According to the U.S. Energy Information Administration, proven and possible natural gas reserves in the Caspian Basin comprise two-thirds of the region’s total hydrocarbons. Already, proven Caspian gas reserves are estimated at 243-248 trillion cubic feet (tcf), which is comparable to North American reserves of 300 tcf. This, along with their geographic proximity to China and India, makes the gas-rich Caspian states of Turkmenistan and Kazakhstan potential supply sources for Asian energy markets. Options for constructing gas pipelines east to Asia from the Caspian have been discussed for the last decade.

In spite of historic ties among the Central Asian states, China, and India, the shipment of energy resources east has yet to materialize. While there has been considerable Western investment in the development and transportation of Caspian oil, large-scale investments in Caspian gas projects have not yet become economically viable. The markets on both sides are still developing. For Turkmenistan and Kazakhstan, current proven reserves are insufficient to justify the transportation costs involved in pipelines to Asia. For India and China, although demand for gas is increasing, specific markets have yet to be identified and major structural changes have to take place in their domestic energy sectors. High infrastructure costs are also an obstacle for both sides of the supply-demand chain. Gas pipeline options from the Caspian to Asian energy markets—unlike oil pipelines from the Caspian to Europe and Turkey—are very much long-term prospects.

With this long-term view in mind, conference participants—including leading scholars, energy industry representatives, government officials, and private consultants—urged U.S. policymakers to broaden their frames of reference for the Caspian, Central Asia, and Asia to consider the future geopolitical implications of natural gas flows from the Caspian Basin to India and China.

India and Natural Gas

For India, the options to import gas from the Caspian Basin, particularly from fields in Turkmenistan and Iran, have been actively discussed for almost a decade at the academic, government, and industry levels. Although pipelines would have to traverse a distance of at least 1500 kilometers from Turkmenistan and Iran to India, existing networks of pipelines within Iran can be extended to partly offset costs.

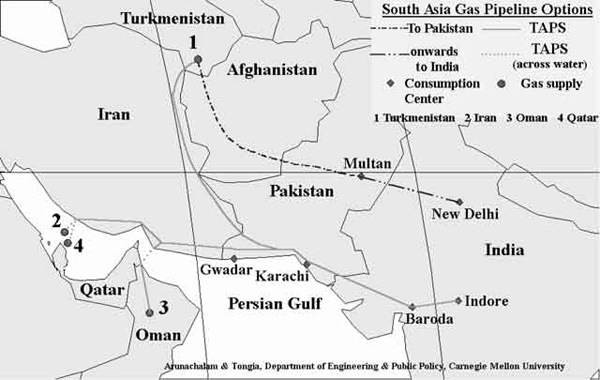

Figure 1: South Asia Gas Pipeline Options

Rahul Tongia, a member of the research faculty in the Department of Engineering and Public Policy at Carnegie Mellon University, offered various regional pipeline options that are considered both technically and economically feasible. Tongia suggested that a pipeline could originate in the Gulf States of Oman or Qatar, traverse Iran and Pakistan, and end in India, picking up Iranian gas along the way. Tongia also proposed that a pipeline could carry Turkmen gas through Afghanistan and Pakistan to India, or through Iran and Pakistan to India. Finally, Tongia said Iran itself could serve as the sole supplier of gas to India with a pipeline through Pakistan. In these scenarios, if Pakistan serves as a transit country and also becomes a future recipient of Iranian or other Middle Eastern gas, there will be important cost-sharing savings to both India and Pakistan.

Obstacles to Pipeline Projects

Other conference participants discussed the obstacles that have prevented the realization of these projects. First, the development of India’s energy market has been constrained by domestic factors, including the failure to implement energy sector reform. India’s electricity industry is in disarray, and is plagued by massive subsidies to the agricultural sector, which consumes almost one third of current Indian power output. Subsidization has led to skewed pricing and underproduction of electricity, as well as corruption and inefficiency in state electricity boards.

Under these circumstances, power theft poses a significant problem—one quarter of power produced “simply disappears,” according to V.S. Arunachalam, also of Carnegie Mellon University’s Department of Engineering and Public Policy. India also suffers from insufficient generating capacity. Arunachalam asserted that India would need to build at least one new power plant per month—each with a 1,000 megawatt annual capacity—for the next 15 years to keep pace with its growing energy needs. A project on this scale would cost around $22 billion per year and, without international investment in the sector, would consume 4.5 percent of India’s Gross National Product. International investment in India’s power sector has recently been threatened by a major contract dispute between the Indian government and the international energy giant, Enron, which has invested $2 billion in Indian power plants. Energy industry representatives stressed that the impact of a possible abrogated contract with Enron should not be underestimated, and that other companies were reconsidering their positions in the Indian energy market as a result of the dispute.

Second, geopolitical issues have further constrained Caspian-Indian pipeline projects. Afghanistan has been ruled out as a gas pipeline transit country given its chronic instability and ongoing civil war, which has resulted in the almost complete destruction of the country’s infrastructure. Pipelines traversing Pakistan are also an unlikely option for India given its nuclear arms race with Pakistan, the long-term conflict over the disputed region of Kashmir, and the Indo-Pakistan “Cold War” in Afghanistan.

In spite of the great economic potential that could result from cooperation on energy projects, and over 50 years of close interactions between India and Pakistan, Stephen Philip Cohen, a Brookings scholar and South Asia expert, argued that both countries are willing to take economic losses in return for short-term political and strategic gains in their political and military standoff.

Third, all options—excluding the now “dead” Afghanistan pipeline—involve either gas supplies or pipelines from Iran. Brookings scholar Suzanne Maloney discussed how Iran has made economic issues a cornerstone of its increasingly pragmatic foreign policy and, consistent with this policy, has been eager to supply India with its gas. Energy discussions that focused on the possibility of a gas pipeline from Iran to India were a major feature of Indian Prime Minister Vajpayee’s state visit to Tehran in April 2001. Iran has also held its own discussions with Pakistan on the issue, and in late May 2001, Tehran secured nominal support from Islamabad for an overland gas pipeline that would terminate in India—even absent current demand in Pakistan for Iranian gas supplies.

However, again, participants stressed that India is unlikely to enter into any arrangement that would involve dependency on Pakistan, and that might empower Pakistan to exert economic leverage in an effort to wrest Indian concessions on Kashmir or other critical strategic issues. As a result, Iran and India have also discussed the possibilities of constructing a deepwater offshore gas pipeline to bypass Pakistan and of importing liquefied natural gas (LNG) from Iran’s South Pars gas field by tanker. Like other international investors, however, Iran remains nervous about the investment climate in India in light of the Enron dispute.

Even if domestic Indian conditions made projects commercially viable for the international energy industry, U.S. sanctions policy (the Iran-Libya Sanctions Act) would preclude American involvement and constrain international involvement in exploring options for India to tap into Iranian gas supplies, or in brokering a tripartite Iran-India-Pakistan deal on pipelines. U.S. sanctions policy would have to be addressed before these projects could be realized.

Participants further noted that, even putting U.S. sanctions aside and assuming that Iran could temper its own ambitions to supply India with natural gas and become a transit route for Turkmen gas to India, Russia’s hold over Turkmenistan’s gas would remain a major obstacle. Recently, the European Union and the Russian government initialed an agreement that calls for Europe to double its Russian gas imports over the next 25 years. At the same time, the Russian gas monopoly, Gazprom, intends to create new routes for East Siberian gas to China and possibly further afield to Korea and Japan.

Energy consultant Florence Fee, former president of Mobil Russia Ventures, Inc., pointed out that because Gazprom has made insufficient exploration and development investments over the past decade in its West Siberian gas fields, it may be difficult for the company to realize the ambitious goal of doubling exports to Europe. Therefore, she argued, Gazprom may seek to maintain and increase Turkmen gas flows through its pipeline system in order to ensure adequate supplies to the Russian internal market. This would avoid a clash with domestic political priorities, and consequently preserve West Siberian volumes for the strategically important European export market. In this context, Moscow is unlikely to favor a Turkmenistan decision to export gas to India, which would open a new market for Ashgabat and turn Turkmenistan into a competitor for regional gas markets.

Iran-Russia Relations

The complex, evolving relationship between Iran and Russia is an additional complicating factor in Caspian gas development. Together the two states hold one half of the world’s known gas reserves and both states have been strategic competitors in the past. They have vied for influence in the Caspian region, and remain at odds over the still unresolved status of the Caspian Sea. However, developments under the Putin administration—including diplomatic forays, technology and weapons transfers, and mutual concerns about developments in Afghanistan—suggest that Moscow is moving toward a new level of rapprochement with Iran. Recent agreements signed between Iran and Russia, and other regional states, to create a North-South energy and trade route between South Asian markets and Europe confirm Moscow’s change in strategy and indicate that Russia now sees itself, Iran, and the Caspian as part of a global transportation hub.

Finally, India has a number of supply options beyond Caspian Basin gas to meet its future energy demands. These include India’s own largely unexplored but significant renewable energy resources (such as hydroelectric, wind, and biomass); the further development of its domestic nuclear power industry with potential assistance from the United States; extensive gas supplies in neighboring Bangladesh; increased oil imports from the Persian Gulf and Middle East; and LNG supplies from Southeast Asia. LNG purchases from Iran are also a significant option and more likely than the construction of a gas pipeline.

China and Caspian Gas

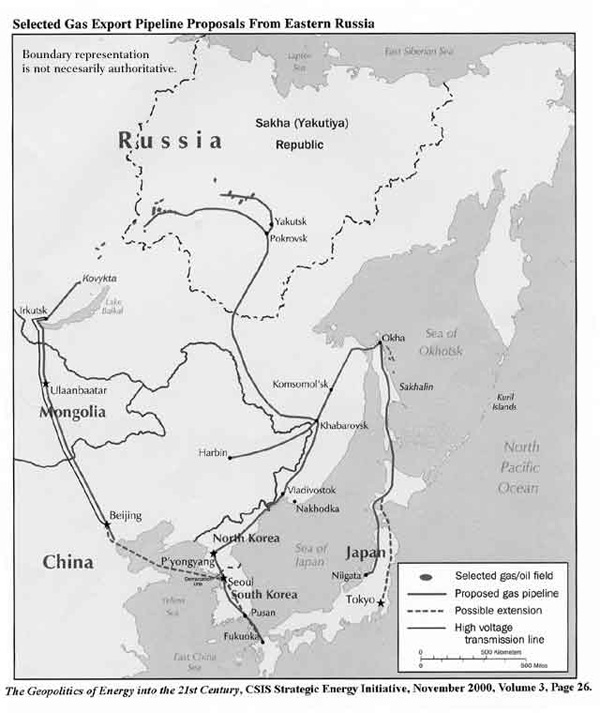

Figure 2: Selected Gas Export Pipeline Proposals from Eastern Russia

China’s interest in pursuing natural gas import options has been shaped by significant economic costs from pollution and the burning of coal incurred over the past decade. According to the 1997 World Bank “Clear Water, Blue Skies” report, the effects of excessive pollution (in the form of premature deaths, sickness, and damage to productive resources) have cost China $54 billion a year, or 8 percent of Gross Domestic Product.

William Chandler, Director of Advanced International Studies at Battelle Memorial Institute’s Pacific Northwest National Laboratory, said that China has made reducing its carbon emissions a priority in its latest five-year plan for 2001-2005. Official Chinese government statistics show that coal consumption has already dropped by 22 percent and carbon emissions declined by 15 percent between 1996 and 2000. In fact, China now emits 100-200 metric tons of carbon equivalent (mtc) less than it was forecasted to emit in the mid-1990s.

As part of its efforts to alleviate the harmful effects of pollution, the Chinese government has also placed a priority on increasing the share of natural gas in its power generation sector, as well as in its industrial and residential sectors. While natural gas comprises only three percent of total energy consumption in China today, this fraction could increase to 10 percent over the next 20 years.

Allan Hoffman, the director of the Country Studies Program in the U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy, cited a study by Shell, which estimates that a combination of natural gas and renewable energy sources could comprise 50 percent of China’s energy consumption by 2050.

In this context, gas reserves from Kazakhstan remain a long-term option for China’s energy market. Currently, the volumes of gas reserves in Kazakhstan are insufficient and the distances to be traversed from Kazakhstan are too great, even for energy markets in Xianjiang and China’s other western provinces closest to Central Asia. Furthermore, population growth and industrial development in China’s western provinces are not likely to generate sufficient new demand in the next decade to merit the active exploration of gas pipeline projects from Central Asia. Most of China’s increasing energy demand will be in northern and central regions and in the fast growing industrial centers in the east and along the coast. Kazakh government plans to restrict the activities of foreign investors through legislation have also posed challenges to China’s current energy investment projects in Kazakhstan and restrained the development of new projects.

Russia’s Role

The most likely source of new regional supply of natural gas for China is, in fact, Russia. The Russian and Chinese governments, as well as international energy companies such as Shell, ExxonMobil, and BP, are actively pursuing potential gas and LNG exports to China from fields in Western and Eastern Siberia and from Russia’s Sakhalin Island. Several conference participants also noted that other Asian countries such as Japan have seriously explored the possibilities of importing gas from Sakhalin Island.

Consultant Robert Smith of the East-West Center in Hawaii stated that there is a high likelihood that LNG will be shipped from Sakhalin fields to Japan in the near future. Pipeline natural gas shipments to northern China are also part of the long-term plans for the full development of Sakhalin gas reserves.

Russian companies are also becoming increasingly active in East Siberian oil and gas development projects directed at the Chinese market. To ensure that it has a voice in promoting export projects to its own market, the Chinese government—through the state-owned China National Petroleum Corporation—is also pursuing equity positions in East Siberian fields.

Representatives of the energy industry indicated that a Russian pipeline from East Siberian gas fields to China, either transiting Mongolia or directly crossing the Russo-China border, is a legitimate, intermediate option. Gazprom has thus far been reluctant to divert supply from its West Siberian Yamal fields destined for Europe to serve the Chinese market, but the Russian government has made China projects a priority. Discussions are thus underway to ship a portion of Yamal gas to East Siberia, potentially pick up additional local reserves there, and then trans-ship the total volume onward to northeast China. This method and route would provide the requisite reserves and adequate supply for such a long-distance export project. Energy industry representatives noted that this pipeline option involving Gazprom parallels a separate BP project to supply gas to China by constructing a pipeline from the Kovytka gas fields near Irkurtsk. Energy consultant Florence Fee noted that the new head of Gazprom, Alexei Miller, could push to involve Gazprom in the Kovytka project. Miller has had extensive experience in Russian-Chinese energy relations as the former general director of Vostokgazprom, the company’s branch that controls interests in East Siberia and the Far East.

The Middle East

While China continues to explore its gas supply options in Central Asia and Russia, the Middle East currently accounts for 60 percent of China’s total oil imports. Professor Yitzhak Shichor of the Hebrew University in Jerusalem argued that this could reach as much as 90 percent in the next two decades, which would further increase China’s dependency on the region. The relatively low cost of producing oil in the Middle East will be a major factor in future development. Shichor noted that while it costs an average of $2 per barrel to produce oil in the Middle East, it costs $12 per barrel in China’s fields in Daqing (Heilongjiang Province).

Indeed, Julia Nanay of the Petroleum Finance Company stressed the more active role that China will play in Middle East energy politics in the coming decade. In particular, China is already engaged in one energy exploration project in Iran and is refurbishing two refineries for swapping oil from the Caspian region. Nanay noted that Chinese service companies are also active in Turkmenistan, and that China seeks increased oil and gas shipments via Iran from Turkmenistan. Finally, China has been negotiating for an oil field in Iraq for many years.

Over the long-term, while domestic coal remains the dominant energy source, no single source is likely to satisfy China’s energy needs. The Chinese government has also underscored the importance of avoiding dependence on any one regional supplier, and China’s overarching policy is to pursue a diversity of energy resources and suppliers, including oil, gas, and LNG from Southeast Asia, the Middle East states, Russia, and Australia. This strategy also includes putting a premium on exploiting domestic Chinese gas fields in the western Tarim Basin and oil fields in the east.

Conference participants concluded that in keeping with this policy, China would continue to explore options in Russia and the Middle East, and would likely maintain its foothold in Kazakhstan. They also noted that in the last few years, the Chinese government has attempted to increase its economic and political influence in the broader Caspian region, investing in development projects outside the energy sector in the Caucasus states as well as in Central Asia.

Conclusion

The conference discussions stressed that increasing energy demand in China and India poses real challenges to global energy security. These new energy demands are likely to cause future tensions with the United States and Europe as competition for access to supply increases. Participants also underscored the threat to the global environment if countries such as China and India are forced to continue relying on burning domestic coal because they are denied access to affordable gas and prove unable to restructure their economies to utilize it. In this context, while the natural gas reserves in the Caspian Basin are not the solution for India and China’s energy needs, the hydrocarbon resources of the Caspian states, along with Russian, Iranian, and other Middle Eastern and Asian suppliers, will all contribute to satisfying this growing demand.

The Brookings conference provided a foundation for further analysis of the important geopolitical and energy relationships evolving in Asia and a forum for an ongoing dialogue on the full range of solutions to the region’s energy needs.