Content from the Brookings Institution India Center is now archived. After seven years of an impactful partnership, as of September 11, 2020, Brookings India is now the Centre for Social and Economic Progress, an independent public policy institution based in India.

Key findings

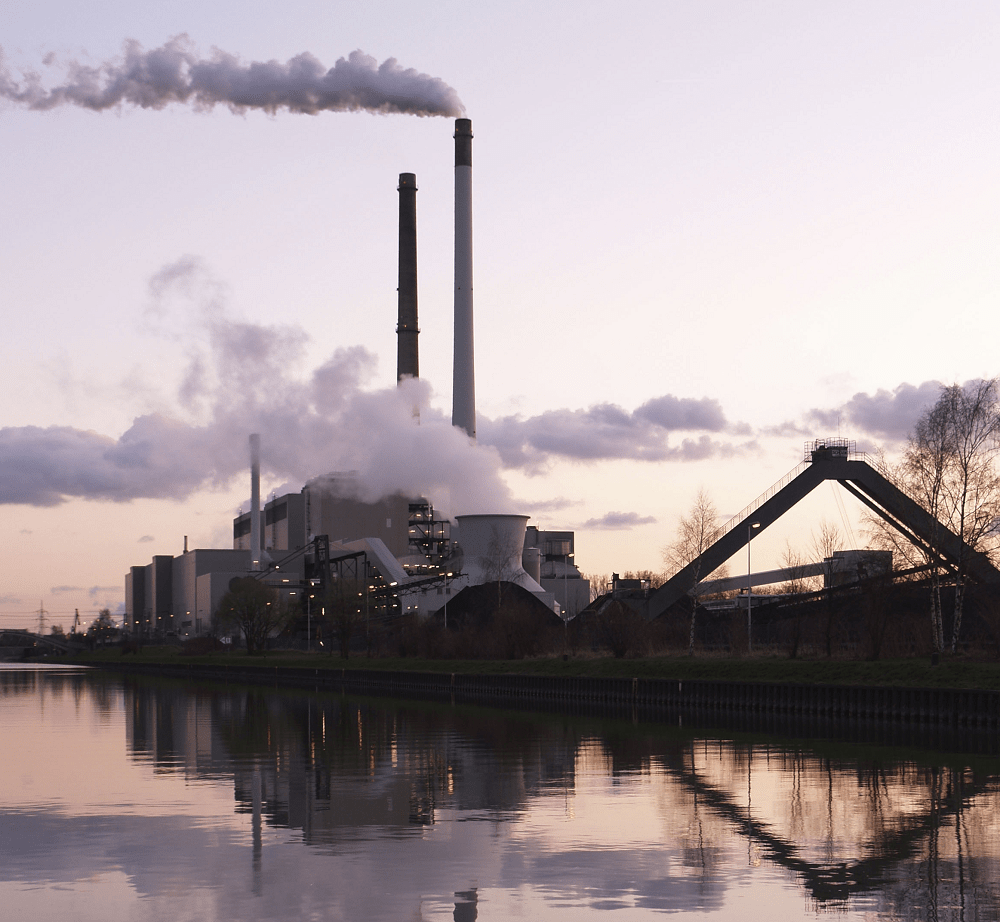

- India is heavily dependent on coal based power for its electricity needs, 79 per cent of total electricity generation is coal/thermal based. This is not expected to change drastically in the near future.

- Thermal power generation consumes around 76 per cent of total coal available in the country (imports included). Given its high coal consumption, power sector has a disproportionate impact on future coal demand.

- Imported coal constituted 26 per cent of total coal supply in FY’14-15 (212 MT of the total supply of 820.3 MT), however, the imports were 6 per cent lower (than 212 MT) in FY’15-16. Given that boiler technology locks in to a specific type of coal (imports/blending inclusive), it is unlikely that imports will ever be zero.

- The ambitious target of producing 1.5 billion tonnes of domestic coal is too high, vis-a-vis the expected increase in coal requirement(s) by 2020. The actual coal requirements are expected to be (at a maximum) around 1.2 billion tonnes in 2020 (subject to certain optimistic assumptions of growth in demand).

- In addition to GDP growth rates, the Renewable Energy capacity targets of 175 GW by 2022 could also impact coal demand in 2020, pushing it further down, displacing thermal generated kWh.

- Huge thermal power capacities are expected online by 2020. This will impact PLFs, with economic and technical implications for the new capacities. And, if financial reforms in the distribution companies do not work as expected, there could be stressed assets as well, impacting liquidity in the banking sector.

- Railways capacity augmentation is a related investment within the same timeframe (till 2020) to enable actual coal offtake for increased mining capacity. To enable capacity augmentation, it is essential to look holistically at the total capital requirements for both these sectors simultaneously.

In FY’14-15, the government announced an ambitious plan to produce 1.5 billion tonnes of coal domestically by 2020, an annual growth of almost 20 per cent. The announcement came at the back of the then chronic shortfall of coal. However, by the end of FY’15-16 India’s coal shortfall ended. In fact, power plants—which are the largest users of coal—reported an oversupply of coal, a situation mirrored in terms of power, with plant capacity growth outstripping power demand growth.

Almost 76 per cent of coal is consumed by the power sector, and 79 per cent of electricity generated from thermal power plants. Given that coal power plants take years to materialise, we can assume that plants in 2020 are either under operation or already planned or under construction. Given that boiler technology requires specific coal quality—sometimes fully imported, other times with blending—it is unlikely that imports will be zero by 2020 or even later.

This report calculates in detail that the Government of India target for 2020 are unnecessary, and it shows, in fact, that India does not need more than 1200 MT of coal in that period, and that too is a very generous estimate.

Also see a model so that analysts/scholars/decision-makers can modify key assumptions made in this report to visualise their impact. Also read notes from the launch event.

All content reflects the individual views of the author(s). Brookings India does not hold an institutional view on any subject.