This piece was updated on March 28, 2023, to more accurately represent the Debt Relief for a Green and Inclusive Recovery proposal.

In the lead up to the COP27 climate summit, the urgency of climate change had never been clearer. A third of Pakistan had submerged under water, half of China’s landmass was parched by drought, and repeated heatwaves set Europe ablaze with some regions losing up to 80% of their harvest.

Despite this, the global community in Sharm El-Sheikh, Egypt was unable to muster the financial commitments needed to adequately respond to the climate crisis. Achieving the Paris Agreement’s temperature and adaptation goals requires an estimated global investment of $3-6 trillion a year until 2050, but current investment levels are nearly a tenth of that, just around $630 billion. Further, according to the Intergovernmental Panel on Climate Change (IPCC), annual climate finance to developing countries needs to increase by four to eight times by 2030, yet COP27’s new finance pledges came nowhere near this target, and no headway was made on a new 2025 finance goal.

There were some victories, like the establishment of the Global Shield fund for climate risk, and a historical Loss and Damage Fund to help countries recover from climate impacts. But the details of these funds could take years to formalize before any country sees the proceeds. In the meantime, emerging market and developing economies will continue to face the brunt of the impacts of climate change with the fewest resources, while also being the least responsible for warming the planet.

Given this context, a new tool, debt-for-adaptations swaps, could be a game changing way to accelerate the lethargic pace at which climate finance is made accessible to countries desperately in need.

Vulnerable developing countries deserve financial support from those who got us into this situation in the first place

In a debt-for-adaptation swap, countries who borrowed money from other nations or multilateral development banks (e.g., the IMF and World Bank) could have that debt forgiven, if the money that was to be spent on repayment was instead diverted to climate adaptation and resilience projects. This has an opportunity to both alleviate debt distress and increase funding to adaptation which has proved far more difficult to finance than clean power. There has been a lot of interest in debt swaps from developing countries and multilateral development banks, especially at COP27, but not specifically focused on adaptation.

The U.S. should take on a leading role in this effort, not only because it is the right thing to do but also because it advances U.S. interests in its geo-strategic rivalry with China. As developing nations look to see who will help them out of the climate catastrophe, the U.S. has a chance to pioneer an alternate model to China’s Belt and Road Initiative, which is entrapping developing countries into loans and debt distress.

Moreso, the sovereign debt burden of developing countries is largely a historical product of colonialism. By championing debt-for-adaptation swaps, the Biden administration can advance its environmental justice objectives and quickly channel critical resources to vulnerable communities.

The State of Play: Loans and Mitigation Dominate, Grants and Adaptation Lag Behind

There is no common, universal definition for what “climate finance” means but it generally refers to two types of financial flows: (1) climate investments which seek to generate financial returns, and (2) climate aid which is given as a grant with no expectation of repayment.

Nearly 94% of existing climate finance is in the first category1—an investment through either debt or equity where the funder is expecting some financial return. These funders include commercial banks and investors, governments, and multilateral and national finance institutions (e.g., World Bank, International Monetary Fund, U.S. International Development Finance Corporation).

The expectation of revenue generation for climate investments structurally binds the success and likelihood of deals to broader macroeconomic and political trends. Therefore, climate investment has been slow in developing countries due to a real and perceived risk of doing business in countries which may be involved in or adjacent to armed conflicts, face political or economic instability, or experience humanitarian disasters. While private investors do want to invest in the developing world, most such projects are at very high-risk levels, well above what is considered “investment grade.”

90% of all climate finance last year went exclusively to activities which mitigate greenhouse gas emissions

Projects that do meet the “investment grade” criteria are almost all focused on renewable energy. Indeed, 90% of all climate finance last year went exclusively to activities which mitigate greenhouse gas emissions. This makes sense from an investor perspective because electricity can be bought and sold, generating predictable cash flows to yield returns.

The tradeoff is that climate adaptation has been almost entirely neglected in climate finance flows despite being more urgent for many developing countries. Roughly $50 billion in adaptation finance was tracked between 2019-2020, compared to $571 billion for mitigation. The U.N. estimates that developing countries already need $70 billion per year to cover adaptation costs now and will need $140–$300 billion in 2030, rising to $280-500 billion by 2050. The damage from this year’s monsoon flood in Pakistan alone will exceed $40 billion.

There are a range of reasons why adaptation projects like drought-resistant seeds, resilient buildings, environmental restoration, or sea walls have struggled to attract private sector financing. At its core, it is more difficult to capture the benefits of adapting to climate change in a way that generates revenue. Suffice it to say, as long as profit-motive drives the majority of climate finance flows, adaptation finance will lag behind.

What adaptation lacks in revenue generation opportunities, though, it makes up for in avoided damages. Adaptation finance can help avoid the costs of infrastructure collapse, climate refugees, and potential failed states. A conservative estimate finds that by 2050, the economic cost of climate change will be between $1 trillion and $1.8 trillion (not including non-economic losses like loss of cultural sites).

The hope is that climate aid, or money that’s given without expectation of financial return (e.g., grants), can fill this gap in climate adaptation finance. Unfortunately, developed countries have channeled a comparatively meager amount of overall climate finance through grant-based instruments. In total, grants currently account for only 6% of climate finance. Between 2016-2018, grant-based bilateral climate finance accounted for 34% of all U.S. contributions ($645M), 12% of Japan’s ($1.2B), and only 3% of France’s ($146M). There have been some bright spots, however, with 91% of the U.K.’s contributions coming through grants ($1.3B), 99% of Australia’s ($111M), and 100% of Sweden’s ($482M). At COP27, developed countries failed to make headway on the Glasgow Climate Pact to double adaptation finance, nor did they define the Global Goal on Adaptation (equivalent to the Paris Agreement’s 1.5°C mitigation target).

In the U.S., there has been political reluctance to legislatively disburse funds for climate aid grants. President Biden requested $11.4 billion in climate aid every year till 2024, but Congress has authorized just $1 billion total. The politics of grant-based aid remain controversial, as Republicans and Democrats are virtually in different worlds on how to address the climate crisis and the role of the U.S. in supporting other countries.

Therefore, in the absence of a significant inflow of grant money, innovative solutions are needed to overcome the barriers to scaling up climate finance for adaptation. By using debt-for-adaptation swaps, climate finance for adaptation can be mobilized while simultaneously tackling debt distress.

Tackling the Twin Crisis of Climate Vulnerability and Debt Distress

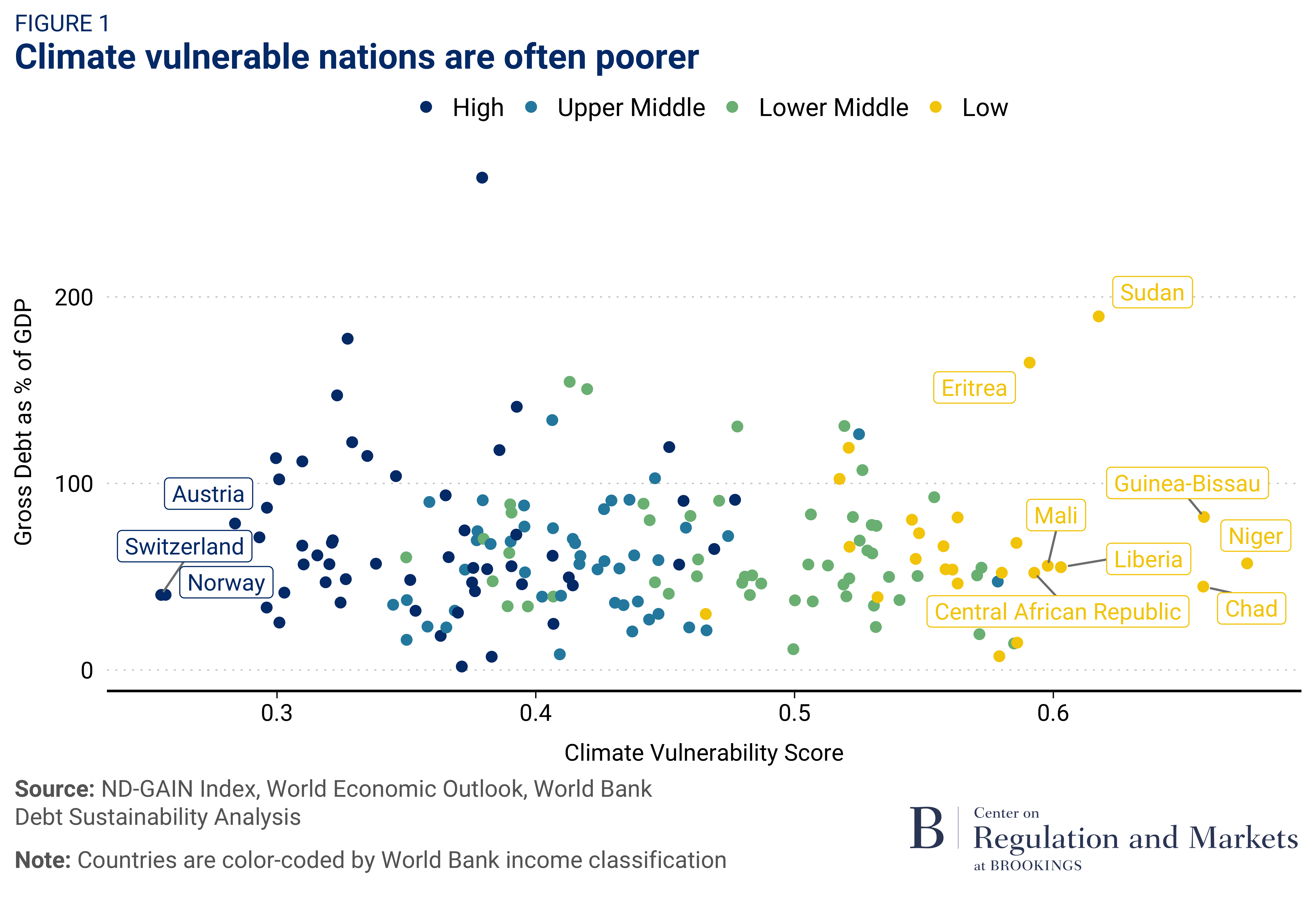

Climate-vulnerable countries tend to be poorer. Figure 12 below combines data from the Notre Dame Global Adaptation Initiative (ND-GAIN) Index, which summarizes a country’s vulnerability to climate change, and the IMF’s most recent World Economic Outlook with individual country’s income and debt levels. The chart demonstrates that virtually all low-income countries are in the upper range of climate vulnerability. In addition, many have sovereign debt levels at or above 100% of their GDP. Consequently, these countries are spending five times more on repaying their debts than fighting climate change. For example, small island developing states like those in the Caribbean are highly vulnerable to climate disasters but are spending 30-70% of their public revenue on debt repayment.

Climate-vulnerable countries tend to be poorer

Both challenges—high debt/low income and climate vulnerability—will exacerbate each other going forward in a vicious spiral. Displacement due to climate change erodes tax revenues and imposes steep costs for reconstruction and recovery, potentially requiring borrowing from international donors and banks. At the same time, high levels of debt reduce the capacity of states to sufficiently invest in climate projects due to debt repayment obligations and higher borrowing costs. High levels of debt also crowd out private sector climate investment as it becomes difficult for countries to take on more debt-financed projects. This problem is compounded by the fact that a majority of existing climate finance (61%) is executed through debt-based instruments. On top of all this, climate vulnerability itself can increase debt: One study found that climate vulnerability raised the average cost of borrowing by 1.17%, translating to $40 billion in additional interest payments over the last 10 years.

Explore an interactive version of this graph here.

Explore an interactive version of this graph here.

Many developing countries that had significant debt burdens before the pandemic are now reaching crisis levels of debt due to the expansive relief measures to hospitals, businesses, and families. The global inflation spike which followed is deepening the debt problem in at least 70 low-and-middle income countries due to rising interest rates in high-income countries; higher rates are causing emerging market currencies to depreciate and thereby raising the cost of repaying debts. Tackling these challenges together is important to interrupt this despairing cycle.

Typically, unsustainable debt situations are addressed through debt restructuring, which includes a broad parameter of actions that modify the financial structure of a country’s financial liabilities to reduce their net present value. This can sometimes (but not always) result in outright forgiveness. Restructuring may just change the timeline on which the debt is repaid (re-scheduling) or lower the interest paid on the outstanding debt (known as a haircut).

Debt restructuring for environmental protection, known as debt-for-nature swaps or debt-for-climate swaps, have been part of the sovereign debt restructuring toolkit since the Latin American debt crises of the 1980s. The first was the 1987 swap between Bolivia and Conservation International, a U.S.-based nonprofit. With $100,000 in philanthropic funding, Conservation International purchased $650,000 worth of Bolivia’s external debt from the secondary market at an 85% discount. This debt was forgiven in exchange for the Bolivian government setting aside 3.7 million acres in the Amazon Basin for conservation purposes.

Since then, the U.S. has pursued dozens of debt-for-nature swaps—though largely uncoordinated and for small-scale projects. Cumulatively, the U.S. has cancelled nearly $2 billion owed by 21 low- and middle-income countries under debt-for-nature swaps, accounting for 64% of all such bilateral deals. As a result, nearly half a billion dollars in conservation funding has been unlocked, resulting in participating countries having lower deforestation rates.

Recently, debt-for-nature swaps have increased in their sophistication. In 2018, Seychelles became the first country to participate in a debt swap to protect the oceans, resulting in a commitment to protect 30% of its marine area. The swap wiped out $21 million in debt, ending their obligations to Paris Club creditors—an informal group of 20 industrialized nations. Belize soon followed in 2021, re-purchasing $553 million, a quarter of their total public debt, in exchange for protecting 30% of its ocean and the ecologically vital Mesoamerican Reef. These were highly complex deals involving multiple stakeholders, raising questions as to whether this model is scalable or replicable.

In circumstances where the climate risks are large, implementation of adaptation or risk-mitigation activities could materially lower the sovereign risk (the risk of a country defaulting on their debt). This is where adaptation investment can work in tandem with restructuring debt.

Debt-for-Adaptation Swaps: Why We Need Them and Who Should Get Them

We propose a twist on traditional debt-for-nature swaps. Rather than exclusively focusing on conservation, recipient countries who have debt forgiven should direct those funds towards climate adaptation activities, with a focus on building resilience against sea level rise, flooding, droughts, and extreme heat. This would be a uniquely powerful tool to enable emerging and developing economies to climate-proof both their economies and public finances.

Recipient countries who have debt forgiven should direct those funds towards climate adaptation activities

Existing approaches for climate adaptation financing have not worked, as evidenced by the monumental financing gap noted above. The debt-for-adaptation approach effectively works around the lack of private sector attractiveness for adaptation financing and limited public grant-based climate aid by unleashing money that already exists. Issuing new debt could be politically difficult, but unshackling countries from pre-existing debt under bilateral or multilateral loans can be done more easily and without the same political challenges.

An added benefit is that recipient countries can use their local currencies to finance these adaptation projects rather than be exposed to foreign exchange currency risk through the debt repayment process. This structure also sweetens the pot for private investors who might be interested in investing in climate projects in debt-for-adaptation swap recipient countries, since those countries will have more fiscal space to secure debt financing and can absorb more risk going forward.

How would the swap work? The first step is determining which countries should be eligible to receive a debt-for-adaptation swap. We want to prioritize countries that face both high climate vulnerability and a high risk of debt distress.

Explore an interactive version of this graph here.

Explore an interactive version of this graph here.

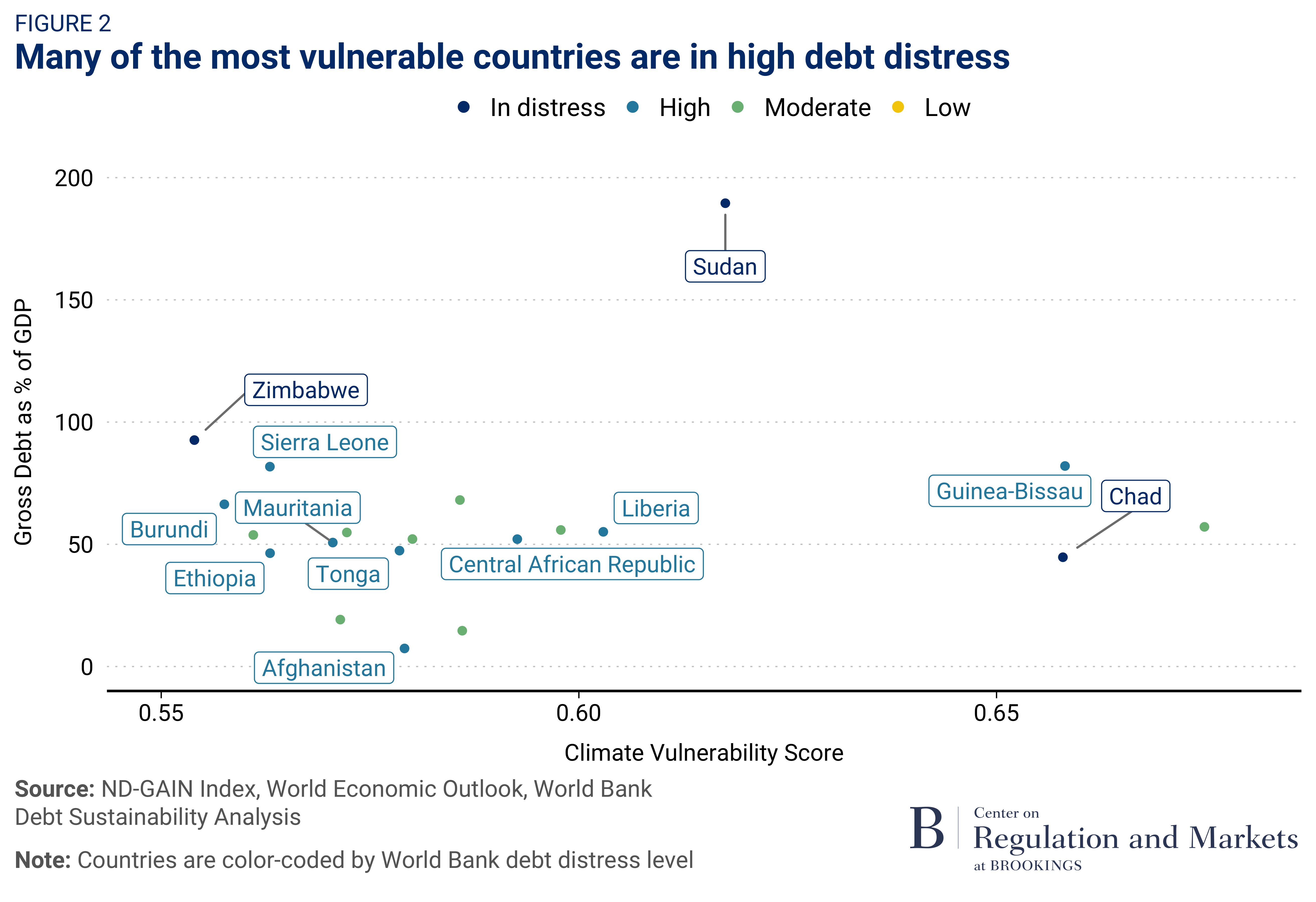

To identify the countries that meet both criteria, Figure 2 overlays the World Bank Group’s Debt Sustainability Analysis, which determines a country’s debt-carrying capacity and provides a risk rating of external and overall public debt distress, on top of the ND-GAIN and IMF World Economic Outlook data from Figure 1.

Here, we focus on the right half of Figure 1, looking at the most climate vulnerable countries, and indicate which ones the World Bank has determined are already in debt distress or at high risk of becoming distressed. Based on this analysis, the first tranche of countries which should be considered for a debt-for-adaptation swap are Chad, Sudan, and Zimbabwe—countries which are extremely vulnerable to climate change and are already in debt distress. After that, a handful of other countries that are also quite vulnerable and at high risk of debt distress should be considered: Guinea-Bissau, Liberia, Tonga, Mauritania, Sierra Leone, Burundi, Ethiopia, and Afghanistan.

Next, we want to identify whether these countries are already receiving substantial funding from institutions like the United Nations Green Climate Fund (GCF), the world’s largest source of climate finance. If they are not, then they would benefit from bilateral and multilateral debt relief to finance new adaptation projects. In Figure 3, we use data from the GCF Open Data Library to look at how U.N. GCF funding is allocated across climate vulnerable countries. We plot total GCF funding for each country against its ND-GAIN climate vulnerability score (on the x-axis), its income level (shown by the color of the circle), and its debt profile (the larger the circle, the larger the country’s debt as a percent of GDP).

Explore an interactive version of this graph here.

Explore an interactive version of this graph here.

Based on Figure 3, it is evident that the countries with the highest climate vulnerability are not receiving a substantial amount of GCF money. The countries getting the most financing are mostly lower-middle-income countries, like India, Indonesia, and Mongolia, which are not as climate vulnerable and have relatively modest debt levels. This means that debt-for-adaptation swaps are a good fit for the 11 countries identified above as they have high climate vulnerability, receive little international support, and have higher debt levels.

Countries with the highest climate vulnerability are not receiving a substantial amount of GCF money

Lastly, we can estimate the upper end of resources that can be freed up per country under a debt-for-adaptation swap. Table 1 shows that, for the 11 highest-priority countries, a total of $32 billion in external debt is sitting on the table to be forgiven by bilateral and multilateral creditors alone—not far from the $46 billion in total adaptation finance tracked from 2019-2020 globally.

Table 1: International Monetary Fund, Annex Table 1.1, August 2022

| Countries | External Debt (Excl. Private) in Billions | Private Debt in Billions |

| Afghanistan | 2.0 | 0.0 |

| Burundi | 0.5 | 0.0 |

| Ethiopia | 22.5 | 6.5 |

| Guinea-Bissau | 0.5 | 0.2 |

| Liberia | 1.0 | 0.0 |

| Mauritania | 4.2 | 0.0 |

| Sierra Leone | 1.1 | 0.2 |

| Tonga | 0.2 | 0 |

| Chad | N/A | N/A |

| Sudan | N/A | N/A |

| Zimbabwe | N/A | N/A |

| Total | $32B | $6.9B |

Policy Recommendations

We propose five tangible steps for the United States to move the ball forward on debt-for-adaptation swaps.

First, it should leverage its role as the primary funder of the IMF and World Bank to bring together the Paris Club creditors and get them serious about putting debt-for-adaptation swaps on the front-burner of the climate finance discussion, particularly for Chad, Sudan, Zimbabwe, Guinea-Bissau, Liberia, Tonga, Mauritania, Sierra Leone, Burundi, Ethiopia, and Afghanistan. These countries are the most vulnerable in the world and have the fewest resources to deal with it—both in terms of domestic fiscal space and international support.

In addition, in the lead up to COP28, the U.S. should advocate for the inclusion of debt forgiveness towards the annual $100 billion climate finance goal set by developed countries. This will motivate other developed-nation debt holders to also pursue bilateral debt-for-adaptation swaps.

Second, to get private creditors on board for more expansive deals, the U.S. should work to convene a network of developed-country finance ministries, private financial institutions, and credit rating agencies to establish a framework for debt restructuring. One promising approach is Project Debt Relief for a Green and Inclusive Recovery, which proposes a new facility administered by the World Bank whereby private creditors would swap old debt for a new sustainability-linked bond as part of a broad-based debt relief initiative which includes a significant haircut that is comparable to all other bilateral and multilateral creditors. The facility provides credit enhancements and guarantees for the new bonds so that collateral would be released to private creditors in the event of any missed payments. This should be explored more seriously for a longer-term solution to the debt and climate vulnerability cycle, which includes middle-income countries.

Third, given that many of the proposed countries for the initial tranche of swaps face endemic corruption and financial mismanagement issues, providing rigorous technical assistance through the U.S. State Department, U.S. Agency for International Development (USAID), the World Bank, and IMF will be critical. This will ensure that the freed-up funds are supervised to be spent on adaptation and resilience projects, not diverted into kickbacks for public officials. For countries like Chad, Sudan, and Zimbabwe, where corruption is widespread, or Afghanistan, which has been seized by the Taliban again, we would have to proceed with caution to narrowly scope out what is possible.

Fourth, the U.S. should convene adaptation and resilience experts to develop minimum required acceptable adaptation activities that the debt repayment funds would go towards and the monitoring and evaluation processes that would oversee it. In addition to curating a detailed list of types of adaptation/resilience projects, developing key performance indicators like a minimum climate impact per dollar of financial support can help keep countries accountable to their swap promises. This can also help minimize domestic blowback to governments prioritizing climate adaptation over traditional anti-poverty services by explicitly tying the two together. For example, drought resistant seeds would bolster food security, while wastewater treatment and desalination projects would improve access to clean water. External public debt service is currently greater than health, education, and social protection expenditures in many developing countries—debt-for-adaptation swaps present an opportunity to tackle this problem based on a broad definition of adaptation activities.

Lastly, the Biden administration should align the push for debt-for-adaptation swaps under the broader effort to advance environmental justice and counter Chinese influence—a framing that will bring in even more stakeholders who share these goals. Rectifying the current debt crisis that many of these countries face would not only help right historical wrongs but sway developing countries to align themselves with the U.S. instead of inking deals on China’s Belt and Road Initiative which are only pushing them deeper in debt. Debt-for-adaptation swaps could be part of the U.S.’s “Climate” Belt and Road by stepping up in a time of need, to invest in green infrastructure and disaster recovery which will help minimize the coming environmental damages.

Conclusion

It is undeniable that there is not enough money to address climate change and whatever has been made available is moving too slowly. At the 2009 United Nations Climate Change Conference in Copenhagen, developed countries pledged to channel $100 billion annually to emerging markets and developing economies to adapt to and mitigate against climate change. The $100 billion mark has never been met and COP27 failed to move the needle on reaching that target.

Among existing funds, climate adaptation is being sorely neglected while developing countries are facing an onslaught of environmental catastrophes

Among existing funds, climate adaptation is being sorely neglected while developing countries are facing an onslaught of environmental catastrophes. These countries simply cannot wait out the years needed for the governance structure and capitalization process of the COP27 Global Shield and Loss and Damage Fund to play out. Developed countries have a moral obligation to do more and at a faster pace.

It will remain difficult for adaptation projects to generate revenues like renewable energy projects do, so the prospect of the private sector mobilizing finances for adaptation is slim. As a result, creative financing mechanisms are needed to fill the gap.

A debt-for-adaptation swap is an elegant tool which can have a transformative effect on tackling the vicious circle of unsustainable debt burdens exacerbated by climate change. By reducing or eliminating bilateral and multilateral debt obligations conditional on those funds being committed to adaptation activities, developed countries have an opportunity to immediately unleash $32 billion. This will help developing nations protect their people from climate damages without having to wait on grant-based finance or other aid.

Business as usual will not stem the climate crisis. The wealthy, developed nations who achieved their high standards of living through centuries of pollution and wealth extraction from the developing world must help address the mess they created. Vulnerable developing countries deserve financial support from those who got us into this situation in the first place. Further, if action is not taken, the risks of instability, climate refugees, and conflicts will continue to grow, eventually threatening the security of developed nations. Although the world’s advanced economies have yet to provide climate finance on the scale needed, it’s not too late to act.

-

Footnotes

- Author’s calculations, based on data provided on page 4, “Global Landscape of Climate Finance 2021” by the Climate Policy Initiative

- Interactive versions of the figures in this article are available here.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).