Content from the Brookings Institution India Center is now archived. After seven years of an impactful partnership, as of September 11, 2020, Brookings India is now the Centre for Social and Economic Progress, an independent public policy institution based in India.

India is expected to be among the top growth markets in the world for electricity in the coming decade. At the same time, electricity supply mixes are changing worldwide, in large part due to the rise of renewable energy (RE). Apart from RE, the elements of the Indian electricity sector transition today include near zero energy and peak deficits, and stranded capacity in the coal sector, projected slowdown in demand owing to structural factors and energy efficiency, and electrification of new applications such as cooking, transport and industry. On the policy front, there is a shift in emphasis from merely capacity addition to minimising deficits, efficient utilisation, risk-reward frameworks (power sector reforms) and addressing contemporary challenges in fuel security and air pollution.

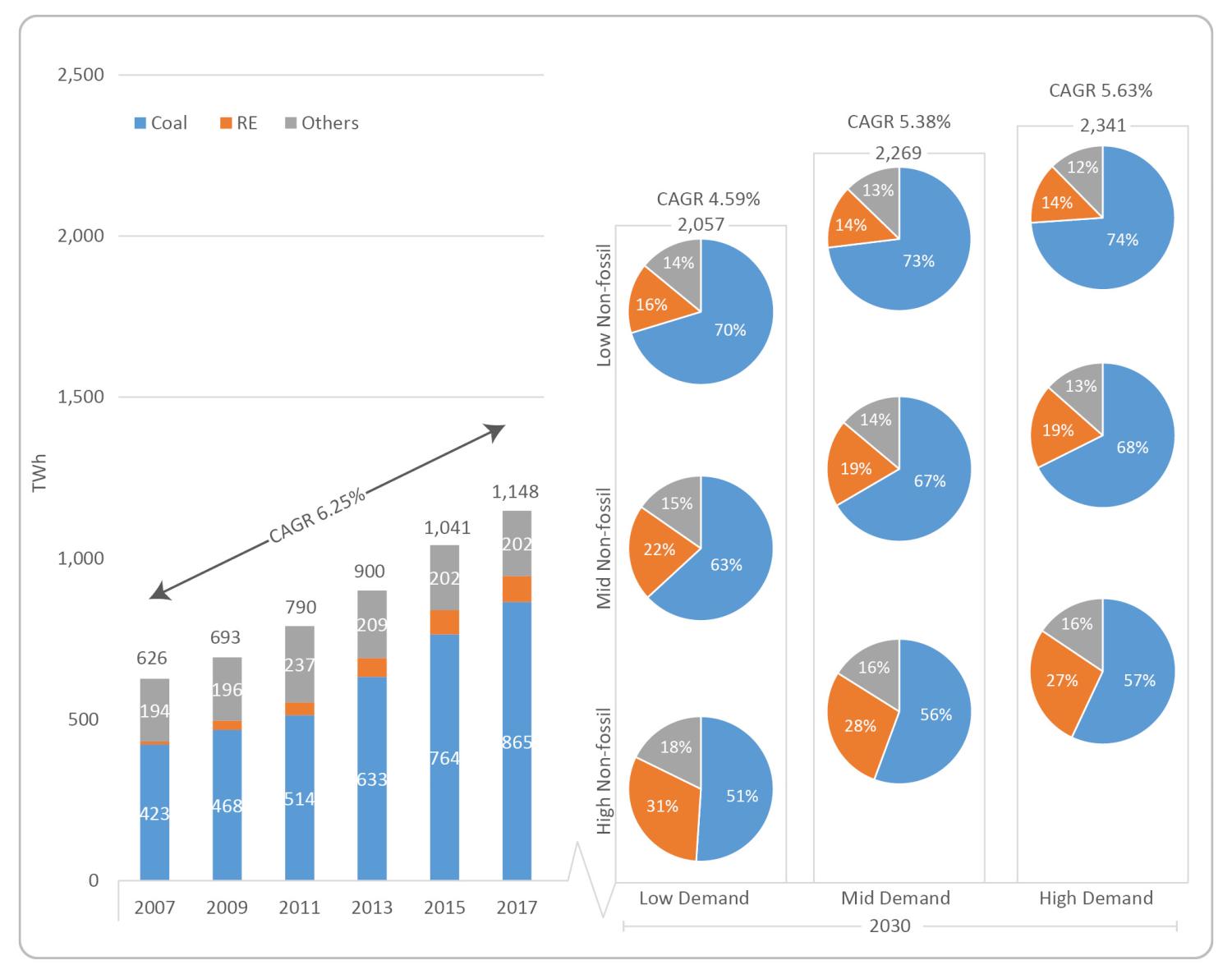

A new study by Mohd. Sahil Ali and Rahul Tongia examines the growth and changes in India’s 2030 electricity supply, using quantitative scenario-based modelling. This analysis builds on a separate paper on bottom-up modelling of India’s electricity demand in 2030, which indicates a significant slowdown in electricity demand growth rates compared to the past, after accounting for scenarios of captive use, electric vehicles, 24×7 supply, and other aspects of growth and development directly affecting power (irrigation, housing, manufacturing, space cooling, mobility and cooking).

This study models the generation requirement from thermal power plants by 2030 based on developments in non-fossil capacity and electricity demand. This is with the objective of deriving application-wise (grid and captive) and source-wise (domestic and imported) demand for coal in 2030. A mix of scenarios are presented combining changes in demand growth as well as alternatives for non-coal capacity. Generation requirement and, subsequently, coal demand are derived as residual in the model that simply matches the supply with the demand (at the bus-bar).

A total of nine scenarios are presented in the study, out of 81 modelled. These include three cases of demand and three of non-fossil characterised as low, mid, and high. Mid scenario is at the intersection of the 3×3 matrix, and can be understood as the representative value (note: it is not the median or the average of the extremes). The ‘likelihood’ of the mid scenario depends on the convictions of the reader in the future bets they are willing to make. For the authors, mid value represents a plausible but not necessarily the most probable future scenario, after consultations with a wide variety of stakeholders and experts.

Past Highlights

- In the previous decade, energy and peak deficits have fallen to less than 2% from over 10%. Within the same time, thermal power PLFs have also reduced by nearly 20 percentage points. Between 2012 and 2017, thermal capacity addition grew by nearly 12% CAGR, thermal generation by 9%, while end-use electricity demand by only 6%.

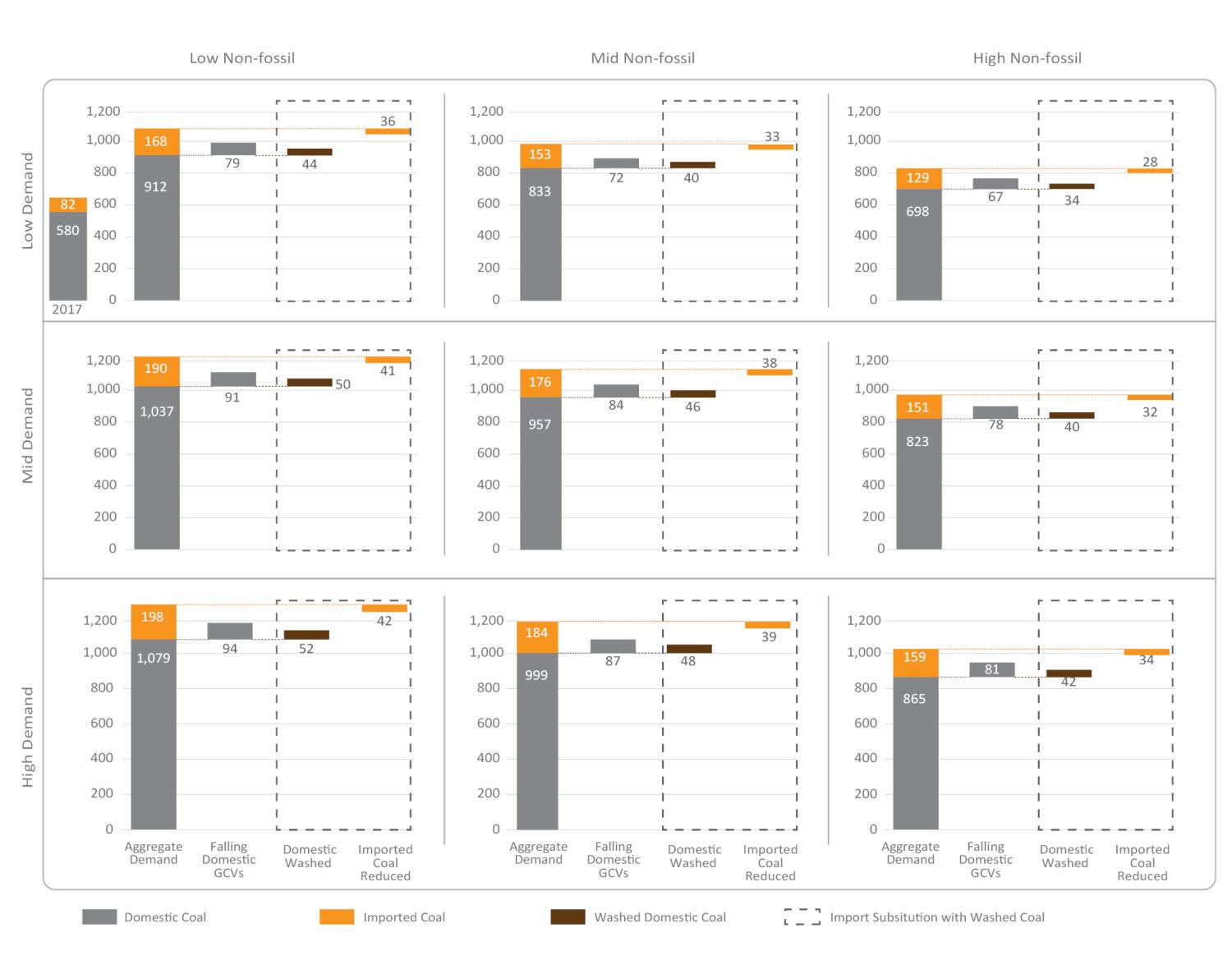

- In 2017, grid-based thermal plants performed at an average efficiency of 33.72%; of the thermal capacity, over four-fifths is sub-critical. Grid-based plants consumed 575 million tonnes (Mt) of coal, out of which 67 Mt were imported. Including captive power plants, the total coal consumption in 2017 was672 Mt of which 82 Mt was imported. The share of imported coal has grown rapidly in recent years.

- The average domestic coal grade has been declining across CIL subsidiaries in addition to grade slippage (failing to meet contractual grade commitments), resulting in lower energy delivered per ton of coal. Other policy and logistical issues—cancellation of captive mining blocks and transportation bottlenecks—built an impetus towards imports. We calculate the average GCV of domestic coal in grid power plants as 3,058 kcal/kg in 2017. Approximately 39 Mt of lignite, 20 Mt of washed non-coking and 38 Mt raw coking (non-metallurgical) coal also form a part of the domestic coal mix to the power sector.

Key FUTURE TRENDS

- Grid electricity requirement is projected to grow to 2,057-2,341 TWh (4.6-5.6% CAGR) by 2030, of which coal may contribute 1,090-1,779 TWh (1.8-5.7% CAGR) – a substantial range dependent on non-fossil penetration. Coal will remain a dominant source with over 50% share in generation. Net generation from captive is projected to grow to 318-361 TWh (4.6-5.6% CAGR) with coal contributing two-thirds, down from over 80% in 2017. A grid-based coal capacity of 260 GW suffices across scenarios, with some adjustments required along the extreme scenarios to remain within 60-75% PLF.

- Overall coal demand for the power sector increases from 672 Mt in 2017 to 827-1,277 Mt by 2030 (1.6-5.1% CAGR), marking a considerable slowdown from 6.7% CAGR between 2012 and 2017. The analysis indicates that it is unlikely we will see peak coal by 2030, unless 500 GW of solar and wind capacities are deployed with adequate storage and alternatives. Due to a relatively younger fleet mix and higher share of supercritical, generation efficiency improves by 2.5 percentage points by 2030. The average grid specific coal consumption (SCC) drops to 0.57 kg/kWh in 2030 from 0.62 kg/kWh in 2017.

- Based on historical trends and assessment of future coal quality, plant specifications and logistics, imported coal’s share may grow from 12.2% in 2017 to 15.5%, reaching 129-198 Mt by 2030. Falling domestic coal calorific value could raise the requirement for mining around 75 million tonnes of domestic coal, and worsen SCCs. To check growth in share of imports, greater substitution by washed coal is required to the tune of 20-25 of domestic coal mix used for generation.

Insights and Recommendations

- There are several potential threats and opportunities at the cusp of India’s energy transition. Our study suggests a cautious and phased deployment of planned coal capacity while adding no more, but accelerating retirements and retrofits to meet pollution norms. This requires phasing such activities in a gradual manner instead of close. Further, there needs to be an overhaul in domestic coal quality control, transportation and logistics. The coal value chain supports diverse aspects of the economy, including the Indian Railways given the location specific nature of coal (eastern India) and RE (southern and western India).

- India needs to check its falling coal quality domestically and also offer a value proposition against imported coal, especially for new technologies. In this respect, washed coal use needs to be seriously ramped up— our calculations suggest at least a four-fold increase in existing non-coking washing capacity (and improving utilisation to 75%) to keep the imported coal below 2017 levels. Due on the relative slowdown in growth rates, a key challenge before power sector coal is not the quantum but the quality of coal, along with issues of linkages and logistics.