Past Event

Content from the Brookings Institution India Center is now archived. After seven years of an impactful partnership, as of September 11, 2020, Brookings India is now the Centre for Social and Economic Progress, an independent public policy institution based in India.

Brookings India roundtable discusses ongoing research on power sector coal requirement by 2020 and future of renewable energy

Brookings India hosted a high-level roundtable triangulating coal, power, and renewable energy (RE) on 1 April 2016 in New Delhi. This brought together leaders from the Government (including the Secretaries of Power, Coal, and New and Renewable Energy), leaders from Central Electricity Authority (CEA), Power System Operation Corporation (POSOCO), distribution companies (discoms), the banking sector, and scholars, amongst others. The roundtable featured a free and frank discussion (under Chatham House Rule, i.e., non-attribution) on the risk of incongruities among connected sectors; bringing together discussions on coal, thermal power, renewable energy and power demand. The session was moderated by Rahul Tongia, Fellow, Brookings India, and chaired by Rakesh Mohan, Distinguished Fellow, Brookings India.

Background: Brookings India Studies on Coal and Power

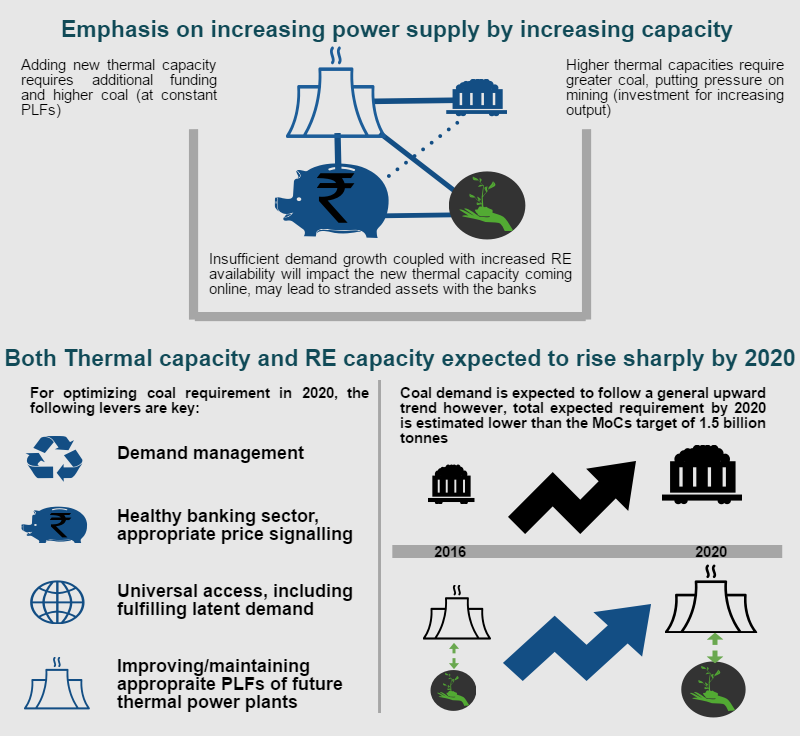

The basic objective of this ongoing study at Brookings India was to triangulate the implications of, the Ministry of Coal (MoC) target of mining 1.5 billion tonne of coal by 2020, using empirical data of electricity demand in 2020 and power capacity by 2020. Power generation/electricity is the highest consumer of coal among all sectors in India hence the special attention. Brookings India modelled coal requirement in 2020 by gathering data on two different influencers the projected electricity demand in 2020 and thermal coal based power capacity expected online by 2020 (data gathered down to the individual power plant level was used for calculating expected upcoming capacity). Additional coal requirement in 2020, on top of the actual consumption in the financial year 2014-15, was forecasted on the basis of estimated increase in electricity consumption by 2020 (assuming a steady GDP growth rate, fulfilment of latent electricity demand and complete electrification, among other assumptions). The calculation of coal on the basis of electricity demand also included an assumption of fractional displacement of thermal electricity by RE generation contributing to proportionate decrease in coal mining. The coal requirement thus calculated (from the demand side) was then triangulated with a forecast value of coal requirement due to increase in total thermal power plant capacity by 2020 and the additional coal required to run all of these plants at a specified plant load factor (PLF) (assuming financial viability for upcoming plants). It was found that the likely capacity (and thereby coal required for this capacity) is far higher than necessarily required, if plants were to target a high PLF (75%+). Simultaneously, it is important to note that the demand side coal estimate numbers also assume an optimistic scenario with fulfilment of all the latent demand and a complete electrification, possibly throwing up higher (than necessarily required) coal requirement numbers. However, whichever side one looks from, one thing is amply evident after the triangulation exercise – The actual coal requirement in 2020 would be lower than officially targeted value for coal requirement by 2020 (1.5 billion metric tonnes of coal), contingent to the stated assumptions holding water.

Roundtable Discussion Agenda

To kick-start discussions, Brookings India presented key findings of its soon-to-be-released study, forecasting a lower than official coal requirement for 2020. Discussions showed there was general consensus in the findings of a reduced need for coal than earlier envisaged, and a much lower need for additional coal-fired power plant capacity. Brookings India opened the floor with a number of questions for the policy makers to harmonise total coal requirement and electricity demand by 2020. Some of the key questions raised at the roundtable are given below:

The study set the agenda for a discussion which would take into account the multiplicity of levers that move the coal and closely connected power sector value chain and also addresses the uncertainty on the variables that impact this sector.

Major Issues Identified

Financial implications of excess thermal power capacity

About 89 GW of thermal power plant capacity (pan India) has all approvals (environmental clearance, land acquisition and financial closure) in place, as of 31 March 2015. The total capacity expected online, by 2020, is even higher, although not as certain. Any new capacity addition is fraught with operational and financial risks (lower future PLFs and stranded assets with higher marginal cost of generation respectively) in the absence of a firm power purchase agreement from the discoms. A lot also, hinges on the institutional support for improving discoms – the UDAY scheme – that could significantly alter the future viability of this sector.

RE capacity addition and impact on PLFs

The target of adding RE capacity would impact the thermal power plant PLFs in the future considering the diurnal nature of solar power and seasonal nature of wind, coupled with a lack of storage in the short run. RE should not only be integrated better but also be more affordable among the portfolio of total power. The various modes of power (solar/wind/hydro etc.) and the scale of RE projects, including rooftop solar and grid scale solar, need to be sufficiently addressed in a comprehensive policy framework to avoid distortion and incorrect signalling to capital investment.

Demand uncertainty (management) and rural electrification

Demand uncertainty (five years from now) would be a key variable impacting the power and coal sector capacities coming online by 2020. It would be a good idea to include demand side management as one of the key objectives for incentivising and reducing the gap between available power and latent demand.

Rural electrification is one of the other key variables that would impact demand. A realistic analysis of cost of power supply to rural areas of the country against a distributed/micro grid kind of an arrangement would help in realising cost savings and also ensure a sustainable model of power consumption at the village level.

Future analysis should factor in Time of Day implications of different supply and demand scenarios, which will help with optimising the supply portfolio for India.

Like other products of the Brookings Institution India Center, this report is intended to contribute to discussion and stimulate debate on important issues. Brookings India does not hold any institutional views.

Rahul Tongia, Anurag Sehgal, Puneet Kamboj

2020

Online Only

3:00 am - 4:40 am IST

Saneet Chakradeo

August 18, 2020