This paper is part of the fall 2020 edition of the Brookings Papers on Economic Activity, the leading conference series and journal in economics for timely, cutting-edge research about real-world policy issues. Research findings are presented in a clear and accessible style to maximize their impact on economic understanding and policymaking. The editors are Brookings Nonresident Senior Fellow and Northwestern University Professor of Economics Janice Eberly and Brookings Nonresident Senior Fellow and Harvard University Professor of Economics James Stock. Read summaries of all the papers from the journal here.

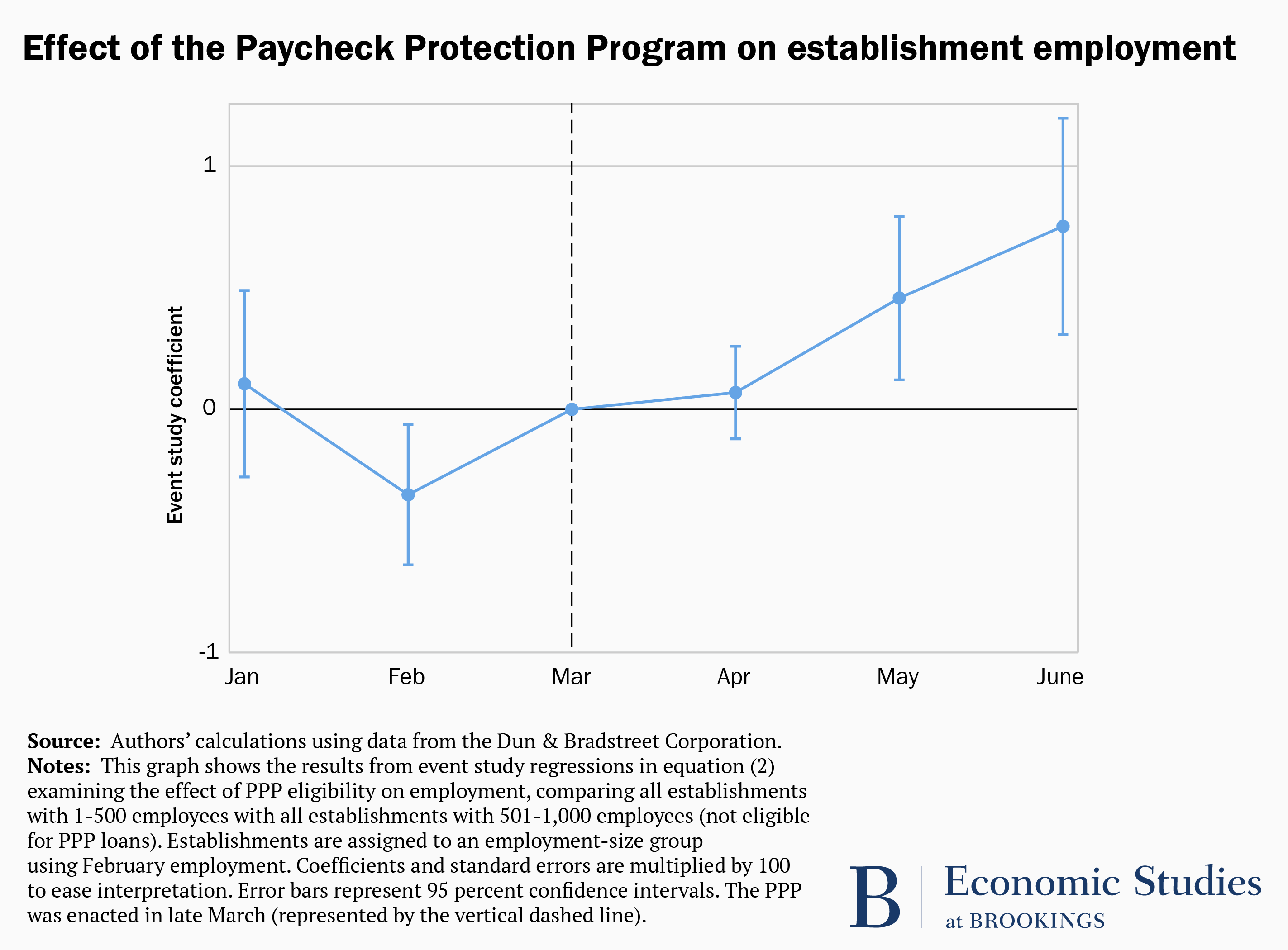

The Paycheck Protection Program (PPP) substantially increased the employment, financial health, and survival of small businesses during the COVID-19 lockdowns of April and May and as the economy began reopening in June, finds a paper discussed at the Brookings Papers on Economic Activity (BPEA) conference on September 24.

But the authors—Glenn Hubbard of the Columbia Business School and Michael R. Strain of the American Enterprise Institute—caution that it is too early to issue a conclusive judgment on its success. And they suggest that future support for small businesses, as the economy evolves to meet post-lockdown needs, should be less focused on maintaining pre-lockdown employment relationships.

The PPP, which ran from April 3 through August 8, provided $525 billion in government-guaranteed, forgivable loans (essentially grants) to businesses with 500 or few employees, which account for 47 percent of private-sector employment. Recipients were required to spend 60 percent of their loan on payrolls.

Using data from Dun & Bradstreet Corporation, the authors compared firms that applied for PPP loans worth $150,000 or more with larger firms (with 501-1,000 employees), which weren’t eligible for PPP loans. Firms that applied for PPP loans were much less likely to go out of business than the larger ineligible firms, were more likely to pay their bills on time, and were more likely to maintain employment levels.

Thus, they conclude, the program succeeded in its short-run goals, including helping smaller firms withstand sharp revenue declines during the shutdown and keeping workers connected to their employers. But it is too soon to say whether the program will achieve its medium-run goals, including preventing a wave of bankruptcies.

“It will be particularly important to see what happens to businesses that received PPP [loans] and the workers they employ once they have exhausted their forgivable loan,” the authors write in Has the Paycheck Protection Program succeeded?

They raise several concerns about the program’s design as well as its implementation by the Treasury Department and Small Business Administration. The PPP should have focused on more on replacing lost revenue and less on assisting businesses to meet their payrolls; many small businesses, for instance, needed help to pay high rents, they write. The government also could have done a better job of convincing banks that they would be held harmless in the event of borrower misrepresentation, they say. And they cite implementation shortcomings that slowed lending after mid-May.

“Treasury’s muddled management of PPP’s implementation is noteworthy because of its failure to take seriously the advice it was given by a range of private-sector participants and policy experts, leading it to make mistakes that were both forecastable and forecasted,” they write.

Still, during its first three months, the PPP “was able to get an astonishing amount of money to millions of small businesses very quickly,” they write, and media coverage suggesting the program was mainly offering grants to large and well-connected firms was overblown.

David Skidmore authored the summary language for this paper. Becca Portman assisted with data visualization.

CITATION

Hubbard, Glenn and Michael R. Strain . 2020. “Has the Paycheck Protection Program Succeeded? ” Brookings Papers on Economic Activity, Fall, 335-390.

CONFLICT OF INTEREST DISCLOSURE

The authors did not receive financial support from any firm or person for this article or from any firm or person with a financial or political interest in this paper. They are currently not officers, directors, or board members of any organization with an interest in this paper.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).