Teachers are taking more investment risks than ever before. At least, their pension plans are.

Even though teachers themselves are less willing to take risks compared to other professionals, teacher pension plans are taking substantial risks on their behalf. That has implications for today’s teachers and retirees, not to mention the long-term health of the teaching profession.

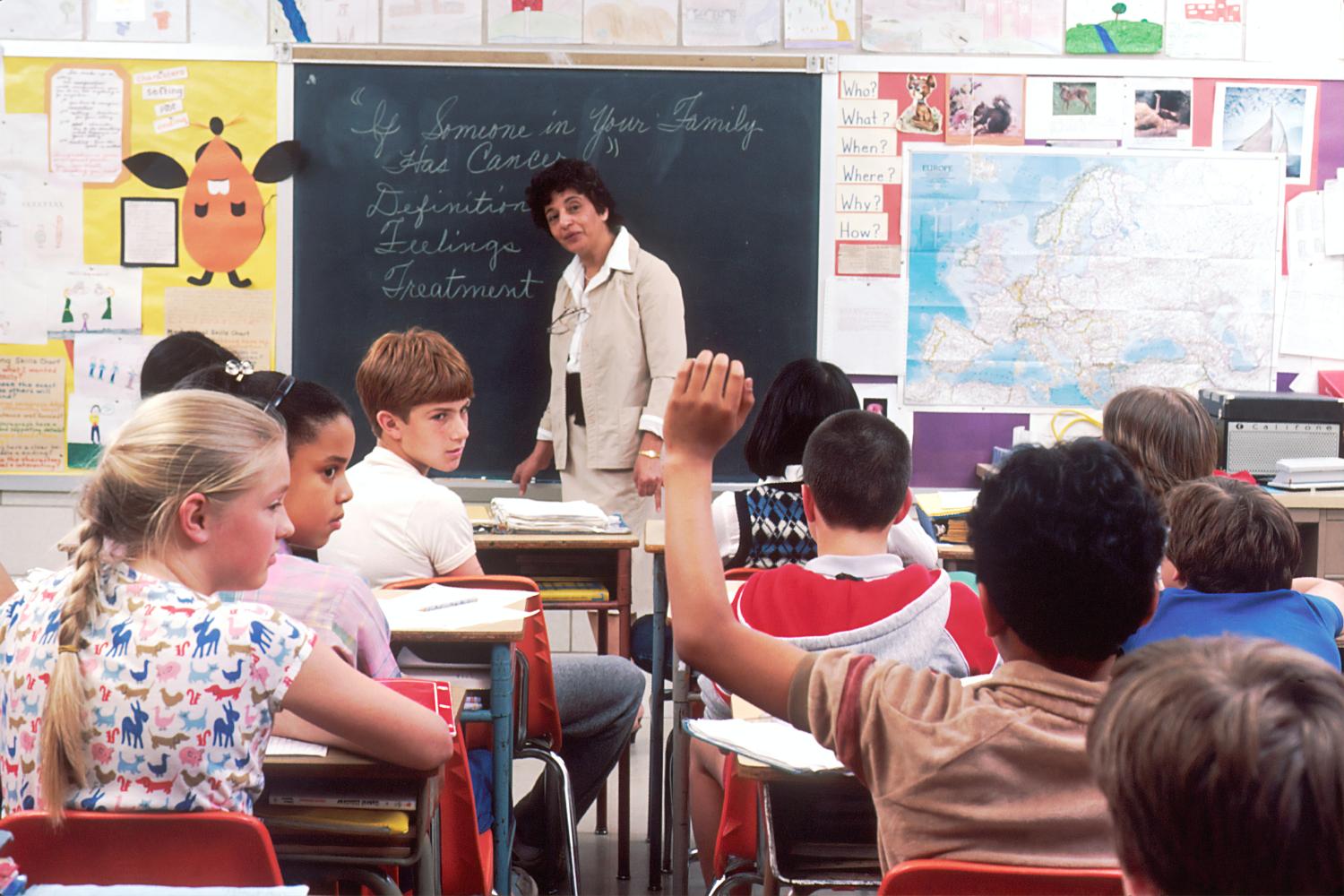

Ninety percent of public school teachers are enrolled in defined-benefit pension plans. Under those plans, a member’s benefits are based upon transparent formulas tied to their salary and years of experience. Thus, teachers may feel like they are protected from the whims of financial markets because their benefits are not directly tied to the plan’s contributions or investments. In other words, teachers themselves bear no direct risk—but that doesn’t mean investment risks don’t affect them.

Each year, pension plans accumulate liabilities as they make promises to pay future benefits. To estimate the value of those promises, the plan has to make assumptions about how fast salaries will grow, how many teachers will stick around to collect a benefit, how long teachers will live in retirement and collect benefits, and how fast the plan’s investments will grow. In the case that all the plan’s assumptions were correct, the plan’s expected assets would fully match its expected liabilities and the plan would be considered fully funded.

This creates opportunity for a cost-saving move that plans can and do engage in: The faster the plan assumes its investments will grow over time, the less it needs to save in the present to pay for its future promises. Yet, if a plan is overly optimistic, that decision could bring long-term consequences as the gap between assumptions and realities crystallizes.

This is where pension plan risks start to trickle down to teachers. Even taking their own assumptions at face value, the typical teacher pension plan has not been fully funded at any point in the last two decades. Their overly aggressive investment assumptions have contributed to today’s unfunded liabilities, which collectively total over $500 billion. That figure takes for granted that all of their current assumptions are proven correct.

But those assumptions are riskier today than they have ever been. In particular, pension-plan investment assumptions are wildly out of touch with the markets. Using figures from the Public Plans Database, I find that the typical teacher pension plan today assumes it will earn 7.25% per year on its investments.

Many economists argue those expectations are too high. Instead, they compare pension plan expectations against what is known as a “risk-free rate.” After all, for political and legal reasons—not to mention moral ones—state governments traditionally honor the promises they’ve made to active and retired teachers. That is, if the benefits must be paid, then the plan should make appropriately conservative investment assumptions. Private-sector pension plans, for example, are required to calculate their assets and liabilities using a more conservative investment assumption. Proponents of the current systems argue, however, that state and local governments don’t need to be as conservative as private sector companies, since companies can always go bankrupt while governments do not. (Though there are exceptions, especially at the city level.)

Without taking a side in that debate, it is striking to note that pension plan assumptions are growing farther and farther apart from the risk-free rate. The graph below compares the median teacher plan’s assumed rate of return over time (the solid blue line) against the risk-free rate, or what the plan could have earned by investing in long-term Treasury bonds. As the graph shows, the gap between these two lines—what economists call the “risk premium”—has grown considerably over time.

To their credit, teacher pension plans have lowered their assumed rate of return somewhat over time, from 8.25% in the early 1990s to 7.25% today. It’s just that bond rates have fallen even faster. It may be hard to believe today, when 30-year Treasury bonds are yielding less than 2%, but in the early 1990s the same risk-free bonds were paying 7-8% interest. Putting these two trends together, we can see that teacher pension plans in the early 1990s were assuming rates of return that were about .50 or .75 percentage points higher than the risk-free rate, or a premium of about 10%. Today, the gap has grown to around 5 percentage points, a risk premium of more than 200%.

The average teacher may not follow the bond markets very closely, and concepts like the risk premium taken on by their respective pension plan may feel abstract, but that doesn’t mean they don’t affect the average teacher. When pension plans fail to hit their aggressive investment targets, that can create additional costs that trickle down to teachers.

Rising pension costs have led to lower take-home pay for teachers and steeper costs for their employers. While it’s hard to pin down causal effects, researchers Dongwoo Kim, Cory Koedel, and P. Brett Xiang found that a 1% increase in pension costs led to a 0.24% reduction in district expenditures on teacher salaries. They did not see evidence of salary cuts for individual teachers, but they did see a slowdown in teacher hiring. That is, pension costs seemed to lead districts to reduce their pace of hiring, presumably resulting in slightly larger class sizes.

Pension costs have been associated with other spending reductions as well. A study by Josh McGee found that rising pension costs were associated with declines in spending on school equipment, facilities, and instructional supplies like textbooks. And a number of studies have documented that states have dealt with rising pension costs by cutting retirement benefits, especially for new teachers.

Of course, teacher pension plans aren’t the only ones taking on additional risks; the same pattern is common across all types of public-sector pension plans. In response, those plans are changing their asset allocations to chase higher investment returns. Two decades ago, about 90% of pension plan assets were invested in ordinary stocks and bonds. Today, that has fallen to just 60%. Instead, public-sector pension plans have ramped up their investments in private equity, real estate, commodities, and hedge funds. Ironically, the rise in actively managed, high-fee investments in the public sector is happening at the same time that private sector investors are pouring their own money into passively managed, low-cost mutual funds.

The effects I’m describing are being felt today, in the midst of the longest and strongest bull market since World War II. If another recession hits, or even if we experience a period of middling investment returns, states would be forced into another round of cost-cutting that would harm teachers and make the teaching profession even less attractive to the next generation. Teachers may not be aware of those risks, but they’re real—and they’re growing.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).