Index #9: Last Five Quarters

As the dust settles from the partisan fight over the debt ceiling, the recovery continues to falter, the labor market remains weak, the stock market is volatile and the public mood is increasingly pessimistic. In the ninth “How We’re Doing” Index, a team of scholars at the Brookings Institution has looked at the past five quarters to assess the state of our political and economic conditions. Facing a real risk of recession, and with the Iowa caucuses only six months away, the impact on the 2012 elections of macroeconomic performance and three military conflicts loom large. Continue reading below chart »

Related Materials:

Past How We’re Doing indexes »

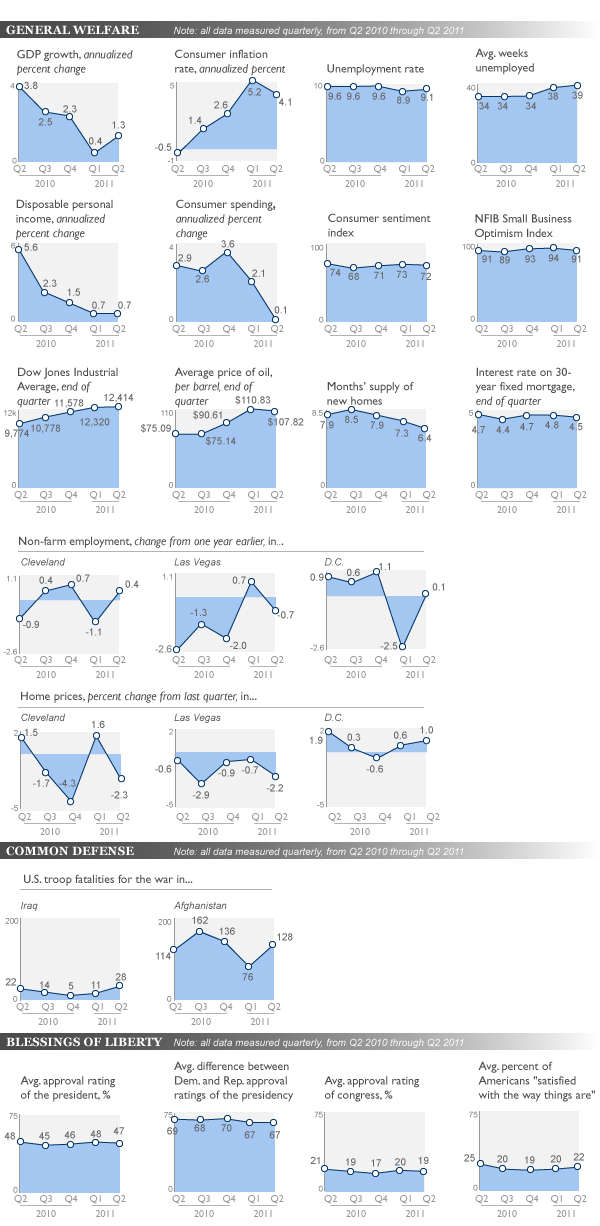

Real growth in gross domestic product was barely above 1 percent in the second quarter of 2011, and first quarter GDP was just 0.4 percent. This anemic pace is not enough to significantly dig out of the loss of nearly 9 million jobs from the recent recession. After peaking at 10.1 percent in October 2009, the unemployment rate remains stubbornly high, at more than 9 percent, and average duration of unemployment also remains persistently high.

The housing sector has often led the way out of past downturns, but home prices have slipped further nationwide over the past year, with metropolitan areas in Nevada, Florida, and California remaining among the hardest hit. Consumers are pessimistic, with confidence in July slumping to its lowest level since early 2009, and the National Federation of Independent Business’s “optimism index” for small businesses is down again after two quarters of small increases.

The foreign policy situation remains difficult as well. U.S. combat fatalities rose in both Iraq and Afghanistan during the second quarter, although the situation has since improved.

After lengthy, tense negotiations between Congress and the White House over raising the debt ceiling and reducing the federal budget deficit, public confidence in government is low. Barely one in five voters says he or she is satisfied with the way things are going in the United States, according to Gallup polling. Neither party generates much confidence, although twice as many voters approve of the job being done by President Obama compared to Congress. Republicans and Democrats remain far apart in their preferred policies, which makes the task of practical problem solving very challenging for elected officials.

Against this backdrop of weak performance, the 2012 elections are taking shape. In past elections, Democrats have often sought to emphasize domestic economic circumstances, while Republican candidates emphasized foreign policy and national security. In the upcoming cycle, though, we may see the parties switching roles as the GOP highlights high unemployment and weak economic growth, and the president campaigns on his policy of scaling back involvement in unpopular wars in Iraq and Afghanistan.

So far, there are nine Republicans likely to seek to replace Obama, but the president does not have opposition in the Democratic nominating process. Historically, presidents who have not faced a primary challenge are more likely to win reelection. That was the case with Ronald Reagan, Bill Clinton and George W. Bush, but the unemployment rate was lower when each of them sought a second term. No president since Franklin Roosevelt has been re-elected — or even run for re-election — with unemployment over 8 percent.

See also:

» State of Metropolitan America—portraying the demographic and social trends that shape our nation’s metropolitan areas

» GovWatch—tracking the progress and performance of our institutions in economic recovery

» MetroMonitor—a barometer of the health of America’s 100 largest metropolitan economies

Sources:

GDP growth:

U.S. Bureau of Economic Analysis

Unemployment rate:

U.S. Bureau of Labor Statistics

Average weeks unemployed:

U.S. Bureau of Labor Statistics

Disposable personal income:

U.S. Bureau of Economic Analysis

Consumer inflation rate:

U.S. Bureau of Labor Statistics

Dow Jones Industrial Average:

Yahoo! Finance

Average price of oil:

Energy Information Administration

Consumer sentiment:

Reuters/University of Michigan survey of consumers

Small business optimism:

NFIB Small Business Optimism Index

Consumer spending:

U.S. Bureau of Economic Analysis

Months’ supply of new homes:

U.S. Census Bureau

Interest rate on 30-year fixed mortgage:

Freddie Mac

Metro area employment rates:

U.S. Bureau of Labor Statistics

Metro area home price growth:

Case-Shiller Index

U.S. combat fatalities, Iraq and Afghanistan:

icasualties.org

Approval ratings of president and Congress:

Gallup

Percent of Americans “satisfied with the way things are”:

Gallup