The U.S. economy is currently growing and creating jobs, a situation I hope and expect will continue. We can’t rule out the possibility, though, that at some point in the next few years our economy will slow, perhaps significantly. How would the Federal Reserve respond? What tools remain in the monetary toolbox? In this and a subsequent post I’ll discuss some policy options the Fed might consider, focusing first on negative interest rates. Readers should also be aware of the March 21 conference at the Hutchins Center at Brookings on the tools remaining to monetary and fiscal policymakers should the economy deteriorate.

To anticipate, I’ll conclude in these two posts that the Fed is not out of ammunition, and that monetary policy could help cushion a possible future slowdown. That said, there are signs that monetary policy in the United States and other industrial countries is reaching its limits, which makes it even more important that the collective response to a slowdown involve other policies—particularly fiscal policy. A balanced monetary-fiscal response would both be more effective and also reduce the need to use unconventional monetary tools.

First steps for easing policy

Given where we are today, how would the Fed respond to a hypothetical economic slowdown? Presumably the central bank’s first response, after dropping any plans to raise rates further, would be to cut short-term interest rates, perhaps to zero. Unfortunately, with the fed funds rate (the Fed’s target short-term rate) now between ¼ and ½ percent, and likely to remain relatively low, moving to zero provides much less firepower than in the past. For comparison, the Federal Open Market Committee (FOMC), the Fed’s monetary policy-making body, cut the short-term interest rate by 6.8 percentage points in the 1990-91 recession and its aftermath, by 5.5 percentage points in the 2001 recession, and by 5.1 percentage points at the beginning of the Great Recession in 2007-2008.

With the fed funds rate near zero, the FOMC could next turn to forward guidance, that is, to communicating to markets and the public about the Fed’s policy plans. If the Fed can convince market participants that short-term rates will stay low for some time, it can “talk down” longer-term rates, such as mortgage rates, which are typically more important to consumers, businesses, and investors.[1] (When central bankers get together over a ginger ale, they like to call these efforts “open-mouth operations.”) The evidence suggests that forward guidance can be quite powerful, and if the amount of extra policy support needed is not too great, rate cuts plus guidance might be all that is needed.

But what if not? The Fed could resume quantitative easing (QE), that is, purchases of assets (typically longer-term assets) for the Fed’s portfolio, financed by the creation of reserves in the banking system. Like forward guidance, the goal of QE is to reduce longer-term interest rates to encourage borrowing and spending. It appears to work through at least two channels. First, the Fed’s purchases push up the price and (equivalently) push down the yield of the assets it buys. That effect is transmitted through the system as investors who sold the assets shift into others (such as stocks or corporate bonds). Second, the Fed’s asset purchases can help signal its intention to keep rates low for a long time. [2] For more on QE and its effects, see here.

The Fed employed QE from late 2008 until October 2014, and the policy helped support the U.S. recovery and reduce the risk of price deflation. Other major central banks are using it now. But the FOMC might be reluctant to turn to it again. It’s hard to calibrate, and communicating about it is difficult (as we learned in 2013 when Fed talk about ending QE led to a “taper tantrum” in financial markets). It’s also possible that a new round might be less helpful than before.

For these reasons, before undertaking new QE, the Fed might want to consider other options. Negative interest rates are one possibility.

Negative interest rates: general considerations

Several central banks, including the Bank of Japan and the European Central Bank, have implemented negative interest rates. In practice this means that, instead of receiving interest on the reserves they hold with the central bank, banks are charged a fee on reserves above a threshold. The expectation is that, to avoid the fee, banks will shift to other short-term assets, which drives down the yields on those assets as well, possibly to negative levels. Ultimately, the efforts of banks and other investors to avoid negative returns on the shortest-term assets should lead to declines in a broad range of longer-term interest rates, such as mortgage rates and the yields on corporate bonds. (Generally, though, we’d expect these longer-term rates to remain positive, because of the extra compensation that investors demand for bearing credit risk and for tying up their money for longer periods.) By putting downward pressure on the interest rates most relevant to borrowing and spending decisions, the introduction of negative interest rates should work through the same channels as more standard monetary policies.

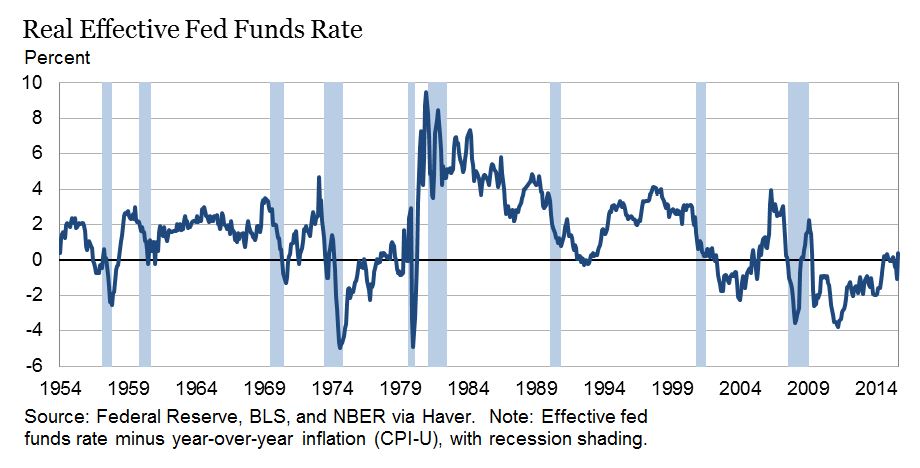

The idea of negative interest rates strikes many people as odd. Economists are less put off by it, perhaps because they are used to dealing with “real” (or inflation-adjusted) interest rates, which are often negative. Since the real interest rate is the sticker-price (nominal) interest rate minus inflation, it’s negative whenever inflation exceeds the nominal rate. Figure 1 shows the real fed funds rate from 1954 to the present, with gray bars marking recessions.[3] As you can see, the real fed funds rate has been negative fairly often, including most of the period since 2009. (It reached a low of -3.8 percent in September 2011.) Many of these negative spells occurred during periods of recession; this is no accident, since during recessions the Fed typically lowers interest rates, both real and nominal, in an effort to spur recovery.

For most of the period reflected in Figure 1, the Fed had no need to implement a negative interest rate in order to ease policy: Until 2008, the nominal fed funds rate was always well above zero, so that ordinary interest rate cuts remained feasible when needed. Since late 2008, however, the fed funds rate has been barely above zero much of the time, so that achieving further reductions in the real funds rate would have required taking the nominal rate negative. In principle at least, how much extra pop could this policy have delivered? If during this period the Fed had decided (and been able) to lower the short-term nominal interest rate to, say, -0.5 percent, then it presumably could have achieved a real fed funds rate half a percentage point lower as well. For example, instead of being -3.8 percent in September 2011, the real fed funds rate might have been around -4.3 percent, with commensurate declines in other interest rates. As you can see, the amount of extra stimulus generated by this further reduction in rates would not have been negligible by any means (roughly, it would have corresponded to two extra quarter-point rate cuts in more normal times), but neither would it likely have been a game-changer.

Negative interest rates: practical issues

In August 2010, Federal Reserve staff prepared a memo for the FOMC evaluating the likely effects of cutting the interest rate paid on bank reserves to zero or below. That memo, recently released by the Fed, was lukewarm about negative interest rates for mostly practical reasons. I’ll repeat and address a few points made by the staff, with, of course, the benefit of five years’ hindsight.

Legal and operational constraints

Some of the staff’s concerns were operational (software might need to be modified to handle negative rates, the demand for currency might increase, etc.). These don’t seem that worrisome to me. Of greater concern is the basic legal issue: Does the Fed have the authority to impose a negative interest rate on the reserves banks hold with it? [4] (I don’t pretend to any legal expertise on this matter and my comments should be treated accordingly.)

Outside observers often do not seem to appreciate the legal constraints the Fed faces (regarding the assets it can purchase, for example), which are generally much tighter than those faced by other major central banks. In this instance, the law says that the Fed can pay banks interest on their reserves, but it is not immediately clear whether that authority extends to “paying” negative interest. If it does not, an alternative the Fed might consider is to use its authority to charge banks a fee for accepting their reserves—something it already does for providing other services. A fee on reserves would be essentially equivalent to a negative interest rate. A possible problem with this strategy is that, per the Federal Reserve Act, the Fed’s fees for services must reflect, “over the long run,” the actual costs of providing those services. Presumably the direct cost to the Fed of holding banks’ reserves is low. A separate authorization allows the Fed to charge banks for its costs of supervision and regulation; possibly a fee on reserves could be subsumed under that heading. In short, as pointed out by Chair Yellen while speaking to Congress in February, there remain some legal issues to resolve before the Fed could implement a negative interest rate. For the rest of this post I’ll assume these away.

How negative?

The fundamental economic constraint on how negative interest rates can go is that, beyond a certain point, people will just choose to hold currency, which pays zero interest. (It’s not convenient or safe for most people to hold large amounts of currency, but at a sufficiently negative interest rate, banks or other institutions could profit from holding cash, for a fee, on behalf of customers.) Based on calculations of how much it would cost banks to store large quantities of currency in their vaults, the Fed staff concluded in 2010 that the interest rate paid on bank reserves in the U.S. could not practically be brought lower than about -0.35 percent.[5] Moreover, for various reasons, the 0.35 percentage points would not be fully reflected as declines in other short-term and longer-term rates, they argued. They concluded that the monetary policy benefit of a negative rate would likely be small.

Since then, however, several countries have implemented negative policy rates below the putative limit of -0.35 percent without triggering massive currency hoarding. For example, Switzerland’s policy rate is now at -0.75 percent, Sweden’s at -0.50 percent. Negative rates have even spread to longer-term securities; in Germany, government debt carries a negative rate out to maturities of eight years. The lack of currency hoarding in Europe is intriguing and suggests that the negative rates tool might be more powerful than thought. I am skeptical, though, that U.S. rates could go as negative as in Switzerland or Sweden, at least not without causing significant disruptions to the functioning of some key financial markets and institutions (see below). And a general conundrum is that central banks need market participants to believe negative rates will be in place for a long time for there to be much effect on economically important long-term rates; but if market participants believe that, they’ll have even more incentive to buy vault space and pay the other costs involved in hoarding cash.

Effects on money market funds

There has been much discussion recently about negative rates’ effects on bank profitability, but the 2010 Fed memo was more concerned about money market funds (MMFs), which play a larger role in the U.S. than in Europe or Japan. Like banks, U.S. MMFs have traditionally promised their investors the ability to withdraw at least the full amount that they’ve invested. Not making good on this promise is known as “breaking the buck.” (When a fund did this in 2008 due to losses on its Lehman Brothers commercial paper, it started a highly destructive run on the fund industry.) The Fed staff memo expressed concern that, facing zero or negative short-term interest rates, MMFs could break the buck or shut down as their management fees dried up. [6] MMFs are important providers of short-term funding for both banks and nonfinancial firms; and, although in the long run the cash that flows through MMFs would find some other channel, in the short run a squeeze on MMFs could be disruptive.

Events since the staff memo was written have reduced, but not eliminated, these concerns. MMFs used to be able to maintain the appearance of stability by displaying a constant net asset value of at least $1.00 per share, but Securities and Exchange Commission (SEC) reforms announced in 2014 (set to be fully implemented this October) have changed that. Starting in October, MMFs will have to display floating net asset values with four decimal places, except for government MMFs (funds with 99.5% or more of their holdings in cash or government securities) and prime funds focused on retail depositors (as opposed to institutional investors). With floating net asset values, MMFs will no longer effectively be promising to pay investors back dollar for dollar, that is, “breaking the buck” is no longer an issue. However, as mentioned, not all funds must adopt the new approach; those that do not could still be potentially rendered unstable by consistently negative returns on the assets they hold.

Effects on banks and their profits

What about banks? A concern often heard about negative rates in Europe and Japan starts with the presumption that banks are unwilling or unable to pass negative rates on to their depositors. Consequently, it is argued, negative rates for reserves and possibly other assets create a profit squeeze for banks, which could be a problem if it prevents banks from lending normally.

Of course, banks have been dealing with a low-interest-rate environment for a while now, and short-term rates going negative would not help. It seems implausible, though, that modestly negative short-term rates would have large incremental effects on bank profitability or lending. Contrary to the simple story, most U.S. bank funding does not come from small depositors, but from wholesale funding markets, large institutional depositors, and foreign depositors, all of whom would presumably accept a marginally negative rate if the alternative were holding currency.[7] On the asset side of banks’ balance sheets, the interest rates on loans and other investments would almost certainly remain in positive territory, so that banks would continue to enjoy positive interest margins. Finally, to the extent that banks in general were not able to pass on the negative rate to their sources of funding, in a competitive credit market the extra cost would be borne at least in part by borrowers and not just banks. (Though if the central bank’s negative interest rate does not pass through fully to the cost of credit, the benefits of the policy are reduced.)

Disruptions to some financial markets

Fed staff also worried, in 2010, about the effects of negative rates on the functioning of some key financial markets. Notably, the federal funds rate, which the FOMC targets, is determined in the market for overnight loans among banks. Because banks today hold very large quantities of reserves (a residue of QE), they have little need to borrow reserves from each other, with the result that activity in the fed funds market has declined dramatically. For a number of reasons, activity in that market would likely fall still further if rates paid on reserves went to zero or to slightly negative levels, raising the possibility that the FOMC would not have a market-determined value of the federal funds rate to use as a policy target. Were that to happen, though, it would not be particularly problematic for the FOMC to switch the rate it targets; it could even set policy in terms of the interest rate it pays (or receives) on reserves.

Conclusion on negative interest rates

The anxiety about negative interest rates seen recently in the media and in markets seems to me to be overdone. Logically, when short-term rates have been cut to zero, modestly negative rates seem a natural continuation; there is no clear discontinuity in the economic and financial effects of, say, a 0.1 percent interest rate and a -0.1 percent rate. Moreover, a negative interest rate on bank reserves does not imply that the most economically relevant rates, like mortgage rates or corporate borrowing rates, would be negative; in the US, they almost certainly would not be. Negative rates have some costs, in their effects on money market funds for example, but these ought to be manageable. On the other hand, the potential benefits of negative rates are limited, because rates that are too negative would trigger hoarding of currency. Although the European experience suggests that rates can be more negative than the Fed staff estimated in 2010, I don’t think U.S. rates could approach the extreme values seen in Switzerland or Sweden without becoming counterproductive.

Overall, as a tool of monetary policy, negative interest rates appear to have both modest benefits and manageable costs; and I assess the probability that this tool will be used in the U.S. as quite low for the foreseeable future. Nevertheless, it would probably be worthwhile for the Fed to conduct further analysis of this option. We can imagine a hypothetical future situation in which the Fed has cut the fed funds rate to zero and used forward guidance to try to talk down longer-term interest rates. Suppose some additional accommodation is desired, but not enough to justify a new round of quantitative easing, with all its difficulties of calibration and communication. In that scenario, a policy of modestly negative interest rates might be a reasonable compromise between no action and rolling out the big QE gun.

[1] Forward guidance comes in a number of varieties. It can be qualitative, with few specifics (as when the FOMC promised to keep short-term rates low “for a considerable period”) or quantitative, giving numerically explicit circumstances that would prompt a policy change. It can be time-dependent (specifying a date, as when the FOMC in August, 2011 promised to keep rates low “at least through mid-2013”) or state-dependent, tying future policy actions directly to conditions in the economy.

[2] In a variant of quantitative easing, the Maturity Extension Program of 2011, the Fed bought longer-term assets but sold shorter-term assets. This policy, known informally as “Operation Twist,” allowed the Fed to put downward pressure on longer-term interest rates without expanding its total assets holdings.

[3] Here we define the real fed funds rate as the effective fed funds rate minus the year-over-year CPI-U. There are many possible definitions, but they all tell the same story.

[4] This Wall Street Journal article discusses some of the legal issues.

[5] Another potential constraint arises from the fact that the Fed is not allowed to pay interest to the government-sponsored enterprises, such as Fannie Mae and Freddie Mac, even though the GSEs hold reserves at the Fed. Presumably, if the Fed relies on the interest-on-reserves law to charge interest to banks, the GSEs would be exempt. If so, they would have an incentive to accept money from banks for redeposit at the Fed at zero interest, an arbitrage that would reduce the ability of the Fed to maintain a negative rate.

[6] See here for another Fed memo—this one from December, 2008—estimating the effect of a zero-interest-rate environment on money market funds.

[7] According to the FDIC, half (49.3%) of all U.S. commercial bank deposits are insured, which amounts to just over one-third (37.6%) of total liabilities. Presumably almost all small retail deposits are insured, so that this figure is a ceiling for banks’ reliance on such deposits.

Comments are now closed for this post.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

What tools does the Fed have left? Part 1: Negative interest rates

March 18, 2016