Editor’s Note: This briefing note was prepared for a retreat convened by the Independent Research Forum on a Post-2015 Sustainable Development Agenda (IRF2015).

A Large Scale Task

The sustainable development goals are likely to have a more ambitious scope than the Millennium Development Goals. Accordingly, they will need a more ambitious financing for development strategy that can mobilize much more public, private, and “blended” finance. Very rough estimates indicate that at least $1 trillion of additional annual investment is required in developing and emerging economies. At first glance this might appear to be a large number, but it represents only approximately 10 percent of extra investment above current levels.

It is clear that official development assistance, on its own, would be incapable of meeting financing needs, even if the target to provide 0.7 percent of gross national income were to be achieved by all developed countries. But official development assistance (ODA) could, through leverage and catalytic support, help mobilize substantially more private capital. In the current context of low interest rates that is expected to hold in the medium term, private capital can generate profit for its owners while also producing significant development benefits. It is in this area of overlap between private profits and sustainable development outcomes that post-2015 private financing needs to be assessed.

Each element of the post-2015 agenda will have its own required mix of public and private financing. In some instances increased public investment flows and improved targeting will be required. In other cases better regulatory frameworks need to improve incentives for private capital. In still other instances new instruments might be needed to help public capital increase its multiplier in leveraging private dollars.

Recent experience suggests that private markets are not a panacea, and that there are significant impediments to the flow of private capital that cannot always be unlocked by policy reform within a country. Public-private partnerships, or blended finance, offer some potential for reducing these obstacles, but these must be constructed at a fine level of disaggregation in order to have an impact.

Two Key Variables for Private Finance: Risk and Return

Many individual firms have expressed a desire for more effective public-private partnerships to create a framework within which they can participate more effectively in profitable, development-oriented investments. The development benefits from investments made by private firms come from: (1) the contributions provided to government revenues; (2) the contributions provided to jobs and incomes; (3) the expansion of access to and quality of infrastructure and social services to serve a broader segment of the population, including many poor and near-poor households; and (4) the innovation and cost competitiveness that private firms can generate.

The logic and psychology driving private finance is very different from the motivations for public finance. For areas where private investments are in the lead, firms will seek opportunities based on the reasonable expectation of profit, which is driven by two fundamental variables: risk and return. Individual firms cannot be told where to invest and will rarely pre-commit long-term resource allocations beyond the boundaries of specific projects. They require flexibility in order to adjust their long-term strategies in step with the constant evolution of market competition. They do not pre-commit in the same manner as governments.

The private financing component of the post-2015 agenda is complex precisely because it cannot be planned. However, market forces will predictably move towards areas where there is an opportunity for at least some profit. The issue can therefore usefully be framed from the vantage point of potential investors. What are the incentives and instruments that will attract investors to deploy the types of private finance that are desirable from a post-2015 policy vantage point? How might these vary across different sectors? How can governments, at home and abroad, organize themselves to raise the volume and development impact of private finance?

As general arithmetic, public sector measures will need to either increase private investors’ anticipated returns or decrease their perceived risk, with the latter forming a particularly pervasive barrier in many sectors and geographies. Although risk mitigation instruments are available in global public finance, they are hardly used. The OECD estimated that a total of only $5 billion per year of guarantees were issued between 2009 and 2011. MIGA, one of the largest global risk agencies, provides only around $1 billion a year in guarantees and has only paid out 6 claims since its inception, totaling $16 million—hardly a level of risk-taking commensurate with the possibilities in developing countries. Governments will also need to balance incentives for innovation with promotion of regulatory stability that allows firms to make reliable long-term assessments of risk versus return, in line with the long-term nature of many necessary post-2015 investments.

Five Categories Where Large Private External Investment Could Take Place

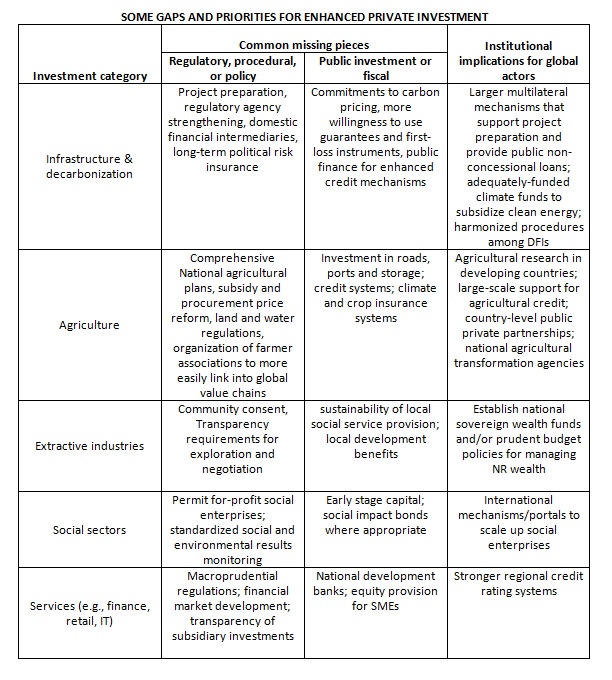

The above general principles apply across the investment horizon. However, the post-2015 agenda entails at least five distinct investment categories, each with its own norms and challenges (see the below table).

In dollar terms the largest of these is infrastructure, most of which is comprised of energy investments, in addition to transport and water. At a practical level the energy and transport investments are generally the same projects as those needed to promote low-carbon energy production. We therefore dub this category “infrastructure and decarbonization,” the latter term referencing a significantly accelerated decline in the rate of carbon intensity per unit of primary energy in the economy. Recently, the number of large infrastructure projects in this category that cannot move forward because of a variety of obstacles has soared. The IFC, for example, tracks infrastructure projects of over $1 billion. It has a long list of over 20 such projects globally. It has also found that there has been a dramatic rise in the number of possible infrastructure projects in Africa, with over 200 being developed, compared to only a few PPP projects a year being completed just a few years ago.

Unblocking these projects will require a combination of actions: regulatory strengthening, new risk bearing instruments, clarity on the grants framework for subsidizing clean energy and other issues. The key point is that these issues are specific to the nature of large infrastructure projects and if capital is to flow into these areas, specific solutions must be found. It is also likely that changes will be needed in the international financing architecture to push this agenda forward, perhaps through the creation of new infrastructure facilities, or through a drastic strengthening of existing multilateral capabilities.

A second category is agriculture and food systems, which can play an especially important role in instigating structural change in low-income economies. Here, there is often a need for complementary investments in transport, rural credit systems, climate risk insurance, and for streamlined mechanisms to coordinate public and private sector activity. While there are promising examples in this area, they remain isolated and have not yet been institutionalized. A number of international forums exist to promote agricultural investments, but they are not well coordinated with each other.

A third area is extractive industries. More than half the countries in Africa are categorized by the IMF as rich or prospectively rich in natural resources. Recent exploration activity suggests that production of key commodities could increase by 50 percent over current levels. But private investments in this area have so far provided disappointingly few development benefits. New public private partnerships could change this, but they would have to support better revenue management in host countries, more sustainable service provision in local areas after mining operations cease, and stronger development benefits for local communities.

A fourth area is social sector investments, such as in health services and education where social enterprises are keen to provide greater access and improved quality to the population. In many countries, however, the hybrid nature of a social enterprise is not even recognized in law. Enterprises are instead classified as either for-profit, in which case they are ineligible to receive grants from public entities, or non-profit, in which case they cannot charge enough for their services in order to expand and reach scale. New platforms to encourage social enterprises, such as the Development Innovations Venture platform launched by USAID, could provide a vital bridge in getting more private capital to flow into this market segment.

A fifth area is in the service sector of the real economy, including the financial sector. Financial intermediaries in developing countries play a key role in mobilizing foreign private capital, sometimes acting as a retail agent (for example for schemes aiming to reach small and medium enterprises). Often, the presence of local capital is also an important indicator of the success of an investment, and financial firms in host countries play a valuable matching role between local and foreign investors. But the ability of some financial firms to gain access to global capital markets is limited by idiosyncrasies in global credit ratings, which often resist giving higher ratings to individual firms (like a national development bank) as compared to the sovereign rating.

The table below presents a schematic approach outlining how policymakers can think about diagnosing and addressing key challenges for each investment category. All components are of course underpinned by the need for an efficient and transparent regulatory environment for business. There are many “links in the chain” for each investment category. The key point is that private capital is not something that be encouraged in the abstract or simply with economy-wide reforms in developing countries. It can be unlocked if there is specific attention to the key obstacles in specific sectors, and if global public finance through ODA and non-concessional instruments is effectively deployed. In some cases, institutional changes at the global level may be needed.

The five areas of focus we have identified are all areas that appear to be promising candidates for much larger amounts of private capital to flow to developing countries at all income levels. However, we should stress that the global investment incentives and mechanisms for infrastructure and decarbonization present the most significant current mismatch between required and available financing systems, and the area where the overlap is potentially greatest between sustainable development needs and the profit motivation, if an appropriate blend of finance is properly constructed. The absence of a few billions of dollars in public financing incentives could be holding back several hundreds of billions of dollars of private finance for necessary infrastructure investments.

New Standards for Corporate Reporting and Auditing

One key driver of post-2015 private finance will lie in standards for corporate reporting. Several companies have already pursued innovative metrics, such as “triple bottom line” for measuring economic, social and environmental performance. Accounting and audit practices need to learn from these experiences so that common standards can be applied to all companies, in line with the overarching goals and targets established for post-2015. The High-Level Panel report on the post-2015 agenda recommended that all large businesses should report on their environmental and social impact—or explain why if they are not doing so.

Implementing such practices requires a mixture of three key ingredients, in addition to sound implementation by firms themselves: (1) clear regulatory standards established by securities regulators and tax authorities, (2) endorsement from large and influential institutional investors, including public pension funds and sovereign wealth funds, (3) practical annual audit service offerings from trusted accounting firms. One could see, for example, the establishment of general sustainable development accounting principles, adding metrics for workforce standards, energy usage, and ecological footprint, both within a firm itself and across its supply chains.

Macro Policy Cautions

At least two macroeconomic meta-policy issues are interwoven with the post-2015 private finance agenda, and might have unanticipated adverse effects:

- The Basel III accord aims to reduce systemic financial risk by increasing minimum bank capital requirements and leverage ratios. Banks can meet these standards by decreasing their holdings of risky assets. However, infrastructure investments can be inherently risky, and commercial banks have long been a key source of finance in this area, so Basel III might lead banks to invest less in infrastructure.

- Current account deficits will automatically increase in step with every investment project. If government deficits rise to provide necessary social services, for example, they will generate higher external (current account) deficits that must be financed somehow with foreign exchange. Private finance (e.g., foreign direct investment) can therefore indirectly facilitate development spending even if the projects being financed by the private sector have nothing to do with development at all.

Key Issues

Although private capital flows for development cannot be negotiated in the same way as official development assistance, the policies and issues to incentivize and unblock private finance are amenable to public policy change by host countries and major capital exporters, as well as by the international financial institutions that can provide a bridge between public and private finance. It is these policies that should be the focus of negotiations at a “Monterrey 2”-type financing conference. Such a conference needs to bridge a range of political processes—including post-2015, sustainable development goals, Financing for Development, climate finance, and Safe Energy for All—due to the extensive overlap at the level of practical investments.

The original 2002 Monterrey conference was novel for bringing together leaders from finance ministries, foreign ministries and development ministries around a common agenda. This time the same actors need to be convened again, alongside leaders from large institutional investors such as sovereign wealth funds and pension funds, in addition to the rest of the private investment and business communities. A balance must be struck between ensuring such a conference maintains the public responsibilities of governments acting on behalf of their entire societies—including marginalized populations that any sustainable development goals must seek to support—and the need for productive mechanisms of interaction between policymakers and often influential private investors whose capital will be essential to achieving post-2015 goals. Many observers will likely be concerned that a community representing high concentrations of wealth is being asked to help solve problems of global exclusion and inequity so soon after the global financial crisis. Properly addressing this concern will likely frame one central global political challenge for post-2015 agreements.

At a substantive level, significant issues that such a conference could debate include:

- Is the size of international bilateral and multilateral development finance institutions adequate to meet the task ahead?

- Do these agencies have adequate instruments to mitigate risk and they are used at an appropriate scale?

- How can grants and technical assistance be blended with private capital to generate structures that are attractive from development and financial perspectives?

- Are public-private partnerships, disaggregated by sector, useful ways of identifying the scope and nature of possible blended finance?

- Should social and environmental externalities, especially for carbon pricing, be factored into project selection in a harmonized way among DFIs? How should the social benefit of reducing carbon emission be priced? Would institutional investors, like pension funds, be willing to enter these markets if financial returns on clean energy projects were sweetened by a carbon-reduction subsidy?

- What other platforms could spur a better flow of information to encourage private flows to developing countries?

Addressing issues of this kind could potentially unblock the flow of hundreds of billions of dollars of private capital per year. Reaching agreement on specific ways forward, while realizing the limited nature of commitments in terms of volumes of flows that could emerge from such a process, would be a key building block for success on the post-2015 agenda.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).