While we have seen considerable progress over the past decade in some indicators of well-being, the gravity of the social challenges the world continues to face today requires serious consideration of innovative ways to finance and deliver services more efficiently and cost-effectively. Some key contributions in recent years have forced those of us working on addressing these challenges to think differently.

First, there has been greater emphasis on evidence as a basis for financing, which has led to a movement to evaluate program impact in both the developed and the developing worlds. As part of that movement, we have observed the consequences of such evaluations for both cost-effectiveness and sustainability of service provision. Second, there has been a greater focus on value for money, leading to the use of performance-based financing and output-based aid programs in both developed countries and by development finance institutions globally. There has been recognition that the private sector can complement the public sector in both financing and delivery of social services. This has resulted in an explosion in the participation of the private sector in financing and driving outcomes through, for example, public-private partnership models. Third, increased appetite for achieving double bottom line returns has led to a growth in impact investing globally.

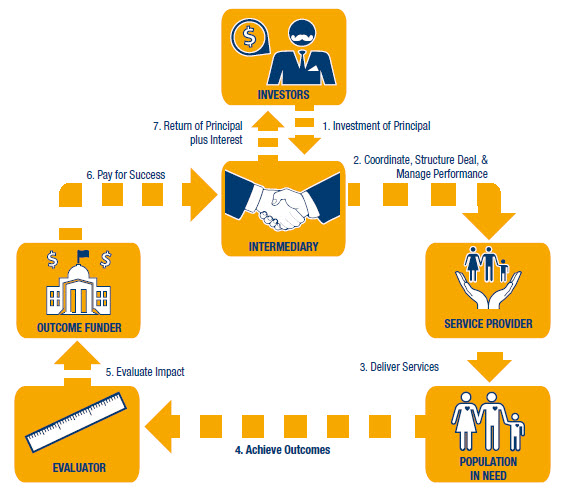

Impact bonds bring together elements of these various strains of thinking and policy action into one instrument. Over the past five years, since the first social impact bond (SIB) was implemented, an exponential growth in the number of deals has occurred in the developed world. While we are still in the very early stages of this market with much remaining to see and learn, our examination of 38 existing deals provides grounds for cautious optimism.

In the study you will find:

- Clear definitions of the concepts, key players, and structuring of impact bond transactions

- A comprehensive inventory of all active 38 SIBs (contracted as of March 1, 2015)* as well as some of the social and development impact bonds in the development stage

- An inventory of key policy actions and legislation to support the impact bond ecosystem

- An analysis of the stakeholder motivations, key facilitating factors, and biggest challenges faced in the 38 impact bond transactions

- A critical examination of 10 positive claims made about impact bonds based on the five years of experience worldwide.

- An analysis of the future potential of impact bonds and any potential derivatives with a particular focus on developing country contexts

It is our hope that the study will contribute to a larger conversation about how to better ensure the achievement of outcomes for poor and vulnerable populations around the world. Impact bonds are one mechanism that could help us get closer to that goal. To move this agenda forward there must be increased transparency and knowledge sharing. More research about how this very nascent field develops will be critical to capture lessons learned, contextualize them within the bigger picture of social sector financing and service provision, and apply them to real-world problems with the populations in need at the center of the discussion.

*Note that as of July 2015, an additional 6 deals had been contracted (four of those as part of one fund in the U.K. plus two separate deals).

Download the full report »

Download the policy recommendations »

Read the related blog series »

Read the follow-up report and policy brief on applications to early childhood development interventions in low- and middle-income countries »