In its latest annual report released in June, the Bank for International Settlements (BIS) flags the foreign currency borrowings of the emerging market economies (EMEs) as a global financial vulnerability. The outstanding stock of U.S. dollar credit to non-bank EME borrowers has roughly doubled since 2008 and currently stands at $3.6 trillion.

The signs are foreboding. May saw a free fall of the Argentinian Peso and the Turkish Lira—since the beginning of 2018, the peso has fallen 23 percent and Lira by 17 percent—as investors grew edgy. About 64 percent of Argentina’s and 56 percent of Turkey’s debt (government and corporate) is in foreign currency. With the dollar headed northwards, confidence in the ability of governments and corporates of EMEs to repay their foreign currency debts headed south. Their troubles led Harvard University’s Carmen Reinhart to remark that due to the steep rise in debt in recent years, emerging markets are worse off today than they were during the 2008 crisis and the 2013 taper tantrum.

Early June brought meltdowns in other emerging market economies. Eastern European currencies including the Russian ruble, Poland’s zloty, and the Hungarian forint have registered noticeable depreciations, prompting many questions. Are we headed for a similar crisis again? Was this not the reason for the Latin American crisis of the 1980s, the Mexican crisis of 1995, and the Asian crisis of the late 1990s? Is another external debt time bomb set to explode in middle-income economies, or have lessons been learned that will pre-empt a recurrence?

These questions do not have easy answers. My view of this matter is influenced by India’s experience since the global financial crisis, so it is somewhat sanguine. For Central Banks in emerging economies, I think that India’s ‘Masala Bonds’ are worth a closer look.

The reasons for rising debt

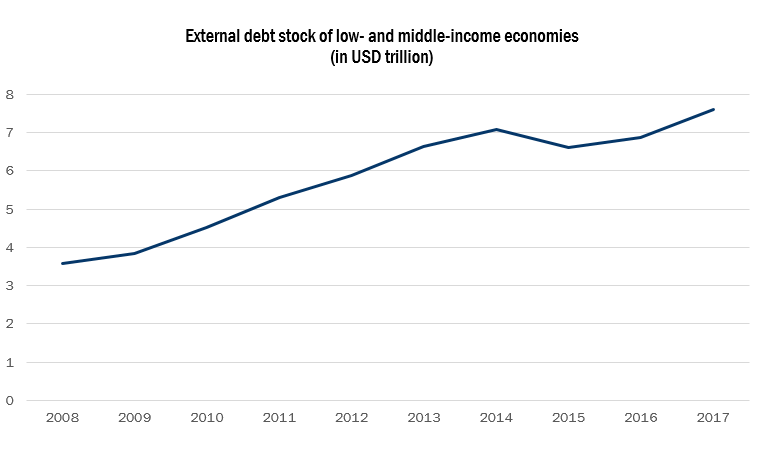

According to Fitch Ratings, debt levels that quadrupled in a decade have made emerging markets vulnerable to tightening financial conditions as U.S. interest rates increase. Fitch reports that outstanding debt securities from developing nations have ballooned to $19 trillion from $5 trillion a decade earlier. Though debt levels of low- and middle-income countries have not grown at the same clip, they exhibit a steep increase as well (Figure 1).

Figure 1: External debt has doubled in developing economies since 2008

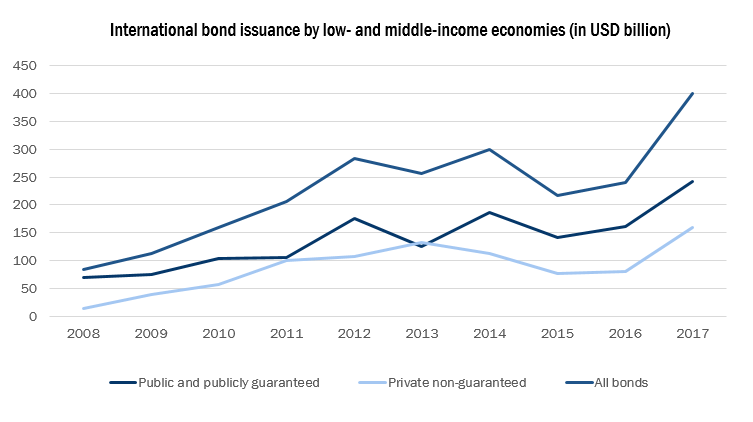

Investment demands of EMEs, opening up to capital inflows and financial market integration were already contributing to the growth of external debt. The interest rate differential made inflows into EMEs lucrative both for investors and borrowers. Global investors were able to earn a higher rate of return on their capital due to higher interest rates (aka the carry trade), the recipients—including governments and businesses—were able to mobilize resources at lower costs. Ultra-easy monetary policies of the advanced economies made capital flows frothier and increased debt levels in emerging market economies. Foreign borrowing skyrocketed (Figure 2).

Figure 2: International bond issuance has quadrupled since 2008

Judging from his speech in Zurich on May 8, 2018, Fed Chairman Jerome Powell is obviously not sympathetic to the argument that easy money in the U.S. is the problem. So U.S. monetary policy is not likely to suddenly become sensitive to debt sustainability concerns in emerging markets.

Worrying market signals about debt

External debt, as long as it is in local currency and is contracted for investments that add to growth, is not a serious problem. But the situation can quickly become precarious if even well-conceived borrowing is in a foreign currency that unexpectedly appreciates. In some emerging market economies, this is what is happening now. Figure 3 is extracted from the BIS Quarterly Review June 2018 which shows the risk of a stronger dollar—especially in Asia and Latin America, but also in Emerging Europe and Africa.

Figure 3: Emerging markets are especially vulnerable to a stronger dollar

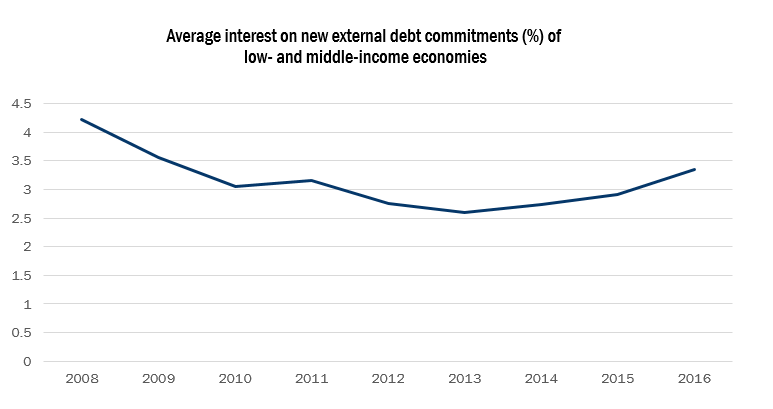

Recent trends in interest rates on newly assumed external debts of low- and middle-income nations do not look comforting. The rates have been creeping up (Figure 4). But readers should be warned that looking just at the interest rates can paint a rosy picture of debt sustainability. For most EMEs, adding the cost of hedging—which ranges between 5 and 10 percent—makes debt a lot less sustainable.

Figure 4: Interest on developing economy external debt is rising

India’s Masala Bonds

When a country is unable to borrow in its own currency and resorts to foreign currency borrowing, the situation is referred to as the ‘Original Sin’. The term was coined by economists Barry Eichengreen and Ricardo Hausmann in 1999 in their paper “Exchange Rates and Financial Fragility”.

The spurt in the foreign currency borrowing by emerging market economies has brought to the fore the problem of Original Sin. The dependence on foreign currency borrowings exposes the borrower to exchange rate risk by creating a currency mismatch. The mismatch arises because while the debt liabilities are in foreign currency, the assets are usually in domestic currency. An appreciating foreign currency increases the repayment risk. Markets then put even more pressure on the domestic currency. The situation can easily spin out of control.

This hasn’t happened in India, even though its financing needs have been growing and foreign borrowing helped meet some of this demand. Indian corporations are allowed to access long-term loans in foreign currency to meet their investment needs. When exchange rates were stable, these sources were often cheaper than domestic borrowing. A stable foreign currency meant that the corporations could avoid the cost of hedging, which lowered their overall borrowing costs.

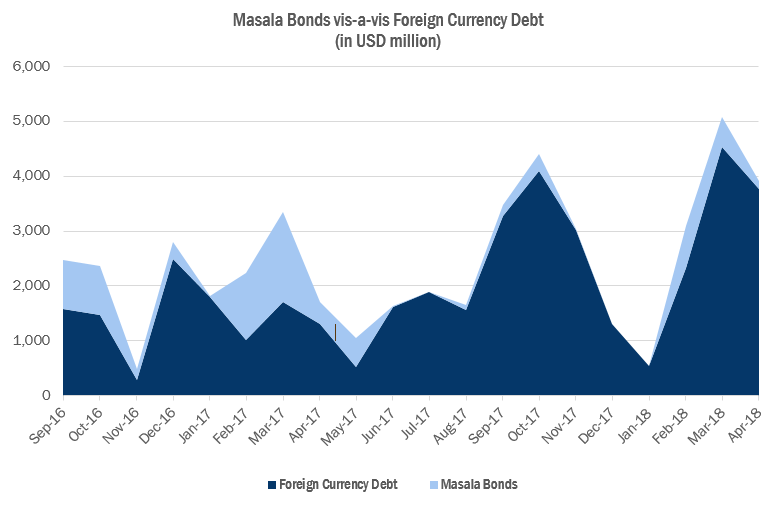

Things have changed and currency volatility is now common, more so as advanced economies are tightening money. To shield local companies from the vagaries of volatility, India introduced a scheme of Rupee denominated bonds in September 2015, popularly known as ‘masala bonds‘ (masala is a mix of Indian spices). Indian corporations have mobilized more than $8 billion through these bonds. The bonds enabled the Indian corporations to borrow in the international markets by linking the interest and principal payments to the Rupee. The exchange rate risk of masala bonds are borne by lenders, not by borrowers. The data suggest that international lenders do have an appetite for these bonds. And the scheme helps India’s macroeconomic stability since it reduces foreign currency denominated debt of the nation.

Figure 5: India has managed to borrow abroad in rupees

Can sinners be choosers?

India isn’t alone. Many nations have been issuing bonds denominated in local currency so the market for such bonds obviously exists. But for low- and middle-income economies that have a structural savings-investment gap, a well-thought-out borrowing plan is a must. Unbridled borrowing in foreign currency can easily put the sovereign in a spot. It is difficult for many lower-middle-income countries to convince foreign lenders to contract loans in the domestic currency of the borrower, but India’s experience shows that a carefully structured scheme can help start a gradual shift to international borrowing in domestic currencies.

The strengthening of the dollar has brought back fears of another debt crisis as foreign currency debt, which piled up in a period of easy money, now has to be rolled over or repaid. Paul Krugman is the latest pundit to predict a recurrence of the 1997-98 crisis. If these predictions come true, the main culprit will be ‘original sin’. Whether they are right or wrong, it will be interesting to compare the experience of countries that actively promoted local currency borrowing abroad with those that accumulated old fashioned foreign debt.

Commentary

The mess and the ‘masala’ in middle-income debt markets

July 5, 2018