Editor’s note: This piece originally appeared in Pathways. Download the original article here.

The nation is now in the midst of a fascinating presidential campaign that, as always, creates an opportunity for a national debate on both the proper priorities of the federal government and the specific policies that Republican and Democratic candidates propose to address those priorities. My purpose in this article is to examine whether the candidates are advancing similar or different proposals on how to reduce poverty and increase economic mobility. It is useful to lay the groundwork for this exercise by first reviewing (a) what we know about poverty and economic mobility in the United States and (b) what the public thinks about poverty and economic mobility in the United States.

The Facts on Poverty and Mobility

There is surprising agreement among Democratic and Republican politicians that America has too much poverty and not enough economic mobility. Does this agreement square with the data? The facts are that the nation has made some progress against poverty since the beginning of President Lyndon Johnson’s War on Poverty in the mid-1960s, but analysts agree that progress has been slow to nonexistent since the beginning of the Great Recession in late 2007. Under a measure of poverty that counts all government-provided benefits as income, government programs reduce the nation’s poverty rate by about one-half, a credible performance.1 But there are still about 47 million poor Americans, including 15.5 million poor children. Under the official poverty measure, the nation has achieved a poverty rate among the elderly of 10 percent (whereas it was over 30% at the beginning of the War on Poverty), but the child poverty rate is more than double the rate among the elderly.2

Meanwhile, economic mobility has been stagnant in recent decades (although the longer-run trend cannot be reliably monitored), with a rate of mobility that lags behind that of most other Western democracies. The odds that a child reared in the top fifth of the income distribution will fall to the bottom fifth is 8 percent; the odds that a child reared by parents in the bottom fifth will stay in the bottom fifth is 43 percent.3 Whatever else might be said about these and related facts on economic mobility, they show that America is not a land of opportunity in which everyone has a good chance to get ahead.

The Views of Republicans and Democrats on Poverty and Opportunity

As shown by polls conducted by the Pew Research Center, the American public does not seem to be overly concerned about high poverty rates and low and stagnant economic mobility, although it is likely that many Americans don’t realize just how high poverty rates really are or just how low economic mobility rates really are.4 In annual polls conducted between 2007 and 2015, a little over half of Americans typically thought that “dealing with problems of the poor and needy should be a top priority.”5 In most of these polls, the poverty issue was no higher than 10th on the list of problems the public considered top priority for federal action. By comparison, in the 2015 poll, 76 percent rated terrorism and 75 percent rated the economy as top priorities for government action.

These numbers for the nation as a whole obscure important differences between Republicans and Democrats in their concern about the poor. In a December 2015 poll, Pew interviewed low-income (below $30,000), middle-income ($30,000– $74,999), and high-income ($75,000 or more) Republicans and Democrats and asked them if the “federal government should play a major role in helping people get out of poverty.”6 Averaged across the three income levels, Democrats were nearly 35 percentage points more likely to say poverty reduction “should play a major role” in federal policy.

This overall difference between the parties conceals a big income difference within the Republican Party in the extent of support for poverty reduction. Whereas low- and high-income Democrats differ by a mere 10 percentage points in their support for policies to reduce poverty (78% for the former; 68% for the latter), the corresponding difference for Republicans is 29 percentage points (53% of low-income Republicans support poverty-reduction policy versus only 24% of high-income Republicans).

Is the “party divide” any different when the focus shifts from poverty to inequality? In a 2014 poll,7 Pew asked conservative Republicans, moderate/liberal Republicans, moderate/conservative Democrats, and liberal Democrats whether government should do “a lot or some to reduce the gap between the rich and everyone else.”8 Again, Republicans and Democrats differed greatly, with about half of Republicans and nearly 90 percent of Democrats supporting the position that government should reduce the income gap between the “rich and everyone else” (when one averages across the two Republican groups and the two Democratic groups).

This poll also asked the same four groups whether “raising taxes on the wealthy and corporations to expand programs for the poor would do more to reduce poverty than lowering taxes on these groups to encourage economic growth.” Again, there were striking differences in the answers of the two Republican groups as compared with the two Democratic groups, although the two Republicans groups differed as much with each other as they did with the two groups of Democrats. Only 17 percent of conservative Republicans and 50 percent of moderate/liberal Republicans thought tax-and-spend was the right approach, as compared with 70 percent of moderate/conservative Democrats and 83 percent of liberal Democrats.

These poll results consistently show that Republicans are less committed to using the federal government to help the poor or to reduce the income gap between the rich and the rest of Americans. The poll results are consistent with the respective philosophies of the two parties; namely, Democrats favor higher taxes and bigger government to solve the nation’s domestic problems, including help for the poor and boosting economic mobility, while Republicans favor lower taxes, less government, and more personal and civic responsibility to deal with poverty and opportunity.9 These underlying tendencies of the electorate regarding support for higher taxes and greater government responsibility would seem to give Democrats an inherent advantage with the poor and marginalized and with voters who are concerned about poverty and opportunity.

There is, however, a modest movement within the Republican Party to bring conservative philosophy about free markets, self-sufficiency, and liberty to the fight to reduce poverty and increase economic mobility. The beginning of this movement is typically associated with Jack Kemp, a Republican member of Congress from 1971 until 1989 and the Secretary of Housing and Urban Development in the George H.W. Bush administration. Kemp frequently visited poor neighborhoods, discussed policies that would help address their problems, and urged other Republicans to pay more attention to poverty and use Republican values to develop policies and programs for the poor.10 Paul Ryan, now the Speaker of the House and perhaps the most influential Republican in Congress, is a Kemp acolyte. For the past two years, Ryan has been touring the nation, visiting inner-city neighborhoods and meeting with community leaders. His purpose has been to listen to local leaders to learn how they think government can help them fight poverty and its effects—and to persuade other Republicans to pay more attention to applying conservative principles to help the poor help themselves.

On January 9th, the Jack Kemp Foundation invited all the Republican and Democratic presidential candidates to a forum on poverty and opportunity in Columbia, South Carolina.11 The discussion was moderated by Ryan and Senator Tim Scott from South Carolina, both of whom emphasized the importance of developing a conservative agenda for reducing poverty and increasing opportunity. Six Republican presidential candidates attended the forum (John Kasich, Jeb Bush, Ben Carson, Chris Christie, Mike Huckabee, and Marco Rubio) and laid out their plans for helping the poor. All offered proposals to address poverty and opportunity. The forum also featured participation by Arthur Brooks, the President of the American Enterprise Institute, arguably the nation’s most influential right-of-center think tank, who added intellectual heft to the argument about why conservative ideas about helping the poor are important and could reshape the nation’s approach to social policy.12

Despite these recent attempts to apply Republican ideas to the problems of high poverty and low economic mobility, the polls show that rank-and-file Republicans continue to rate poverty and opportunity as less important goals of government policy, when compared to more traditional Republican issues like promoting economic growth and maintaining a strong defense against terrorism.

Obstacles to Faithfully Characterizing Policies

The foregoing at least raises the possibility that some of the Republican candidates may be more activist on issues of poverty and inequality than their constituents would imagine. Is this indeed the case? And, likewise, are the Democratic candidates more or less activist than their constituents would seemingly want?

I used three sources to locate the policies proposed or supported by the candidates, including the candidates’ websites; an online resource called “Digital Dialogue,” published by the Every Child Matters Education Fund;13 and articles written by reporters or editorial writers about the candidates. There are at least three problems that arise when trying to create an accurate account of the candidates’ proposals: The first is that there is an important distinction between (a) a position given in a brief comment during a speech, debate, or in response to a question, and (b) a bona fide proposal put forth with some detail and explanation on a candidate’s website or in a position paper. I try to be sensitive to this distinction in describing the candidates’ support for proposals to deal with poverty and opportunity, but have only modest confidence that I have made all the distinctions that would be appropriate.

Second, presumably one wants to distinguish between (a) proposals that are offered in the spirit that they might actually be implemented and (b) those that are more symbolic and offered mainly for the purpose of conveying general or particular ideological commitments. It is of course difficult to sort out those competing rationales and thereby speak to the likelihood that a given proposal would ever be implemented. In many cases, candidates not only make proposals with little or no attention to costs, but they do not tell us whether those costs would be offset by cutting other programs or by increasing taxes. Nevertheless, I do attempt to make at least some comments about feasibility, while still discussing policies that seem infeasible. The “infeasible” policies are, after all, still of interest: It is important to know what the candidates would do about poverty and opportunity if they could, both because it tells us about the candidate’s thinking on poverty and opportunity and because, once elected, presidents can sometimes change the definition of what is feasible.

The third and final problem: There is a dauntingly large and diverse range of proposals on offer. It is helpful in organizing these proposals to draw on a recent report on fighting poverty and increasing opportunity by a prestigious group of scholars organized by the American Enterprise Institute (AEI) and the Brookings Institution.14 The report issued by these two think tanks, usually portrayed as center-right and center-left respectively, argued that both the causes and solutions of poverty and opportunity fell into clusters pertaining to family, work and wages, and education. The AEI/Brookings group argued that a truly effective government strategy to reduce poverty and increase opportunity would mount simultaneous attacks in all three domains. The group proceeded to offer what they considered to be a compromise package of policy proposals that both Democrats and Republicans could support within each of the three domains. While their specific proposals will not concern us here, it is useful to classify the poverty and opportunity proposals offered by the presidential candidates in the same domains (i.e., family, work and wages, and education) used to such good effect by the AEI/Brookings group.6

What Are the Democratic Candidates Saying?

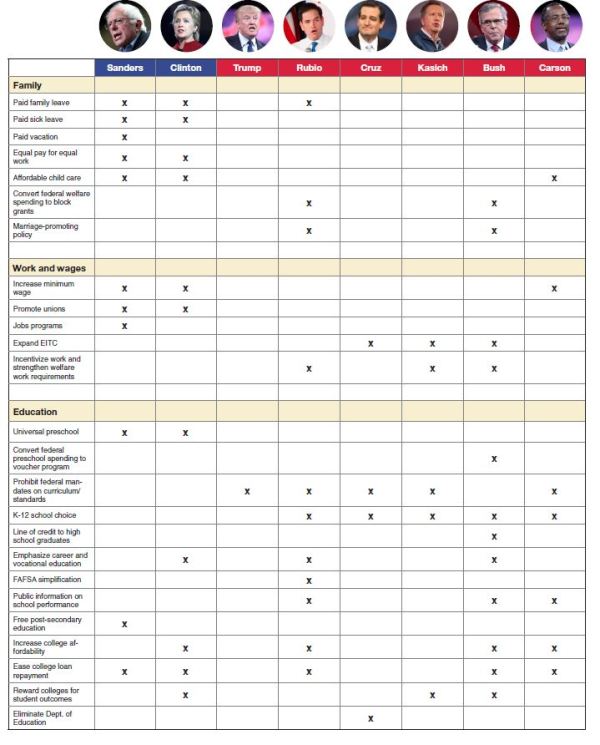

In this section, I review the proposals of the two Democratic candidates, Bernie Sanders and Hillary Clinton. The objective is to distinguish proposals that are concrete and feasible from those that come closer to “talking points.” To assist with comparisons across all the candidates, Table 1 lists, by candidate, the main policies within the domains of family, work and wages, and education.

BERNIE SANDERS

It is useful to begin with Sanders and his proposals pertaining to the family. His proposals in this domain are, relative to those he offers in other domains, quite modest. The only major proposal he advances is to require employers to provide 12 weeks of paid leave for various major health events, such as births, serious illnesses, and adoptions. He also supports the seven days of paid sick leave outlined in Senator Patty Murray’s Healthy Families Act, and 10 days of paid vacation for all workers. The family leave would be covered by a FICA-like withholding tax. According to his website, Sanders also argues that another essential part of family policy is improving the economic security of families, an objective addressed with his recommendations on work and wages.

In reviewing his proposals on work and wages, it is sometimes unclear whether they are bona fide proposals or simply general signals of his abiding commitments. Given Sanders’s long-standing self-identification as a “democratic socialist,” there is little surprise in the magnitude and cost of his poverty and opportunity proposals, which may mean that it would be more difficult to implement them.

A notable aspect of Sanders’s policy on work and wages is an increase in the federal minimum wage to $15 per hour, which could have the net effect of reducing federal and state spending because when low-income workers earn more money, they usually experience a reduction in their government-provided welfare benefits.

Sanders also proposes to help unions, in part because doing so could restore higher wages and better working conditions for low-income workers. He supports measures to make it easier for unions to organize and proposes to give special help to food workers and federal contract workers.

To increase the number of jobs available to workers, Sanders would spend $5 billion to expand high-speed broadband in underserved areas and $1 trillion total over five years to pay for infrastructure projects, such as roads, bridges, and railways.15 He proposes to spend $5.5 billion over five years providing jobs to youth; according to his estimates, this initiative would supply 1 million jobs to young workers.

Regarding education, his proposals are again sweeping and expensive. He does not have major proposals for K–12 education, but he does propose universal preschool and free public post-secondary education. His “College for All” program would, by itself, cost around $75 billion per year.

Sanders has a host of additional proposals that would have an important bearing on poverty and opportunity, but that do not fit squarely into a tripartite distinction between family, work and wages, and education. He promises, for example, to impose a tax that would force “wealthy and large corporations to pay their fair share in taxes,” and he would also stop corporations from “shifting their profits and jobs overseas.” Sanders would create a progressive estate tax that would apply to the top 0.3 percent of the wealthy (i.e., those who inherit more than $3.5 million) and would impose a tax on “Wall Street speculators.” The latter tax, like many others that he suggests, is designed not just to raise revenue, but also to reduce after-tax income at the top. In total, Sanders proposes eight new taxes or modifications of current taxes that would produce revenues on the order of $600 billion per year. In addition, he proposes to finance a large increase in Medicare coverage, essentially expanding Medicare to cover all Americans. This is secured by imposing a tax on employers and households of about $950 billion per year.

HILLARY CLINTON

Clinton, like Sanders, has an elaborate set of proposals designed to deal with poverty and opportunity.16 Her campaign lists 27 areas on her website as “Issues” on which she is making proposals. The issues range widely and include, for example, LGBT equality, national security, Wall Street and corporate America, and campus sexual assault. The information about her proposals summarized below comes primarily, though not exclusively, from these “Issue” statements on her website.

As the scorecard indicates, Clinton is sponsoring a host of provisions that would provide support to families. She supports the Equal Pay Act which, among other provisions, promotes equal pay for equal work. She also supports paid family leave, sick leave, and affordable child care. The family legislation she supports would, for example, ensure replacement of at least two-thirds of wages for 12 weeks. To pay for this proposal, Clinton would increase taxes on the wealthy.

Although Clinton’s proposals on work and wages are not as expansive or expensive as Sanders’s proposals, they are very substantial nonetheless. Like Sanders, she supports an increase in the minimum wage. She endorses an increase to $12 an hour, and has stated that an increase to $15 may be too high. Clinton also sponsors three initiatives that would help working parents pay for child care: (a) provide a tax cut to help middle class families pay for child care; (b) expand the Early Head Start program for children under age 3; and (c) provide $1,500 scholarships for quality child care to parents who are college students. She also, like Sanders, favors legislation to strengthen collective bargaining.

Within the education domain, Clinton has elaborate proposals for early childhood, K–12, and post-secondary schooling. Her proposals for preschool include two large initiatives: (a) expanding Early Head Start and (b) ensuring that within 10 years every four-year-old in the nation has access to a high-quality preschool program. Clinton refers to her extensive proposals for college as the “New College Compact.” Under the compact, she outlines a host of proposals, including (a) providing free tuition to community college; (b) ensuring that no student needs to borrow to afford tuition, books, or fees at any public four-year institution in their state; (c) offering lower interest rates for students who already have student loan debt; and (d) holding colleges responsible for improving outcomes and controlling costs, among other proposals.

What Are the Republican Candidates Saying?

This section summarizes the positions of the main Republican candidates, again using the same three-domain rubric (i.e., family, work and wages, and education), and again with the objective of distinguishing proposals that are concrete and feasible from those that come closer to “talking points.”

DONALD TRUMP

Trump has taken virtually no direct positions on any of the poverty or opportunity issues we are examining.17 His website lists the “Issues” on which Trump wishes his position to be known. The list includes U.S.-China trade reform, Veterans Administration reform, tax reform, Second Amendment rights, and immigration reform. The Digital Dialogue source that we used to search for position statements and comments in speeches of the candidates virtually always says “no recent statements or actions” regarding Trump’s positions on inequality, safety-net programs, child care, early learning and Head Start, college affordability, and so forth. It seems safe to conclude that Trump has given little indication of the specific actions he would pursue to fight poverty or increase economic opportunity.

On the other hand, it could be argued that Trump’s strong stance in favor of reducing immigration and deporting illegal immigrants, reforming the tax code and reducing tax rates for individuals and businesses, and reforming the nation’s trade policy, especially as regards China, would have effects on employment and wages by stimulating economic growth and reducing competition from foreign workers (both those in the United States and those living in other nations that compete with the United States). Trump seems to subscribe to a poverty and opportunity philosophy summarized by the aphorism that the best safety net is a job. By this logic, his goal is to produce more jobs and higher wages—and let the problems of high poverty and lack of economic mobility take care of themselves.

MARCO RUBIO

When we shift to Rubio, we now see a full complement of poverty and opportunity proposals, but they are typically implemented very differently than, say, Sanders or Clinton would implement them. For example, Rubio has a clear parental leave policy, as do Sanders and Clinton, but he would use the tax system to incentivize businesses to offer a plan for parental leave to their employees.18 He would give a 25 percent tax credit (non-refundable) for funds used to offer employees at least four weeks of paid leave of up to $4,000 per employee per year.

Perhaps Rubio’s broadest proposal is to give states what he calls a “flex fund.” Similar to the “opportunity grant” proposed by Paul Ryan (also see Bush’s “Right to Rise Grants” below), the fund would combine money from several welfare programs and give the money to states based on the size of their population in poverty. States would have great flexibility over these funds, which Rubio and other Republicans think would free them to develop innovative programs, such as pro-marriage initiatives and wage supplements that increase the incentive to work and to marry. The objective is to devise a system in which the worker will always do better by combining wages with work-based benefits than with the welfare benefits alone. Rubio would also use program evaluations to ensure that states are accountable for how they spend the flex funds.

Like most of the Republican candidates, Rubio also wants to reform the tax code to promote work. His plan would eliminate most deductions and credits and create three tax brackets of 15 percent, 25 percent, and 35 percent (as opposed to the current seven brackets). He would also modify the Child Tax Credit, making it partially refundable up to $2,500 per child. Because the new tax credit is a supplement to the current tax credit, and because it applies to both income tax and payroll tax, Rubio claims that it would be especially generous to married-couple families and would eliminate marriage penalties that exist in the current tax code. Rubio would also reduce the top corporate tax rate to 25 percent and apply that rate to all business income. Rubio argues that his tax reform would provide more incentive to work than the current tax system for individuals and that his corporate tax reform would unleash business to expand and create more jobs, thereby reducing unemployment and luring people who have left the workforce to return.

What about education? Here, Rubio is mostly silent about early childhood programs, although he once said he supported Head Start and thought that states—rather than the federal government—should control Head Start funding.19 But Rubio has extensive proposals for K–12 and post-secondary education, many of which entail increasing the amount of choice in the system. He is an advocate, for example, of choice in K–12 education, which he would pursue by creating a school choice scholarship program and by supporting the expansion of charter schools at the state and local level. In addition to opposing the Common Core standards, he would prohibit federal mandates pertaining to curriculum or various standards at the state or local level. This commitment to choice is so deep that he even cosponsored legislation that would have allowed states to opt out of any or all federal accountability requirements.

Rubio also advances quite extensive proposals at the post-secondary level. He would consolidate the various tax incentives that subsidize higher education into one easy-to-understand and easy-to-administer tax provision, as well as simplify the notoriously complex and detailed Free Application for Federal Student Aid (FAFSA). Both the Bush and Obama administrations promised to simplify the FAFSA, but had moderate success, at best, in doing so. Similarly, Rubio promises to make more information available on the performance of post-secondary institutions, including information on graduation rates for nontraditional students as well as information on employment and earnings for graduates.

Because many students, especially low-income and minority students, have difficulties paying back their college loans, Rubio proposes to change the loan repayment rules so that students would pay an amount proportional to their earnings. Students who leave school with degrees and get good jobs with relatively high pay would have higher loan repayment rates than students who did not earn a degree and have relatively low earnings. He has a number of other proposals, including making enrollment in online courses easier, increasing access to career and vocational education, and making more extensive use of apprenticeships and on-the-job training. Finally, Rubio would establish a new educational loan system, one in which approved investors could provide funds to students to pay for their education in return for a fixed percentage of their salary for a fixed period of time after the student graduates.

TED CRUZ

Like Trump, Cruz proposes various tax reforms that support families; hence he regards them as a form of pro-family policy.20 In his view, his tax reforms (as described below) would stimulate the economy, thereby creating more jobs at higher wages, which would in turn increase family income. He opposes the expansion of federal provisions on family leave. His website makes it clear that, by opposing abortion and defining marriage as a union involving one man and one woman, he is advancing the “culture of life, marriage, and family” in the nation.

Cruz further argues, again like the other Republican candidates, that tax reform is the key to unleashing the power of the American economy. He sup-ports a flat tax that he says will “reignite promise for millions of American families.” Citing a Tax Foundation study, he claims that the flat tax will boost GDP by nearly 14 percent, increase wages by over 12 percent, and create about 4.9 million new jobs.21 the economy would be further strengthened, he argues, by his proposals on regulatory reform. He also supports an expansion of the EITC by 20 percent and would retain the Child Tax Credit.

Cruz strongly supports school choice and opposes the Common Core. He is so concerned with federal interference in the educational prerogatives of states and localities that he cosponsored legislation to allow states to opt out of any and all requirements on accountability. He has also said that he would eliminate the Department of Education and send the saved money directly to the states.

JOHN KASICH

As with most Republican candidates, Kasich talks about the importance of strong families, but he opposes family leave and has no proposals specifically directed at families.22 In some of his speeches, he has argued that families need good training programs and a better education system, both of which will help parents get better jobs. He also believes in using government to supplement the income of low-income workers who have children.

As an active player in the sweeping 1996 welfare reform law (which passed when he chaired the House Budget Committee), Kasich has always emphasized the importance of work and has favored policies that require welfare recipients to work. In fact, he personally added a work requirement to the food stamp program that passed as part of the welfare reform law, and he has also sought to increase incentives to work (and raise the incomes of working families) by cutting taxes, sponsoring and enacting Ohio’s first Earned Income Tax Credit, and even doubling the value of the Ohio EITC a year after the original provision was enacted.

Finally, Kasich has several proposals to modify the 1996 welfare reform law, with the main objective of these proposals being to allow Ohio (and by implication other states) to help welfare recipients prepare for and find work. He, like nearly all the Republican candidates, thinks states should have more control over the details of most or all welfare programs.

As for education policy, Kasich favors local control of standards, testing, and regulation of the public schools, but he has also supported the Common Core curriculum. He is the only Republican candidate to emphasize his support for the Common Core, although Bush appears to have supported the Common Core in the past. Like the other Republican candidates, he is a strong supporter of school choice. As governor, he greatly increased the number of vouchers that can be used for school choice, as well as the number of schools with students who are eligible for choice vouchers. Finally, in his most innovative and far-reaching post-secondary education policy, he would make state support for post-secondary institutions dependent on the institution’s graduation rate and stability of tuition and other costs.

JEB BUSH

Bush is explicit, both in his speeches and on his website, that he would fight poverty by promoting work and family.23 He argues that children reared in married-couple families do better than children raised in single-parent families on a range of developmental outcomes. Not surprisingly, given his view on the importance of marriage, he features various marriage-promoting initiatives, including encouraging states to find ways to promote marriage, promoting family involvement among the young, and reforming the child support enforcement system. Whether these measures would actually have an impact on marriage rates is not clear.

Bush argues, again like most of the Republican candidates, that he can make jobs available by stimulating the economy. He promises a growth rate of 4 percent in the economy and the creation of 19 million new jobs thorough a three-part plan that entails “fixing” the tax code by reducing rates for individuals and businesses (as well as other changes), reducing “burdensome” regulations that stifle job creation, and ending Obamacare and several welfare programs that encourage dependency.

Bush also features a welfare reform plan that increases work incentives for people on welfare. First, he proposes to terminate nutrition programs (including food stamps), the Temporary Assistance for Needy Families (TANF) program, housing, and other programs. The outlays just for nutrition programs and housing in 2015 were about $170 billion. Bush would convert these into a block grant for states and give them the responsibility to use the money to establish what he calls “Right to Rise Grants.” States would use these grants both to meet the needs of the poor and to help families establish self-sufficiency. He argues that giving states more flexibility in the use of welfare dollars “will open the door for transformative ideas to eliminate poverty and increase opportunity.”

And, finally, Bush has a host of proposals pertaining to education. His preschool plan, like his welfare plan, is nothing if not radical. He would end all the nation’s preschool programs (freeing up around $22 billion by his estimate) and allow states to give this money to parents and permit them to choose the type and hours of preschool. Regarding K–12 education, he again has very aggressive reforms, including (a) expanding charter schools and allowing states to make federal funds “portable,” (b) rewarding schools that improve outcomes for low-income students by providing them with additional funds, (c) providing funds to reward good teachers in the lowest performing schools, and (d) requiring states to provide parents with data on student achievement in the schools in their area. His post-secondary proposals include giving high school graduates a line of credit of $50,000 that would be repaid in an amount proportional to their income after leaving college, supplementing the line of credit for low-income students with need-based Pell grants, helping students to repay their loans, and providing financial incentives to colleges with low student failure rates.

BEN CARSON

Carson stated in a speech to the Conservative Political Action Conference in 2015 that he wasn’t “interested” in eliminating the safety net. Rather, he wants to “get rid of dependency” and “find a way to allow people to excel in our society.”24 His primary emphasis, as with many Republicans, is on reforming the tax code to spur economic growth. He believes his flat tax proposal will stimulate growth, helping everyone rise up and get ahead.

Within the family domain, Carson has opposed federal mandates for paid leave policies and equal pay for equal work. However, in an interview with John Harwood of CNBC, Carson said he wanted to use tax breaks to encourage businesses to provide child care facilities for inner-city single mothers.25

If Carson is a standard Republican in the family domain, he most surely is not in the work domain. Most notably, Carson has opposed the EITC, despite the strong bipartisan backing it enjoys. He says the EITC is a “manipulation” of the tax system. Moreover, he has voiced support for a minimum wage increase.

In the September 16th GOP debate, Carson proposed a two-tier minimum wage: a “starter” wage for the young and a “sustaining” wage for older workers.26

But Carson’s most extensive proposals for increasing opportunity come in the form of education reform. Like most Republicans, he is a vocal promoter of K-12 school choice and a strong critic of federal mandates on curriculum and standards, favoring local control instead. He supports creating flexible block grants that would allow states to develop teacher evaluation systems and compensate teachers for good performance. He also highlights the high cost of college as a serious problem, especially for students from poor families, and supports more transparency in higher education financing, including “clear, easy-to-understand information about repayment rates and future earnings projections in [students’] chosen fields of study.”27 He holds that private sector student loan financing would help control federal costs. To provide an incentive for post-secondary institutions to keep tuition and fees low, he proposes making public universities pay the interest on student loans while students pay the principal.

Reflections

The first and most obvious conclusion from this review is that there is a lot of poverty activism in the current election. Both of the Democratic candidates and most of the Republican candidates are featuring policies that they believe would reduce poverty and increase mobility by strengthening families, pro-mooting work, and boosting education.

But not all candidates are activist in this sense. In each of these three areas, Trump and Cruz are far less active, with both seeming to believe that the best way to fight poverty and increase mobility is via a strong economy that is producing steady increases in jobs and wages. Of course, Democrats and Republicans alike believe that a good economy is essential to fighting poverty and increasing mobility, but only Trump and Cruz would rely almost exclusively on pro-growth policy.

There is also much consensus among the candidates on the key role of education and training in reducing poverty. The scholarly consensus on this point may account for this cross-candidate consistency: It is now widely agreed that, due in large part to technology and international competition, the American economy no longer delivers good jobs to those who aren’t educated beyond high school.28 For the last three decades or so, people who are not educated beyond high school have experienced, on average, declining income. It follows that any campaign devoted to reducing poverty and increasing upward mobility will rely on education and training proposals. All the candidates, except Trump and Cruz, have policies that are explicitly designed to ease the path to a four-year college or to help young people acquire new skills, especially by attending community colleges. Although education and training are almost always targeted, the way in which they are targeted and the depth and breadth (and cost) of the proposals differ widely across the candidates.

I have stressed the “poverty activism” of all the candidates save Trump and Cruz. There’s no denying that in all three areas, the two Democratic candidates propose more reforms—and more expensive reforms—than do the Republican candidates. The real outlier here is Sanders: He is especially generous in his proposals, the annual cost of which would be enormous. His proposal to make college free would, in and of itself, cost on the order of $75 billion a year. Although he claims to pay for his proposals, many economists would conclude that the resulting tax increases would have a negative impact on economic growth.29 If Clinton’s tax increases are more modest than those proposed by Sanders, they are considerable nonetheless.

The Republican candidates have, by contrast, not proposed any major tax increases. It is not surprising, then, that their proposals to strengthen families, promote work, and improve education are “real locative” in the sense that they would mostly use dollars that are already being spent in these areas.

But these dollars would be deployed in very different ways. The main difference: The Republicans would transfer authority over how the money is spent to parents and to states and localities. If the specific proposals being offered by Bush, Kasich, and Rubio on programs for the poor were adopted, it would represent a historic shift in responsibility and control from the federal government to the states and to parents. By contrast, Clinton and Sanders would greatly increase the amount of money controlled by the federal government, an increase mainly secured through tax increases on the rich.

The presidential election of 2016 is offering the nation a huge choice between the parties in both tax policy and the size and authority of the federal government to conduct social programs, especially programs designed to fight poverty and increase economic mobility.

Notes

1. Wimer, Christopher, Liana Fox, Irv Garfinkel, Neeraj Kaushal, and Jane Waldfogel. 2013. “Trends in Poverty with an Anchored Supplemental Poverty Measure.” New York: Columbia Population Research Center. Available at http://cupop.columbia.edu/ publications/2013.

2. DeNavas-Walt, Carmen, and Bernadette D. Proctor. 2015. Income and Poverty in the United States: 2014. Washington, D.C.: U.S. Census Bureau. Available at https://www. census.gov/content/dam/Census/library/ publications/2015/demo/p60-252.pdf.

3. Pew Charitable Trusts. 2012. Pursuing the American Dream: Economic Mobility across Generations. Washington, D.C.: Pew Charitable Trusts Economic Mobility Project.

4. Pew Research Center. 2015. “Public’s Policy Priorities Reflect Changing Conditions at Home and Abroad.” Washington, D.C.: Pew Research Center. Available at: http://www. people-press.org/2015/01/15/publics-policy-priorities-reflect-changing-conditions-at-home-and-abroad/.

5. This and other questions are designed such that the interviewer names an issue and then asks the respondent to “tell [us] if [he/ she] thinks the issue should be a top priority, important but lower priority, not too important, or should not be done.” This method allows many issues to be rated as “top priority.”

6.Dost, Meredith. 2014. “Republicans Divided by Income over Government’s Role in ‘Safety Net’ Issues.” Washington, D.C.: Pew Research Center. Available at http://www.pewresearch. org/fact-tank/2015/12/01/republicans-divided-by-income-over-governments-role-in-safety-net-issues/.

7. Menasce Horowitz, Juliana. 2014. “Inequality, Poverty, Divide Republicans More than Democrats.” Washington, D.C.: Pew Research Center. Available at http:// www.pewresearch.org/fact-tank/2014/01/29/ inequality-poverty-divide-republicans-more-than-democrats/.

8. Interviewers asked respondents, “How much, if anything, should the government do to reduce poverty?” Respondents were asked to pick their response from a list giving the choices “A lot, Some, Not much, Nothing at all, Don’t know/Refused to answer.”

9. Olasky, Marvin. 1994. The Tragedy of American Compassion. Washington, D.C.: Regnery Publishing.

10. Jack Kemp Foundation. “The Jack Kemp Oral History Project.” Available at http://www. jackkempfoundation.org/kemp-legacy-project/ on-jack-kemp-the-kemp-oral-history-project/; May, Clifford D. 1988. “Man in the News; Theorist with a Heart; Jack French Kemp.” The New York Times, December 20, 1988.

11. DeBonis, Mike. 2016. “Paul Ryan Turns the GOP Presidential Race toward a Forgotten Issue: Poverty.” Washington Post. Available at: https://www.washingtonpost.com/news/ post-politics/wp/2016/01/09/paul-ryan-turns-the-gop-presidential-race-toward-a-forgotten-issue-poverty/.

12. Arthur C. Brooks has recently published a book laying out these ideas in some detail; see The Conservative Heart. 2015. New York: HarperCollins.

13. Every Child Matters Education Fund, established in 2001, is a 501(c)(3) non-profit, non-partisan organization that tries to increase public investments in children, youth, and families; available at http://www. everychildmatters.org/.

14. AEI/Brookings Working Group on Poverty and Opportunity. 2015. Opportunity, Responsibility, and Security: A Consensus Plan for Reducing Poverty and Restoring the American Dream. Washington, D.C.: American Enterprise Institute and Brookings Institution. The author of this article was a member of the working group.

15. All cost estimates are from the Sanders website.

16. Hillary for America. Available at https:// www.hillaryclinton.com/.

17. Make America Great Again! Available at https://www.donaldjtrump.com/.

18. Marco Rubio – A New American Century. Available at: https://marcorubio.com/.

19.Every Child Matters. “Digital Dialogue: Marco Rubio.” Washington, D.C.. Available at http://www.everychildmatters.org/national-activities/digital-dialogue/digital-dialogue-marco-rubio.

20. Ted Cruz for President. Available at: https://www.tedcruz.org/index. html?utm_medium=home-page-link&utm_ source=contributesubdomain&utm_ campaign=20160203_contributesubdomain_ home-page-link

21. Ted Cruz for President. n.d. “Life, Marriage, and Family. Available at www.tedcruz.org/ issues/life-marriage-and-family/.

22. John Kasich for America. n.d. Available at https://johnkasich.com/.

23. Jeb Bush for President. n.d. Available at https://jeb2016.com.

24. “Ben Carson Remarks at CPAC.” C-SPAN. Available at http://www.c-span. org/video/?324557-1/dr-ben-carson-remarks-cpac-2015.

25. Harwood, John. 2015. “Maverick candidate Ben Carson’s ‘no-brainer’ offer.” CNBC. May 8, 2015. Available at http://www.cnbc. com/2015/05/08/maverick-candidate-ben-carsons-no-brainer-offer.html.

26. Zillman, Claire. 2015. “Ben Carson just proposed a radical minimum wage idea.” Fortune. September 16, 2015. Available at http://fortune.com/2015/09/16/ben-carson-minimum-wage/.

27. Ben Carson for President 2016. n.d. Available at https://www.bencarson.com/.

28. Goldin, Claudia, and Lawrence F. Katz. 2008. The Race between Education and Technology. Cambridge, MA: Belknap Press.

29. Josh Barro. “Bernie Sanders’s Tax Plan Would Test an Economic Hypothesis.” The New York Times, February 9, 2016. Available at http://www.nytimes.com/2016/02/09/ upshot/bernie-sanderss-tax-plan-would-test-an-economic-hypothesis.html?_r=0.