Much of the drop in unemployment and labor force participation driven by declining desire to work

Regis Barnichon of the Universitat Pompeu Fabra and Andrew Figura of the Federal Reserve Board find that, since the mid-1990s, a decline in the self-reported desire to work among those outside of the labor force has reduced the unemployment rate by 0.5 percentage points and the labor force participation rate by 1.75 percentage points, primarily among low-income and prime-age females. About 50 percent of the drop in the desire to work can be attributed to the expansion of social and welfare programs in the 1990s, suggesting that “welfare-to-work” reforms may have reduced secondary earners’ incentives to work by increasing family income.

Employer policies influence 401(k) borrowing behaviors

Using administrative 401(k) plan data, Timothy (Jun) Lu of Peking University, Olivia S. Mitchell of the University of Pennsylvania, Stephen P. Utkus of the Vanguard Center for Retirement Research, and Jane A. Young of Vanguard demonstrate that 401(k) loans are fairly common, with almost 40 percent of participants borrowing at some point over a five-year period. When employer plans allow multiple loans, employees are more likely to borrow, and borrow 16 percent more in aggregate.

Eliminating the Medicare Part D “doughnut hole” would increase insurer spending by 31 percent

Using 2008 Medicare Part D claims data, Christina M. Dalton of Wake Forest University, Gautam Gowrisankaran of the University of Arizona, and Robert Town of the University of Pennsylvania find that, among Part D enrollees who arrive near the coverage “doughnut hole” early in the year, total drug expenditures fall by an average of 28 percent once the doughnut hole is reached. Completely eliminating the doughnut hole, a policy change that is being implemented gradually under the Affordable Care Act, would increase total drug spending by 10 percent and raise insurer spending by 31 percent.

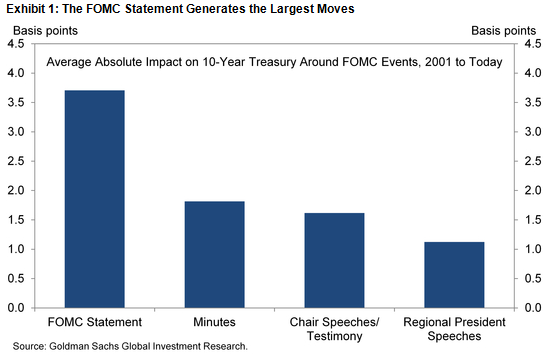

Chart of the week: Impact of Federal Reserve releases

Quote of the week: Fed more likely to bounce up against the zero-lower-bound going forward than was thought in the past

The Fed currently projects that when you finish tightening monetary policy, interest rates will be around 3.75 percent. That’s lower than before the crisis. Does it give you enough room to address the next crisis?

John Williams: We argued in our research before the crisis that 4.5 percent was a sufficient buffer for most cases. If you take 3.75 percent, on that same analysis, it definitely cuts into that buffer quite a bit. And so I do think the zero lower bound issue, by this math, we’re going to be hitting it more often in the future than we thought we would in the past… Unconventional monetary policy, which we’ll be leaving as we get back to normal, will be a necessary ingredient at times. And I really think the biggest lesson to me has been the importance of acting quickly both to lower interest rates and also the willingness and ability to step into these unconventional policies. The Fed moved aggressively on Q.E., but our forward guidance took longer to get going, so that’s a lesson we need to remember in the future.

–John Williams, President of the Federal Reserve Bank of San Francisco

Commentary

Hutchins Roundup: 401(k) Loans, Medicare Part D “Doughnut Hole,” and More

April 23, 2015