The COVID-19 pandemic-era recession was unlike any other in U.S. history. Beginning in February 2020, the recession quickly reached depths not experienced in roughly a century before abating just as fast—lasting just two months according to the National Bureau of Economic Research. A combination of unprecedented fiscal support, rapid deployment of vaccines, and structural economic resilience all helped jumpstart the swift and enduring U.S. recovery, with the economic expansion now entering its fourth year. As the economy continues to grow, two important characteristics have emerged: (i) the U.S. avoided the deep economic scarring that impacted millions of American households in the last recovery; and (ii) the U.S. recovery has far outpaced most of its G10 peer countries.

The prior recovery was marred by economic scarring that emerged from insufficient fiscal support for households and businesses. Following the Great Recession, consumption was very slow to return to its precrisis level, causing a large output gap to emerge, which held down inflation but also limited demand for labor. With employment depressed, millions of discouraged workers exited the labor force and many more would struggle to return to prerecession earnings levels. As a result, consumption and residential investment remained depressed and the output gap between potential and actual GDP persisted.

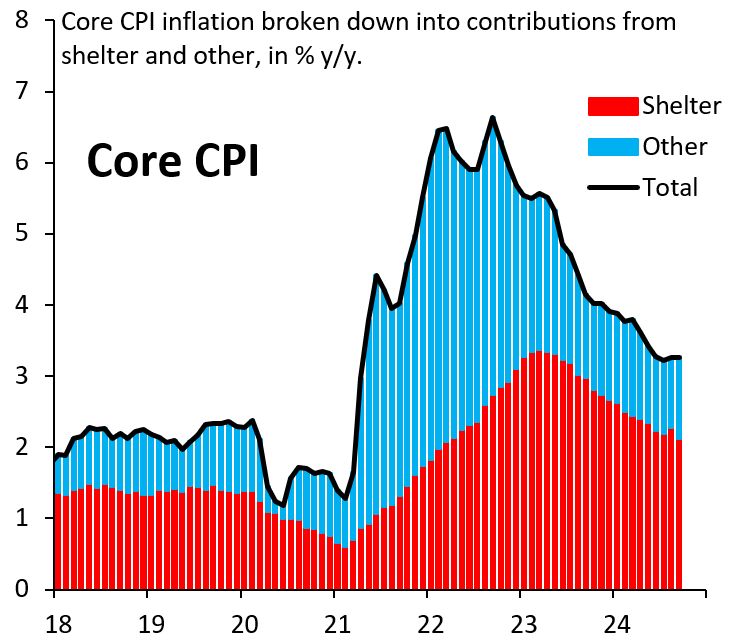

In the wake of the pandemic, many of the United States’ competitors repeated its mistake in the prior recovery. As the global economy remained disrupted by COVID-19 in 2021 and beyond, many foreign governments opted for premature fiscal consolidation in which the policy response was too muted and insufficient to help return their respective economies to prerecession form. By contrast, policymakers in the U.S. opted for more generous countercyclical support—including massive relief bills passed under both Democratic and Republican administrations that would provide assistance past even the omicron and delta waves of COVID-19. As a result, there is now no meaningful slack in the U.S., unlike in Europe where activity is once again falling behind its prepandemic trend. Perhaps most important, U.S. labor force participation has risen to record highs across major population groups, especially among prime-age women. Elevated inflation in 2021 and 2022 abated quickly and in recent years was driven more by supply constraints in the housing market than by fundamental imbalances in supply and demand. The steady fall in non-shelter year-over-year inflation, which now stands at just 1.1%, underscores that supply disruptions—not overheating—were by far the main driver of high inflation right after the pandemic. All told, the post-COVID recovery reaffirms the difficult choices made by policymakers and ultimately vindicates U.S. policy choices.

Avoiding an output gap

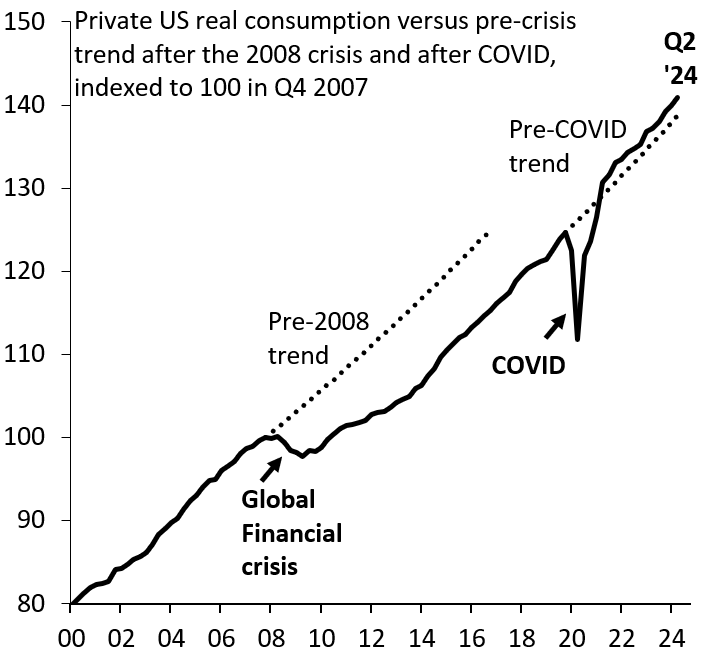

The key to the relative strength of the U.S. recovery has been the absence of a sizable output gap following the COVID-19 shock. Whereas the U.S. economy never regained its pre-2008 momentum after the global financial crisis, ample fiscal support in 2020 and 2021 helped preserve economic activity at prerecession levels save for a temporary drop following widespread lockdowns. While output gaps are notoriously difficult to measure, a simple extrapolation of the pre-2008 growth trend suggests there was substantial slack in the decade after the Great Recession (Figure 1). This large output gap meant chronically low inflation in the years that followed, but also prompted millions of discouraged workers to exit the labor force—which led to a sluggish recovery in both household balance sheets and the national housing market.

The pandemic threatened a repeat of that experience, especially as large parts of the services economy were shuttered. However, aggressive fiscal stimulus ensured that did not happen, as pandemic-relief legislation explicitly aimed to preserve payrolls while also providing generous financial and in-kind support to households. This support in the U.S. was far more generous compared to the rest of the G10 and—as a result—the U.S. has now meaningfully outperformed its peers. Indeed, private consumption has grown at a faster rate than in the rest of the G10, in absolute (Figure 2) and per capita terms. If the U.S. economy had grown at the same rate as the G10 median since Q2 2021, U.S. GDP would be a cumulative three percentage points lower by Q2 2024. In other words, had U.S. policy not pursued its aggressive course, there would again be a material output gap.

Figure 1. Private US real consumption vs. precrisis trend after the 2008 crisis and after COVID-19

Figure 2. Real private consumption across the G10

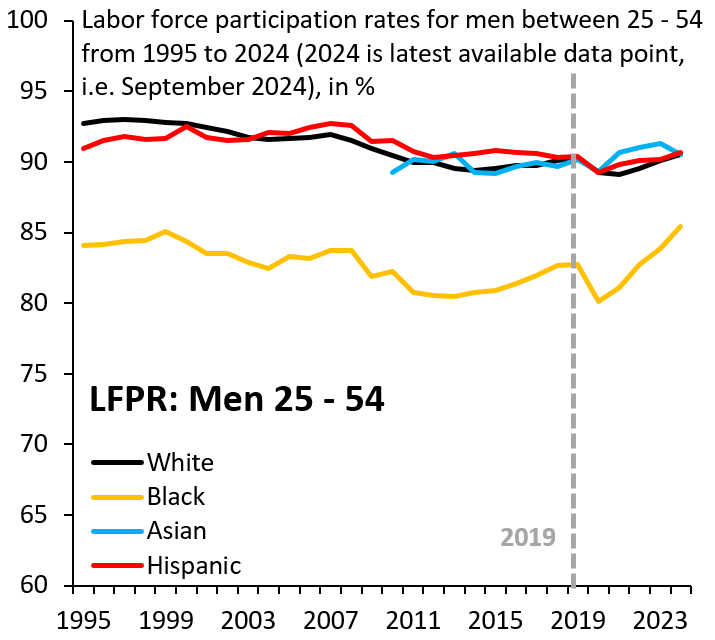

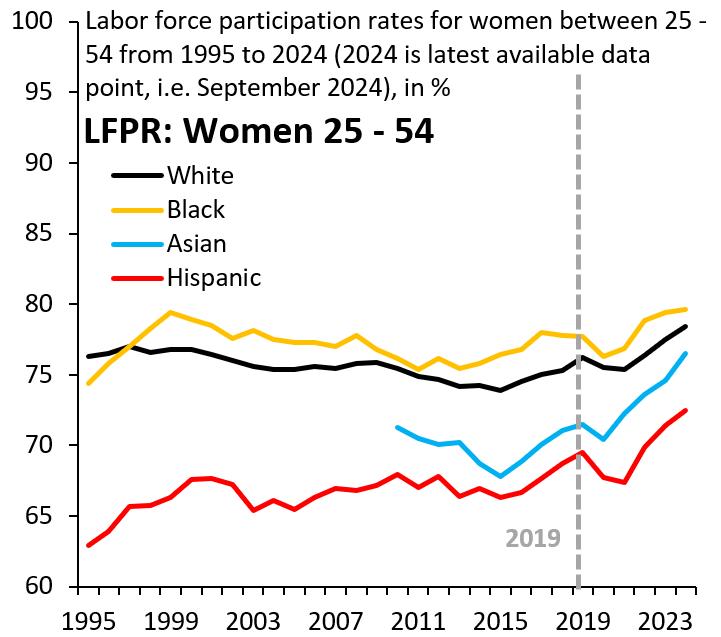

A strong and inclusive labor market

The absence of a sizable output gap in the U.S. led to a tight labor market and rapid growth in employment. Prime-age labor force participation among men (Figure 3) and women (Figure 4) has either fully recovered or risen above prepandemic levels. This recovery is a stark contrast from the decade after the global financial crisis, when discouraged workers exited the labor force, driving labor force participation down by several percentage points. Today the rise in prime-age female labor force participation across all demographic groups is especially notable, as women’s participation has risen to historic highs. The U.S. labor market does not exhibit the scarring that was so prominent after 2008, a remarkable success given that COVID-19 decimated many service-providing occupations.

Figure 3. Labor force participation rates for men aged 25-54

Figure 4. Labor force participation rates for women aged 25-54

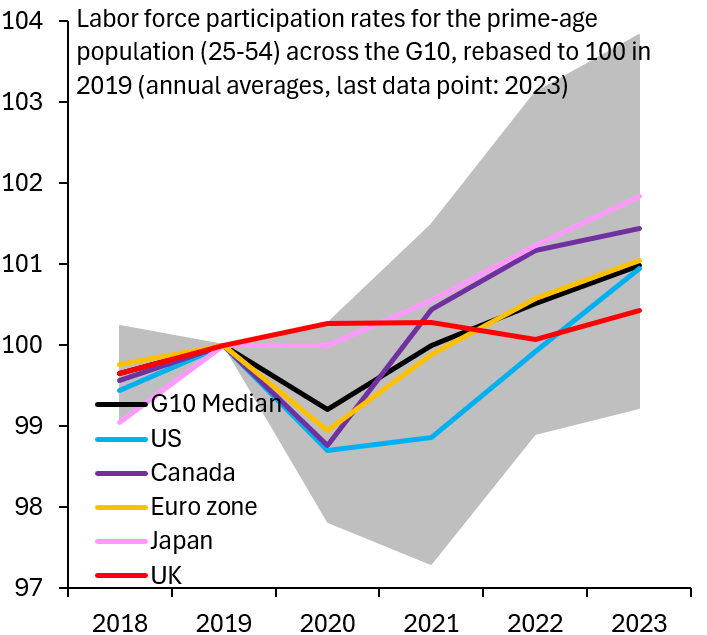

In an international comparison, the rebound in labor participation in the U.S. is especially strong following a more muted recovery in 2021. As can be seen in Figure 5 below, the decline in participation was widespread across the G10 in 2020 and the U.S. was slower to recover in 2021. However, U.S. participation rapidly rebounded in 2022 and 2023 and is now on par with G10 peers.

Figure 5. Labor force participation rates for the prime-age population (25-54) across the G10

Figure 6. Core CPI inflation broken down into contributions from shelter and other

The inflation trade-off

The high post-pandemic inflation experienced in the U.S. can be divided into two phases. The first phase lasted from the end of the recession in April 2020 through June 2022. Here, core CPI grew at an annual rate of 4.8% and was driven largely by supply chain pressures owing to the pandemic. While many of the supply chain disruptions impacted other countries as well, weaker growth helped mute the rise in inflation relative to the U.S.

The second phase lasted from June 2022 through May 2024 and was driven primarily by rising shelter costs—not more generalized inflation. Over this period, core CPI in the U.S. was still elevated—ranging from 6.6% to 3.4% on a year-over-year basis—but the main culprit was the rising cost of housing (Figure 6). Rising housing costs were driven primarily by lack of housing construction over the pandemic and before, the result of idiosyncratic factors linked to the housing supply—such as stringent local zoning laws that depress new building and denser housing—and high mortgage rates which discouraged many incumbent homeowners from listing their homes.

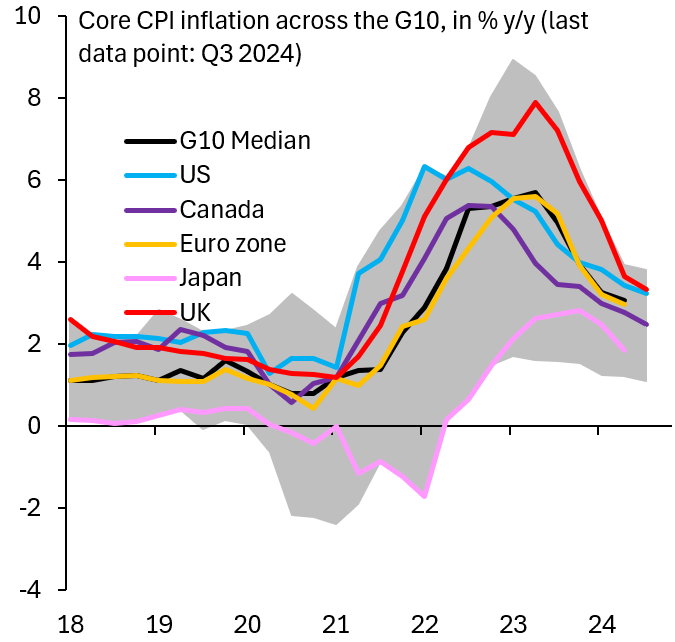

The international experience with inflation is shown in Figure 7 below. Here, inflation in the U.S. was elevated relative to the G10 for the first two years of the pandemic, but quickly reversed course at the start of 2022. Then, inflation began to fall and for a period was below the U.K., the eurozone, and the G10 median. Today, cumulative core inflation in the U.S. is approximately equal to all major competitors except Japan. However, what makes the U.S. experience so unique was that inflation was comparable across developed economies while growth in GDP, consumption, and employment was exceptional relative to competitors.

Figure 7. Core CPI inflation across the G10

Figure 8. Real gross fixed capital formation across the G10

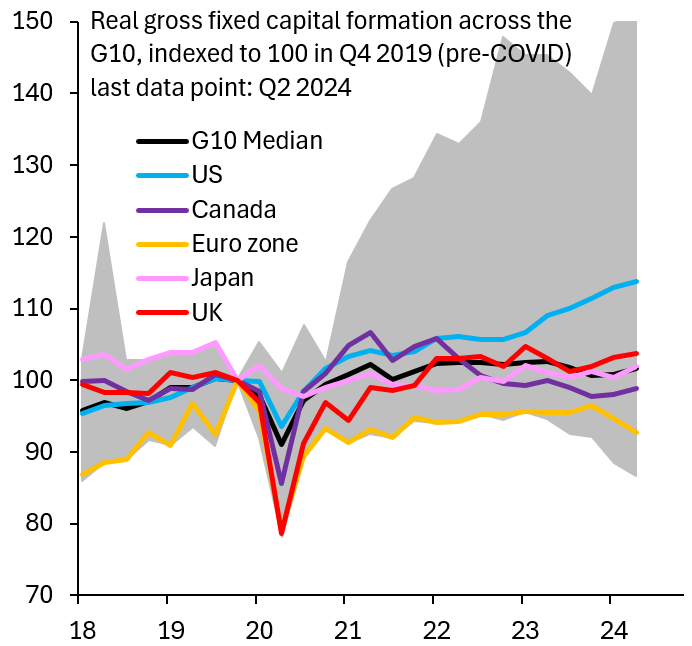

The US investment boom

Investment in the U.S. has been a notable point of optimism relative to other G10 economies. Buoyed by the investment incentives in the Inflation Reduction Act (and to a lesser extent) the CHIPS and Science Act, coupled with broader optimism over the U.S. economy, the U.S. experienced a relative boom in investment compared to its competitors. As can be seen in Figure 8, investment—as measured by real gross capital formation—was especially high in Canada and the U.S. through 2022. Then, in 2023 and 2024, U.S. investment accelerated relative to its peers. Today, U.S. investment is 14% above its pre-COVID level, while investment in the eurozone has fallen by 7% over the same period.

The absolute rise in investment in the U.S. is especially notable when controlling for the business cycle. As noted in analysis by the U.S. Treasury Department, change in investment typically falls (as a share of GDP) in the period following a peak in the business cycle—typically falling by about 1 percentage point between six and 12 quarters from the peak. However, in the current recovery, aggregate investment has remained roughly constant—leading to an additional $430 billion in investment relative to historical norms.

Conclusion

In broad terms, policymakers faced two options during the pandemic with respect to fiscal stimulus. One route was to invoke aggressive fiscal stimulus to avoid persistent economic scarring and sluggish growth but accept elevated inflation in the face of highly atypical supply chain pressures. The second option was to offer more muted fiscal support, and to allow for the emergence of output gaps and slow growth in consumption, which might help offset extra inflation. The U.S. chose the former, while most of the rest of the G10 opted for the latter. As a result, the U.S. has seen substantially more economic growth and more investment, but with slightly higher price levels in the initial years of the recovery.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

The US recovery from COVID-19 in international comparison

October 17, 2024