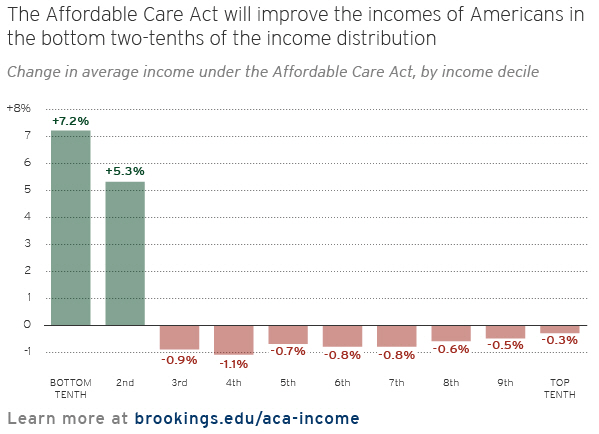

The Affordable Care Act (aka “Obamacare”) was designed to expand health insurance coverage and hold down the cost of insurance, but it will also change incomes of many Americans according to initial projections of Brookings Senior Fellows Henry Aaron and Gary Burtless.

In their new, preliminary paper “Potential Effects of the Affordable Care Act on Income Inequality,” Aaron and Burtless find sizeable income gains in the bottom quarter of the income distribution offset by small losses spread across higher income groups. Their estimates are highly sensitive to the definition of income. They discussed their paper in a recent event, joined by three other economists in a panel discussion.

The value of health insurance gains is fully reflected in a comprehensive measure of family income. Under such a definition, incomes will improve significantly at the bottom of the distribution—more than 5 percent in the bottom quintile. Incomes will decline slightly on the average in the rest of the distribution. For those under age 25 and in the poorest 20 percent of income recipients, their incomes will increase 5.2 percent; for those in the same income group aged 25-64, incomes will increase 9.2 percent. On average, all those above age 65, regardless of income, will experience a minor income loss (an average of .8 percent).

Some of the biggest gains are enjoyed by children and adults under age 65 in households that have low incomes and lacked insurance before the ACA. A notable share of the income losses will be sustained by Americans with high incomes, who pay increased Medicare taxes and premiums and higher investment taxes, and by people enrolled in Medicare Advantage plans who will receive smaller government subsidies for their Medicare insurance.

Most families will be unaffected by reform. Their insurance arrangements will not change, and they are not expected to pay higher taxes or premiums to finance reform or their own insurance.

In the paper, Aaron and Burtless measure income not using the most common measure of “Census Money Income” but by one that does not ignore the value of health benefits provided by employers and the government.

Download and read the paper to understand their methodology, see charts of alternative measures of income, and other important findings.

Commentary

Affordable Care Act Will Improve Incomes of Americans in Bottom Fifth of Income Distribution

January 28, 2014