With over 5 million recorded cases of COVID-19 across the globe and cases rising exponentially in many regions, the impacts of the pandemic are reverberating across sectors. While governments have put in place measures to ensure the health and well-being of the populations they serve, the nature of the virus and the measures being implemented to protect the population have meant unprecedented disruptions in economic activity and dramatic shifts in the delivery of critical social services around the world.

In this policy brief, I explore the impact of the pandemic on social services that are funded through impact bonds, an innovative outcome-based financing mechanism in which investors provide up-front capital to service providers, with the potential for a return if selected outcomes are achieved.1

For the past five years, Brookings has followed the progress of impact bond projects and their beneficiaries, observing the successful achievement of outcomes across a variety of sectors: improved learning outcomes among primary school-aged girls in rural India, family reunification of children in out-of-home care in Australia, and sustained employment among vulnerable youth in Colombia, to name a few. During this time, the financing structure has shifted focus toward outcomes for government, donor agencies, and philanthropy. We have witnessed the empowerment of service providers to collect and utilize data to better serve their beneficiaries, and an increase in collaboration across public, private, and nonprofit sectors

Since the start of the pandemic, I have been concerned with how the most disadvantaged populations around the world—including the nearly 1.2 million served through the active impact bond projects that Brookings researches—would be impacted. Would these vulnerable populations be able to protect themselves from the virus through social distancing? How would government-mandated stay-at-home orders, or the unemployment, illness, or death of a breadwinner impact incomes? How would the lockdowns and stresses of the pandemic impact physical and mental safety and well-being, including such issues as depression, substance abuse, and domestic violence? Would these vulnerable populations continue to receive some of the crucial services they had been receiving through the impact bond?

I also wondered if and how the impact bond-funded projects would fare relative to traditionally based financed projects. I ask this question because impact bonds are different from traditional grant-based financing in a variety of ways that could potentially improve their ability to cope with the shock or could create additional challenges.

|

Box 1: Key differences between traditional grant-based funding and impact bonds

In impact bonds:

1. Investors provide capital to service providers upfront;

2. Service providers have the autonomy to decide which services; how to deliver them; and the frequency and dosage of services;

3. Service providers often receive support to improve their systems of data collection and adaptive management capacity during implementation;

4. Governance structures tend to be strong due the contractual agreements;

5. Outcome metrics are agreed upon across all stakeholders at the start of the project rather than inputs or activities;

6. Third-party verification of data or evaluation is a critical part of the structure;

7. Investors bear operational risk and outcome funders must pay investors only if outcomes are achieved; and

8. Contracts are often longer (average length of five years). |

Source: Authors

I reached out to the impact bond community2 and surveyed 20 impact bond projects and one outcomes fund across five3 impact bond sectors (see Figure 1) and across geographies (Australia, Cambodia, Cameroon, Canada, Colombia, India, Kenya, Portugal, South Africa, Uganda, United Kingdom, and United States) to gain insight into these questions at this stage of the pandemic (See Tables 1-5).

The scale of the problem and compounding existing challenges

With reports of widespread indirect effects of the COVID-19 pandemic due to stay-at-home orders and the closing of nonessential businesses and schools, I expected that the impacts would be substantial among the populations served by the 144 active impact bond projects across the globe spanning the unemployment, social welfare, education, health, criminal justice, and environment sectors. Indeed, the responses from the survey regarding the immediate effect of the pandemic on the impact bond beneficiary populations were universal—the marginalized populations who are being served by impact bonds are among the most vulnerable to the crisis. These populations are finding it harder to find and keep a job; mental health risks are on the rise due to anxiety, isolation, and job loss; and children are facing learning losses and other potential risks while not in school and health risks, including, but not limited to, the virus itself are rising.

Notes: Social welfare sector includes poverty reduction, child and family welfare, and homelessness. Of 194 contracted impact bonds globally, 144 are currently active.

The two primary sectors in impact bonds, employment and social welfare, represent 23 and 37.5 percent of all active impact bonds, respectively, with social welfare including such issues as children placed in out-of-home care, homelessness, poverty reduction, and disengaged youth.

In Colombia, where the first social impact bond (SIB) for a low- and middle-income country was developed for employment, and a second SIB and an outcome fund for employment are underway, unemployment is expected to grow by over 1 million individuals as a result of the current crisis. This high unemployment makes it very difficult for individuals served under these impact bond programs to connect with employment opportunities. The situation is similar in the United States. The Adult Basic Education/MA pathways SIB in Massachusetts, launched in June 2017, aims to support refugee and immigrant communities in the Boston area by providing vocational training and English language instruction to around 2,000 individuals. Though this SIB is almost complete, given the current employment crisis in the country, beneficiaries are facing new barriers to employment that are outside the scope of the intervention. The challenges are similar in Australia, where there are nine impact bonds in implementation—one of which is in the employment sector and five in the social welfare sector—and where a steady job is a large component of addressing the social welfare challenge.

|

“It is early to say but our hypothesis is that vulnerable populations will be disproportionately impacted [by the pandemic]. For example, young job seekers with barriers to the labor market who were on the cusp of employment/recently employed, are likely to become remain/become unemployed.”

– Casey Taylor, Manager, Impact Investing at Social Ventures Australia |

In a DIB focused on poverty reduction in Kenya and Uganda, the service provider Village Enterprise provides training, mentoring, and funding to individuals from ultra-poor communities. In those countries, the impacts are widespread, according to Caroline Bernardi, chief development officer: “As a result of the pandemic, rural communities are facing food shortages, lack of information on the virus, hygiene, sanitation, and health care.”

The pandemic is also, without a doubt, straining health systems across the globe, impacting the availability of health resources and access to care and non-COVID-19-related health care services. In Canada for example, the Community Hypertension Initiative SIB which targets people at risk of hypertension—one of several comorbidities of the virus—has canceled service provision for the time being due to stay-at-home orders. The crisis is putting an enormous burden on those systems, making response to both acute and chronic health issues a challenge. In Cameroon, for example, where there is an impact bond that supports critical cataract surgery, patients who were diagnosed but not yet operated on must wait indefinitely for surgery, risking blindness.

The education sector has also seen large impacts from the pandemic with nearly 190 countries that have closed schools, impacting over 1.5 billion students worldwide. In the Quality Education India (QEI) DIB, all participating schools have closed, and some migrant students have returned to their rural communities. Beyond lost learning opportunities, the survey respondents highlighted the ripple effects that school closures are having on children and their communities. Evidence from previous crises points to girls and women being particularly vulnerable to sexual violence and exploitation, early marriage, and teenage pregnancy. The Impact Bond Innovation Fund (IBIF) for example—one of two education impact bonds in developing countries (18 operating globally)—which provides early childhood development (ECD) services in impoverished neighborhoods outside of Cape Town, South Africa, describes a multitude of challenges.

|

“For many beneficiaries, lockdown presents great challenges, ranging from lack of space, indoors and outside, to increased levels of anxiety. Child protection and gender-based violence issues are of particular concern, with potential for increased levels of domestic violence / abuse during the lockdown period. Many caregivers may have existing health conditions, or are elderly, which could render them particularly vulnerable to COVID-19. Reduced access to work and income, and food insecurity, are likely to be real concerns for many families during and after the lockdown.”

– Joint response from Foundation for Community Work, mother2mothers, and Volta Capital |

There are only two active impact bonds in the environment and agriculture sector. The most recently contracted environmental impact bond, and the only active project in a low-income country, is the Cambodia Sanitation DIB. This DIB aims to improve access to sanitation, making Cambodia a defecation-free country by 2025. Currently Cambodia has the highest rate of open defecation in the region—with 8 in 10 Cambodians defecating in fields, open water, or other spaces instead of a toilet. Furthermore 1 in 3 Cambodians use water from non-improved sources, which indicates that human waste is not properly separated from human contact. With COVID-19 spreading, providing access to clean water has gained even greater urgency for low-income communities across the globe.

Impacts of and responses to the COVID-19 crisis

Since impact bonds focus on outcomes, allow for, and in fact foster, flexibility in modes of service delivery, I posited that adaptation in service delivery could be one area in which impact bond-funded projects could potentially fare better than programs where the focus is on inputs and activities. On the other hand, having outcome metrics which are locked in with contracts could render impact bonds less flexible in the face of the crisis. I also hypothesized that the governance structure, including investors, service providers, intermediaries (often), and outcome funders, could provide a relatively stronger framework for joint problem-solving since it is in all parties’ interest that the impact bond succeed.

In response to the survey, stakeholders described the impacts of the pandemic on service delivery; on monitoring, evaluation, and outcome achievement; and on impact bond contracts including financial implications. I also surveyed stakeholders on their perspectives with respect to how projects funded through impact bonds might cope with the crisis compared to traditionally funded projects.

Impact on service delivery

In all countries in the sample of impact bonds surveyed, strict stay-at-home orders have been implemented making it very difficult or even impossible to deliver services as usual. But there is some variation in this sample in service delivery (see Figure 2). In the health sector, for example, while the intervention focused on hypertension prevention in Canada has, in an initial stage, completely suspended services, in the SIB that provides critical blindness-preventing cataract surgery in Cameroon, doctors have begun to provide virtual counseling and follow-up consultations for patients. The Ways to Wellness SIB in the United Kingdom, supporting individuals with long-term health conditions, has had to expand its interventions to address more immediate coping and crisis management needs. Furthermore, due to COVID-19, key areas of further support have emerged, including emotional and psychosocial support, access to provisions or supplies (e.g., food and medications), and providing crisis response—for example, with self-harm or domestic violence.

In several of the child welfare-focused impact bonds in Australia, service providers are adapting how services are delivered. This includes providing support using phone, email, text, and video conferencing rather than face-to-face interactions with participants, restricting group activities and limiting the number of participants allowed to visit centers at any one time. In the IBIF ECD SIB in South Africa, all face-to-face ECD activities, including parenting groups and mobile playgroup visits, have been suspended and transitioned to a virtual platform for the time being. Close attention is being given to socio-emotional needs and the risk for domestic violence, both in the families of the beneficiaries as well as for the community workers in the program. The ability to provide these modified services is due in large part to the impact bond structure including two intermediary parties (mothers2mothers and Volta Capital), which have worked closely with FCW to make these changes. The focus on outcomes as opposed to inputs, as well as the strong governance structure of the impact bond, also allowed for flexibility in service delivery.

The GM Home Partnership SIB, an impact bond addressing homelessness in the U.K., has both made adaptions and expanded service provisions. Understanding that self-isolation is impossible while homeless, service providers have had to limit face-to-face contact to the most vulnerable users, have adjusted services to respond to emerging needs and policy changes, and are in conversation with commissioners to adjust outcome frameworks and contractual arrangements. In an impact bond supporting small business owners in Kenya and Uganda, the service provider Village Enterprise has also suspended regular in-person field operations (training and mentoring of business groups, as well as savings group gatherings) until government restrictions are lifted and has shifted to remote working and remote mentoring of business owners.

|

“Over the past weeks, Village Enterprise took swift action to support our entrepreneurs and their families during this crisis. Our field staff made calls to over 4,000 business owners and 465 business savings group leaders (in a two-week period) to understand their challenges and provide remote mentoring and vital health information. Using cell phones, Village Enterprise field staff will continue to mentor and provide information to our business owners to ensure their health, safety, and financial resilience during this crisis. We are working on upgrading technological capabilities that we had already been prioritizing organizationally to provide remote support to our business owners and communities during the period of closure.”

– Caroline Bernardi, Chief Development Officer, Village Enterprise |

While initial impact of school closing on learning in the QEI DIB was minimized since the lockdown occurred toward the end of the school year, longer-term impacts may be substantial, and alternative service delivery solutions are imperative. Abha Thorat, executive director of Social Finance at British Asian Trust, responded in the survey: “As a consortium, we are waiting for several uncertainties to reduce in the coming weeks, and in the meanwhile assessing what options lie ahead of us and how we can make the correct decisions to ensure that learning outcomes continue to be achieved in the following years of the program.” Indeed, a recent Brookings Institution blog post notes a reality that rings true for India: “Less than 25 percent of low-income countries currently provide any type of remote learning, and of these, the majority are using TV and radio. In contrast, close to 90 percent of high-income countries are providing remote learning opportunities, nearly all of which are provided online.” In the QEI DIB moving forward, technology constraints combined with the pandemic forcing many migrant children to return to their rural communities will make service delivery very difficult for the near 200,000 children served through four interventions. Alternative and low-cost solutions such as radio, television, or WhatsApp based-learning may be the best options in this context.

Both the employment SIB, in the Municipality of Cali and the new Outcomes Fund for Employment in Colombia, face challenges in the employment and retention of vulnerable people in stable and quality jobs, many of which are in the service industry and thus have been significantly affected by this crisis. The stakeholders noted that the flexibility that characterizes outcome contracts has become very evident as much needed contingency plans come into play. At this stage in the pandemic, they are exploring alternative employment opportunities that have arisen within certain in-demand sectors and are using virtual interviews to connect individuals with potential employers. They also highlighted the flexibility to test and adapt throughout this process in the coming months (or longer), so that they can continuously improve the intervention.

Impact on monitoring, evaluation, and outcome achievement

Given the focus on outcome achievement, a critical piece of the impact bond design centers around monitoring and evaluation. Data collection and analysis during the implementation period feeds into adjustments in service delivery (see Figure 3). Furthermore, payments to the investors who have provided capital to service providers depend on outcome verification or evaluation. On the one hand, this element potentially brings more complexity and even more rigidity (say, if there is a randomized controlled trial in place that limits flexibility) to impact bond projects than traditionally funded projects. On the other hand, if the monitoring and evaluation structures have meant that data collection systems have been introduced as a result of the impact bond, this could be a benefit. Furthermore, in the case of a shock, a rigorous evaluation can help to parse out the effects of the shock from the intervention. These elements, while not necessarily absent from traditional grant financing, are more common in the impact bond structure.

There are a range of scenarios possible with respect to ability to achieve outcomes as a result of the pandemic (see Figure 4). The stage of the impact bond project when the pandemic hit is an important factor in the ability to both achieve outcomes and to measure the achievement of those outcomes. In the Village Enterprise project in Kenya and Uganda, for example, an evaluation that was meant to take place in April 2020 had to be postponed. Doug Emeott, manager at Instiglio, who helped to structure this project, noted that it remains to be seen whether digital delivery of services will be effective. Furthermore, given the restrictions on moving about, it is too early to say what the impact will be on small businesses. Importantly, for this impact bond, there is a rigorous evaluation in place, meaning there is a comparison group that has experienced the same shock but without the intervention. Once data can be collected, an analysis between the two groups will be possible.

In the United States, in the Massachusetts Pathways SIB, which focuses on improving employment options of refugees and immigrants through English and vocational training, services have shifted to virtual instruction and delivery. Given, however, that the impact bond is near the end, it is expected that this shift is likely to have limited effect on the overall achievement of outcomes. The IBIF impact bond for ECD in Cape Town is also near to a close (November 2020), and much of progress has been made and measurement of metrics has occurred (also thanks to mobile monitoring). However, the stakeholders say, for one measure, relating to weekly interactions with families, it may be challenging to achieve the results under the stay-at-home orders in South Africa. For the schools taking part in the QEI DIB in India, given that the lockdown happened toward the end of the school year, end-line results for the second year of the program had already been collected for nearly all the programs, which means that outcome achievement and investor payments will not be immediately impacted. However, the stakeholders noted, it is too early to say to what extent the program’s ability to achieve outcomes will be impacted for years three and four. The assumption is that the longer the schools are closed, the higher the impact will be on student learning. Evidence from previous crises such as Ebola demonstrate substantial learning loss with particular impacts on girls. In India, where already 1 in 10 girls ages 11 to 14 were out of school before the crisis hit, this could have devastating long-term effects.

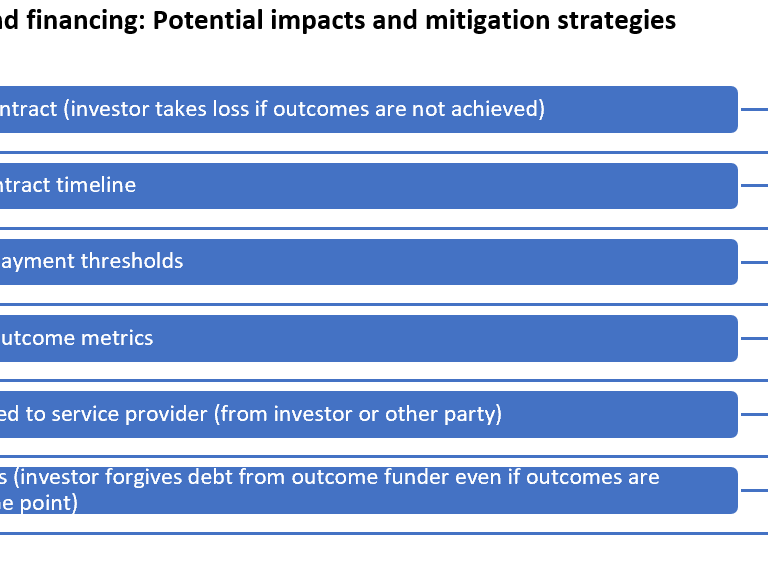

Impact on contracts and financial implications of impact bonds

Some stakeholders are considering modifications to the impact bond contracts because of their concern that outcomes will not be achieved in the given contract period because of the pandemic (see Figure 5). In such cases, all parties in the impact bond must agree to these adjustments which could be either a benefit or a challenge depending on how aligned the stakeholders are. I hypothesize however that the type of investors that generally engage in impact bonds—impact investors who are interested in both the social and financial return—would prefer to make adjustments to increase the possibility of achieving outcomes and returns (albeit delayed) rather than no outcome achievement and no return. The ability to do so will also be highly dependent on the stage of the contract and availability of funds to cover, for example, running costs and staff salaries.

The stakeholders in the IBIF ECD impact bond in Cape Town noted that they are in the process of developing revised definitions of the measure and/or targets that consider the realities of virtual service delivery. It remains unclear if this could impact investor returns. In the Canadian Hypertension SIB, Adam Jagelewski of MaRS Centre for Impact Investing predicts that the impacts of the pandemic would be so substantial on the outcomes, that an extension of the contract would likely be necessary to achieve the outcomes. Joao Machado, Fund Manager at Portugal Social Innovation (PSI) (a government initiative), stated that for three SIBs focused on reducing school dropouts, the outcome funder PSI had announced to the network of investees, social investors, and impact co-investors their openness to adopt more flexible terms as a result of the pandemic. This could include a potential extension of project delivery timeline or adjustment of indicators. They noted that increasing capital to the service providers to face their COVID-19-related challenges would be unlikely due to the European Funds’ strict requirements.

In the Cameroon Cataract Bond, the hospital’s business model is built around a cross-subsidization model for financial sustainability wherein full-paying patients subsidize lower-income patients who receive free and subsidized surgery. With the great majority of its revenue from patient services currently suspended, there are immediate and potentially longer-term financial implications. The stakeholders from the impact bond noted that the hospital is still paying salaries for all staff and discussing options for bridge funding during this period to ensure that the hospital is ready to continue operations in full force after the shutdown has ended.

Are impact bond-funded projects better able to mitigate shocks than traditionally financed ones?

The impact bond has a multitude of stakeholders: service providers, investors, outcome funders, the intermediaries and, at the center of the impact bond, the beneficiaries. The financial impact of any external crisis like the pandemic depends largely on who bears the operational risk. As mentioned above, in an impact bond, this risk is shifted from the outcome funder (the government or a third party such as a donor agency) and from the service provider to the external investor. As noted by many of the stakeholders above, this risk shift largely protects the service providers from financial loss resulting from outcomes not being achieved. The same goes for outcome funders who don’t have to pay for outcomes not achieved. This means that, unless targets or contract dates are shifted because of the pandemic, depending on how far along the impact bond is, this could result in a financial loss to investors. However, if these investors normally provide grants unconditional on outcome achievement, they would not necessarily be worse off in the impact bond case unless the time spent on the impact bond was greater that than for a traditional grant (which is highly probable). If these investors would have invested elsewhere with the potential for a return, it is unclear if they would have been better or worse off because of the pandemic given the impact to the global economy.

|

“If contract amendments are not made to mitigate the impact of COVID-19, then outcomes funded programs would likely be worse off than traditionally funded projects. This is particularly relevant for employment-focused programs, and programs which require group activities. From what I have heard recently from block-funded service delivery orgs, the government contract managers are being really flexible about KPIs during COVID-19 (i.e. there would be no negative consequences if input/activities reported are lower than planned.) Generally, I also think it is quite hard for block-funded contracts to be lost unless the program at a state/national level is defunded, or if the provider commits a material contract breach.”

– Casey Taylor, Manager, Impact Investing at Social Ventures Australia |

There are potentially some risks for service providers and outcome funders as well, however. What if targets aren’t shifted? From the survey, it seems clear that service providers are willing to go to great lengths to ensure that their beneficiaries are taken care of to the extent possible and furthermore, do not want to risk their reputation if outcomes aren’t achieved given the amount of attention on these service providers due to the impact bond. This could mean significant unfunded or underfunded investments on the part of service providers. For outcome funders, there is non-disbursement risk in the case of not achieving outcomes within a certain period which may have budgeting and planning impacts.

|

“There are financial implications for all parties involved. For outcome funders, changes in expected time frame needed to achieve results means that outcome payments will not be disbursed as expected in the coming months. In the implementation, this delay in the expected results, and therefore payments, represents additional operational costs for the service providers and intermediary to continue the intervention through the contingency. For investors, elevated operational costs and extended time frames may also lead to an eventual need for additional capital requirements in order to reach the desired impact for this vulnerable population, and which may, in turn, have an effect in the SIB’s expected financial return.”

– Corporacion Inversor, Colombia |

Several of the stakeholders noted however that the governance structure of impact bonds could help to ease these risks. Although the stakeholders from the Cameroon Cataract Impact Bond thought that it was still too early to say whether the service provider (the hospital) is better or worse off for using an impact bond, they did note that, “Given the large and diverse group of funders and technical experts that make up the Cataract Bond coalition, the hospital is potentially in a better position than if it were only funded with a simple loan or grant due to the high level of technical assistance that is now available to support problem-solving and creative solutions to this situation.” At the same time, they said that while the financing structure also presents different opportunities for flexible financing to keep the hospital afloat during this time, they are seeing that grant-making institutions are also providing a great deal of flexibility to implementers during this time, and technical assistance, as well.

Bridges Fund Management, a key investor in several UK impact bonds including WLZ SIB, Ways to Wellness SIB, and GM Homes Partnership SIB, believes their impact bond structure provided them the data and flexibility to adapt during this time of crisis.

|

“If organizations delivering government and/or donor contracts are working to service specifications, payment mechanisms, or evaluation frameworks which tie them to one pre-determined intervention or method of delivery, it can be difficult to adapt to changing circumstances. With our “impact bond” contracts, we typically agree to a set of progress metrics with the commissioner that reflect tangible improvements to people’s lives. There is very clear accountability for delivering results, but we have a lot of flexibility as to how the project is delivered. That means we can work collaboratively with government and our delivery partners, using real-time data to learn, adapt, and improve delivery. We were able to advance extra funding to our partners where needed so they can protect their people, maintain continuity of services (all but one have been able to keep delivering throughout lockdown), and keep innovating to achieve better outcomes for the people served.”

– Mila Lukic, Partner at Bridges Fund Management |

The stakeholders for the IBIF in South Africa expressed that the impact bond structure most certainly improved the resilience of the project due to the governance structure element but also due to the flexibility and length of the contract in the impact bond compared to grants.

|

“Typically, the work of the IBIF implementing partner, FCW, is funded primarily or exclusively by government on an annual basis, with limited funding provision for necessary components, such as monitoring and evaluation, etc., and limited or no contingency provision for any kind of crisis. SIB funding has provided FCW with greater stability and budget flexibility, as well as capacity building support that has helped to strengthen both program delivery and institutional stability. In this time of crisis, the ongoing support of the intermediaries, as well as a budget with some fungibility, is enabling FCW to respond rapidly and innovatively to the situation to allow beneficiaries services to continue. It is very unlikely that this would have been possible with FCW’s traditional funding model.”

– Joint response from Foundation for Community Work, mother2mothers, and Volta Capital |

The stakeholders from the QEI DIB in India also made the case that the DIB structure forces all parties to consider impacts to the program and seek solutions to potential issues that could arise from the lockdown and allow for them to plan for any future disruption. More specific to the QEI DIB, they highlighted, is the fact that it brings together strong service providers across the country, a rigorous evaluation mechanism, and several key education funders, which enables them to share learnings, document good practice, and potentially offer learnings to the wider education sector. The stakeholders from the employment SIB and Outcomes Fund in Colombia made a similar point around generation of data and learnings; they noted that the SIB is generating real-time data on the current dynamics of the Colombian labor market (e.g., number of participants that have lost their job, type of contracts in higher demand, among others). As a result of the payment by results mechanism only, they argue, that real-time information to adapt quickly and contribute to job placement and retention of vulnerable populations is possible.

Annie Knickman Plancher at Social Finance US noted the benefit of the ongoing performance management systems that are present in impact bonds, helping partners adapt in real time. Adam Jagelewski of MaRS in Canada also said that the outcome contract in place and related investor relationship has essentially locked in the stakeholders to see the program through and noted that the performance management strengthening that comes with impact bonds could make the project more nimble and resilient.

In conclusion, overall, it appears that various aspects of the impact bond benefit the most important stakeholders in the structure—the beneficiaries. First, from the survey responses, it seems that if outcomes can be achieved by pivoting services to meet the emerging needs of the population, then financing by an impact bond is a benefit. Second, the governance structure, strong relationships, and problem-solving capacity that are built up though the design of the impact bonds provide an important safety net in a time of crisis. From my observations researching impact bonds for the past five years, the strong motivation to problem-solve and collaborate stems in part from the large investment made in time and resources to design and implement impact bonds. And third, the strong systems of monitoring and evaluation that are often built into impact bonds provide useful data for problem-solving and forward-looking strategies. Some potential drawbacks of impact bonds were also noted. For example, if the outcome metrics are impossible to achieve during a crisis, such as in the case of employment in Colombia, the structure could be too rigid, and funds could remain locked in for an outcome that may no longer be relevant or achievable. Furthermore, the tight contractual structure of the impact bond such as the timeline or a rigid evaluation framework could present challenges in an impact bond.

There are two weaknesses to the analysis in this brief. First, notably, the sample of 20 impact bonds captured in the rapid survey is not representative of all impact bonds across the globe, but a reasonably broad sample across low-, middle-, and upper-income countries; regions; and the six sectors in which impact bonds are contracted were captured. Second, the analysis of impact bonds relative to the counterfactual (traditional grant-based funding) is not a rigorous comparison, and even qualitatively is only as deep as the experience of the respondents with grant-based funding. However, the majority of respondents are currently engaged in grant-based funding of other projects or the same projects within a service provider giving them some sense of the counterfactual.

The crisis has made it apparent that, while impact bonds bring flexibility around choice of inputs and a strong governance structure that allows for problem-solving, there is also a lot of weight placed on outcomes and timelines in impact bond contracts. Therefore, unless the stakeholders are willing to make adjustments to the contracts at the time of the crisis, this could be a challenge for service providers.

I recommend two things to facilitate service providers’ ability to focus exclusively on how to best serve their beneficiaries in the middle of a crisis, rather than worry if the crisis will result in failure to achieve outcomes within the contractual timelines. First, establish contingencies in impact bond contracts in the event of shocks from the start. This would allow for: 1) outcomes to be adjusted to address the immediate needs of vulnerable populations (shorter term proxies for success); 2) extra funding to support service providers to deliver services through alternative models; and 3) extensions of contracts. Second, I recommend further up-front investment in digital systems of data collection. Not only can the data be useful for alerting service providers where they should focus resources, but the digital systems themselves (in the form of mobile phones, for example) can provide an alternative way to deliver services.

I believe that there is an opportunity to capture lessons from the COVID-19 crisis in the coming years to explore how the projects and beneficiaries receiving funding via impact bonds fare in the face of crises. This could help to inform how outcome-based financed and even traditionally funded projects could be more resilient to future shocks.

Acknowledgements

We are grateful to a number of individuals who responded to the survey providing critical contributions for this policy brief, making it possible. I would like to extend appreciation to: Annie Knickman Plancher at Social Finance US; Joao Machado at Portugal Inovacao; Ricardo Coelho at Associacao Tempos Brilhantes; Adam Jagelewski at MaRS Discovery District; Abha Thorat at British Asian Trust; Dhun Davar at the UBS Optimus Foundation, Samar Bajaj at the Michael and Susan Dell Foundation; Joe Di Silvio and Liesbet Peeters at Volta Capital; Jonathan Ng at USAID; Casey Taylor at Social Ventures Australia; Caroline Bernardi at Village Enterprise; Avnish Gungadurdoss and Douglas Emeott at Instiglio; Nafeesa Rahbeeni at Western Cape Foundation for Community Work; Fiona Burtt at mothers2mothers; Christine Ternent at the Inter-American Development Bank -IDB Lab; Manuela Cleves and Cesar Rodríguez at Corporación Inversor; Daniel Uribe and Laura Casas at SIBs.CO-Fundación Corona; and Mila Lukic at Bridges Fund Management. We are also grateful to Onyeka Nwabunnia for research assistance, and to Tamar Manuelyan Atinc and Katherine Portnoy at the Brookings Institution for their helpful review and edits.

Note: The Center for Universal Education receives funding for its work on innovative financing from British Asian Trust and the UBS Optimus Foundation. The views expressed in this blog are solely those of the authors.

Tables

Table 1: Employment impact bond projects surveyed4

Table 2: Education impact bond projects surveyed

Table 3: Health impact bond projects surveyed

Table 4: Environment impact bond projects surveyed

Table 5: Social welfare impact bond projects surveyed

Citations

Johns Hopkins University. (2020). COVID-19 Map. Retrieved from https://coronavirus.jhu.edu/map.html

Joe Hallgarten. (2020). Evidence on Efforts to mitigate the negative educational impact of past disease outbreaks. https://opendocs.ids.ac.uk/opendocs/bitstream/handle/20.500.12413/15202/793_mitigating_education_effects_of_disease_outbreaks.pdf?sequence=6

U.S. Department of Labor. (2020). Unemployment Insurance Weekly Claims (COVID Impact). Retrieved from https://www.dol.gov/ui/data.pdf

Hypertension Canada. (2017). Hypertension Prevention and Control in Canada: A Strategic Approach to Save Lives, Improve Quality of Life and Reduce Health Care Costs. Retrieved from https://hypertension.ca/wp-content/uploads/2017/11/Hypertension-Framework-Update-2015_Oct_26.pdf

The World Bank. (2020).World Bank Education and COVID-19. Retrieved from https://www.worldbank.org/en/data/interactive/2020/03/24/world-bank-education-and-covid-19

Government of Canada. (2020). People who are at high risk for severe illness from COVID-19. Retrieved from https://www.canada.ca/en/public-health/services/publications/diseases-conditions/people-high-risk-for-severe-illness-covid-19.html

Sawyer, W., & Peter, W. (2020). Mass Incarceration: The Whole Pie in 2020. Prison Policy Initiative. https://www.prisonpolicy.org/reports/pie2020.html

UNICEF.(nd) Water, Sanitation, and Hygiene. Retrieved from https://www.unicef.org/cambodia/water-sanitation-and-hygiene

-

Footnotes

- Data from Brookings Global Impact Bonds Database (May 1, 2020). As of this date, 194 impact bonds had been contracted across 33 countries since the first impact bond was contracted in 2010.

- Survey responses were collected from April 15 to May 15 and are accurate as of those dates.

- We did not receive any responses from stakeholders for any of the active criminal justice impact bonds. As cases of COVID-19 increase, there has been an increased focus on corrections institutions, which are often overcrowded, making them spaces where the virus can easily spread. The decline in employment opportunities due to nonessential business closures gives rise to questions around the already limited employment possibilities for ex-offenders, and access to the resources necessary to transition back into society.

- The Colombia Outcomes Fund: In December 2019, Prosperidad Social, the national government entity of Colombia responsible for designing, articulating, and implementing public policies for social inclusion and reconciliation, with the support of the SIBs program in Colombia, SIBs.CO, structured and established the first Outcomes Fund in Latin America aiming to replicate and scale up social impact bonds in multiple sectors and develop the local market of payment by results in the country. This Outcomes Fund was also included as part of the survey for this study.