Studies in this week’s Hutchins Roundup find that tighter mortgage lending standards can lead to lower housing prices, open market operations in assets might have to be combined with fiscal policy to have an effect on inflation, and more.

Changes in banks’ mortgage lending standards have real consequences for local economies

Using the Fed’s Senior Loan Officer Opinion Survey and banks’ decisions on mortgage applications between 1990 and 2013, Cindy Vojtech and John Driscoll of the Federal Reserve Board and Benjamin Kay of the Office of Financial Research find that when banks tighten lending standards, the mortgage application denial rate rises by 1 percent, holding macroeconomic conditions and borrower credit quality constant. Furthermore, tighter standards substantially reduce the number of approved applications for subprime mortgage loans. The authors also find that communities in which banks tighten standards more exhibit significantly lower delinquency rates and see declining house prices. The authors conclude that the Senior Loan Office Opinion Survey provides valuable information on changes in credit standards, and that changes in credit standards have significant consequences for local economies.

Asset purchases by central banks might not be enough to raise inflation

Gauti Eggertsson and Kevin Proulx of Brown University revisit the argument of whether open market operations in assets like stocks, foreign exchange, and mortgage backed securities can successfully raise inflation at the zero lower bound. They show that asset purchases by central banks should, in theory, lead to higher inflation if the private sector believes that this money supply increase is permanent. However, numerical results show that the scope of these purchases might have to be implausibly large – 10 times the size of GDP –in order to have the desired effect, suggesting that fiscal policy may have to be used together with monetary policy to increase inflation at the zero bound.

Large institutional investors are more likely to destabilize financial markets than a comparable-size set of small institutions

Itzhak Ben-David of the Ohio State University, Francesco Franzoni of Swiss Finance Institute, and Rabih Moussawi and John Sedunov of Villanova University find that concentration of ownership by large institutional investors increases the volatility in the prices of securities in which they invest. Specifically, a 1 percent increase in stock ownership by large investors leads to an increase in stock volatility of 12 to 18 hundredths of a percentage point relative to a daily average volatility of 3.5 percent. They suggest that large institutional investors are more likely to destabilize financial markets than a set of small institutions that trade in a less correlated way.

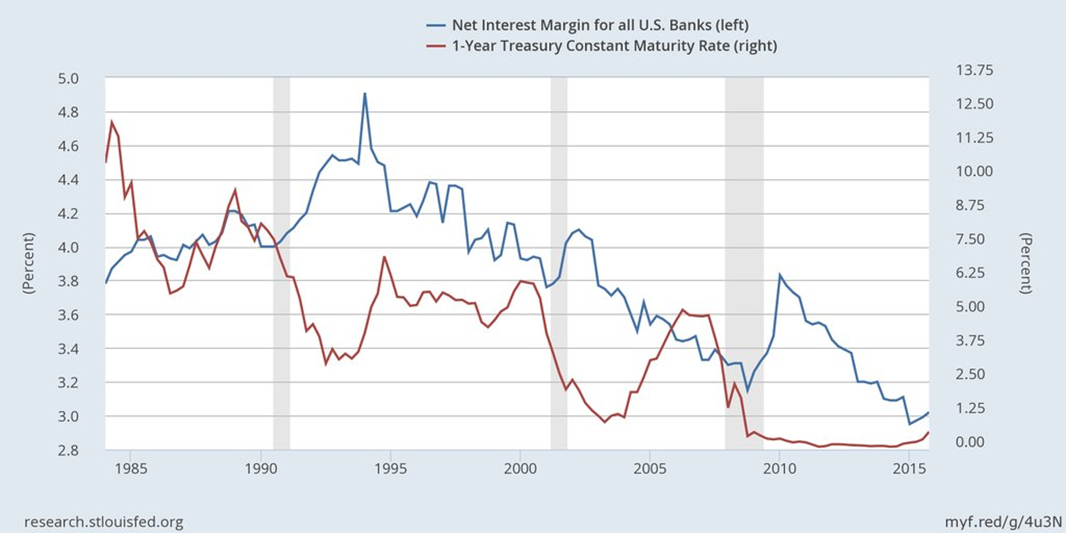

Chart of the week: The relationship between interest rate and net interest margin might be ambiguous

Quote of the week: “[F]ollowing the introduction of “QQE with a Negative Interest Rate,” the policy effects on interest rates already have been seen… Going forward, these effects are likely to steadily spread to both the real economy and the price front,” says Bank of Japan official Haruhiko Kuroda

“Risks to the outlook are tilted to the downside owing to (1) uncertainty over the global economy, particularly emerging economies, (2) volatile developments in financial markets, and (3) the repercussions on business sentiment. The Bank will continue to carefully examine these risks to economic activity and prices at each Monetary Policy Meeting, and take additional easing measures without hesitation in terms of three dimensions – quantity, quality, and the interest rate – if it is judged necessary for achieving the price stability target. “QQE with a Negative Interest Rate” is an extremely powerful policy scheme and there is no doubt that ample space for additional easing in each of these three dimensions is available to the Bank.”

— Haruhiko Kuroda, Governor of the Bank of Japan

Commentary

Hutchins Roundup: Mortgage lending standards, open market operations in assets, and more

May 19, 2016