger review—especially as HSR filings have doubled since 2010—and urge Congress to give the FTC the necessary funding and personnel to challenge cases. As the FTC reassesses antitrust enforcement, more information on startup acquisition would advance understanding of the prospective effects—both beneficial and harmful—of M&A on startups. For now, these special orders are a good start.

[1] The Federal Trade Commission adjusts the minimum threshold for HSR filing on an annual basis. As of February 27, 2020, the Federal Trade Commission requires businesses to submit a premerger notification and report form for M&A transactions above $94 million. See: https://www.ftc.gov/news-events/blogs/competition-matters/2020/01/hsr-thr0eshold-adjustments-reportability-2020

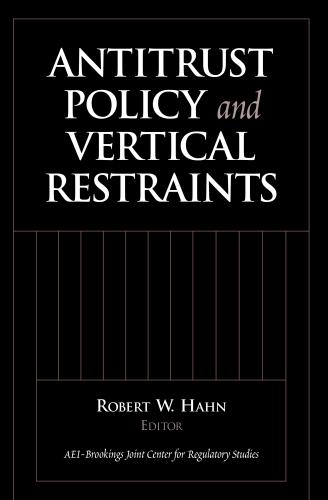

Commentary

With a new 6(b) study, the FTC reassesses antitrust enforcement

March 25, 2020