This essay is part of the Actionable Ideas for Economic Recovery in American Cities, a feature of the COVID-19 Metro Recovery Watch.

Overview

Systemic inequities in America have created a history of wealth inequality, disproportionately exposed certain communities to the COVID-19 pandemic, and established conditions leading to racial violence and social unrest. To address these issues, communities of color—specifically, Black communities—will need broad-based economic support and policy reforms.

One high-priority recommendation in solving the country’s racial wealth equity problem is developing inclusive local tech ecosystems, which can drive Black tech entrepreneurship and increase the Black tech workforce. By prioritizing inclusive tech ecosystems, Black households will be able to leverage the power of innovation and the increased global reliance on technology to create wealth and contribute to enhanced productivity and quality of life in the nation’s local economies.

Achieving this vision will require new corporate governance, workforce development, innovation, community outreach, social impact, and investment decisions that prioritize entrepreneurship strategies that lead to not only economic recovery, but also to racial and economic justice.

Challenge

The ultimate objective of inclusive tech ecosystems is to create racial equity. Black household income is 61% that of white households, and white households have about 10 times more wealth, on average, than Black households.1 This wealth gap results in both significant economic vulnerability for Black America and a less dynamic and productive U.S. economy. McKinsey estimates that U.S. GDP would be 4% to 6% higher by 2028 if the racial wealth gap were closed.2

In our 2019 guide, Building Inclusive Entrepreneurship Ecosystems in Communities of Color, we put forth a metrics-driven blueprint of how to ensure that everyone in America is equitably positioned to prosper from the technology-fueled growth of the fourth industrial revolution, especially how communities with little preexisting wealth can build multigenerational wealth.

Entrepreneurship ecosystem-building (simply called “ecosystem-building” going forward) is a fast-growing economic development strategy focused on supporting and developing businesses poised for rapid growth. According to a 2017 research report by the U.S. Census Bureau, “high growth young firms contribute disproportionately to job creation, output and productivity growth.”3 Similarly, according to a Brookings study, “Business startups account for about 20 percent of US gross (total) job creation while high-growth businesses (which are disproportionately young) account for almost 50 percent of gross job creation.”4

To date, there is only nascent funding—mostly pilots and press releases—to ensure this strategy is inclusive of Black, Latino or Hispanic, and other communities of color. In 2019, according to the National Venture Capital Association, U.S. venture capital investments surpassed $130 billion for the second consecutive year in a row, enabling over 10,777 high-growth companies to grow and scale. But fewer than 1% of Black and Latino or Hispanic founders have successfully accessed this capital.

As the demographics of America change, it is important to include these communities in all economic development strategies. Inclusion is particularly important in ecosystem-building for Black communities because of entrepreneurship’s power to create jobs and close the racial wealth gap.

Response

For wealth creation to occur during or after the COVID-19 pandemic, large investments must be made into programs, platforms, and products that advance tech talent development, entrepreneurship, and capital access for communities of color. Specifically, these efforts should:

1. Invest in talent development by:

- Providing early exposure to the edge technologies, skills, and careers that are driving the future of work in the fourth industrial revolution. This requires funded outreach, marketing, advertising, and public relations resources to ensure that all Americans—particularly Black and Latino or Hispanic Americans—are informed about the opportunities available in tech ecosystems.

- Creating the opportunity to reskill for all Americans—particularly Black and Latino or Hispanic Americans—with skills that lead to in-demand, upwardly mobile career paths. Skills include (but aren’t limited to) software development, web and mobile development, technical sales, growth marketing, and company-building, with modules in artificial intelligence and machine learning, data science, quantum computing, health innovation, cybersecurity, and distributed ledger technologies.

- Incentivizing venture-backed companies, large corporations, research institutions, and governmental agencies to hire this newly skilled workforce and equitably compensate them with salary, benefits, and equity when appropriate.

2. Invest in entrepreneurship by:

- Building “equity districts” to accelerate inclusive innovation and the commercialization of research that solves problems for local, national, and global industry supply chains.

- Preparing small business owners and startups to become technology-enabled and skilled in the science of company-building.

3. Invest in capital by funding new companies before and during the seed stage to achieve revenue growth.

When these inputs combine in a local community, they form an entrepreneurship ecosystem, which we define as the individuals, organizations, support programs, investors, companies, relationships, policies, environments, spaces, and cultures that interactively work together in support of entrepreneurs.5 For ecosystem-building to increase racial equity, government, industry, and Black institutions need to partner with Black-owned and leading ecosystem-building organizations.6

Funding

For each pillar of our strategy, this section outlines the roles and funding responsibilities for: 1) the federal government, 2) industry-led initiatives in tandem with local governments, and 3) community-driven grassroots campaigns.

Talent development

We estimate that the unit economics of training a worker for an in-demand tech career are approximately $15,000.

Federal government: Our view is that the magnitude and intensity of the COVID-19 economic crisis demands federal investment in training. During the CARES Act deliberations, we recommended that the federal government invest $1.5 billion over 10 years to train 1 million Americans from socially disadvantaged communities—particularly Black communities—for in-demand technology careers such as software development, AWS cloud engineering, cybersecurity, Salesforce, technical sales, and growth marketing.

Local governments and corporations: Should the federal government fail to act, local governments and the private sector can step in. Large tech companies, Fortune 1000 companies, and high-growth startups can fund the reskilling of America. They are also in the first position to hire this newly skilled talent and benefit from reduced turnover among its workforce. According to the Kapor Center’s 2017 Tech Leavers Study, unfairness-based turnover in tech is a $16 billion-a-year problem, from which they concluded, “Diversity, equity & inclusion initiatives can improve company culture and reduce turnover, if they are done right.” Mitigating racism and bias in companies frees up resources for reskilling and upskilling.

Meanwhile, cities and states (via their workforce boards) can fund in-demand reskilling and upskilling programs from their Workforce Innovation and Opportunity Act (WIOA) dollars, while convening employers to allocate apprenticeships and full-time roles for program graduates. At $15,000 per trainee, hundreds of people could benefit from a multimillion-dollar investment in tech training.

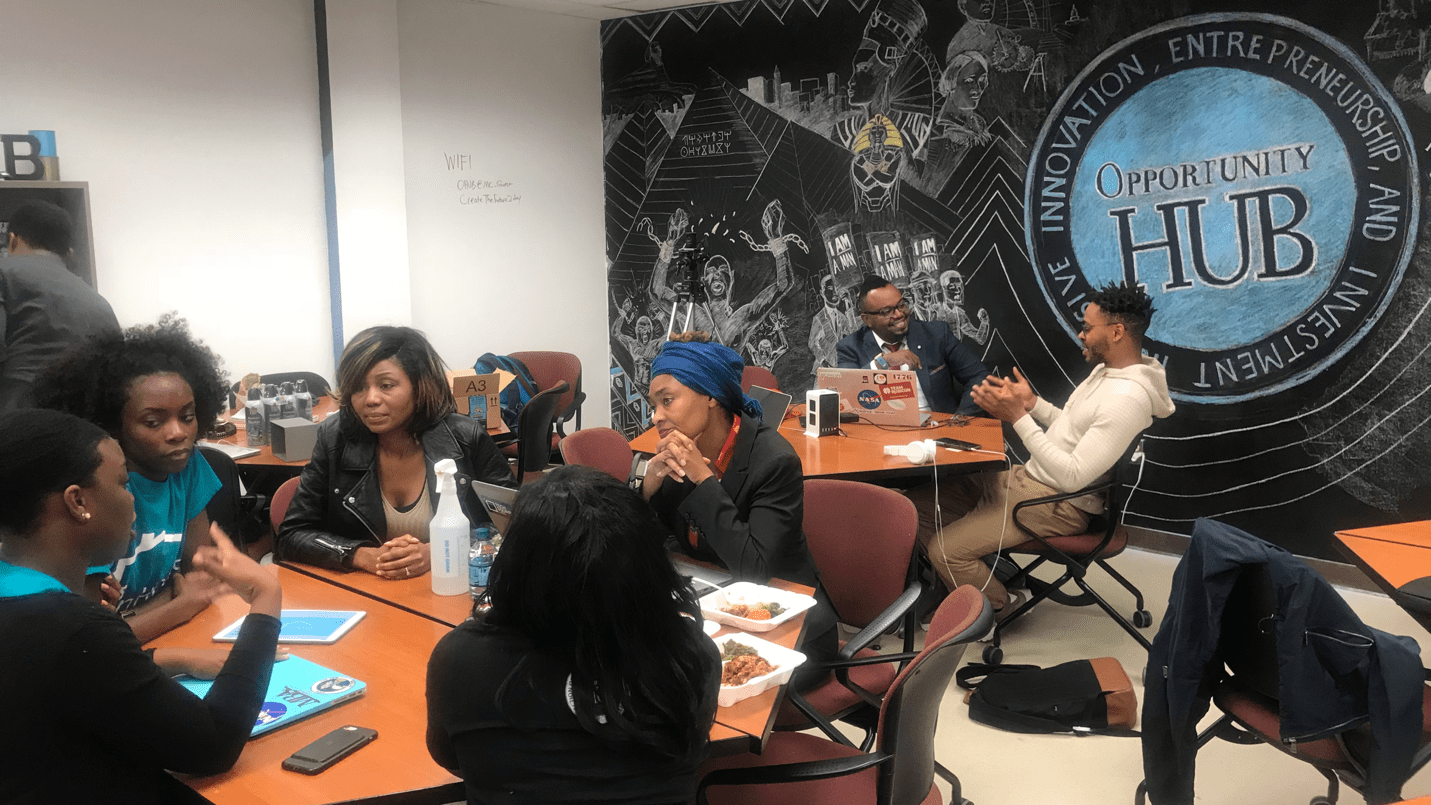

Community and educational institutions: If government or industry won’t take action, then it is up to our communities to fund their own platforms to drive funding. This approach could leverage educational institutions such as historically Black colleges and universities (HBCUs), which are collaborating on the launch of new in-demand skills certificate programs (such as Momentum@Morehouse) or launching co-branded technology hubs and accelerators. These partnerships could scale nationwide, with 100 HBCUs each training 100 coders, resulting in 10,000 new software engineers per year. HBCUs could partner with organizations such as Opportunity Hub, which facilitate recruitment, admissions, and financial aid options.

Entrepreneurship

We estimate the unit economics of exposing up to 1,000 people a year to the tech startup ecosystem are $1 million per year per city, and the unit economics of accelerating a product-ready startup are $50,000.

Federal government: The main role for the federal government in entrepreneurship support will be to fund inclusive tech ecosystems across as many local communities as possible. Ecosystem-building organizations, entrepreneurship-support programs, preaccelerators, accelerators, and technology incubators are on the frontlines of building high-growth companies in America, including Black-led ecosystem-builders operating successfully in the most socially disadvantaged communities. Every day, ideas are nurtured into viable businesses. An $1 billion investment ($100 million per year over 10 years) could provide $1 million grants to 100 local communities with a significant share of Black residents to support ecosystem exposure and startup acceleration.

Local governments and corporations: Local governments and private sector leaders can also be critical investors in their local entrepreneurship ecosystem. For instance, a city’s economic development corporation, in partnership with local foundations, can fund ecosystem-building initiatives, preaccelerators, and accelerators via program-related investments. Individual communities could commit to inclusive ecosystem development and startup acceleration for about $1 million per year.

Community and educational institutions: Black institutions such as churches, civil rights organizations, industry associations, and nonprofits can educate themselves and their constituents on the opportunities for new income and wealth creation while co-fundraising on behalf of their members and constituents. Cultural icons such as actors, artists, professional athletes, and social media influencers can invest in Black funds and founders, and use their platforms to amplify early exposure and equity-based crowdfunding initiatives.

Capital

We estimate the unit economics of investing in seed rounds are $1 million on average.

Federal government: One way the federal government could provide seed funding to Black-owned venture funds would be to reactivate the 2010 State Small Business Credit Initiative, a Treasury Department program used to support state-level small business financing. The department could issue $1 billion per year in the form of convertible notes and equity as issued and accepted by most startup accelerators and incubators. Black-owned venture funds that can demonstrate a historical mission, precedence, and track record of serving and investing in marginalized and socially disadvantaged entrepreneurs would be selected to invest the capital.

Local governments and corporations: Many Fortune 1000 companies and large tech companies have corporate innovation initiatives and startup programs with accompanying venture capital funds. These corporate-led funds can become limited partners in Black-owned venture funds or direct investors in founders. Cities and public-private economic development organizations can also become limited partners in venture funds or direct investors in founders as well.

Community and educational institutions: Black investors that are accredited per the Securities and Exchange Commission can learn to invest in venture funds, startup companies, and accelerators. The Jumpstart Our Business Startups (JOBS) Act, which enables companies to raise equity and debt-based startup capital for their companies, is available to all Americans to participate. For example, Angela Benton’s Streamlytics raised $250,000 in 24 hours and over $1,000,000 in less than one week using Title III (Reg CF) of the JOBS Act. Dawn Dickson’s PopCom recently raised $1 million in 45 days also using Title III (Reg CF) of the JOBS Act. Jay Morrison’s Tulsa Real Estate Fund recently raised another $3.7 million for a total of $12 million from 15,000 investors utilizing Title IV (Reg A+) of the JOBS Act. Opportunity Hub is planning a $50 million Reg A+ equity crowdfunding raise with JE Dunn Capital Partners and Keystone Innovation District to build an equity district in Kansas City, Mo.

Potential impact

What we have outlined would be the most ambitious investment in Black wealth in modern American history. Nationwide, a $26 billion suite of programs over 10 years could train 1 million new skilled tech workers, enable 100 ecosystem-building organizations to train 100,000 high-growth technology startups, and provide seed funding to 10,000 Black-led technology startups. These investments will create permanent new jobs while recapturing centuries of lost wealth due to economic exclusion, all while continuing to inspire future generations of Americans.

Federal action is the clearest path to this scale, but local recovery planning efforts need not wait. Applying these per unit costs to a 10-year, $50 million investment in a locally led inclusive entrepreneurship ecosystem effort could train 1,500 new highly skilled tech workers, expose 10,000 residents to high-growth entrepreneurship, pre-accelerate 500 new ventures, provide acceleration services to 100 high-growth startups, and fund the seed rounds for 10 scaling companies.

| Use of Proceeds | Black-owned and -operated organizations doing the work | Economic outcome | Allocation |

| Accelerated workforce technology skills development | Momentum@Morehouse, OHUB Future School, re:Work, STEM Whisperers | Train and place 100,000 new skilled tech workers per year over 10 years, equaling 1 million new tech workers |

$1.5 billion per year over 10 years, equaling $15 billion |

| Entrepreneurship education, training, and support | Camelback Ventures, digitalundivided, Founder Gym, NewME, OHUB | Train and position 10,000 minority-led high-growth startups for the future of work per year for 10 years |

$100 million per year over 10 years, equaling $1 billion |

| Early stage equity capital | 100 Black Angels and Allies Fund I, Backstage Capital, Cake Ventures, Impact America Fund, Fearless Fund, Lightship Capital, MaC Venture Capital, Plexo Capital, Precursor Ventures | Fund the top 1,000 tech firms per year with a 12 to 18 month runway per year for 10 years. |

$1 billion per year over 10 years, equaling $10 billion |

| Total | $26 billion |

-

Footnotes

- Kriston McIntosh and others, “Examining the Black-white wealth gap” (Washington D.C.: The Brookings Institution, 2020). and Katherine Schaeffer, “6 facts about economic inequality in the U.S.” (Washington D.C.: Pew Research Center, 2020).

- Shelley Stewart III and others, “The economic impact of closing the racial wealth gap” (New Jersey and Washington D.C.: McKinsey, 2019).

- John Haltiwanger and others, “High growth young firms: contribution to job, output, and productivity growth,” in Measuring entrepreneurial businesses: current knowledge and challenges, ed. by John Haltiwanger and others (Chicago: University of Chicago Press, 2016), pp. 11-62.

- Ryan Decker and others, “The role of entrepreneurship in US job creation and economic dynamism,” Journal of Economic Perspectives, 28 (3) (2014) pp. 3-24.

- Modified from: Grow Your Own Entrepreneurship-based Development for Local Communities (Kansas City: The Federal Reserve Bank of Kansas City, nd).

- Examples include OHUB, The Plug, All Star Code, G | Code House, Black in AI, NewME, Hillman Accelerator, Lightship Capital, Camelback Ventures, MaC Venture Capital, Fearless Fund, Backstage Capital, and 100 Black Angels and Allies Fund.